Did you know that 82% of business failures are due to poor cash flow management? This sobering statistic from a U.S. Bank study highlights the importance of cash flow forecasting for businesses of all sizes.

Without proper management of cash flow, a business simply cannot survive. In this blog, we will explore what cash flow forecasting is, why it’s important, and how you can create and automate your cash flow forecast to ensure your business’s financial health and success.

What is a cash flow forecast?

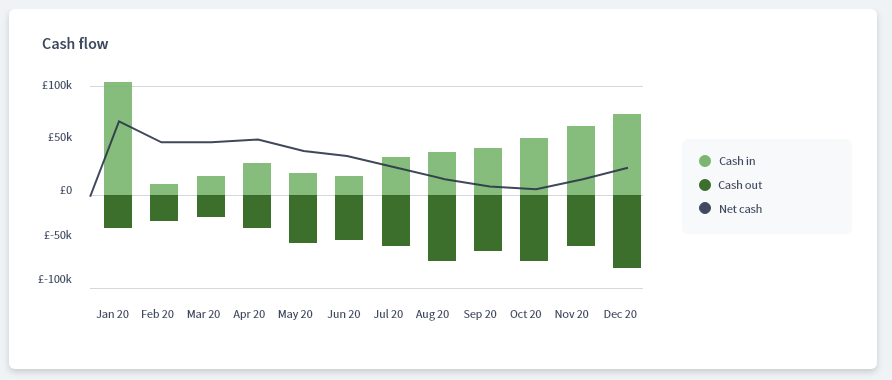

A cash flow forecast is a financial tool that helps businesses predict the amount of cash they will have on hand at any given time in the future. It takes into account past cash flows, current cash position, and expected future cash inflows and outflows to estimate how much cash a business will have available. Cash flow forecasting is essential for businesses to plan ahead, identify potential cash flow problems, and make informed decisions about investments and growth opportunities.

Benefits of cash flow forecasting

There are several benefits to cash flow forecasting, including:

Better financial planning

By forecasting your cash flow, you can plan for future expenses and revenue, which can help you make better financial decisions.

Improved cash management

Cash flow forecasting allows you to manage your cash more effectively, ensuring you have enough funds on hand to cover expenses and take advantage of opportunities.

Early warning signs

A cash flow forecast can help you identify potential cash flow problems before they become critical, allowing you to take corrective action.

Easier access to financing

Lenders and investors often require a cash flow forecast as part of their due diligence process, so having a solid forecast can improve your chances of securing financing.

Improved business performance

With better financial planning, improved cash management, and early warning signs, cash flow forecasting can help improve your overall business performance and profitability.

How to create a cashflow forecast

Creating a cash flow forecast is an essential part of managing the finances of any business. Here are the key steps to create a cash flow forecast:

1. Gather all financial data

To create a cash flow forecast, you need to gather all of your financial data, including past income and expenses, accounts receivable and payable, inventory, and any upcoming investments or payments.

2. Estimate your income or sales

Use historical data to estimate your income or sales for the period you’re forecasting. Take into account any seasonal fluctuations, market trends, or changes in your business operations.

3. Estimate your cash inflows

Identify all cash inflows, including customer payments, loans, or investments, and estimate the timing of these inflows.

4. Estimate your cash outflows and expenses

Identify all cash outflows, including rent, utilities, salaries, inventory purchases, and loan payments, and estimate the timing of these expenses.

5. Subtract your cash outflows from your cash inflows

This will give you your projected cash balance for each period. Use this to identify potential cash flow problems and plan accordingly.

6. Update your forecast regularly

Update your cash flow forecast regularly, ideally on a monthly basis, to reflect any changes in your business operations or financial situation.

7. Use your forecast to inform business decisions

Use your cash flow forecast to make informed business decisions, such as whether to invest in new equipment, hire additional staff, or adjust your pricing strategy.

Creating a cash flow forecast can be a complex process, but it’s crucial for ensuring the financial stability of your business. By following these steps and regularly updating your forecast, you can gain a better understanding of your business’s financial health and make informed decisions for its future.

Streamline your cash flow forecasting process with our free template

No more manual data entry or calculations needed – simply input your financial data and let our template do the rest. Download it now to save time and reduce the risk of errors.

Cash flow forecasting methods

Cash flow forecasting is the process of estimating the amount of cash inflows and outflows that a business can expect over a specific period. There are two main methods of cash flow forecasting:

Direct cash flow forecasting

This method involves creating a detailed projection of all expected cash inflows and outflows for the period in question. It requires a thorough understanding of a business’s financial transactions, including sales revenue, expenses, and investments.

Indirect cash flow forecasting

This method involves using a company’s income statement and balance sheet to estimate its future cash flows. It relies on assumptions about how changes in these financial statements will impact a business’s cash position.

Both methods have their pros and cons, and the best method for your business depends on your specific circumstances. Direct cash flow forecasting is generally considered more accurate, but it requires a significant amount of time and effort to create. Indirect cash flow forecasting is less time-consuming but may be less accurate, especially if there are significant changes in a business’s financial statements.

Ultimately, the goal of cash flow forecasting is to gain a better understanding of a business’s cash position and plan accordingly for the future. By using one of these methods, businesses can make informed decisions about investments, expenses, and other financial matters.

Tips for an accurate cash flow forecast

Creating an accurate cash flow forecast can be a complex process, but there are several tips that can help improve its accuracy. Here are some tips to consider:

Review historical data: Look at past financial data, including cash flow statements, to gain insights into previous cash flow patterns. This information can help inform your forecast.

Be realistic: Be realistic about your revenue and expenses. Avoid overestimating revenue or underestimating expenses, which can lead to an inaccurate forecast.

Consider multiple scenarios: Create multiple scenarios for your cash flow forecast, including best-case, worst-case, and most likely scenarios. This can help you prepare for unexpected events and make informed decisions.

Monitor regularly: Regularly monitor and update your cash flow forecast, especially during periods of change or uncertainty.

Get input from stakeholders: Seek input from key stakeholders, including accountants, financial advisors, and department heads, to ensure your forecast is comprehensive and accurate.

Use technology: Consider using cash flow forecasting software or other tools to help streamline the process and improve accuracy.

By following these tips, you can create a more accurate cash flow forecast that provides valuable insights into your business’s financial health and future performance.

How automation can streamline cash flow forecasting and save your time over a spreadsheet

Cash flow forecasting is a critical aspect of financial management for businesses of all sizes, but it can also be a time-consuming process when done manually. This is where automation can help. Using our cash flow forecasting software will allow you to easily create accurate cash flow forecasts, monitor your cash flow in real-time, and make informed financial decisions. With features like scenario planning, automatic data syncing, and customizable reports, you can get a complete picture of your business’s financial health and plan for the future with confidence.

If you’re tired of spending hours manually creating and updating spreadsheets for your cash flow forecasting, it’s time to try Brixx. Say goodbye to manual data entry and hello to accurate, efficient cash flow forecasting with Brixx.