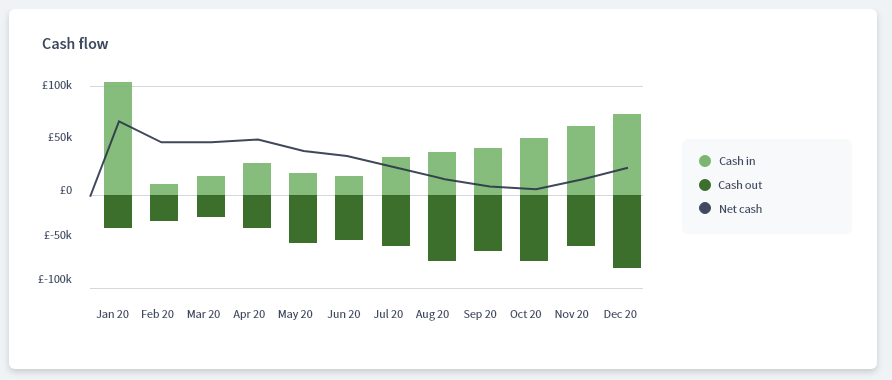

Cash flow defined

Having a strong grasp of cash flow is essential for running a successful business. Understanding the differences between cash inflow and cash outflow, and how to manage both effectively, is critical for managing your business finances with confidence.

What is cash inflow?

When we talk about cash inflow, we’re talking about money coming into a business account. It can come from all sorts of sources, including business sales, loans, or investments. Cash inflow is considered a positive thing event as it means there’s more cash available for the recipient. It is an important aspect of cash flow management as it helps to ensure that a business or individual has enough cash to cover expenses and investments.

What is cash outflow?

Cash outflow refers to anything related to the payment of cash from a business or an individual, including expenses and other financial obligations that require the transfer of money. Cash outflows can be anything from employee salaries to loan repayments. It is considered equally as important as cash inflow as businesses need to ensure that there is enough cash available to cover expenses and prevent cash shortages.

Why does business cash flow matter?

Business cash flow is important for several reasons:

It ensures the survival of the business

Cash flow is the lifeblood of any business. It is essential to keep the business running by paying employees, suppliers, and other expenses. Without adequate cash flow, a business can run into financial trouble and potentially go bankrupt.

It enables growth and expansion

Positive cash flow allows a business to invest in growth opportunities such as hiring new employees, expanding operations, or launching new products or services. By having enough cash on hand, businesses can take advantage of these opportunities and continue to grow.

It helps with financial planning

Cash flow is an important factor in financial planning. By forecasting cash inflows and outflows, businesses can plan for the future and make informed decisions about investments and expenses.

It makes a business more attractive to investors

Investors are interested in businesses that have a positive cash flow. This is because positive cash flow indicates that a business is financially stable and has the ability to pay back loans or generate profits.

It helps with tax planning

Understanding cash flow is important for tax planning. By managing cash flow effectively, businesses can reduce their tax liabilities by maximizing deductions and taking advantage of tax credits.

Overall, cash flow is critical for the success and sustainability of any business. It is essential for day-to-day operations, growth opportunities, financial planning, and attracting investors.

Types of cash flow within a business

There are three main types of cash flows that a business can experience: operating, investing, and financing.

Operating costs

This is the cash flow that results from a business’s core operations. It represents the cash generated or used by a company’s day-to-day activities, such as sales, inventory purchases, and expenses. Operating cash flow can be positive or negative, depending on whether a company is generating more cash from its operations than it is spending.

Investing

This is the cash flow that results from a company’s investments in assets such as property, plant, and equipment, as well as financial investments such as stocks and bonds. Investing cash flow can be positive or negative, depending on whether a company is investing more cash than it is receiving from the sale of assets.

Financing

This is the cash flow that results from a company’s financing activities, such as issuing or repaying debt, or issuing or repurchasing equity. Financing cash flow can be positive or negative, depending on whether a company is raising more cash than it is spending on debt and equity transactions.

Understanding and managing these three types of cash flows is essential for a business’s success. A business needs to generate enough cash from its operations to cover its operating costs and invest in growth opportunities, while also managing its debt and equity financing to ensure it has enough cash to fund its operations and growth initiatives.

How to maintain positive cash flow

Maintaining positive cash flow is critical for the long-term success and sustainability of any business. Here are some tips that can help:

Develop a cash flow budget

Creating a cash flow budget will help you plan your expenses and ensure that you have enough cash to cover them. This cash budget should include all of your expenses, such as rent, utilities, payroll, and taxes, as well as any expected inflows, such as sales revenue.

Invoice promptly

One of the most common reasons for a negative cash flow is slow payment from customers. To prevent this, make sure you send out your invoices as soon as possible and follow up on overdue payments promptly.

Manage inventory levels

Holding too much inventory can tie up cash that could be used for other expenses. To avoid this, keep track of your inventory levels and adjust your orders to match your sales demand.

Control your expenses

Keep your expenses under control by negotiating with suppliers, looking for ways to reduce your overhead costs, and avoiding unnecessary expenses.

Monitor your cash flow regularly

Review your cash flow regularly to make sure you’re staying on track. This will help you identify any potential problems early and take action to prevent them.

By following these tips, you can improve your cash flow and ensure the long-term success of your business.

How to calculate cash flow?

Calculating cash flow involves analyzing the inflow and outflow of cash from a business or investment. Here’s a general formula to calculate cash flow:

Cash Flow = Cash Inflow – Cash Outflow

It’s important to note that there are different types of cash flow calculations, such as the previously mentioned operating cash flow, investing cash flow, and financing cash flow, which look at specific types of cash inflows and outflows. The method of calculating cash flow can also vary depending on the business or investment being analyzed.

How to improve your cash flow

Improving your cash flow can be a crucial step to the success of your business or personal finances. Here are some tips to improve your cash flow:

Create a cash flow forecast

This involves creating a detailed plan of your expected cash inflows and outflows over a certain period, typically a month or a quarter. This will help you predict your cash needs and identify potential cash shortages before they occur. We have a cash flow forecast template available to download.

Invoice promptly and follow up on unpaid invoices

Send invoices as soon as possible after the service or product has been delivered, and follow up on any overdue payments. This will help you receive payment faster and improve your cash flow.

Offer discounts for early payment

Consider offering a discount for customers who pay their invoices early. This can encourage them to pay sooner and improve your cash flow.

Negotiate payment terms with suppliers

Negotiate with your suppliers for longer payment terms or discounts for early payment. This can help you manage your cash flow better.

Cut costs

Review your expenses and look for ways to reduce costs. This can include negotiating better prices with suppliers, reducing inventory levels, or using technology to automate processes.

Increase revenue

Explore ways to increase your revenue, such as by expanding your product or service offering, improving marketing efforts, or targeting new customer segments.

By implementing these tips, you can improve your cash flow and help ensure the success of your business or personal finances.

Can you forecast your cash flow?

To forecast your cash flow, you will need to gather and analyze financial data such as sales revenue, expenses, and accounts receivable and payable. You can use this data to create a cash flow statement that predicts your expected cash inflows and outflows over a specific period of time. We’ve collated some tips for forecasting:

Be realistic

Use realistic assumptions and conservative estimates when forecasting your cash flow.

Update regularly

Regularly review and update your cash flow forecast to reflect changes in your business or personal finances.

Consider various scenarios

Consider different scenarios that could affect your cash flow, such as changes in market conditions or unexpected expenses.

Seek professional advice: If you are uncertain about how to forecast your cash flow, consider seeking advice from a financial professional or accountant.

Using Brixx for cash flow forecasting

As a cash flow forecasting tool, Brixx offers various features to help you with your forecasting, such as scenario planning, budgeting, and financial reporting. By using Brixx for cash flow forecasting, you can gain insights into your business’s financial health and make informed decisions to achieve your financial goals. See more with our video tutorials and demos.