Financial Modelling Tool for Fintech Companies

If you’re a new fintech company that is navigating rapid growth, having an understanding of your cash flow is absolutely essential. Brixx gives all fintech businesses the powerful modelling tools they need to make informed, future-focused financial decisions.

Start using this template in Brixx

Model your fintech business in Brixx - see how quickly your finances can make sense!

This template is available in Brixx. Follow the guidance below to get started. If you need any further assistance, don’t hesitate to get in touch – we’re here to help!

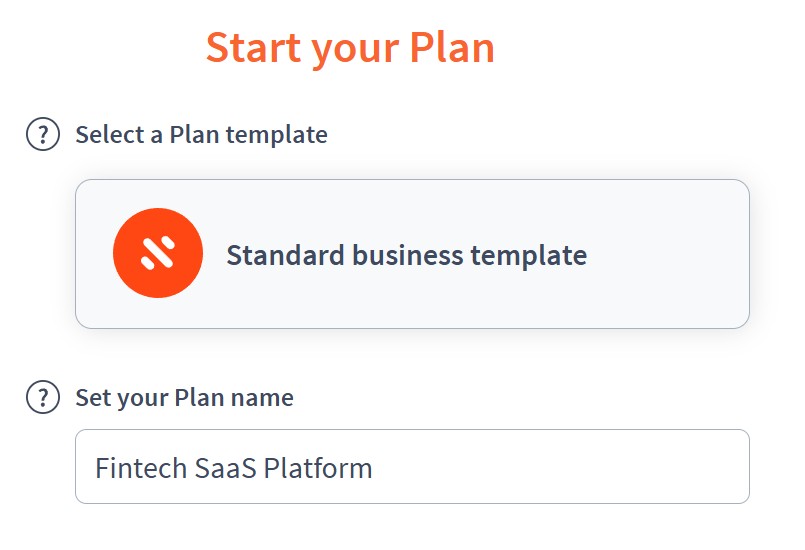

Project Setup

- Project name: Fintech SaaS Platform

- Time period: Monthly (ideal for recurring income and cost modelling)

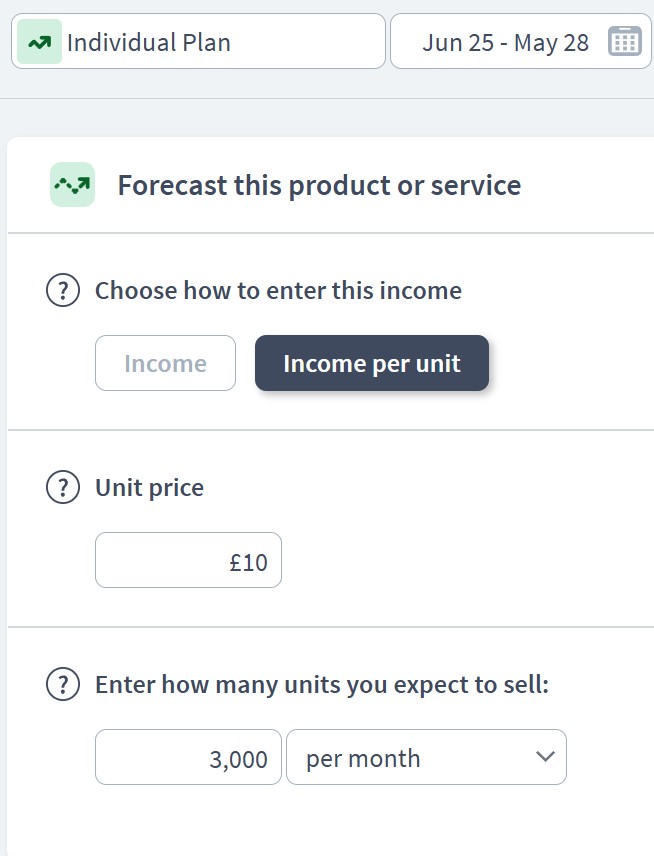

Income Components

- Component: SaaS Subscription Revenue

- Sub-components:

- Individual Plan (£10/month × 3,000 users = £30,000/month)

- Business Plan (£100/month × 100 clients = £10,000/month)

- Enterprise Plan (£1,000/month × 5 clients = £5,000/month)

- Sub-components:

- Component: Transaction Fees

- Sub-components:

- Card Processing Fees (0.5% per transaction on £2M monthly volume = £10,000/month)

- FX Conversion Fees (£500/month average)

- Late Payment Fees (£1,000/month estimate)

- Sub-components:

- Component: Other Income

- Sub-components:

- Affiliate Revenue (£2,000/month)

- Interest on Held Balances (£500/month)

- Sub-components:

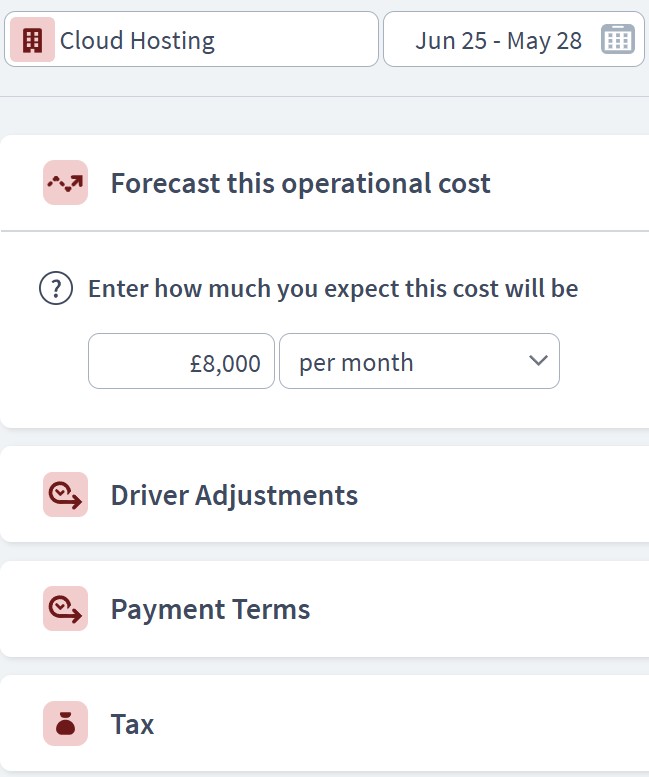

Expenditure Components

- Component: Operating Costs

- Sub-components:

- Cloud Hosting (AWS, Azure, etc.): £8,000/month

- Customer Support Staff (3 FTEs): £9,000/month

- Compliance & AML Monitoring Tools: £1,200/month

- Payment Processing Fees (charged to you): £4,000/month

- Sub-components:

- Component: Development Costs

- Sub-components:

- In-house Developers (5 FTEs): £25,000/month

- Product Manager: £6,000/month

- Software Licenses & Dev Tools: £800/month

- Sub-components:

- Component: Marketing & Sales

- Sub-components:

- PPC & Paid Ads: £5,000/month

- SEO & Content Team: £3,000/month

- CRM & Outreach Tools: £1,000/month

- Sales Team Commissions: £2,000/month

- Sub-components:

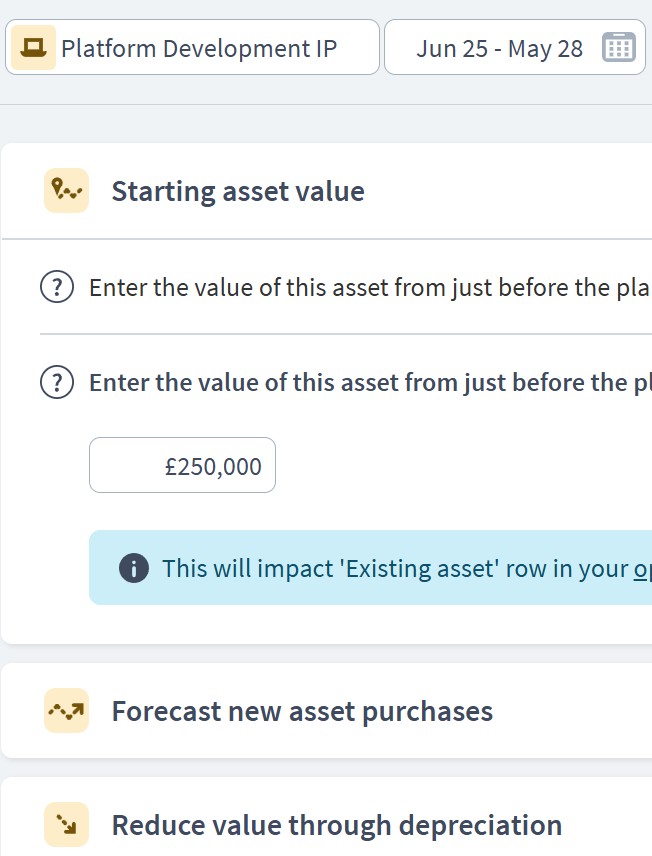

Asset Components

- Component: Intangible Assets

- Sub-components:

- Platform Development IP (initial £250,000, depreciated over 5 years)

- Patents or proprietary algorithms (£50,000 initial, depreciated)

- Sub-components:

- Component: Current Assets

- Sub-components:

- Cash Reserves (e.g., £100,000 starting balance)

- Accounts Receivable (£20,000/month average)

- Prepaid Expenses (e.g., marketing spend paid upfront)

- Sub-components:

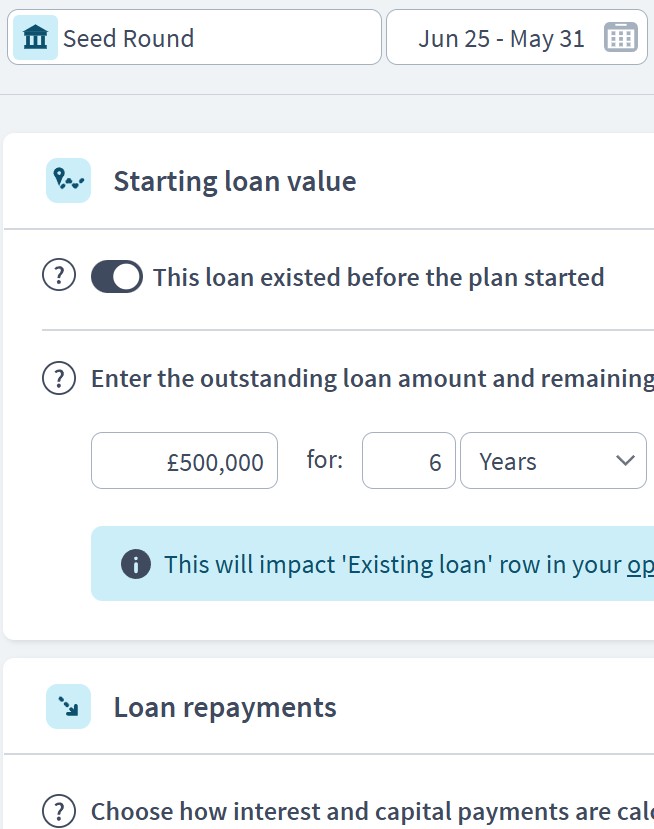

Funding Components

- Component: Equity Investment

- Sub-components:

- Seed Round (£500,000 from angel investors)

- Series A (£2 million VC round)

- Sub-components:

- Component: Grants & Incentives

- Sub-components:

- Government Innovation Grant (£100,000 received upfront)

- R&D Tax Credits (estimated £30,000/year)

- Sub-components:

- Component: Loans (if applicable)

- Sub-components:

- Short-term Working Capital Loan (£50,000, 6% interest, 12-month term)

- Sub-components:

Scenario Planning in Brixx

- Churn Rate Impact

- Model 2%, 5%, 10% churn to project lost MRR and CAC payback.

- User Growth Projections

- Adjust growth rates to test scaling revenue vs. hiring pace.

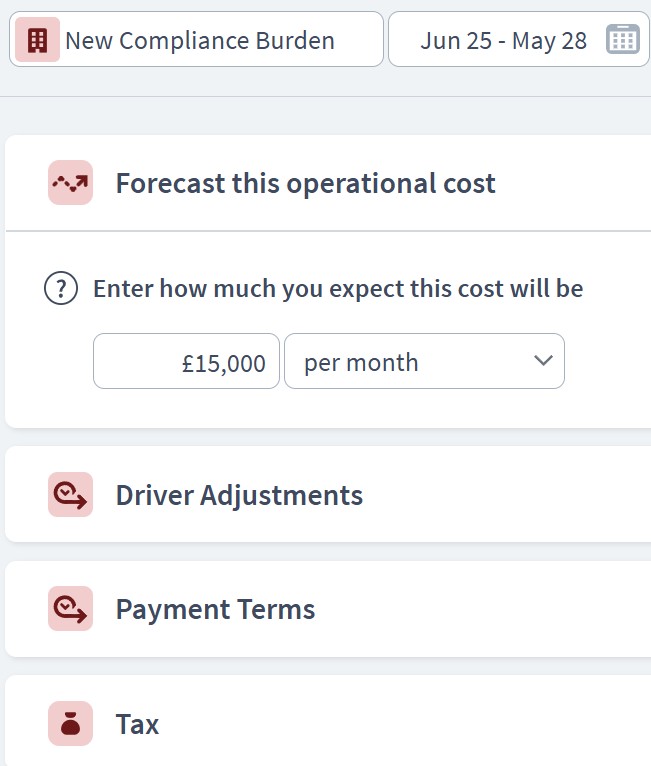

- Regulation Cost Spikes

- Add a scenario for a new compliance burden (£15k/year).

- Funding Delays

- Simulate delay in Series A and effect on cash runway.

Dashboard & Reporting

- Cash Flow Report

- Track SaaS income vs. dev/marketing burn.

- Balance Sheet

- Monitor equity raised, platform IP value, and monthly liabilities.

- Profit & Loss

- Revenue breakdown by plan vs. grouped cost categories.

- Custom KPIs

- Monthly Recurring Revenue (MRR)

- Customer Acquisition Cost (CAC)

- Customer Lifetime Value (LTV)

- Burn Rate and Runway

Who can use this Brixx template?

- Fintech startups

- Financial service providers

- Digital banking and lending platforms

Brixx is a great tool for:

- Finance leads and CFOs building forecasts for fintech businesses

- All founders managing their business capital

- Any fintech team preparing for funding rounds, potential expansion, or new product launches

What are the benefits for fintech businesses?

- A tailored, custom approach to modelling revenue from your ventures, including subscriptions, lending, payments, and transaction fees

- Plan and anticipate fundraising, runway, CAC vs. LTV, and regulatory costs

- Visualise how user growth, churn, or new product lines could affect your bottom line

- Test scenarios instantly – like fee changes, team growth, or partnerships – before committing

- Share clear dashboards and insights with investors and stakeholders

Strategic forecasting in Brixx

- Building forward-looking cash flow models for investor presentations

- Calculating the impact of variable revenue streams (e.g. interest income, usage fees)

- Forecasting tech development costs and hiring plans

- Planning for licensing, compliance, and other regulatory obligations

- Evaluating funding needs based on scaling milestones and market conditions

Explore different industry frameworks you can build in Brixx for your business

Brixx for SaaS Businesses

Explore our template for SaaS business. It’s designed to model subscription revenue, churn rates, and customer acquisition costs.

Brixx for Tech Startups

Explore our template for tech startups. It’s designed to forecast funding rounds, team expansion, and scalable growth.

Brixx for Cybersecurity

Explore our template for cybersecurity. It’s designed to help manage service delivery, tech investment, and risk-based pricing.

Brixx for Consultants

Explore our template for consultants. It’s designed to forecast project fees, utilisation rates, and client growth.

Get started with Brixx

£30 / month

Prices exclude local taxes

7 Day Free Trial

No credit card required

- Scenario testing

- 10-year financial forecast

- Pre-built templates

- Xero integration

- Automated reports: P&L, balance sheet, cash flow, tax & more

“For business acquisitions, we’ve been able to test all our assumptions to see whether it’s viable for us to buy a business and expand our company. Brixx does a tremendously thorough job.”

Peter Wood, ASfBStart building a stronger fintech business with Brixx today!

Brixx’s financial forecasting software gives fintech teams the clarity and flexibility they need to grow at a sustainable rate. With precise forecasting, you’ll stay ahead of the market.

With over two decades of experience in business modelling, Brixx delivers the depth fintech companies need – without any complexity! From managing burn rate to planning international expansion, Brixx helps you model what matters.

Choose financial forecasting software built for innovation. Choose Brixx.