Financial Modelling Tool for Insurance Firms

Running an insurance business means managing complex financial inflows, claim liabilities, and premium cycles – all while staying ahead of market risks. Brixx equips insurance firms with the forecasting tools needed to stay in control, adapt quickly, and make well-informed financial decisions year-round.

Start free trial

Model your insurance firm in Brixx - see how quickly your finances can make sense!

We are working on creating this template in Brixx. Although it isn’t available just yet, you can follow the guidance below to help get started. If you need any further assistance, don’t hesitate to get in touch – we’re here to help!

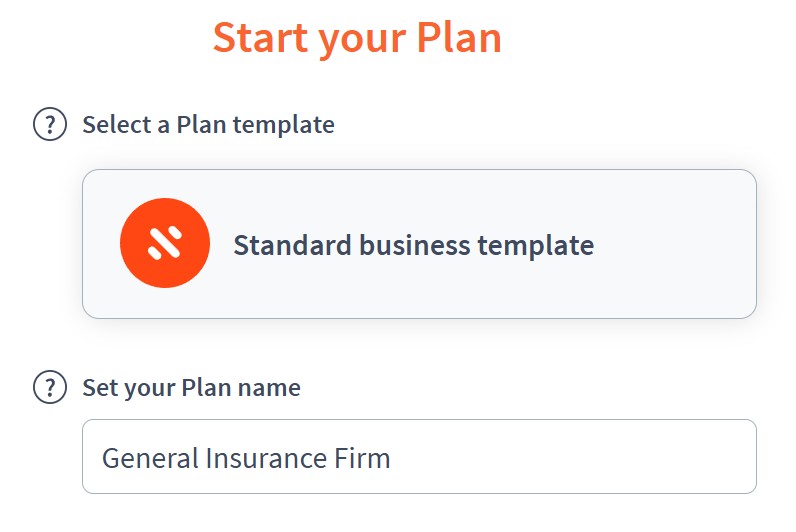

Project Setup

- Project name: General Insurance Firm

- Time period: Monthly (to track premium income, claims, and reserves)

Income Components

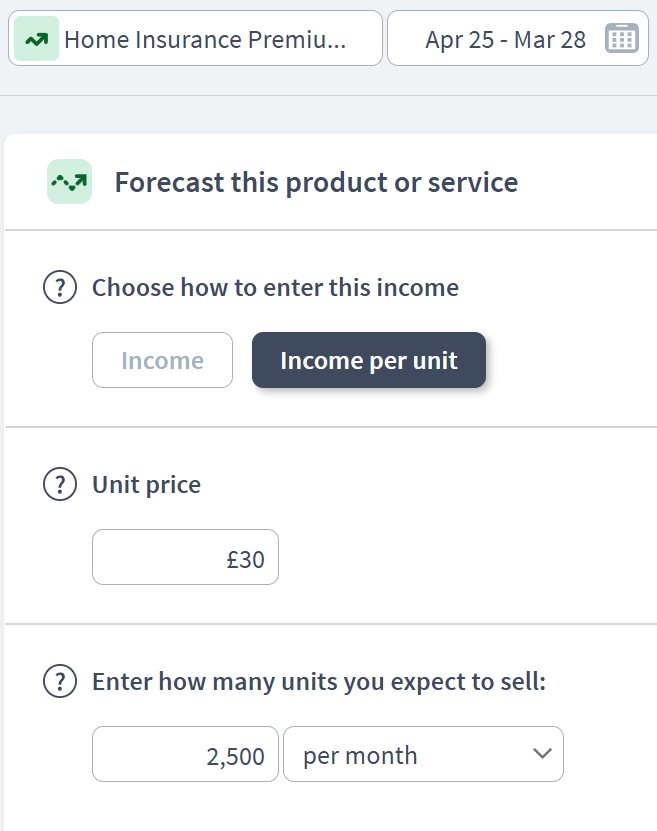

- Component: Premium Income

- Sub-components:

- Home Insurance Premiums (£75,000/month from 2,500 policies @ £30 each)

- Auto Insurance Premiums (£100,000/month from 2,000 policies @ £50 each)

- Liability Insurance Premiums (£25,000/month from 500 policies @ £50 each)

- Sub-components:

- Component: Investment Income

- Sub-components:

- Interest from Bond Investments (£8,000/month)

- Dividend Income from Equity Portfolio (£3,000/month)

- Capital Gains on Asset Sales (Modelled annually, £20,000/year estimated)

- Sub-components:

- Component: Fee Income

- Sub-components:

- Policy Administration Fees (£5,000/month)

- Broker Commission Rebates (£2,000/month)

- Sub-components:

Expenditure Components

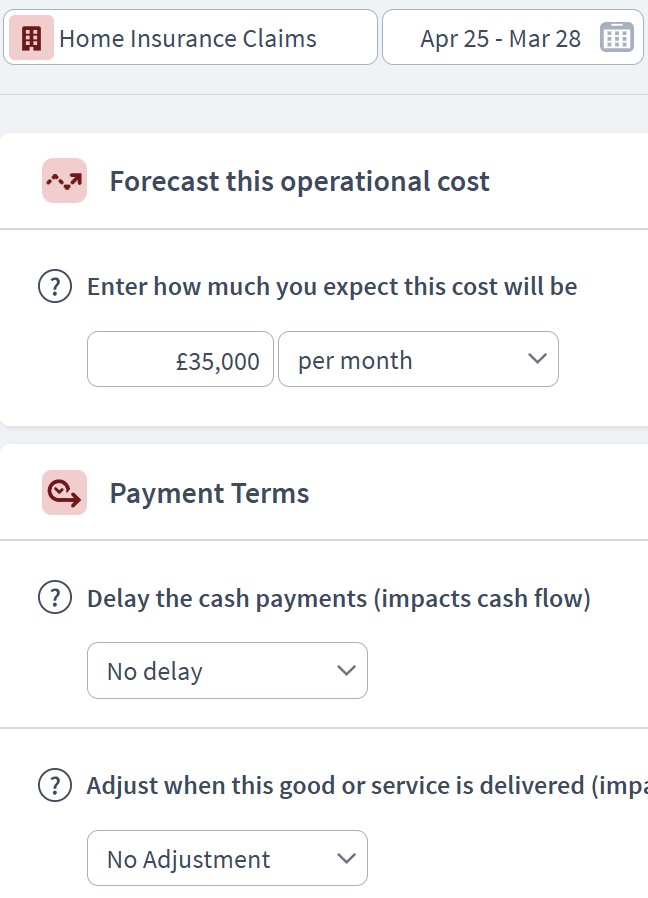

- Component: Claims Paid

- Sub-components:

- Home Insurance Claims (£35,000/month average)

- Auto Insurance Claims (£60,000/month average)

- Liability Claims (£10,000/month average)

- Large Claims Reserve (One-off events – £100,000 allocated annually)

- Sub-components:

- Component: Operational Costs

- Sub-components:

- Underwriting & Claims Staff Salaries (£50,000/month)

- Customer Service & Admin Staff (£30,000/month)

- IT & Systems (£10,000/month for software, servers, data)

- Office Rent & Utilities (£5,000/month)

- Reinsurance Premiums (£20,000/month to reduce claim risk)

- Sub-components:

- Component: Administrative Costs

- Sub-components:

- Regulatory & Compliance (£2,000/month)

- Marketing & Advertising (£8,000/month)

- Professional Services (Audit, Legal, Actuarial – £3,000/month)

- Training & Recruitment (£1,500/month)

- Sub-components:

Asset Components

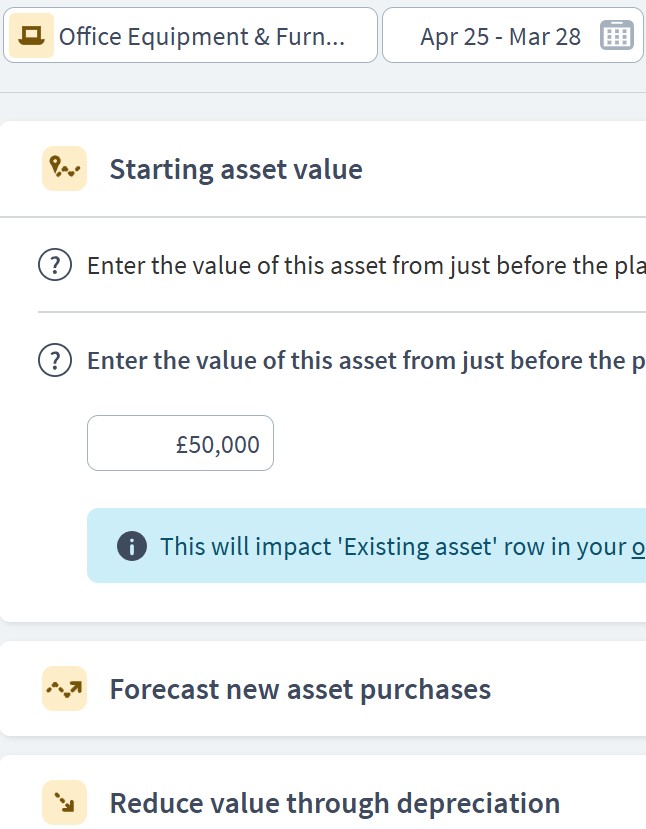

- Component: Fixed Assets

- Sub-components:

- Office Equipment & Furniture (£50,000, depreciated over 5 years)

- Internal Systems Development (£100,000 CapEx, depreciated over 3 years)

- Sub-components:

- Component: Current Assets

- Sub-components:

- Cash Reserves (Starts at £500,000, fluctuates monthly)

- Accounts Receivable (Outstanding premiums, £60,000 rolling balance)

- Prepaid Reinsurance (£40,000 annually, amortised monthly)

- Sub-components:

- Component: Investments

- Sub-components:

- Bond Portfolio (£1,000,000 @ 4% return)

- Equity Investments (£500,000 with 6% annual return and capital gain assumptions)

- Sub-components:

Funding Components

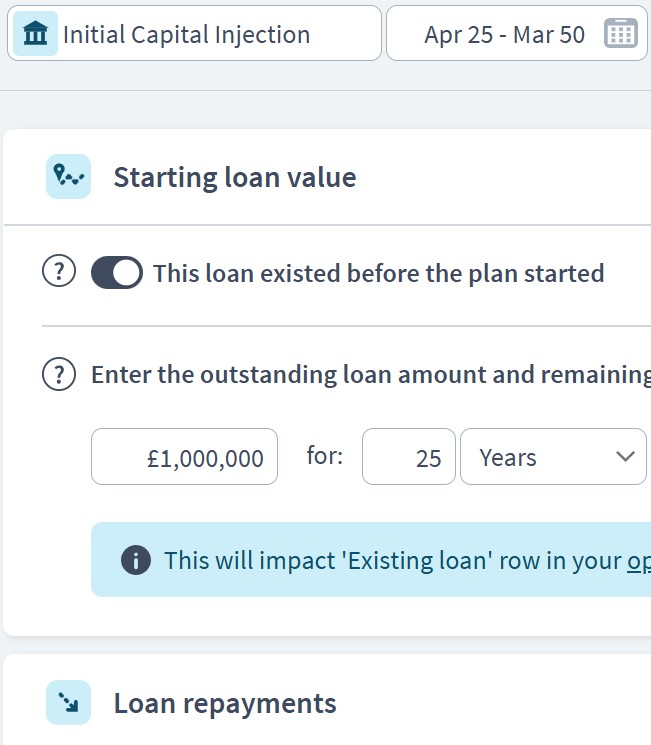

- Component: Shareholder Capital

- Sub-components:

- Initial Capital Injection (£1,000,000 from shareholders)

- Sub-components:

- Component: Retained Earnings

- Sub-components:

- Reinvested profits from previous years (automatically built in)

- Sub-components:

- Component: Loan Facility (Optional)

- Sub-components:

- Business Line of Credit (£250,000 max, 5% interest, only used in cash shortfall scenarios)

- Sub-components:

Scenario Planning in Brixx

- Claims Volatility

- Model scenarios with 10%, 20%, or 30% spike in claims to simulate catastrophe events.

- Investment Market Shock

- Drop bond returns by 50% and equity returns to 0% to test financial impact.

- Premium Rate Changes

- Increase/decrease premium pricing by 5% to see effect on income and churn.

- Regulatory Fees Increase

- Simulate a potential 10% rise in compliance and licensing fees.

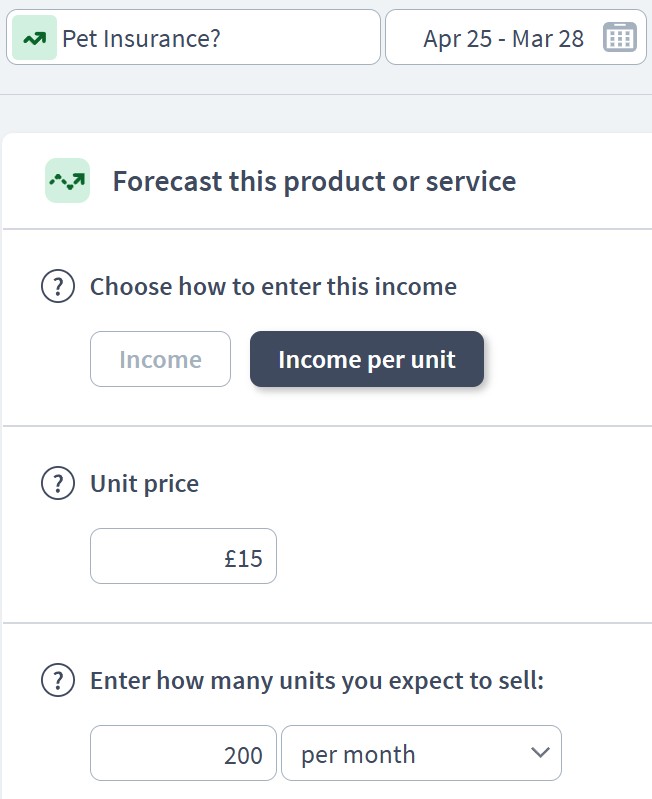

- New Product Launch

- Add a new product line (e.g., Pet Insurance) with setup costs and ramp-up premiums.

Dashboard & Reporting

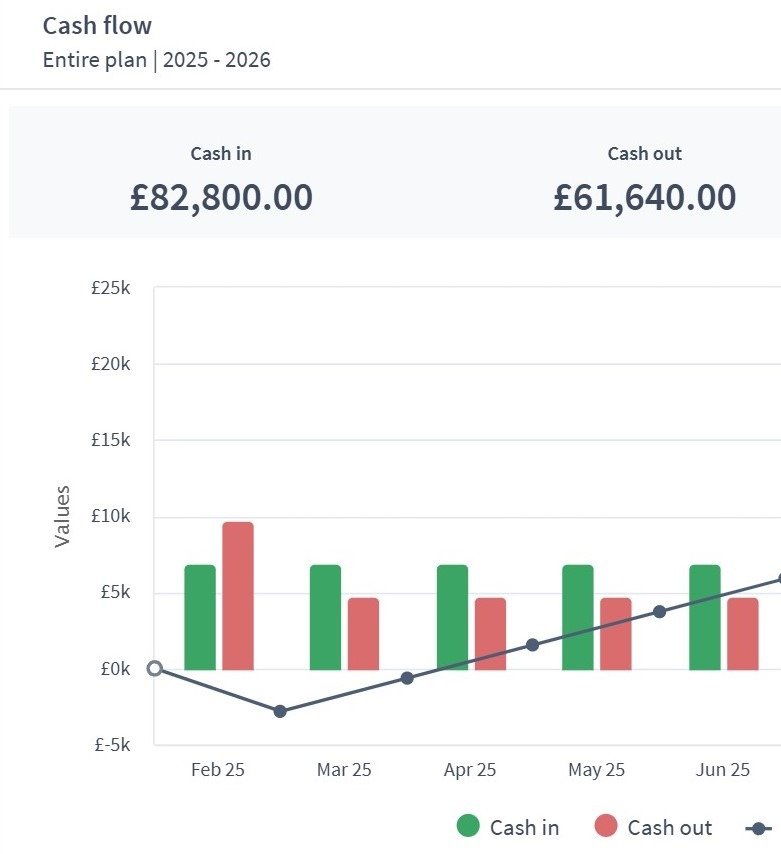

- Cash Flow Report

- Tracks premium inflows vs. claim outflows and operational costs.

- Balance Sheet

- Shows reserve levels, claims provisions, investment portfolio, and shareholder equity.

- Profit & Loss Statement

- Displays premium revenue, investment income, claims paid, expenses, and net income.

- Custom KPIs

- Loss Ratio (Claims / Premiums)

- Combined Ratio ((Claims + Expenses) / Premiums)

- Investment Yield (Investment Income / Invested Assets)

- Solvency Ratio (Assets / Liabilities)

Who can use this Brixx template?

- Insurance brokers and agencies

- Underwriting and claims departments

- Finance teams in insurance firms

Brixx is a great tool for:

- Ideal for anyone managing premiums, claims payouts, operational expenses, and long-term financial strategy

- Supports finance managers, analysts, and business owners in tracking revenue, liabilities, and risk mitigation plans

What are the key benefits for insurance companies?

- A tailored structure designed to reflect the unique cash flow patterns of insurance operations

- Model premium income, claims expenditure, operational costs, and reinsurance arrangements

- Visualise financial trends and gain clarity on policy profitability and growth potential

- Easily scenario test the effects of new insurance products, pricing strategies, or regulatory changes

- Understand the financial implications of changing claim rates, market trends, or customer retention strategies

Strategic forecasting in Brixx

- Analyse how different premium structures and claim frequencies affect profitability

- Prepare financial documentation to support funding or partnership proposals

- Budget for marketing campaigns, staffing costs, and digital transformation initiatives

- Model the capital impact of large-scale claims events or policy changes

- Track performance over time and adjust plans in response to market conditions

Explore different industry frameworks you can build in Brixx for your business

Brixx for Investment Consultants

Explore our template for investment consultants. It’s designed to forecast income from advisory services and client fees.

Brixx for Consultants

Explore our template for consultants. It’s designed to help you plan billable hours, client work, and revenue from projects.

Brixx for Accountants

Explore our template for accountants. It’s designed to track client income, plan retainers, and forecast financial services.

Brixx for Lawyers

Explore our template for lawyers. It’s designed to support firms managing client retainers, case fees, and hourly billing.

Get started with Brixx

£30 / month

Prices exclude local taxes

7 Day Free Trial

No credit card required

- Scenario testing

- 10-year financial forecast

- Pre-built templates

- Xero integration

- Automated reports: P&L, balance sheet, cash flow, tax & more

"It’s really clever software and so easy to use. It was so useful to see the cash flow in one, two, and three-year blocks."

Jack Berryman, MintMechStart building better financial plans with Brixx today

Whether you’re growing an independent insurance agency or managing a larger operation, Brixx provides the clarity and flexibility your business needs. Gain a deep understanding of your financial position, plan for multiple scenarios, and stay ahead of industry challenges.

From forecasting future claims liabilities to projecting premium revenue and regulatory compliance costs, Brixx empowers insurance firms to make confident, data-led decisions. With two decades of expertise in business modelling, Brixx offers a smart, intuitive platform that helps you prepare for whatever comes next.

Take the guesswork out of financial planning and bring precision to your insurance business with Brixx.