Financial Modelling Tool for Energy Companies

Running an energy company means dealing with variable costs, shifting demand, and the pressure to make data-driven decisions quickly. With Brixx, you can create detailed financial forecasts that help you navigate uncertainty, manage investments, and plan for growth – giving you the clarity you need to lead your energy business into the future.

Start free trial

Model your energy business in Brixx - see how quickly your finances can make sense!

We are working on creating this template in Brixx. Although it isn’t available just yet, you can follow the guidance below to help get started. If you need any further assistance, don’t hesitate to get in touch – we’re here to help!

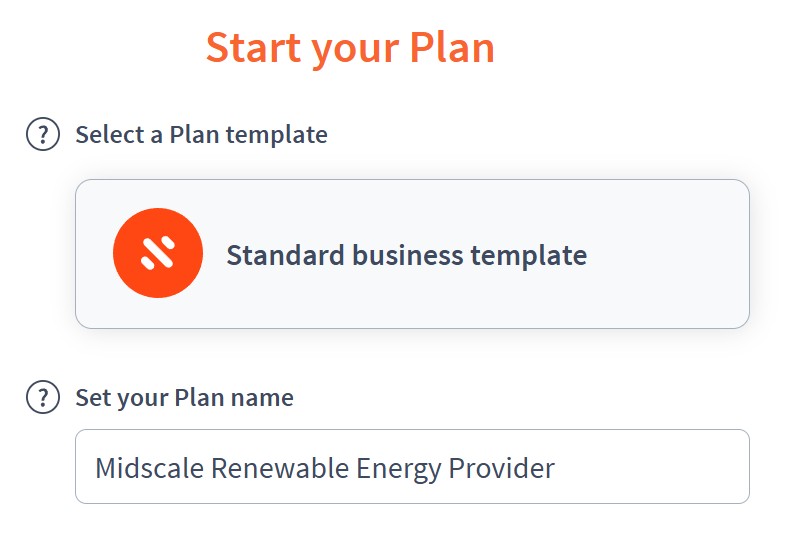

Project Setup

- Project name: Midscale Renewable Energy Provider

- Time period: Monthly (ideal for tracking energy production, sales, and operational costs)

Income Components

- Component: Energy Sales

- Sub-components:

- Residential Electricity Sales (£0.18/kWh, average 400,000 kWh/month → £72,000/month)

- Commercial Electricity Sales (£0.22/kWh, average 250,000 kWh/month → £55,000/month)

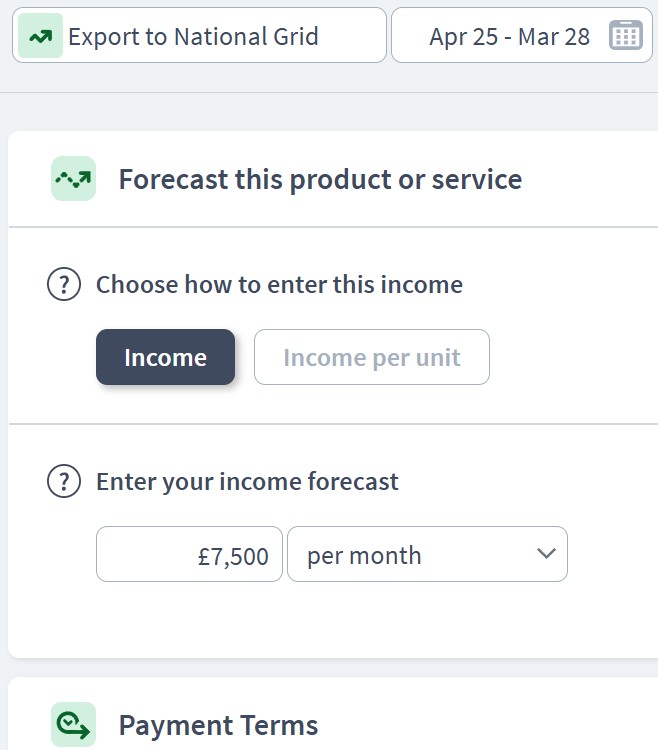

- Export to National Grid (Feed-in Tariff: £0.05/kWh, 150,000 kWh/month → £7,500/month)

- Sub-components:

- Component: Green Incentives & Subsidies

- Sub-components:

- Renewable Obligation Certificates (ROCs) – £15,000/quarter

- Government Grant for Solar (£100,000 annual grant paid quarterly)

- Carbon Credit Trading Revenue (£10,000/year, paid annually)

- Sub-components:

Expenditure Components

- Component: Operational Costs

- Sub-components:

- Staff Salaries & Benefits (£45,000/month)

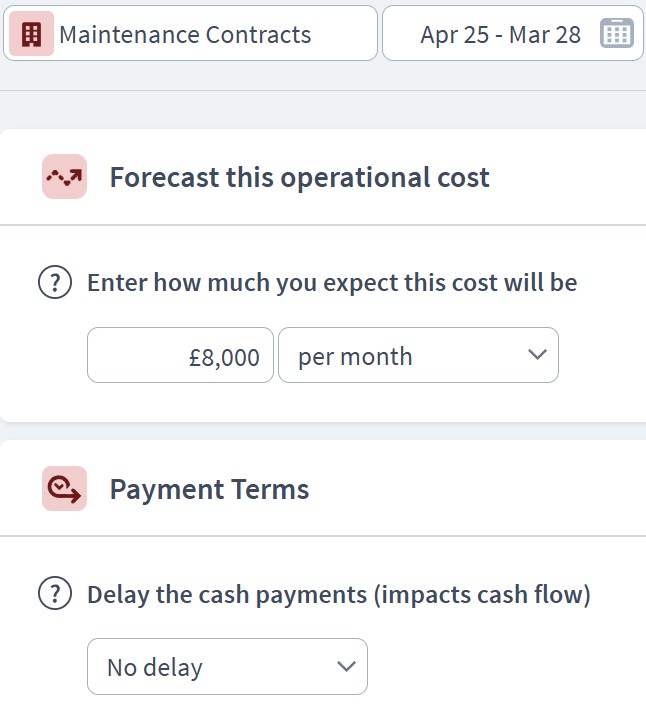

- Maintenance Contracts (Turbines/Solar Panels) – £8,000/month

- Energy Storage & Battery Leasing – £6,000/month

- Land Lease Payments – £4,000/month

- Insurance (Property, Liability) – £12,000/year

- Energy Metering & Monitoring – £2,000/month

- Sub-components:

- Component: Administrative Costs

- Sub-components:

- Office Rent & Utilities – £3,000/month

- Legal & Regulatory Compliance – £6,000/year

- Accounting & Audit Fees – £8,000/year

- IT & Software (SCADA, CRM, Brixx!) – £1,500/month

- Marketing & PR – £2,500/month

- Sub-components:

Asset Components

- Component: Fixed Assets

- Sub-components:

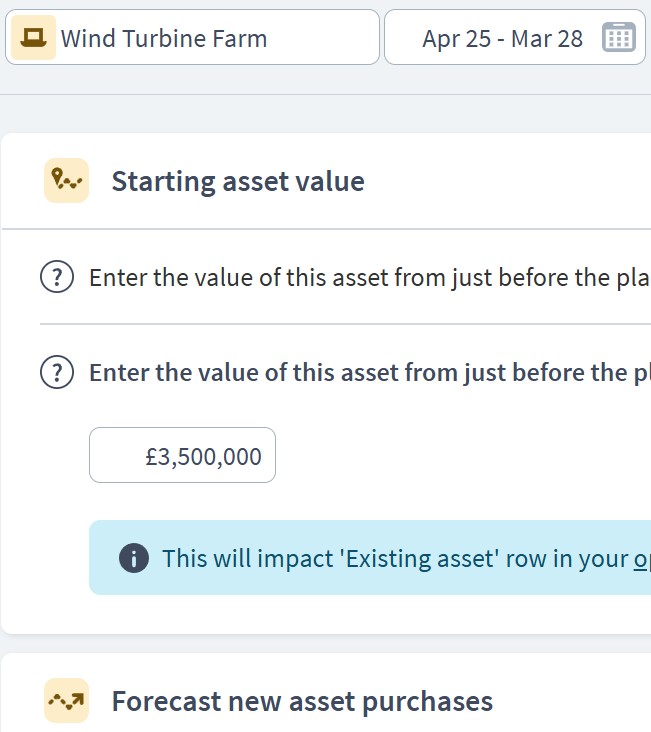

- Wind Turbine Farm (Cost: £3.5M, depreciated over 20 years)

- Solar Farm (Cost: £2.2M, depreciated over 25 years)

- Battery Storage Systems (£500,000, depreciated over 10 years)

- Operations Building (£600,000, appreciation at 2% per annum)

- Sub-components:

- Component: Current Assets

- Sub-components:

- Cash Reserves (Starting: £250,000 + ongoing surpluses)

- Accounts Receivable (Electricity bills outstanding – avg. £90,000)

- Spare Parts Inventory (£50,000)

- Sub-components:

Funding Components

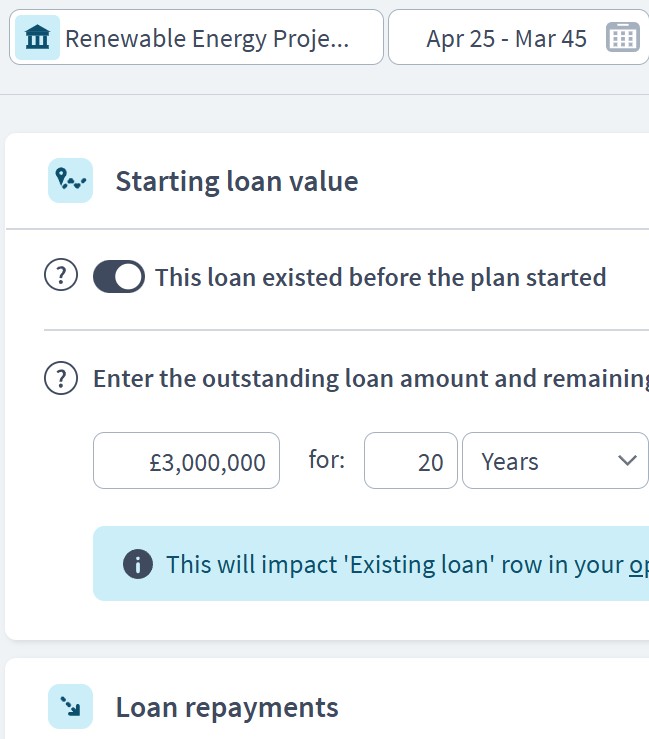

- Component: Bank Loans & Green Bonds

- Sub-components:

- Renewable Energy Project Loan (£3M at 4.2% interest, 20-year term)

- Green Bond Issuance (£1.5M at 3.5% coupon, interest-only for 5 years)

- Sub-components:

- Component: Equity Investment

- Sub-components:

- Series A Equity Round (£2M initial capital raise from investors)

- Sub-components:

- Component: Grants & Subsidies (Non-repayable)

- Sub-components:

- Renewable Infrastructure Grant (£1M, upfront payment at project start)

- Sub-components:

Scenario Planning in Brixx

- Energy Price Fluctuations

- Model +10% changes in electricity sale price to simulate market conditions.

- Production Output Variance

- Simulate poor weather reducing solar generation by 20% in winter months.

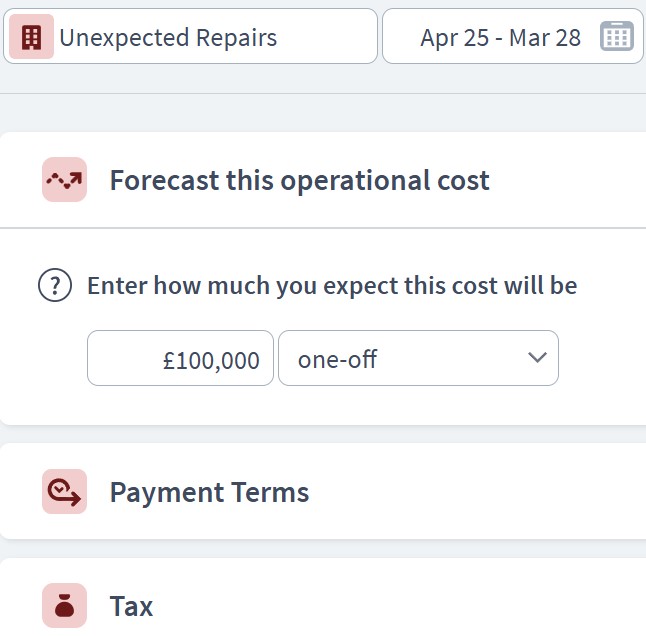

- Maintenance Shock Events

- Create a one-off “Unexpected Repairs” scenario (£100,000 battery replacement).

- Funding Delay

- Delay grant or bond issuance to assess liquidity stress.

Dashboard & Reporting

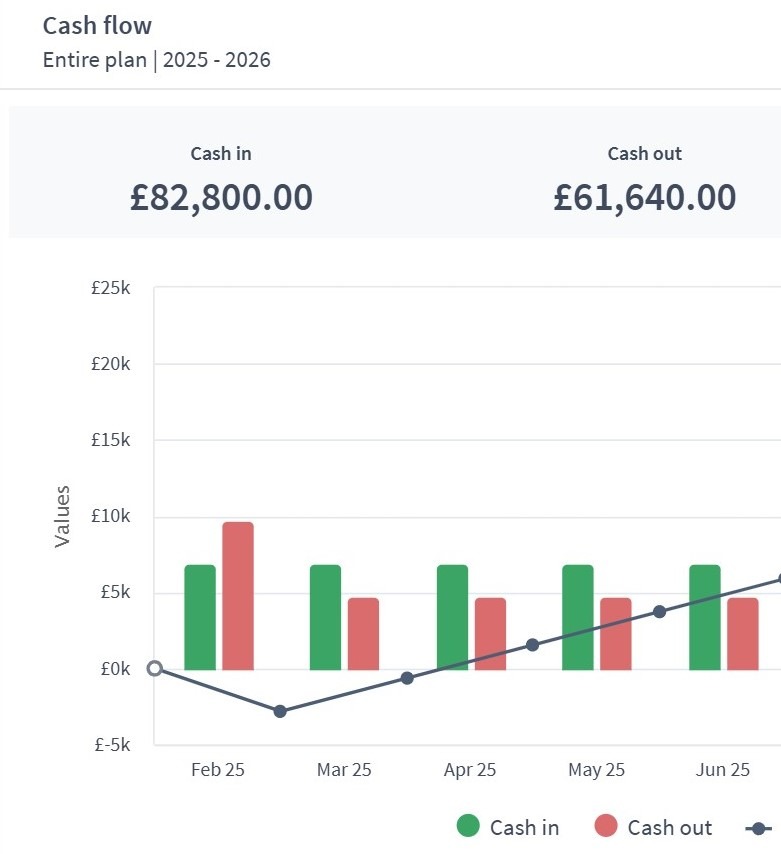

- Cash Flow Report

- Track net cash position monthly, including grant inflows and loan outflows.

- Balance Sheet

- See increasing asset values (appreciating land/buildings) vs. decreasing liabilities (loan repayments).

- Profit & Loss Statement

- Detail operational revenue, costs, and net profit per month and year.

- Custom KPIs

- Cost per kWh Produced

- EBITDA Margin

- Debt Service Coverage Ratio (DSCR)

- Carbon Offset Equivalent (kg CO₂ saved)

Who can use this Brixx template?

- Independent energy producers

- Renewable energy startups

- Utility providers

- Energy consultants and financial planners

Brixx is a great tool for:

- Business owners or finance teams in the energy sector

- Anyone responsible for budgeting, financial planning, or capital expenditure forecasting

- Stakeholders seeking to assess the financial feasibility of new energy projects

What are the benefits for energy companies?

- The template is tailored to the energy industry, helping you model operations, investment cycles, and regulatory costs

- Forecast revenue from power generation, distribution, or green energy initiatives

- Analyse the effect of fuel prices, maintenance expenses, and carbon credits on cash flow

- Quickly understand the impact of adding new income streams, like feed-in tariffs, grid contracts, or service-based offerings

- Simulate future scenarios such as rising demand, infrastructure upgrades, or regulatory shifts to make informed strategic decisions

Strategic forecasting in Brixx

- Model the financial effects of fluctuating energy prices and production levels

- Build forecasts that demonstrate revenue potential for stakeholder presentations or funding rounds

- Plan long-term infrastructure investments and maintenance cycles

- Anticipate funding needs for renewable expansion or grid upgrades

- Evaluate the effect of market conditions and policy changes on income and operational costs

Explore different industry frameworks you can build in Brixx for your business

Brixx for Pharmaceutical Company

Explore our template for pharmaceutical companies. It’s designed to model R&D cycles, regulatory costs, and product rollouts.

Brixx for Manufacturers

Explore our template for manufacturers. It’s designed to manage production costs, asset depreciation, and supply chain forecasting.

Brixx for Fintech Businesses

Explore our template for fintech businesses. It’s designed to plan growth through investment, acquisition, and revenue.

Brixx for Government Contractors

Explore our template for government contractors. It’s designed to track projects, budget timelines, and compliance revenue.

Get started with Brixx

£30 / month

Prices exclude local taxes

7 Day Free Trial

No credit card required

- Scenario testing

- 10-year financial forecast

- Pre-built templates

- Xero integration

- Automated reports: P&L, balance sheet, cash flow, tax & more

"The features within Brixx enabled us to plan and map this out alongside our forecasts and was a useful tool for explaining the impacts to potential investors."

Ed, Bird EyewearGet started with the best financial projection software - today!

Financial modelling software like Brixx offers invaluable insight for energy companies, enabling smarter planning and better investment decisions. From budgeting for plant maintenance to forecasting the ROI of renewable projects, Brixx gives you the tools to understand your business at a deeper level.

With decades of business modelling expertise behind it, Brixx makes it easy to navigate changing market conditions, assess financial risks, and plan for a more sustainable future. Whether you’re growing a green energy startup or managing a utility company’s financial roadmap, Brixx helps you bring clarity to your plans.

Take charge of your energy company’s future. Use Brixx to build a stronger financial foundation and fuel long-term success.