Financial Modelling Tool for Tutors

As a private tutor, it’s important to stay on top of how your income can change throughout the year and when to make important financial decisions. Brixx offers the tools you need to gain clear insights, helping you plan your budget, manage expenses effectively, and ensure your tutoring business continues to thrive.

Start free trial

Model your tutoring business in Brixx – watch how easily your finances come into focus!

We are working on creating this template in Brixx. Although it isn’t available just yet, you can follow the guidance below to help get started. If you need any further assistance, don’t hesitate to get in touch – we’re here to help!

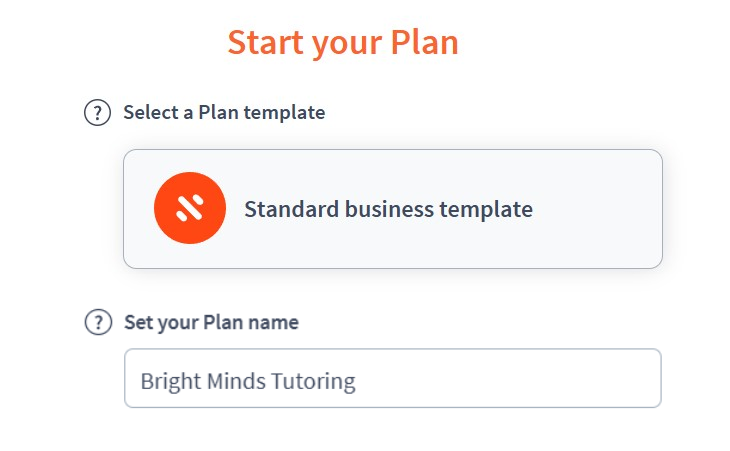

Project Setup

- Project Name: “Bright Minds Tutoring”

- Time Period: Monthly (to track fluctuations in demand, e.g., school exam periods)

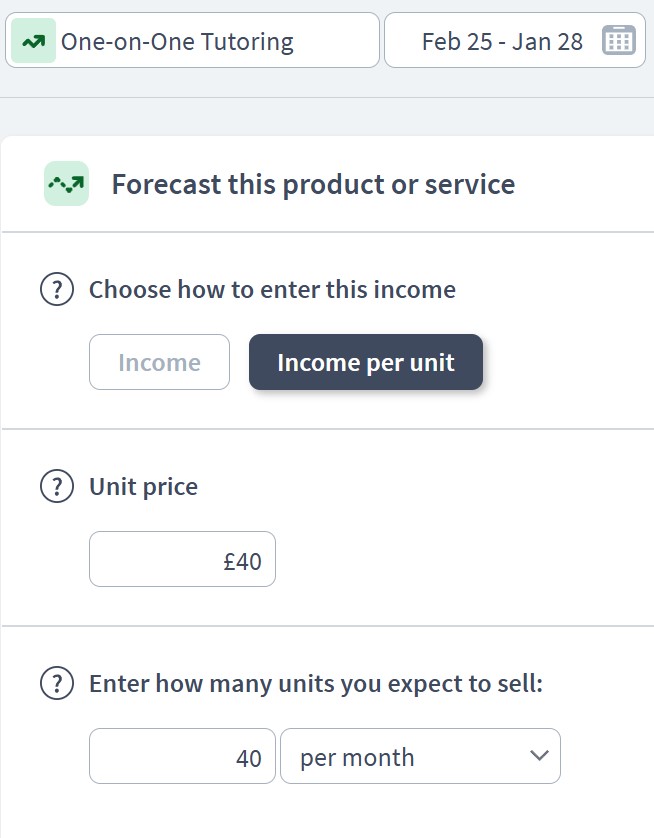

Income Components

- Component: Tutoring Services Revenue

- Sub-components:

- One-on-One Tutoring (Online/In-Person): £40/session, 10 sessions per week → £1,600/month

- Group Tutoring (Up to 5 Students): £25/student, 2 sessions per week, 4 students per session → £800/month

- Intensive Exam Prep Courses (Short-Term, Seasonal Peaks): £300/course, 5 students per course, 2 courses per term → £3,000 per term (averaging £1,000/month)

- Homework Help Subscription (Recurring Monthly): £50/student, 10 students → £500/month

- Sub-components:

- Component: Educational Products

- Sub-components:

- E-books & Study Guides: £20 each, 10 sales per month → £200/month

- Pre-Recorded Video Courses: £100 each, 3 sales per month → £300/month

- Sub-components:

- Component: Workshops & Webinars

- Sub-components:

- Study Skills Webinars: £20 per attendee, 15 attendees per month → £300/month

- Parenting & Education Seminars: £50 per attendee, 5 attendees per quarter → £250 per quarter (averaging £83/month)

- Sub-components:

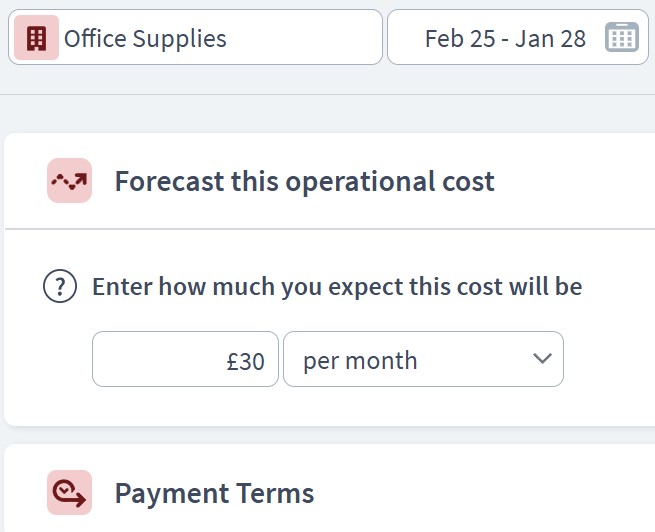

Expenditure Components

- Component: Operational Costs

- Sub-components:

- Teaching Materials & Subscriptions (Zoom, Whiteboard Tools, Exam Papers): £50/month

- Office Supplies (Printing, Notebooks, Stationery): £30/month

- Travel Costs (Fuel/Public Transport for Home Visits): £100/month

- Marketing & Advertising (Social Media, Flyers, Website): £150/month

- Website Hosting & Software Subscriptions (Brixx, Scheduling Software): £30/month

- Sub-components:

- Component: Administrative Costs

- Sub-components:

- Business Insurance (Liability Coverage): £25/month

- Legal & Accounting Fees: £50/month

- Sub-components:

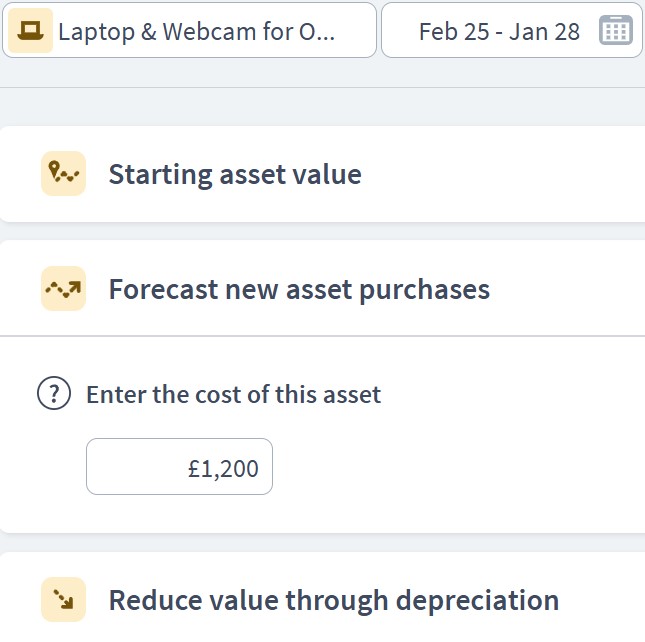

Asset Components

- Component: Fixed Assets

- Sub-components:

- Laptop & Webcam for Online Teaching: £1,200 (depreciated over 3 years)

- Whiteboard & Office Setup: £500 (depreciated over 5 years)

- Sub-components:

- Component: Current Assets

- Sub-components:

- Cash on Hand (Starting balance + monthly surplus): Variable

- Accounts Receivable (Pending Payments from Students): £500/month

- Sub-components:

Funding Components

- Component: Personal Investment

- Sub-components:

- Initial Owner Capital: £5,000

- Sub-components:

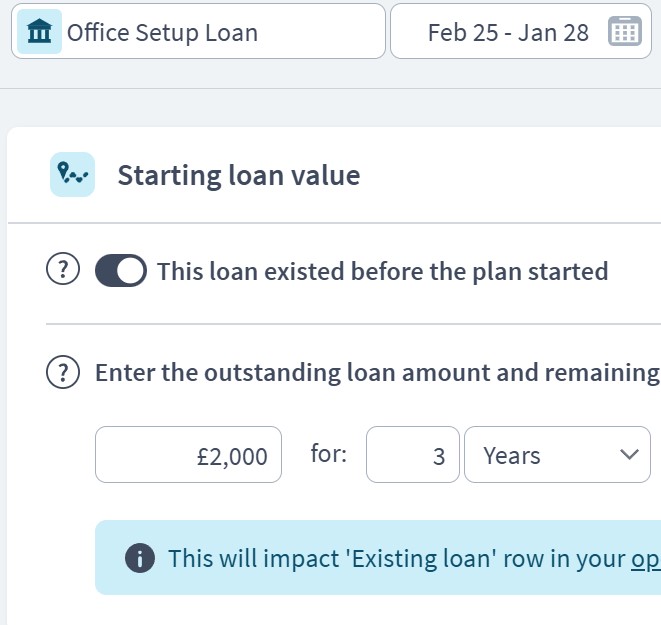

- Component: Loans & Credit (If Required)

- Sub-components:

- Small Business Loan for Office Setup: £2,000 at 6% interest, 3-year term

- Sub-components:

Scenario Planning in Brixx

- Seasonal Revenue Fluctuations

- Higher income in exam periods (April-June, October-December)

- Lower income during summer holidays → Model reduced tutoring revenue in July/August

- New Revenue Stream

- Adding pre-recorded courses or subscription services and measuring profitability

- Unexpected Costs

- Laptop repair/replacement, sudden increase in advertising costs

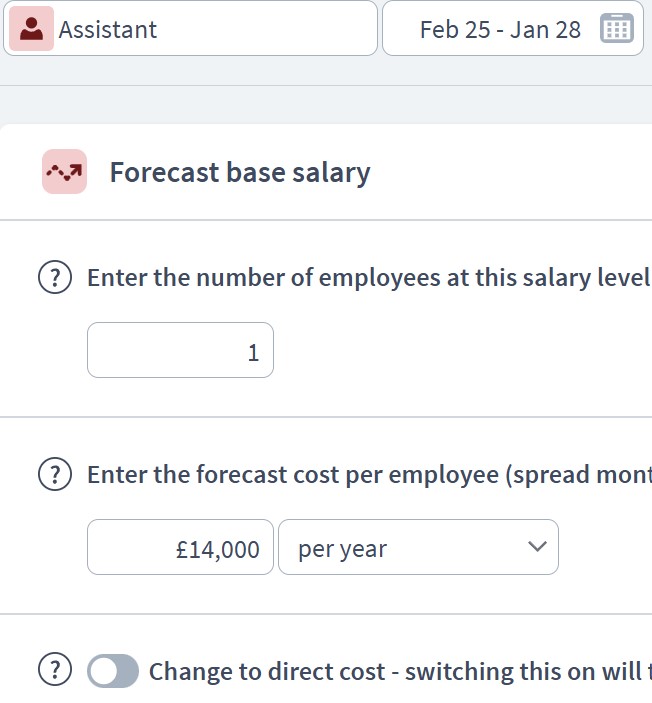

- Scaling Up

- Hiring an assistant tutor or expanding group session capacity

Dashboard & Reporting

- Cash Flow Report

- Shows income variations during peak academic months vs. holidays

- Profit & Loss Statement

- Tracks tutoring fees, digital product sales, and operational costs

- Balance Sheet

- Highlights asset depreciation (laptop, office setup) and cash reserves

- Custom KPIs

- Profit per student, ROI on digital courses, seasonal earnings trends

Who can use this Brixx template?

- Private tutors

- Tuition centres

- Online educators

Brixx is a great tool for:

- Anyone managing a tutoring business and its finances

- Freelance educators looking to track income, expenses, and growth

- Education consultants and academic coaches

What are the benefits for private tutors?

- The template is designed specifically for tutoring businesses, covering lesson planning, pricing, and cost management

- Easily model cash flow, lesson fees, marketing costs, and subscription income

- Quickly analyse financial health with clear reports on revenue, expenses, and profitability

- Assess the impact of adding new services, adjusting pricing, or seasonal demand changes

- Receive instant feedback when testing different scenarios like expanding online courses, hiring an assistant, or investing in new learning tools

Strategic forecasting in Brixx

- Evaluating the impact of term-time vs. holiday demand on income

- Demonstrating projected earnings and costs to support loan applications or business expansion

- Forecasting and budgeting for software subscriptions, teaching materials, and marketing efforts

- Planning financial requirements for new tutoring services, course development, or hiring additional staff

- Assessing the financial impact of pricing changes, student retention, and industry trends

Explore different industry frameworks you can build in Brixx for your business

Brixx for Education Providers

Explore our template for education providers. It’s designed to help you plan classes, manage student numbers, and forecast tuition income.

Brixx for Course Creators

Explore our template for course creators. It’s designed to help you model course sales, digital content delivery, and subscription revenue.

Brixx for Consultants

Explore our template for consultants. It’s designed to help you plan billable hours, client work, and revenue from advisory projects.

Brixx for Freelancers

Explore our template for freelancers. It’s designed to help you track client income, manage projects, and plan your workload effectively.

Get started with Brixx

£30 / month

Prices exclude local taxes

7 Day Free Trial

No credit card required

- Scenario testing

- 10-year financial forecast

- Pre-built templates

- Xero integration

- Automated reports: P&L, balance sheet, cash flow, tax & more

"Brixx is a fab product. It’s been enormously valuable for us. "

Peter Wood, Accounting Services for Business (ASfB)Get started with the best financial projection software - today!

Financial forecasting software is an essential tool for private tutors, offering the insights needed to manage finances effectively. By forecasting income streams like tutoring fees and course sales, you can better understand your financial situation. Additionally, forecasting expenses helps you make informed decisions about budgeting, growth, and sustainability.

Being able to spot trends, adjust your strategies, and plan for financial uncertainties strengthens your ability to build a long-term, successful tutoring business. With over 20 years of business modelling experience, Brixx is a trusted solution, with comprehensive features to help tutors navigate the complexities of financial planning with confidence.

Investing in expert financial modelling software like Brixx empowers tutors to optimise income strategies, scale their business, and ensure lasting success in the education space.