Financial Modelling Tool for Aviation Businesses

For aviation businesses and aircraft leasing companies, managing seasonal fluctuations, capital-intensive assets, and complex financing arrangements is no small task. Brixx equips aviation professionals with powerful financial planning tools to model, forecast, and steer your operations with confidence – helping you make critical decisions at the right time.

Start free trial

Model your aviation business in Brixx - see how quickly your finances can make sense!

We are working on creating this template in Brixx. Although it isn’t available just yet, you can follow the guidance below to help get started. If you need any further assistance, don’t hesitate to get in touch – we’re here to help!

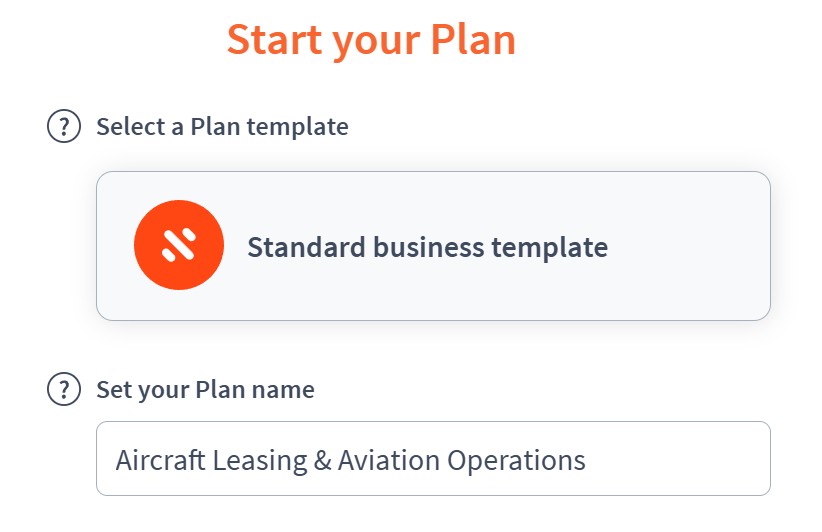

Project Setup

- Project name: Aircraft Leasing & Aviation Operations

- Time period: Monthly (ideal for tracking lease payments, maintenance cycles, and loan repayments)

Income Components

- Component: Aircraft Leasing Income

- Sub-components:

- Lease Revenue – Aircraft A320 (Dry lease at £180,000/month)

- Lease Revenue – Aircraft B737 (Wet lease at £240,000/month, includes crew/maintenance)

- Short-Term Lease Income (Ad hoc leases, £50,000/month average)

- Sub-components:

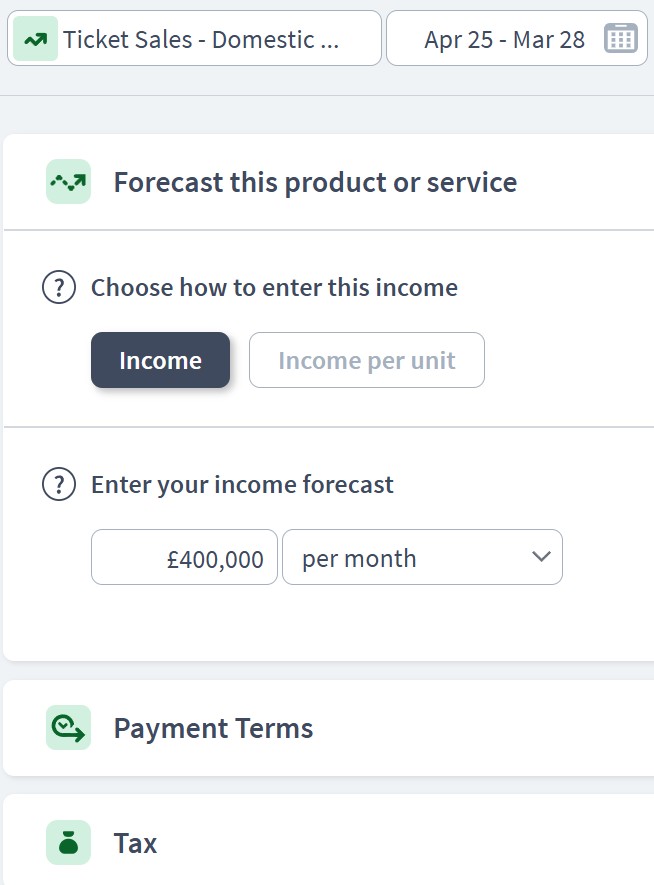

- Component: Operational Flight Revenue (if applicable)

- Sub-components:

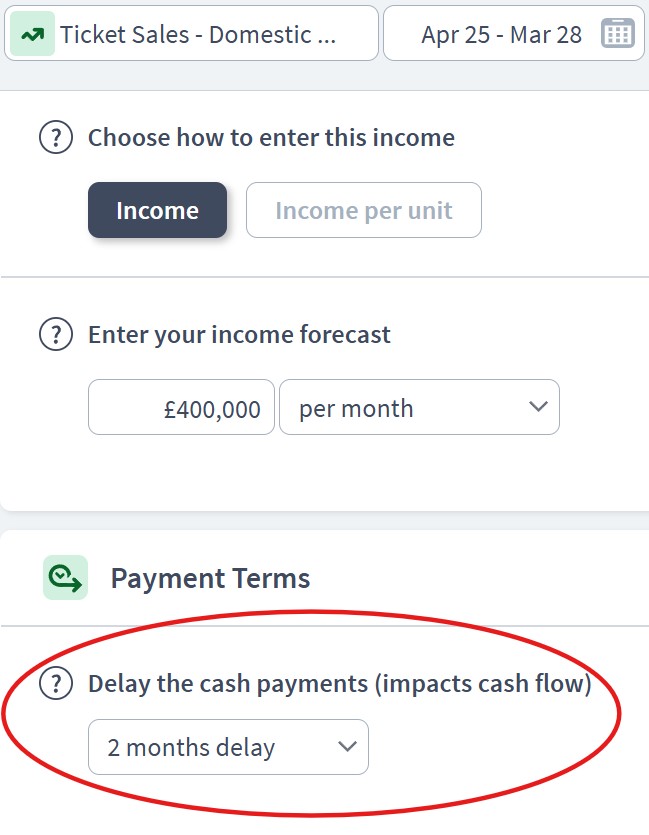

- Ticket Sales – Domestic Routes (£400,000/month)

- Ticket Sales – International Routes (£600,000/month)

- Baggage Fees & Ancillary Revenue (£80,000/month)

- Cargo Income (£120,000/month)

- Sub-components:

- Component: Other Income

- Sub-components:

- Maintenance Pass-Through Revenue (£30,000/month from lessees)

- Airport Incentives/Subsidies (£50,000/quarter)

- Sub-components:

Expenditure Components

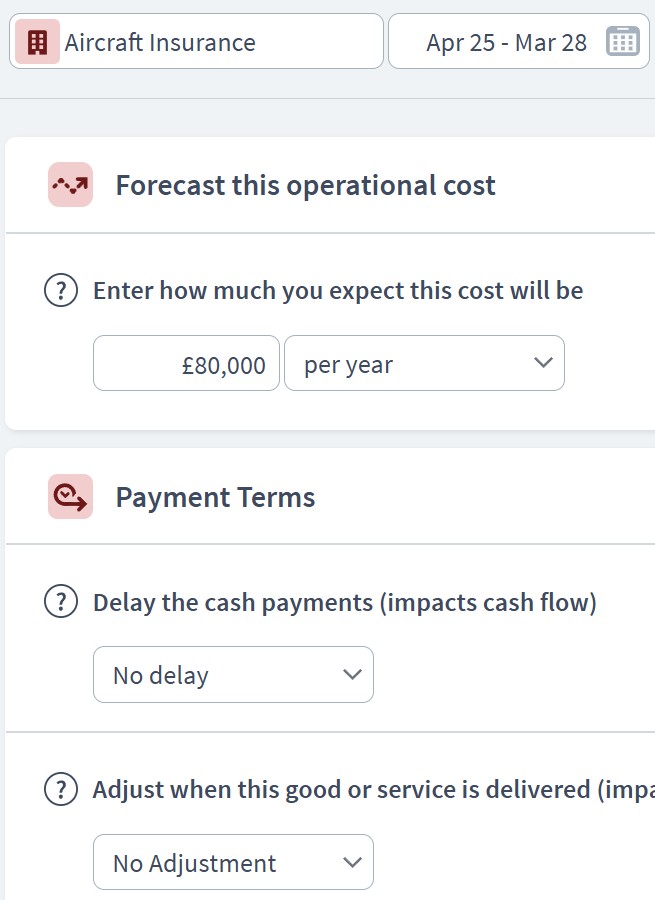

- Component: Operational Costs

- Sub-components:

- Maintenance & Repairs (Routine: £100,000/month per aircraft; Heavy Check: £500,000/year per aircraft)

- Crew Salaries (If wet leasing or operating flights: £250,000/month)

- Fuel (For owned ops: £350,000/month, varies with oil prices)

- Aircraft Insurance (£80,000/year per aircraft)

- Ground Handling Fees (£30,000/month)

- Airport Fees (Landing, parking, etc.: £40,000/month)

- Sub-components:

- Component: Administrative Costs

- Sub-components:

- Legal & Accounting Fees (£3,000/month)

- Aircraft Registry Fees (£2,000/year per aircraft)

- Compliance & Audits (£20,000/year)

- IT Systems, Booking & Ops Tools (£2,500/month)

- Sub-components:

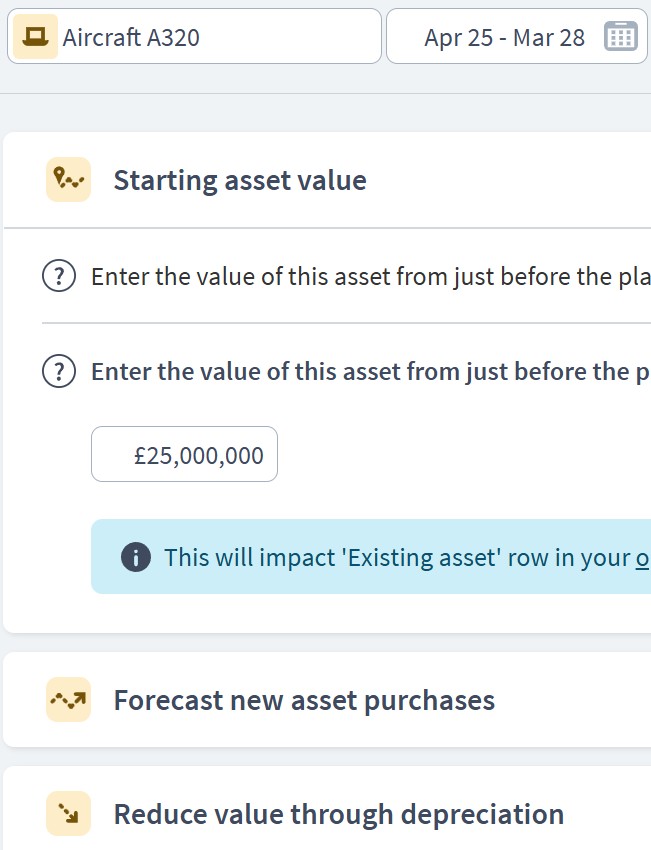

Asset Components

- Component: Fixed Assets

- Sub-components:

- Aircraft A320 (Purchase Price: £25,000,000, depreciated over 15 years)

- Aircraft B737 (Purchase Price: £28,000,000, depreciated over 15 years)

- Ground Equipment (£2,000,000, depreciated over 10 years)

- Maintenance Tools & Parts Inventory (£500,000)

- Sub-components:

- Component: Current Assets

- Sub-components:

- Cash Reserves (£1,500,000 opening balance + net surplus)

- Accounts Receivable (Lease income yet to be collected)

- Prepaid Maintenance Reserves (£1,000,000)

- Sub-components:

Funding Components

- Component: Loans & Aircraft Financing

- Sub-components:

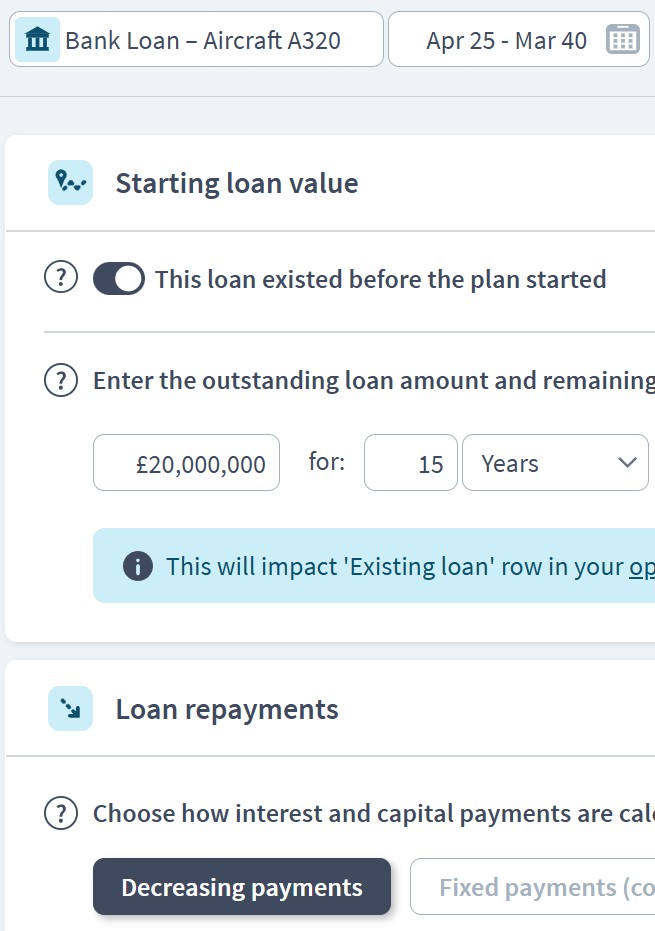

- Bank Loan – Aircraft A320 (£20,000,000 at 5% interest, 15-year term)

- Lease Financing – Aircraft B737 (£22,000,000 at 4.5% interest, 10-year term)

- Sub-components:

- Component: Equity Investment

- Sub-components:

- Initial Shareholder Equity (£10,000,000)

- Capital Raise – Series A (£8,000,000 projected in year 2)

- Sub-components:

- Component: Future Funding

- Sub-components:

- Bridge Loan for Fleet Expansion (£5,000,000, short-term, 7% interest)

- Government Grant – Green Aviation (£2,000,000 for electric fleet transition)

- Sub-components:

Scenario Planning in Brixx

- Lease Default Scenarios

- Model 1-2 month payment delays or full lessee default for worst-case projections.

- Fuel Price Fluctuations

- Vary fuel cost by 10–30% to test operational margin.

- Aircraft Downtime

- Model unplanned maintenance grounding 1-2 months to see impact on revenue.

- Expansion Planning

- Add new aircraft in year 3 with related lease or financing setup.

- Currency Risk

- Simulate exchange rate changes for USD-based leases and loans.

Dashboard & Reporting

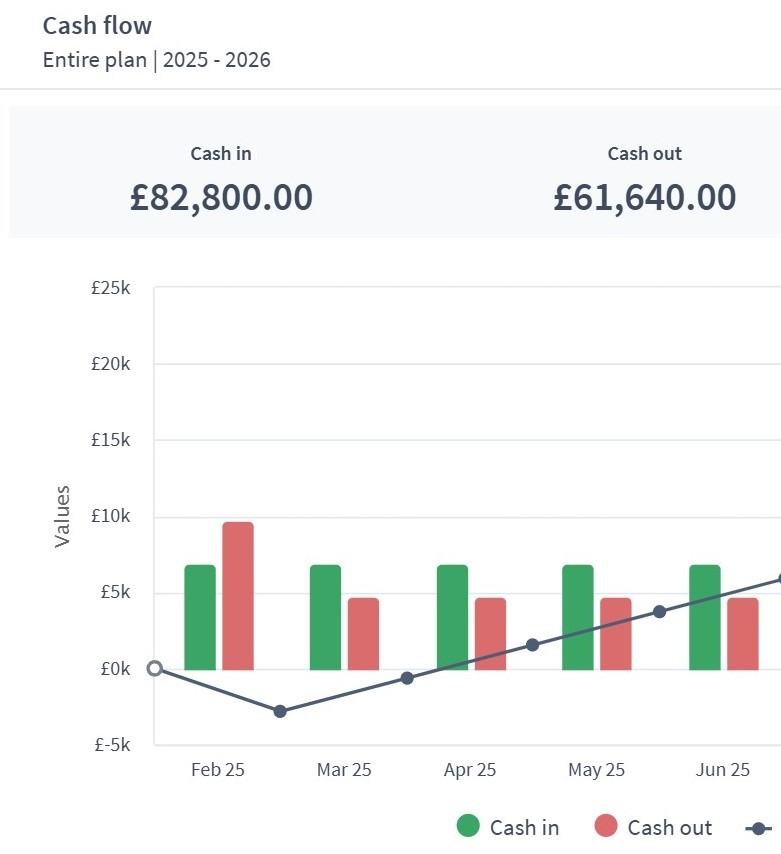

- Cash Flow Report

- View monthly net cash flow with breakdown by lease income and operations.

- Balance Sheet

- Shows aircraft book value, depreciation, loans outstanding, and equity.

- Profit & Loss Statement

- View EBITDAR (a key metric in aviation) and net profit.

- Custom KPIs

- Lease Yield per Aircraft

- EBITDAR Margin

- Debt-to-Asset Ratio

- Fleet Utilization %

- Maintenance Reserve per Aircraft

Who can use this Brixx template?

- Aircraft leasing companies

- Regional and private airline operators

- Aviation maintenance, repair, and overhaul (MRO) providers

Brixx is a great tool for:

- Aviation finance managers handling budgets, leases, and long-term fleet planning

- Aircraft lessors managing lease income, maintenance reserves, and asset depreciation

- Business owners forecasting operational costs, fleet expansion, and funding scenarios

What are the benefits for aviation and aircraft leasing professionals?

- Built with aviation in mind – track lease payments, fleet costs, maintenance schedules, and financing terms in one place

- Plan and forecast long-term cash flows, asset values, and operational revenue with ease

- Visualise the financial outcomes of different fleet acquisition strategies or maintenance cycles

- Test various market scenarios – such as fuel cost changes, lease rate adjustments, or downtime implications

- Gain clarity on your capital structure and funding needs to support growth or navigate downturns

Strategic forecasting in Brixx

- Simulate the impact of fluctuating lease rates, downtime, and fleet utilisation

- Present revenue and profit forecasts to investors or lenders with clear, professional outputs

- Budget for major inspections, overhauls, or compliance upgrades

- Anticipate funding gaps or refinancing opportunities during fleet expansion or replacement

- Understand how market volatility affects aircraft values and cash positions

Explore different industry frameworks you can build in Brixx for your business

Brixx for Car Dealerships

Explore our template for car dealerships. It’s designed to help you plan asset purchases, financing, and revenue from sales or leasing.

Brixx for Logistics Companies

Explore our template for logistics companies. It’s designed to manage transport operations, fleet costs, and delivery income.

Brixx for Garages

Explore our template for garages. It’s designed to forecast servicing income, parts costs, and technician hours.

Brixx for Energy Companies

Explore our template for energy companies. It’s designed to track fuel usage, operating expenses, and infrastructure planning.

Get started with Brixx

£30 / month

Prices exclude local taxes

7 Day Free Trial

No credit card required

- Scenario testing

- 10-year financial forecast

- Pre-built templates

- Xero integration

- Automated reports: P&L, balance sheet, cash flow, tax & more

"The ability to just hit a few buttons and move things in and out of the forecast means that you can identify the impact of an income stream or project in moments."

Malcolm Veall, Naked AccountingGet started with the best financial projection software - today!

Financial modelling software like Brixx is an essential co-pilot for aviation and leasing professionals. Whether you’re tracking lease income, preparing for fleet upgrades, or analysing profitability under different market conditions, Brixx helps you build a clear and strategic financial roadmap.

With over two decades of experience in business modelling, Brixx offers aviation businesses the tools needed to bring structure and insight to a dynamic and capital-heavy industry.

Forecast with confidence, optimise your lease portfolio, and prepare for whatever’s on the horizon – with Brixx.