Financial Modelling Tool for Driving Instructors

As a driving instructor, understanding how your cash flow may fluctuate throughout the year and knowing when to make strategic decisions is essential. Brixx provides the financial tools you need to gain timely and crucial insights to manage your business effectively.

Start free trial

Model your driving instructor business in Brixx - see how quickly your finances can make sense!

We are working on creating this template in Brixx. Although it isn’t available just yet, you can follow the guidance below to help get started. If you need any further assistance, don’t hesitate to get in touch – we’re here to help!

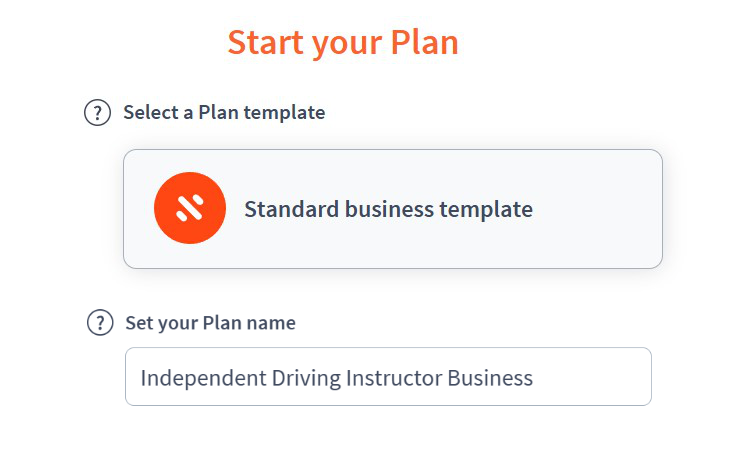

Project Setup

- Project name: Independent Driving Instructor Business

- Time period: Monthly (tracks lesson bookings, fuel costs, etc.)

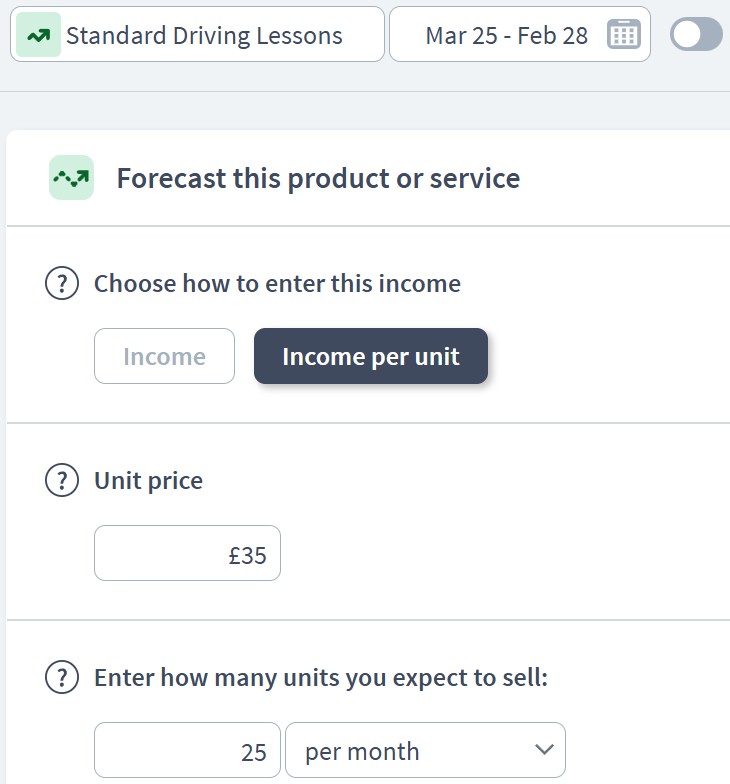

Income Components

- Component: Driving Lesson Income

- Sub-components:

- Standard Driving Lessons (25 lessons/week at £35 each) – £3,500/month

- Intensive Course Packages (2 students/month at £600 each) -£1,200/month

- Pass Plus Lessons (4 courses/month at £200 each) – £800/month

- Theory Test Coaching (5 sessions/month at £40 each) – £200/month

- Sub-components:

- Component: Additional Income

- Sub-components:

- Car Rental for Test Use (5 bookings/month at £50 each) – £250/month

- Referral Bonuses (Partnership with other instructors, estimated) – £100/month

- Online Course Sales (e.g., Theory Test Prep, estimated) – £150/month

- Sub-components:

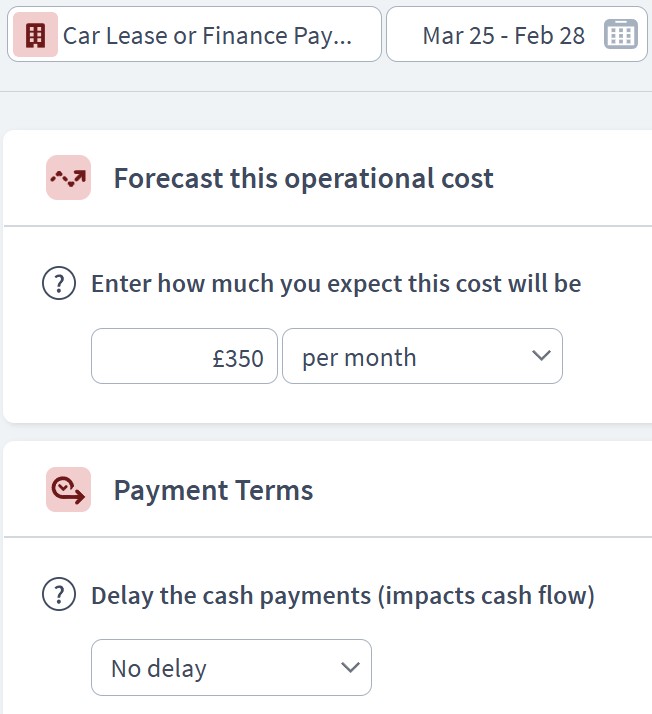

Expenditure Components

- Component: Operational Costs

- Sub-components:

- Car Lease or Finance Payment – £350/month

- Fuel Costs (1,500 miles at £0.18/mile) – £270/month

- Car Insurance (Specialist driving instructor policy) – £100/month

- Road Tax & MOT – £25/month

- Vehicle Maintenance & Repairs – £50/month

- AA/RAC Breakdown Cover – £15/month

- Sub-components:

- Component: Administrative Costs

- Sub-components:

- Driving School Franchise Fee (if applicable) – £200/month (optional)

- Advertising & Website (Google Ads, Facebook, domain, hosting) – £100/month

- Booking System Subscription (if using a tool like Calendly) – £15/month

- Accounting Software (Xero, QuickBooks) – £15/month

- Accountant Fees – £600/year (~£50/month)

- CPD/Instructor Training (upskilling, memberships) – £200/year (~£17/month)

- Sub-components:

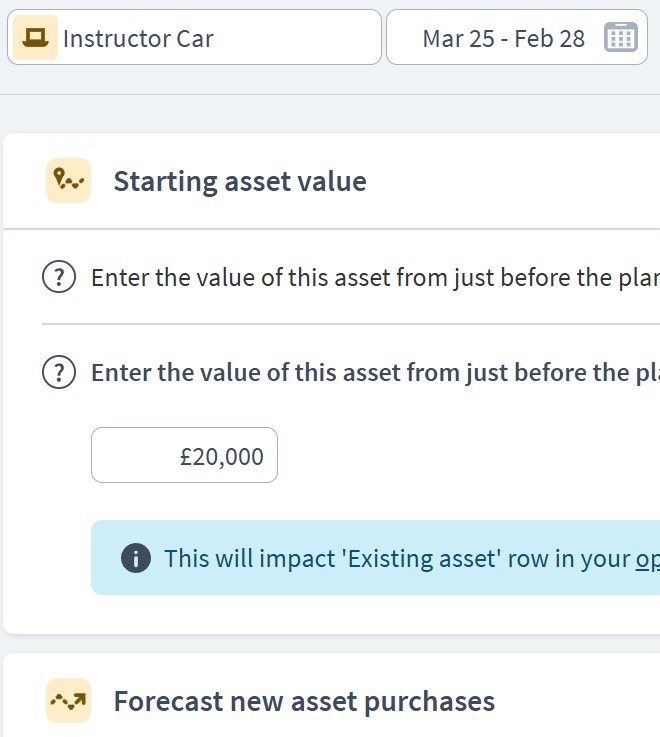

Asset Components

- Component: Fixed Assets

- Sub-components:

- Instructor Car (Purchase price: £20,000, depreciated over 5 years)

- Dual Controls Installation (£500, depreciated over 3 years)

- Dash Cam & Other Tech (£200, depreciated over 3 years)

- Sub-components:

- Component: Current Assets

- Sub-components:

- Cash Reserves (Starting balance + monthly surplus)

- Accounts Receivable (Outstanding payments from students)

- Prepaid Expenses (e.g., annual insurance, franchise fees)

- Sub-components:

Funding Components

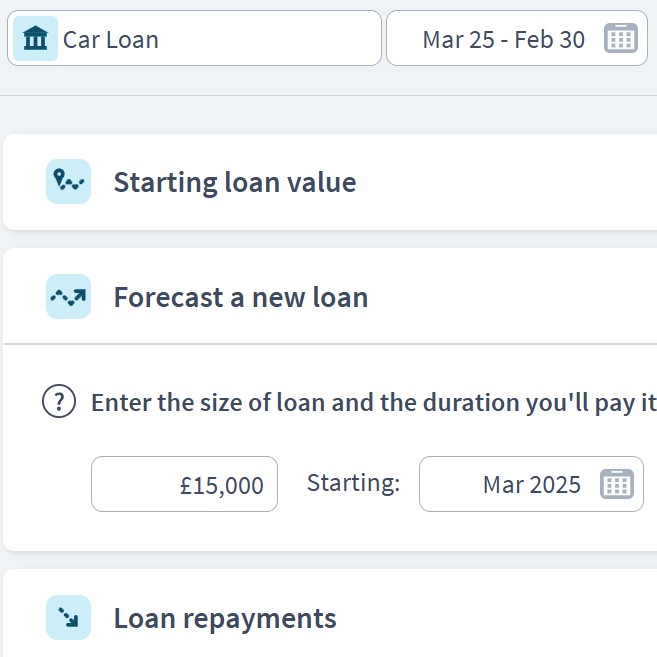

- Component: Business Loans

- Sub-components:

- Car Loan (£15,000 at 6% interest, 5-year term) – £290/month repayment

- Sub-components:

- Component: Personal Investment

- Sub-components:

- Initial Setup Costs (Website, car deposit, marketing) – £5,000 self-funded

- Sub-components:

- Component: Future Funding (Optional)

- Sub-components:

- Small Business Loan (For expansion, additional vehicle, branding)

- Crowdfunding (For online course development)

- Sub-components:

Scenario Planning in Brixx

- Lesson Demand Variability

- Model scenarios where lesson bookings drop by 10%, 20%, or 30%.

- Assess impact on income and whether expense reductions are needed.

- Fuel Price Increases

- Test how an increase from £0.18/mile to £0.25/mile affects profitability.

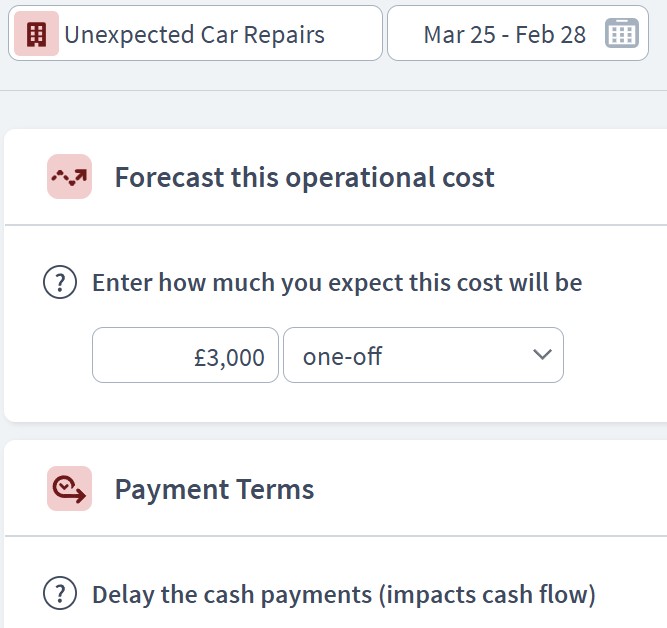

- Car Breakdown or Replacement

- Create an Unexpected Expenses component for emergency repairs or a replacement car.

- Price Increase Impact

- Model increasing lesson prices from £35 to £40 per lesson and its effect on revenue.

Dashboard & Reporting

- Cash Flow Report

- Visualise monthly lesson income versus running costs, identifying net earnings.

- Balance Sheet

- Track asset depreciation (car value decreasing over time) and loan repayment progress.

- Profit & Loss Statement

- Display Total Revenue (£6,200), Total Expenses (£1,192), and Net Profit (~£5,000 before tax).

- Custom KPIs

- Lesson Utilisation Rate (actual lessons booked vs. max capacity)

- Profit per Lesson (after expenses)

- Breakeven Point (minimum lessons needed to cover costs)

Who can use this Brixx template?

- Independent driving instructors

- Driving school owners

- Franchise driving instructors

Brixx is a great tool for:

- Anyone managing the financial planning and budgeting for a driving instruction business

- Driving instructors, accountants, or business owners overseeing income, expenses, and growth strategies

What are the benefits for driving instructors?

- The template is tailored to the driving instruction industry, covering all aspects of business finances

- Effortlessly model cash flows, lesson revenue, vehicle maintenance, and operational costs

- Easily interpret results and graphs to assess the profitability of your business

- Quickly evaluate the impact of new income streams, such as intensive courses, fleet expansion, or instructor training programs

- Receive immediate feedback when testing different scenarios like price changes, fuel cost increases, or seasonal fluctuations

Strategic forecasting in Brixx

- Calculating the profitability impact of varying lesson prices and student demand

- Demonstrating projected earnings to support loan applications or business expansion

- Forecasting and budgeting for vehicle maintenance, insurance, and fuel costs

- Anticipating financial requirements for upgrading vehicles or hiring additional instructors

- Evaluating the impact of market changes on lesson pricing and operating expenses

Explore different industry frameworks you can build in Brixx for your business

Brixx for Tutors

Explore our template for tutors. It’s designed to forecast hourly sessions, learning packages, and student volume.

Brixx for Freelancers

Explore our template for freelancers. It’s designed to help you manage flexible income streams, bookings, and costs.

Brixx for Education Providers

Explore our template for education providers. It’s designed to support structured lesson plans, enrolment fees, and staffing.

Brixx for Garages

Explore our template for garages. It’s designed to track vehicle-related costs, maintenance, and usage.

Get started with Brixx

£30 / month

Prices exclude local taxes

7 Day Free Trial

No credit card required

- Scenario testing

- 10-year financial forecast

- Pre-built templates

- Xero integration

- Automated reports: P&L, balance sheet, cash flow, tax & more

“With Brixx, the time, accuracy and ease of generating reports is much more efficient for my clients.”

Malcolm, Naked AccountingGet started with the best financial projection software - today!

Financial modelling software is essential for driving instructors, providing the insights needed to plan and manage your business effectively. By forecasting costs, you can gain a clearer picture of your financial landscape, from vehicle expenses to marketing and insurance. Additionally, forecasting potential income from lessons and training programs enables informed decisions on pricing, scheduling, and business growth.

The ability to identify seasonal trends, adjust lesson availability, and plan for fluctuations in demand further strengthens your long-term success. With over 20 years of business modelling experience, Brixx is a trusted solution, offering powerful tools to help driving instructors confidently navigate financial planning.

Investing in expert financial modelling software like Brixx empowers you to optimise your income, manage expenses, and strategically forecast the future of your driving school business. Get started for free today.