Starting a clothing business is an exciting adventure, but it also comes with its own set of financial challenges. One key to success is being able to predict your cash flow, which is simply knowing when money will be coming in and going out of your business. This guide will walk you through how to create a cash flow forecast, a tool that can help you plan for the future, avoid surprises, and keep your business on track. It’s not as complicated as it sounds and by the end, you’ll feel more confident about managing your finances. So let’s dive in!

What is cash flow forecasting?

A cash flow forecast is a projection of the amount of money a company expects to flow in and out of the business within a certain period. This forecast takes into account all potential revenue sources and expenses, such as sales income, supplier payments, payroll, and overhead costs. A good cash flow forecasting tool will account for all of these things and more.

Get started with our forecasting software so that you can plan your business' futureCreate cash flows for your clothing business in Brixx

Why is cash flow forecasting important in a clothing business?

Cash flow forecasting is crucial in the clothing industry as it helps with effective inventory management, accommodating the industry’s seasonality, planning for business growth, and mitigating financial risks. Through accurate forecasting, businesses can balance inventory to meet demand, prepare for seasonal fluctuations, identify optimal expansion opportunities, and foresee potential financial shortfalls to ensure business resilience.

The data needed for a clothing line cash flow forecast

Compiling accurate data is a crucial step in creating a robust cash flow forecast for your clothing line. This data can be broadly classified into money coming in and money going out. Let’s examine these categories:

Incoming Cash:

- Sales: Your projected income from selling your clothing items. Estimate the quantity and pricing of your clothing pieces to calculate your potential revenue.

Outgoing Cash:

- Cost of goods sold (COGS): These are expenses directly associated with the production of your clothing line. Typically, this includes materials used and direct labor costs.

- Operational expenses: This category encompasses regular, ongoing costs necessary for running your business. Examples in the clothing line industry might include rent for your store or workshop, salaries for your staff, utilities, marketing costs, and more.

- Asset expenditure: If your business requires one-off purchases of significant assets such as machinery, vehicles, or property, these costs need to be factored in.

- Debt repayments: If your clothing line has accrued any debt, it’s important to account for the repayments in your cash flow forecast.

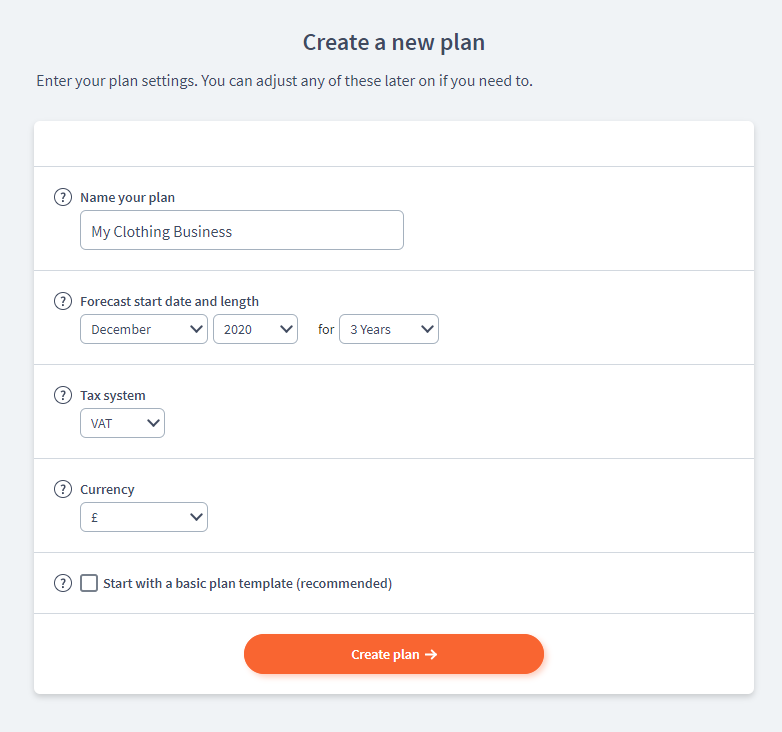

Steps to create a cash flow forecast for a clothing business using Brixx

In the following sections, we’ll break down the steps to create a cash flow forecast for a clothing business using Brixx.

Brixx is a financial forecasting and business modelling tool – allowing you to forecast Cash Flow, P&L and Balance Sheet up to 10 years in the future.

You can follow along by signing up or with a free cash flow forecast template.

With that out of the way, let’s get cracking.

Step 1: Inputting your starting cash

This is the cash you currently have in your business account. It is your business’s baseline for the forecast.

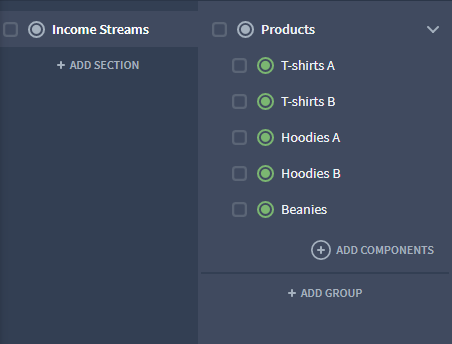

Step 2: Forecasting your income streams

Identify your anticipated sales. Your income streams are your sources of cash inflow. For a clothing business, this will mainly be sales revenue. You might have different income streams for different product lines. Be sure to consider seasonality and trends in sales.

In this case, you expect to sell:

- T-shirt A: 10 a month at £15 each

- T-shirt B: 10 a month at £15 each

- Hoodies A: 5 a month at £30 each

- Hoodies B: 5 a month at £30 each

- Beanies: 15 a month at £10 each

Let’s take the “T-shirts A” income component as an example.

This is a snapshot of your “T-shirts A” income component. As the forecast illustrates, you anticipate selling an additional two units each month.

Now, we can save this data and proceed to input the details for the other income streams.

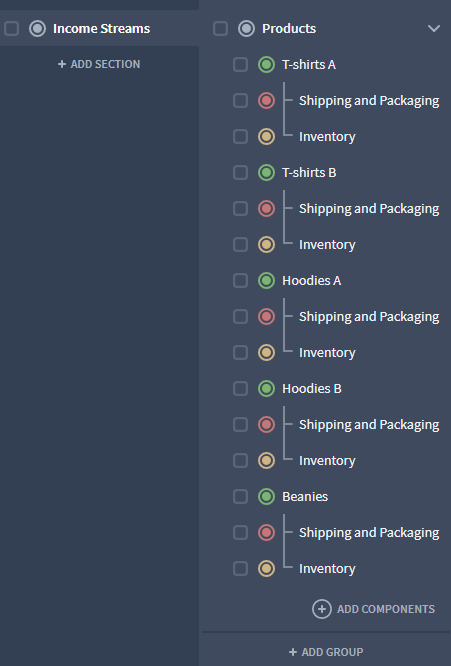

Step 3: Forecasting your costs

There are two primary costs to consider:

- Cost of goods sold (COGS)

- Operational expenses

1. Detailing cost of goods sold (COGS)

These are the costs directly associated with producing and selling your products.

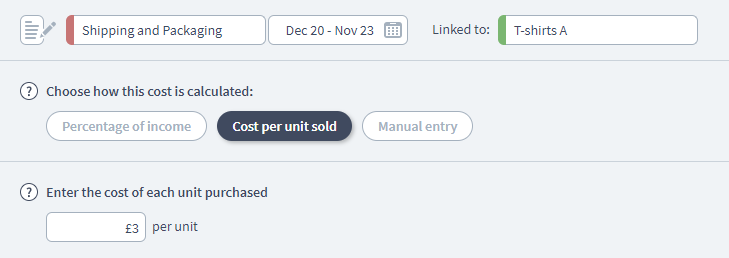

- Shipping and packaging

- Inventory

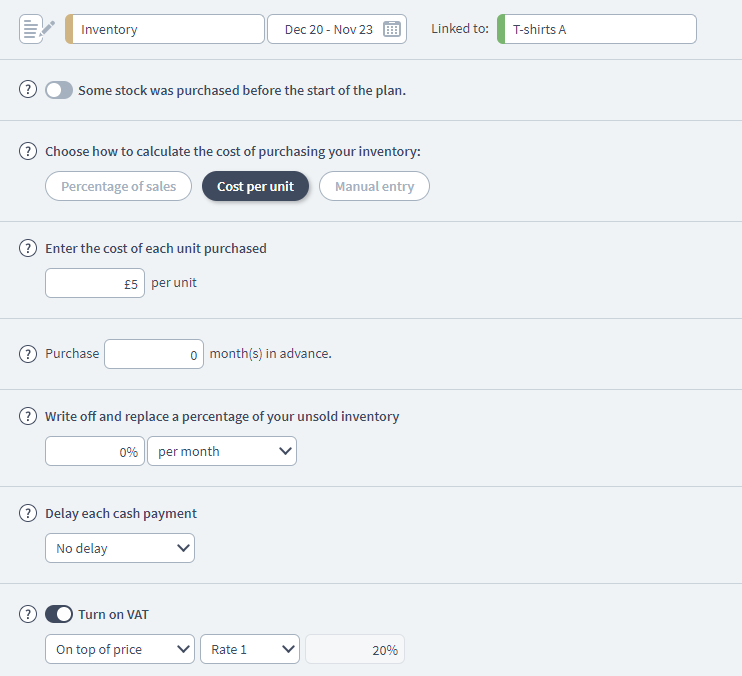

Let’s take T-shirt A as an example again.

For this clothing business, an individual t-shirt will cost roughly £5, so we enter it as the cost of each unit purchased.

There is also an additional £3 for packaging and shipping.

2. Outlining operational costs

Operational costs are the costs associated with running the day-to-day operations of the business.

For our case, the monthly costs include:

- Electricity (£30)

- Gas (£20)

- Internet (£30)

- Water (£20)

- Insurance (£80)

- Rent (£2500 per quarter)

- Social media ads (£80)

- Website hosting and management (£30)

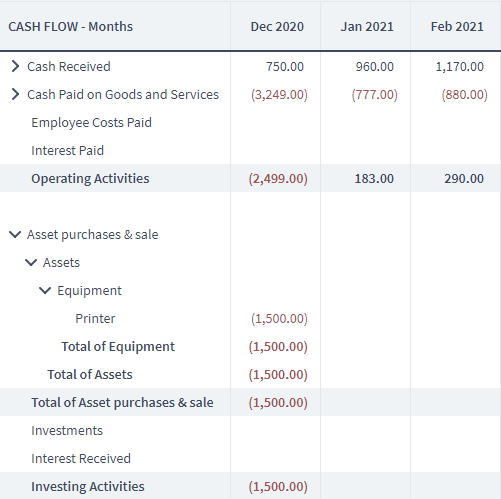

Now, let’s have a look at the cash flow again:

As we can see, all the Operating Costs have been entered into the plan, and are displaying in the Operating Activities section! We’ve nearly finished creating the cash flow forecast. Let’s now move onto adding assets.

Step 4: Including your assets in the forecast

In clothing businesses, whether you manufacture in-house or outsource impacts your asset purchases. These are items that your business owns and can contribute to its income.

Payment terms for assets vary. Buying an asset upfront means owning it outright but involves a significant one-time cash outlay. Alternatively, credit purchase allows gradual payments over time, though financial difficulties might affect repayment ability.

Consider this clothing business:

You need a printer for the designs, costing £1,500. We added this to the plan, accounting for the VAT and annual depreciation of 10% due to usage. Now, our cash flow includes Income, Costs, and Assets.

Now we’ve covered Income, Costs and Assets. Let’s move onto the last section, funding.

Step 5: Incorporating funding sources into your forecast

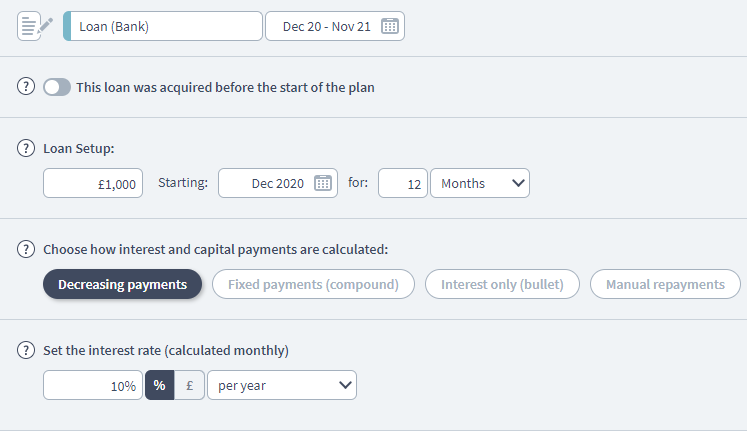

To launch the business, you invested £2000 of your own money and secured a £1000 loan from a bank. This should also be added to the forecast.

This Loan component is set so you receive £1,000 in December, and pay off the loan + 10% interest over a 12 month period.

Step 6: Creating your net cash flow

In Brixx, input all the information you gathered in steps 1-5. Brixx will calculate your net cash flow by subtracting your total expenses (cost of sale components, operational costs, and asset costs) from your total income (income streams plus starting cash and funding sources).

Step 7: Adjusting and reviewing your cash flow forecast

Finally, compare your forecast to your actual business performance regularly. Adjust your forecast as needed based on actual sales, cost fluctuations, and other variables. Remember, your cash flow forecast isn’t set in stone; it should be a dynamic tool that evolves with your business.

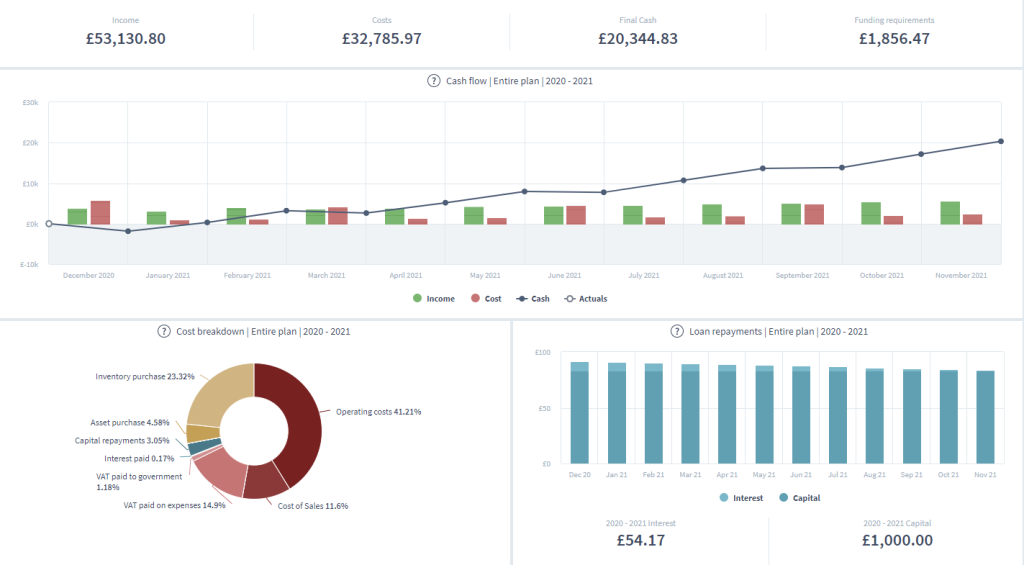

With all your data entered into Brixx, your basic cash flow forecast is complete. The next step is visualizing these numbers to make them more understandable.

Visualizing cash flow can help you identify when costs are due, when cash comes in, and spot any potential issues. Luckily, Brixx has a built-in dashboard for this purpose. It automatically transforms your data into intuitive charts and graphs. Here’s a glimpse of how it looks:

This visual tool simplifies your data analysis, helping you anticipate and address any financial challenges promptly.

Taking the next step!

Great! You’ve successfully navigated the initial stages of forecasting your clothing business’s cash flow. But remember, this journey doesn’t end here.

As your business expands, your cash flow will proportionally increase, calling for re-assessment and contemplation of various scenarios. Whether it’s ensuring sufficient cash for a sudden spike in inventory demand, budgeting for a new hire, preparing for unexpected equipment repairs, or planning a move to a larger workspace, your cash flow forecast provides the answers.

Start your journey to financial foresight today with our free forecasting software. Enjoy the confidence and control that come with an accurate and efficient cash flow forecast.