Financial forecasting is critical for all businesses. However, the accuracy of these forecasts is a topic of ongoing debate. This article delves into the challenges surrounding financial forecasting, explores the factors influencing its accuracy, and discusses how to best and most accurately create accurate forecasts.

What are financial forecasts?

Financial forecasts are predictions of your business’ financials based on factors like incoming and outgoing cash, historical trends within the business, and future market analysis. These predictions play a crucial role in guiding business decisions.

There are a multitude of different financial forecasts. These can be created in Excel, Google Sheets, or by utilising a tool like Brixx. These forecasts will use mathematical models, data analytics, and expert analysis, and will attempt to anticipate future financial conditions, enabling businesses to make informed decisions and plan for potential opportunities or challenges. However, the accuracy of financial forecasts is inherently challenging due to the dynamic nature of the economic environment, the influence of human behavior, and the limitations of forecasting models.

Get started with our forecasting software so that you can plan your business' futureCreate accurate financial forecasts in Brixx

What are the challenges of accurate financial forecasting?

Accurate financial forecasting faces several challenges, both internally and externally. For one, the dynamic nature of the economy, influenced by factors like geopolitical events and technological changes, makes it difficult to predict future conditions. Similarly, human behavior and market psychology can introduce unpredictability.

Forecasting models rely on assumptions, and any deviation can lead to inaccuracies. Data quality also plays a crucial role, as incomplete or outdated information can compromise the reliability of predictions. These challenges collectively make achieving pinpoint accuracy in financial forecasting a complex task.

- Recommended Reading: How to Overcome Inaccurate Financial Forecasts

What influences the accuracy of financial forecasts?

Several factors influence the accuracy of financial forecasts. As can be expected, economic factors such inflation rates and interest rates can impact predictions. Technological advancements and changes in market sentiment contribute to the unpredictability of forecasts. Additionally, the quality and availability of data used in forecasting models significantly affect accuracy. The interplay of these factors creates a dynamic environment that makes it challenging to achieve perfect precision in financial predictions.

Short term vs long term forecast accuracy

Short-term and long-term financial forecasts differ in their accuracy due to the inherent challenges associated with predicting different timeframes.

Short-term forecast accuracy

Short-term forecasts typically cover a period of up to one year, including 13 week forecasts and 12 month forecasts. These predictions often benefit from the availability of more current and relevant data. Factors influencing short-term outcomes are generally more predictable, allowing for a higher degree of accuracy. However, unexpected events or sudden market shifts can still introduce uncertainties, impacting the precision of short-term forecasts.

Long-term forecast accuracy

Long-term forecasts extend beyond one year and are inherently more challenging due to the increased uncertainty over an extended timeframe. Predicting variables like economic conditions, technological advancements, and geopolitical events becomes more complex. Long-term forecasts are more susceptible to unforeseen changes, making it difficult to maintain high levels of accuracy over extended periods.

In summary, short-term forecasts tend to be more accurate due to the availability of current data and the relative predictability of near-future events. Long-term forecasts, on the other hand, face greater challenges in accurately predicting outcomes over extended periods due to the increased complexity and uncertainty associated with a more extended timeframe.

Has technology improved the accuracy of financial forecasting?

Technology has allowed a significant improvement of the accuracy of financial forecasting. Several technological advancements have played a crucial role in enhancing the precision and reliability of financial predictions:

Data analytics

Advanced data analytics tools allow businesses to process large datasets efficiently. Analyzing historical and real-time data enables better-informed decision-making and more accurate predictions. Tools like Brixx can do this without human calculation.

Machine learning and AI

Machine learning algorithms and artificial intelligence (AI) have the capability to identify patterns and trends within data that may not be apparent through traditional methods. These technologies can adapt to changing market conditions, improving forecast accuracy over time.

Predictive modelling

Sophisticated predictive modeling techniques enable businesses to simulate different scenarios and assess potential outcomes. This helps in developing more robust and adaptable financial forecasts.

Real-time information

Technology facilitates access to real-time information, allowing businesses to react swiftly to changes in the market. Timely updates contribute to more accurate and relevant forecasting.

Cloud computing

Cloud computing is the infrastructure that allows the storing and processing of vast amounts of data. This scalability allows businesses to handle complex computations and analyses, contributing to improved forecasting capabilities.

While technology has significantly improved financial forecasting accuracy, it is essential to acknowledge that challenges still exist. The dynamic nature of the financial landscape requires continuous adaptation and refinement of technology-driven forecasting models to stay ahead of emerging trends and unforeseen events.

How to improve financial forecasting accuracy

Improving financial forecasting accuracy is crucial for making informed business decisions and mitigating risks. Here are some strategies to enhance the precision of financial forecasts:

Use multiple forecasting methods

Employ a combination of forecasting methods, such as time series analysis, regression analysis, and scenario planning. Diversifying the approaches can provide a more comprehensive understanding of potential outcomes.

Scenario analysis

Conduct scenario analysis to account for different potential situations. This approach helps identify key variables and assess the impact of various scenarios on financial performance. As a scenario testing tool, Brixx can help to do this across multiple plans.

Continuous monitoring and updating

Regularly monitor and update forecasts to reflect the latest information and market conditions. The financial landscape is dynamic, and adjusting forecasts in real-time improves their accuracy.

Diversify data sources

Utilize a diverse range of data sources. Incorporating real-time information and industry-specific data enhances the reliability of predictions.

Risk management strategies

Develop robust risk management strategies to address potential uncertainties. Identifying and mitigating risks before they materialize can improve the accuracy of forecasts.

Benchmarking and comparative analysis

Compare actual financial performance with forecasts regularly. Conducting post-forecast analysis helps identify areas for improvement and refine future forecasting processes.

Review and learn from past forecasts

Evaluate the accuracy of past forecasts and learn from discrepancies. Understanding the reasons behind forecasting errors helps refine future predictions and improve overall forecasting accuracy.

By adopting a multifaceted approach that combines different methods, businesses can enhance the accuracy of their financial forecasts.

Improve your financial forecasting accuracy with Brixx

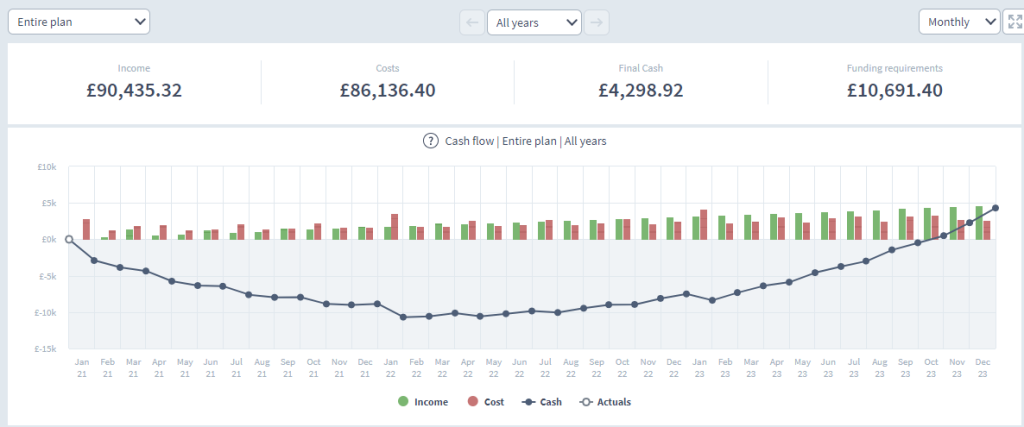

Improving financial forecasting accuracy is simplified with Brixx, a powerful financial forecasting tool designed to streamline and enhance the entire forecasting process.

With Brixx, users can benefit from its user-friendly interface and comprehensive features that facilitate efficient time series analysis and scenario planning. The tool allows for real-time collaboration, ensuring that teams can work together seamlessly to input accurate data and contribute to a more holistic forecasting process.

Brixx’s advanced technology further elevates its capabilities, enabling users to harness the latest in data analytics for more precise and adaptive financial predictions. By leveraging Brixx, businesses can unlock a new level of accuracy in their financial forecasts, making informed decisions and staying ahead in an ever-changing economic landscape.