Financial Modelling Tool for Bookkeeping Businesses

Running a bookkeeping business means staying on top of your cash flow. With Brixx, you gain the tools to model your finances clearly and make confident, informed decisions – without any spreadsheets!

Start using this template in Brixx

Model your bookkeeping business in Brixx - see how quickly your finances can make sense!

This template is available in Brixx. Follow the guidance below to get started. If you need any further assistance, don’t hesitate to get in touch – we’re here to help!

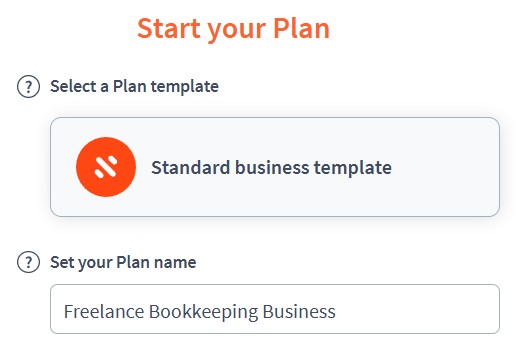

Project Setup

- Project name: Freelance Bookkeeping Business

- Time period: Monthly (perfect for tracking regular client income and subscriptions)

Income Components

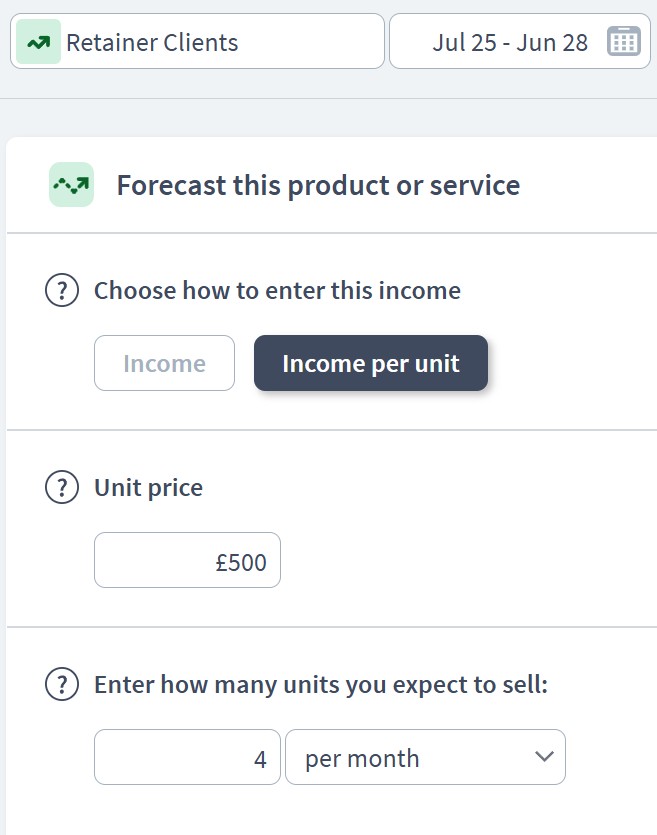

- Component: Client Revenue

- Sub-components:

- Retainer Clients (4 clients x £500/month) – £2,000/month

- Hourly Work (ad-hoc, 20 hours/month @ £40/hour) – £800/month

- One-off Projects (e.g., year-end accounts, estimated quarterly) – £1,200/quarter (~£400/month average)

- Sub-components:

- Component: Other Income

- Sub-components:

- Training/Webinars (run one per quarter, earning £300) – £100/month average

- Affiliate Software Referrals (e.g., Xero/QuickBooks bonuses) – £50/month

- Sub-components:

Expenditure Components

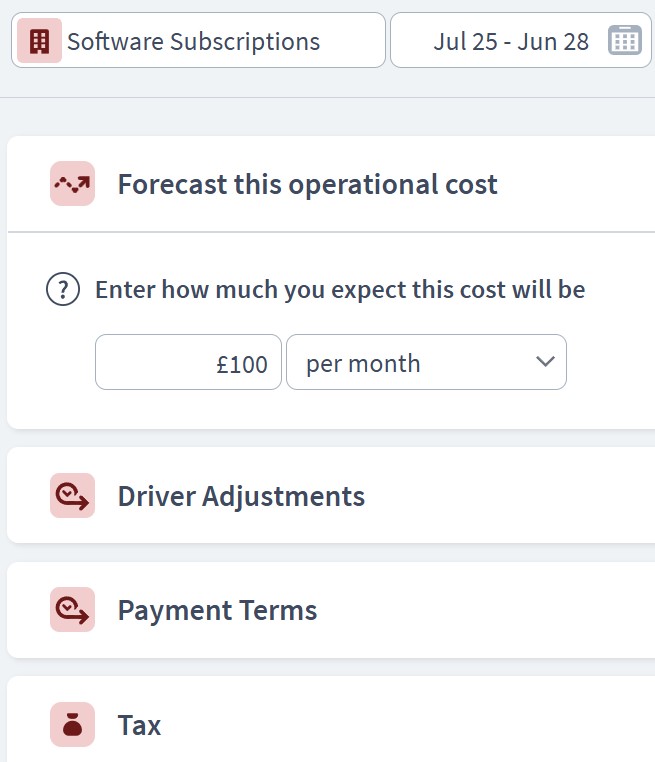

- Component: Operational Costs

- Sub-components:

- Software Subscriptions (Xero, Dext, Office 365, Zoom, Brixx) – £100/month

- Professional Memberships (e.g., AAT, ICB) – £300/year (~£25/month)

- CPD Training – £600/year (~£50/month)

- Sub-components:

- Component: Admin & Marketing

- Sub-components:

- Website Hosting & Maintenance – £25/month

- Marketing & Ads (Google/LinkedIn) – £100/month

- Business Insurance – £300/year (~£25/month)

- Legal & Accounting Support (outsourced) – £600/year (~£50/month)

- Sub-components:

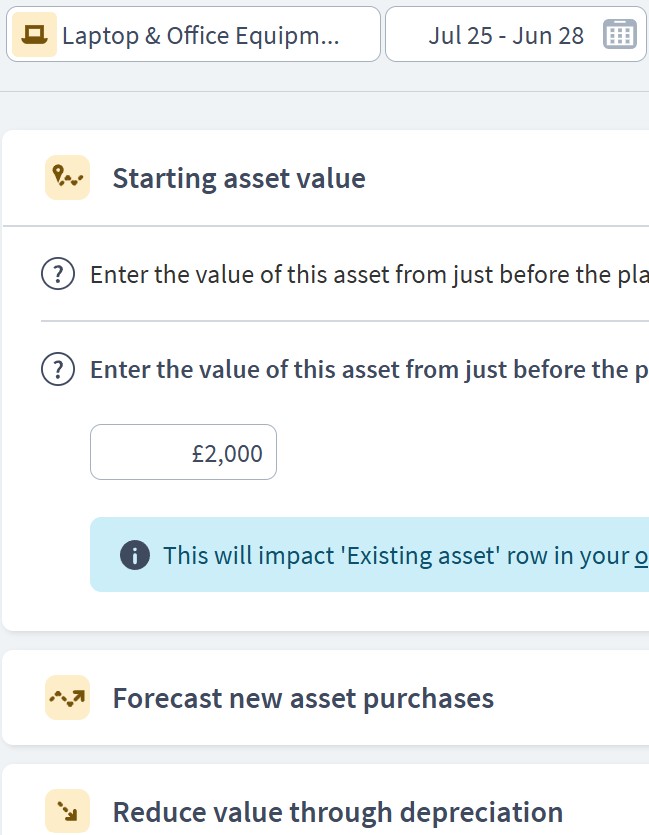

Asset Components

- Component: Fixed Assets

- Sub-components:

- Laptop & Office Equipment (£2,000, depreciated over 3 years)

- Office Furniture (£1,000, depreciated over 5 years)

- Sub-components:

- Component: Current Assets

- Sub-components:

- Cash Reserves (starting at £5,000)

- Accounts Receivable (model unpaid invoices, assume £1,000/month outstanding)

- Sub-components:

Funding Components

- Component: Initial Investment

- Sub-components:

- Personal Investment (used to start business, buy equipment, initial cash) – £7,000

- Sub-components:

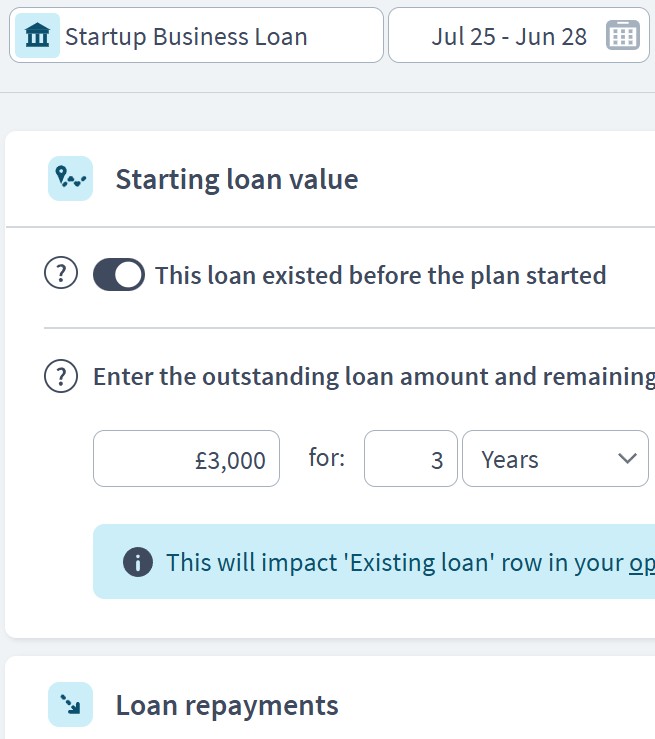

- Component: Loans (if applicable)

- Sub-components:

- Startup Business Loan (£3,000 at 5%, 3-year term) – optional if not bootstrapped

- Sub-components:

Scenario Planning in Brixx

- Client Loss Scenario:

- Model losing one retainer client for 3 months to see income dip and impact on cash reserves.

- Increased Demand:

- Simulate 10 more ad-hoc hours/month or onboarding a new retainer client.

- Tax Changes:

- Increase income tax to 25% to simulate impact of bracket shift or IR35 changes.

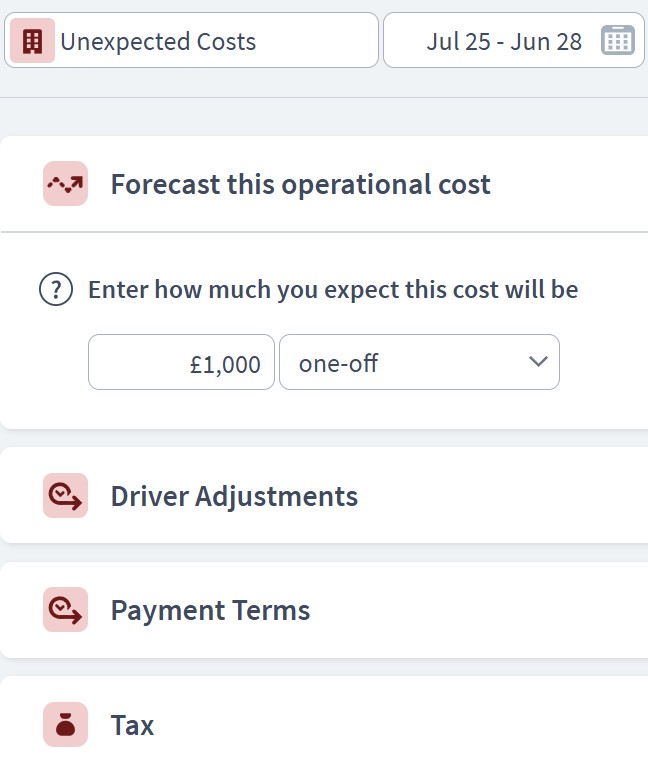

- Unexpected Expenses:

- Add an “Unexpected Costs” line (£1,000 emergency equipment replacement).

Dashboard & Reporting

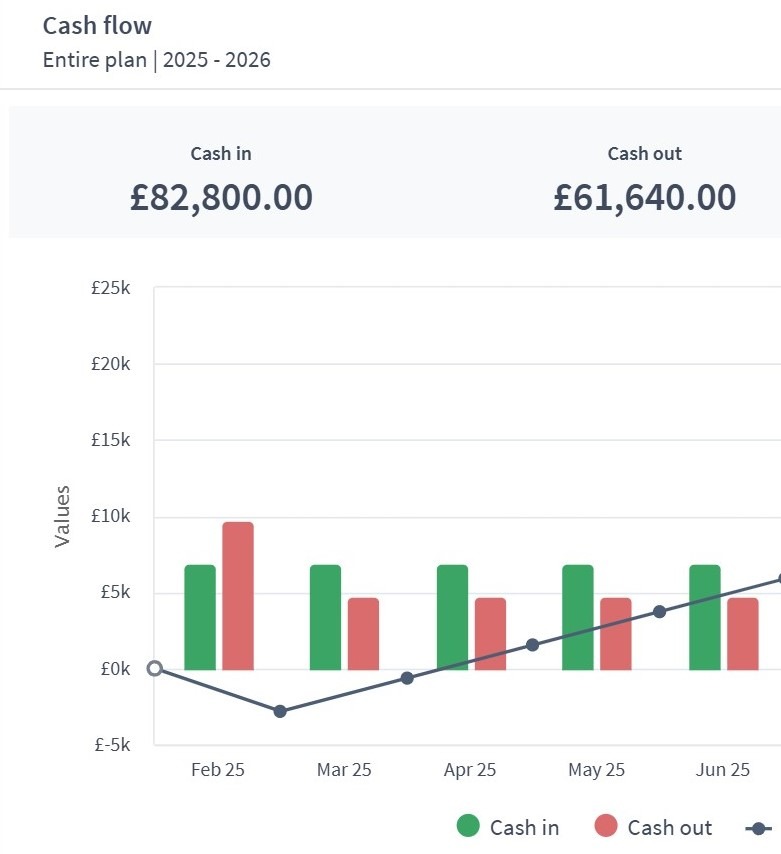

- Cash Flow Report:

- See monthly retained earnings, peaks in one-off income.

- Balance Sheet:

- Track depreciating office assets and improving cash.

- Profit & Loss Statement:

- Understand net profitability over the year.

- Custom KPIs:

- Average Client Value

- Effective Hourly Rate (inc. admin/non-billable time)

- Monthly Net Margin %

Who can use this Brixx template?

- Freelance bookkeepers

- Small to mid-sized bookkeeping practices

- Accounting firms offering bookkeeping services

Brixx is a great tool for:

- Business owners overseeing budgets, pricing, staffing, and cash flow

- Bookkeepers planning for growth, service expansion, or taking on new clients

- Firms needing clear financial forecasts to make confident business decisions

What are the benefits to bookkeeping businesses?

- Specifically built for service-based operations, helping you forecast income from client retainers, hourly work, or packaged services

- Easily plan and visualise monthly cash flow, staff costs, software subscriptions, and marketing expenses

- Model the impact of adding new clients, adjusting service rates, or changing team capacity

- Instantly see how seasonal trends or late client payments could affect your financial position

- Scenario test key decisions like hiring, service changes, or taking on larger contracts

Strategic forecasting in Brixx

- Projecting future revenue based on new client acquisition or pricing changes

- Budgeting for expenses such as staff wages, training, and software tools

- Planning for tax obligations and ensuring sufficient cash reserves

- Stress-testing cash flow against periods of reduced work or unexpected expenses

- Building long-term financial plans to support business growth, funding, or investment

Explore different industry frameworks you can build in Brixx for your business

Brixx for Accountants

Explore our template for accountants. It’s designed to help you manage service income, client fees, and operating costs with ease.

Brixx for Consultants

Explore our template for consultants. It’s designed to support project-based billing, advisory services, and cash flow forecasting.

Brixx for Freelancers

Explore our template for freelancers. It’s designed to plan irregular income, personal expenses, and flexible workloads.

Brixx for Recruiters

Explore our template for recruiters. It’s designed to forecast client contracts, placement fees, and team performance.

Get started with Brixx

£30 / month

Prices exclude local taxes

7 Day Free Trial

No credit card required

- Scenario testing

- 10-year financial forecast

- Pre-built templates

- Xero integration

- Automated reports: P&L, balance sheet, cash flow, tax & more

"With Brixx, the effort, time, accuracy, and ease of generating reports is much more efficient for my clients."

Malcolm, Naked AccountingStart building your financial future with Brixx - no spreadsheet skills needed!

Brixx offers bookkeeping businesses a modern solution for financial planning and cash flow forecasting. By modelling income and costs clearly, firms can make faster, better decisions – whether it’s pricing services, hiring new staff, or navigating quieter periods.

With over two decades of business modelling expertise behind it, Brixx provides the clarity and confidence needed to manage a successful bookkeeping practice. Gain control of your finances, optimise your operations, and forecast your next phase of growth with Brixx.

Ready to take your bookkeeping business to the next level? Brixx’s financial forecasting software makes it simple. Get started today!