What is the quick ratio?

The quick ratio is a financial metric used to evaluate a company’s short-term debts. It is also known as the ‘acid test ratio’.

This ratio measures a company’s ability to cover its immediate debts/liabilities with its most liquid assets. The quick ratio is a more precise measure of liquidity than the current ratio because it excludes inventory from the calculation, as inventory may not be easily converted into cash in the short term.

Forecasting the quick ratio gives you a tool to look ahead and ensure you can meet any short term debts your business plans to take on to fund its activities.

Why is it called the quick ratio?

The name “Quick Ratio” reflects emphasis on the speed and ease of converting highly liquid assets into cash to meet short-term financial obligations promptly.

Quick ratio formula

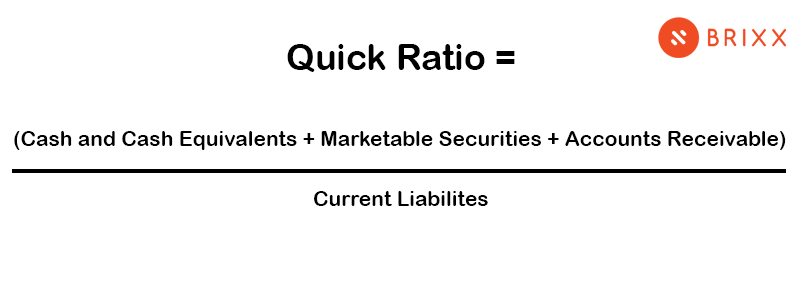

The formula for calculating the quick ratio (or acid-test ratio), is as follows:

Why is the quick ratio important in finance?

When used, the quick ratio indicates a company’s ability to settle its short-term debts by relying solely on its most liquid assets. This of course holds significant importance as it serves as a crucial indicator for both internal management and external investors regarding the company’s cash flow sustainability.

Unlike other liquidity ratios like the current ratio, the quick ratio takes a conservative approach, making it a much more precise and valuable metric in assessing a company’s cash-raising capabilities in financial analysis.

What do you need to calculate the quick ratio?

To calculate the quick ratio, you need to gather the following information from a company’s financial statements:

- Cash and cash equivalents: This includes the amount of cash on hand and highly liquid assets that can be quickly converted to cash.

- Marketable securities: These are short-term investments that can be easily sold or converted into cash.

- Accounts receivable: Accounts receivable represents the amount of money owed to the company by its customers for goods or services provided.

- Current liabilities: These are the company’s short-term liabilities that are due within one year, such as accounts payable, short-term loans, or accrued expenses.

Once you have these values, add the amounts of cash and cash equivalents, marketable securities, and accounts receivable together. Then, divide that sum by the total current liabilities of the company. The resulting figure is the quick ratio, which indicates the company’s ability to meet its short-term obligations using its most liquid assets.

Quick ratio vs current ratio

As we have inferred within this article, the quick ratio and the current ratio are both measures of a company’s liquidity, but they differ in the assets included in their calculations. Here are the key differences between the two ratios.

Quick ratio

The quick ratio focuses on a company’s most liquid assets, excluding inventory from the calculation.

As we have stressed, this ratio focuses on immediate liquidity and is useful in industries where inventory conversion may take time or inventory values may fluctuate significantly. A ratio above 1 suggests that a company has sufficient liquid assets to cover its short-term liabilities.

Current ratio

Comparatively, the current ratio includes all current assets in its calculation, including inventory. It measures a company’s ability to cover its short-term obligations using all its current assets.

This ratio provides a broader view of a company’s liquidity position by considering all current assets. It is helpful in industries where inventory turnover is rapid and inventory can be easily converted into cash. A ratio above 1 indicates that a company has more current assets than current liabilities, implying a relatively strong liquidity position.

What are the advantages of using quick ratio?

The quick ratio provides a more precise view of short-term cash capabilities, which enables a more conservative estimate as to how liquid a company is. With an easy calculation, it is simple to understand.

1. Focus on immediate liquidity

The focus on immediate liquidity is useful in industries where inventory may not be easily converted into cash or where inventory values can be volatile.

2. Conservative assessment of liquidity

The quick ratio excludes inventory, which offers a more conservative measure compared to the current ratio, which includes all current assets.

3. Identifying potential cash flow issues

By highlighting potential cash flow issues, the quick ratio helps identify situations where a company might face difficulties in handling unexpected financial demands.

4. Quick comparison and benchmarking

The quick ratio, as a standardized metric, allows for easy comparison and benchmarking across companies and industries.

5. Effective cash management evaluation

The quick ratio encourages companies to focus on efficient cash management practices and strategies to ensure they have sufficient liquidity to meet short-term obligations.

Although the quick ratio offers valuable insights into short-term liquidity, it is just one aspect of financial planning and analysis. It should be used in conjunction with other financial metrics and factors to gain a comprehensive understanding of a company’s financial health.

What are the disadvantages of using quick ratio?

Unfortunately, the quick ratio doesn’t allow for assessing the future cash flow activity of a company. It is a very immediate notice of a company’s performance, and may not show how well it will retain or maintain cash balance in the future.

1. Exclusion of inventory

For companies heavily reliant on inventory turnover, the exclusion of inventory can distort the liquidity assessment.

2. Potential overemphasis on short-term liquidity

The quick ratio focuses primarily on short-term liquidity. Overemphasizing this financial entity can neglect the long-term sustainability and viability of the company.

3. Limited assessment of cash flow dynamics

The quick ratio provides a static snapshot of a company’s liquidity at a given moment. It does not take into account the company’s cash flow dynamics or the timing of cash inflows and outflows.

4. Industry-specific considerations

The quick ratio may not be universally applicable across all industries. Different industries have unique characteristics and liquidity requirements. It is important to consider industry norms and specific circumstances when interpreting quick ratios.

5. Lack of context and qualitative factors

The quick ratio alone may not provide sufficient context or insight into a company’s overall financial health. It does not consider qualitative factors such as the quality of accounts receivable, creditworthiness of customers, or potential risks to cash flow.

It is crucial to consider these limitations and supplement the quick ratio analysis with other financial metrics and qualitative factors to obtain a more comprehensive view of a company’s liquidity and financial health.

How does the quick ratio help you with financial forecasting?

The quick ratio can be helpful in financial forecasting by providing insights into a company’s short-term liquidity position. Of course, by using and understanding this ratio, your business will be able to see if current cash and liquid resources will be able to cover upcoming financial obligations. Similarly, if your ratio is below industry benchmarks then it might indicate cash flow challenges, which allows you to take proactive measures, such as adjusting cash management strategies or seeking additional funding, to address potential challenges before they become critical.

By manipulating the quick ratio in financial forecasting models, you can perform sensitivity analysis to assess the impact of changes in liquidity on the company’s financial projections. Sensitivity analysis allows you to explore different scenarios and evaluate how variations in the quick ratio, such as changes in accounts receivable, may affect the company’s cash position and overall financial outlook.

Of course, with all of the above (and including other liquidity ratios for a further understanding), the quick ratio can guide decision-making in financial forecasting. It helps management evaluate the potential effects of different strategies on the company’s liquidity position. This information enables informed decision-making to optimize liquidity and ensure financial stability in the forecasted period.

The quick ratio is great, but it’s not the only liquidity ratio!

Whilst you might find the quick ratio great for your business, it’s not the only KPI to track. You don’t want to have to do the calculations in your head each time you look at your financial reports, so keeping track of these KPIs alongside your forecasts is a must.

Ultimately, using a mixture of ratios and KPIs can bolster your forecasting efforts; don’t overlook them when planning your business.