Financial Modelling Tool for Catering Businesses

As a catering business owner, understanding how your cash flow fluctuates throughout the year and knowing when to make strategic decisions is essential. Brixx offers the financial tools you need to gain timely and crucial insights to guide your catering business toward success.

Start free trial

Model your catering business in Brixx - see how quickly your finances can make sense!

We are working on creating this template in Brixx. Although it isn’t available just yet, you can follow the guidance below to help get started. If you need any further assistance, don’t hesitate to get in touch – we’re here to help!

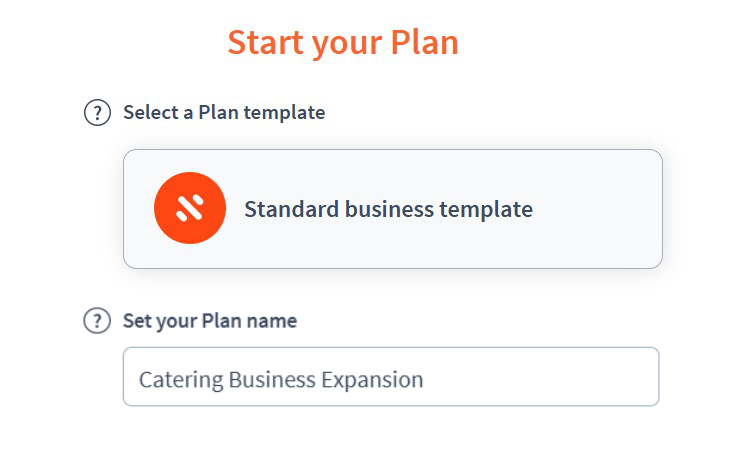

Project Setup

- Project name: Catering Business Expansion

- Time period: Monthly (ideal for tracking event-based and recurring catering revenue)

Income Components

- Component: Event Catering Income

- Sub-components:

- Corporate Catering (£3,000 per event, 4 events/month) = £12,000/month

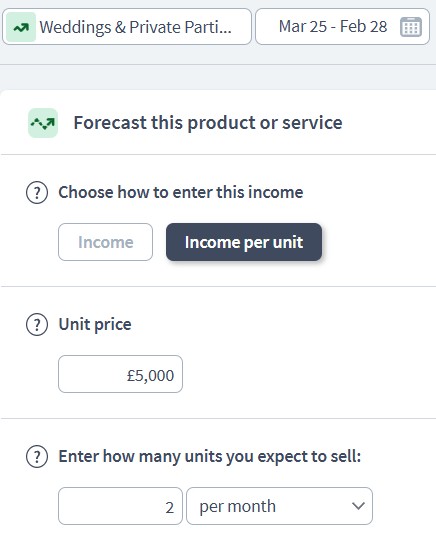

- Weddings & Private Parties (£5,000 per event, 2 events/month) = £10,000/month

- Festivals & Public Events (Variable, est. £4,000/month)

- Sub-components:

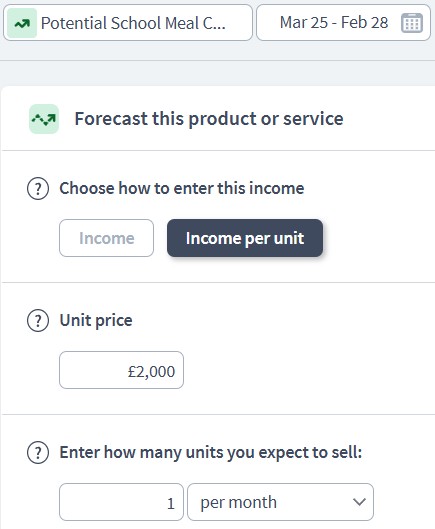

- Component: Recurring Catering Income

- Sub-components:

- Office Lunch Contracts (£1,500 per contract, 3 contracts) = £4,500/month

- School Meal Contracts (£2,000 per contract, 2 contracts) = £4,000/month

- Sub-components:

- Component: Additional Income

- Sub-components:

- Beverage Sales Add-ons (Soft drinks, alcohol at events) = £2,500/month

- Equipment Rental (e.g., tables, heaters, utensils) = £1,000/month

- Delivery Charges (£50 per order, ~20 orders/month) = £1,000/month

- Sub-components:

Expenditure Components

- Component: Operational Costs

- Sub-components:

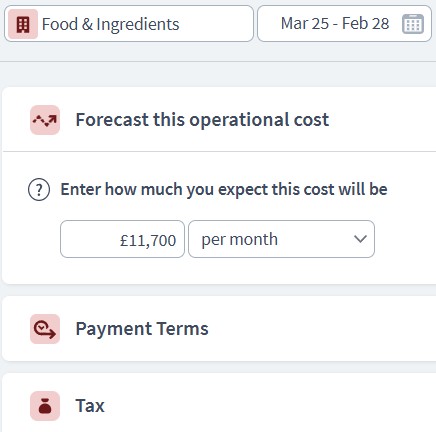

- Food & Ingredients (30% of sales) = £11,700/month

- Staff Wages (Chefs, Servers, Drivers) = £10,000/month

- Kitchen Rental / Premises Rent = £2,500/month

- Vehicle Costs (Fuel, Insurance, Leasing, Maintenance) = £1,200/month

- Event-Specific Costs (Décor, Disposable Items, Licenses) = £2,000/month

- Sub-components:

- Component: Administrative Costs

- Sub-components:

- Marketing & Advertising (Social media, Google Ads, flyers) = £1,500/month

- Software & Tools (Accounting, Scheduling, POS System, Brixx) = £300/month

- Insurance (Public Liability, Equipment, Vehicle) = £1,000/year (~£83/month)

- Legal & Accounting Fees = £2,000/year (~£167/month)

- Sub-components:

Asset Components

- Component: Fixed Assets

- Sub-components:

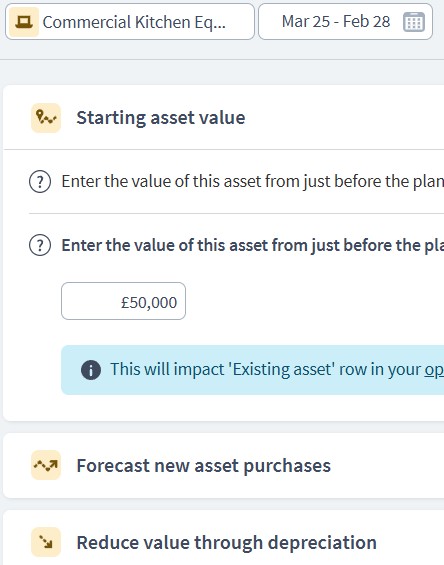

- Commercial Kitchen Equipment (£50,000, depreciated over 5 years)

- Catering Vehicles (Vans, Refrigerated Trucks) (£30,000, depreciated over 7 years)

- Furniture & Serving Equipment (Tables, Chafing Dishes, Cutlery, etc.) (£10,000, depreciated over 3 years)

- Sub-components:

- Component: Current Assets

- Sub-components:

- Cash Reserves (£15,000 starting balance)

- Accounts Receivable (£5,000 outstanding invoices from corporate clients)

- Inventory (Non-perishable food, paper goods, utensils) (£3,000 value)

- Sub-components:

Funding Components

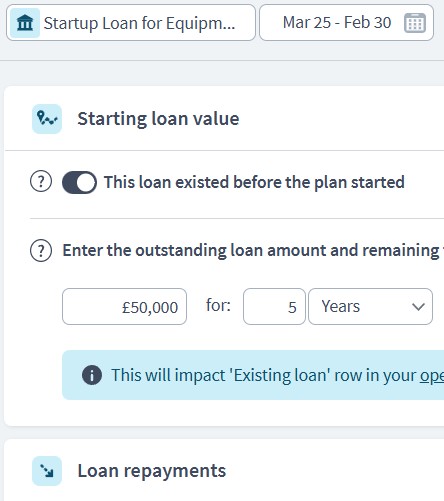

- Component: Business Loans

- Sub-components:

- Startup Loan for Equipment Purchase (£50,000 at 6% interest, 5-year term)

- Van Lease (£30,000, monthly lease payment of £500 over 5 years)

- Sub-components:

- Component: Personal Investment

- Sub-components:

- Founder’s Initial Capital Injection (£20,000)

- Sub-components:

- Component: Future Funding (Optional)

- Sub-components:

- Government Grant for Small Businesses (£5,000, one-off payment)

- Crowdfunding for Expansion (£10,000 target)

- Sub-components:

Scenario Planning in Brixx

- Seasonal Demand Fluctuations

- Model lower bookings in off-season (e.g., Jan-Feb) vs. peak season (e.g., summer weddings, holiday parties).

- Cost Increases

- Simulate a 10% rise in food costs to see the effect on margins.

- New Contracts

- Model an additional school meal contract (£2,000/month) to predict growth impact.

- Unexpected Repairs or Equipment Replacement

- Add an Unexpected Expenses component for emergency costs (e.g., broken fridge, van repair).

Dashboard & Reporting

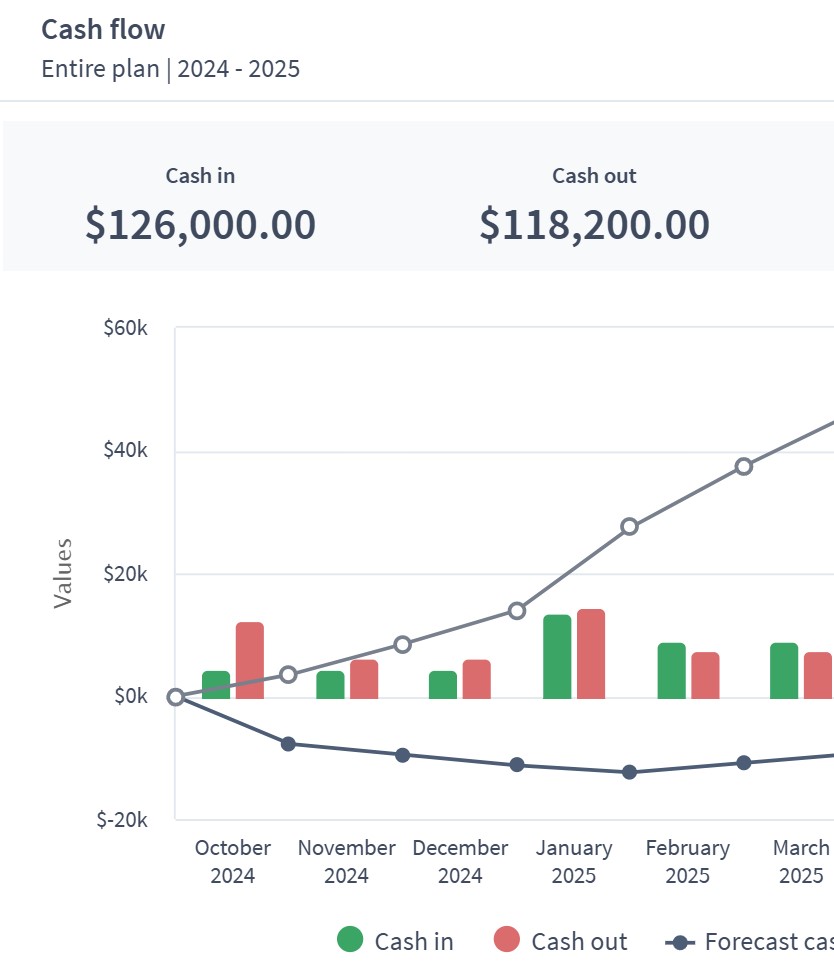

- Cash Flow Report

- Tracks monthly revenue vs. costs, ensuring positive cash flow.

- Balance Sheet

- Monitors asset growth and loan repayments.

- Profit & Loss Statement

- Summarises revenue, direct costs, and net profit.

- Custom KPIs

- Gross Profit Margin (%)

- Event Profitability Analysis

- Recurring vs. One-off Revenue Split

Who can use this Brixx template?

- Catering business owners

- Food service entrepreneurs

- Event caterers

Brixx is a great tool for:

- Anyone managing the financial planning and budgeting for a catering business

- Caterers, accountants, or business owners overseeing operational costs, pricing strategies, and revenue forecasting

What are the benefits to catering businesses?

- The template is tailored to the food service industry, covering all aspects of catering operations and financial management

- Effortlessly forecast cash flows, food costs, staffing expenses, and seasonal fluctuations

- Easily interpret results and graphs to assess the profitability of various catering services

- Quickly evaluate the impact of new revenue streams, such as event catering, delivery services, or wholesale contracts

- Receive immediate feedback when modelling different pricing strategies, supplier costs, or menu changes

Strategic forecasting in Brixx

- Calculating the profitability impact of menu pricing and portion sizes

- Demonstrating projected earnings and cost structures to support loan applications

- Forecasting and budgeting for ingredient purchases, staffing, and equipment investments

- Anticipating financial requirements for business expansion or new service offerings

- Evaluating the impact of market trends, food costs, and customer demand on revenue

Explore different industry frameworks you can build in Brixx for your business

Brixx for Event Planners

Explore our template for event planners. It’s designed to manage bookings, staffing, and income across multiple events.

Brixx for Restaurants

Explore our template for restaurants. It’s designed to help you forecast food costs, table service income, and staff scheduling.

Brixx for Food Vans

Explore our template for food vans. It’s designed to plan mobile operations, stock levels, and daily takings.

Brixx for Coffee Shops

Explore our template for coffee shops. It’s designed to support regular footfall, consumable costs, and café service income.

Get started with Brixx

£30 / month

Prices exclude local taxes

7 Day Free Trial

No credit card required

- Scenario testing

- 10-year financial forecast

- Pre-built templates

- Xero integration

- Automated reports: P&L, balance sheet, cash flow, tax & more

"Brixx provides real structure, supports smarter decision-making, and ultimately helps businesses become more proactive and profitable.”

Wilson PartnersGet started with the best financial projection software - today!

Financial forecasting software is essential for catering businesses, offering the insights needed to plan and manage finances effectively. By forecasting costs, caterers can gain a clearer picture of their financial landscape. Additionally, forecasting potential revenue from events, contracts, and seasonal demand enables informed decisions on menu pricing, staffing, and expansion.

The ability to identify market trends, adjust pricing strategies, and plan for fluctuations in costs further enhances a caterer’s ability to succeed in the long term. With over 20 years of business modelling experience, Brixx stands out as a trusted solution, offering a robust set of features to help catering businesses confidently navigate the complexities of financial planning.

Investing in expert financial modelling software like Brixx empowers you to optimise your catering business and strategically forecast the future of your operations.