Financial Modelling Tool for Tech Startups

Running a tech startup means navigating rapid growth, shifting markets, and constant innovation. To stay ahead, you need to understand how your finances will evolve and when to act on key opportunities. Brixx gives you the power to map out your financial future with precision. Begin to make strategic decisions with confidence.

Start using this template in Brixx

Model your tech startup business in Brixx - see how quickly your finances can make sense!

This template is now available in Brixx. Follow the guidance below to get started. If you need any further assistance, don’t hesitate to get in touch – we’re here to help!

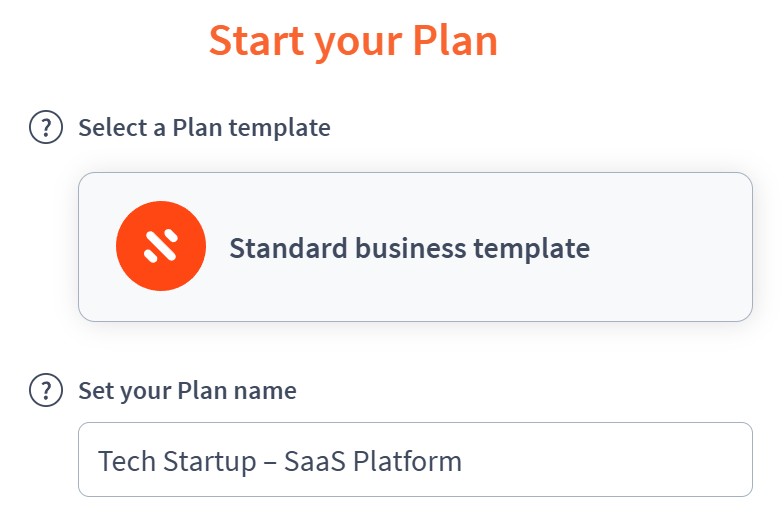

Project Setup

- Project name: Tech Startup – SaaS Platform

- Time period: Monthly (ideal for recurring revenue, runway, and growth tracking)

Income Components

- Component: Recurring Revenue (MRR)

- Sub-components:

- Basic Plan Subscriptions – £20/user, 500 users (£10,000/month)

- Pro Plan Subscriptions – £50/user, 200 users (£10,000/month)

- Enterprise Clients – Custom pricing, 3 clients @ £1,500/month (£4,500/month)

- Sub-components:

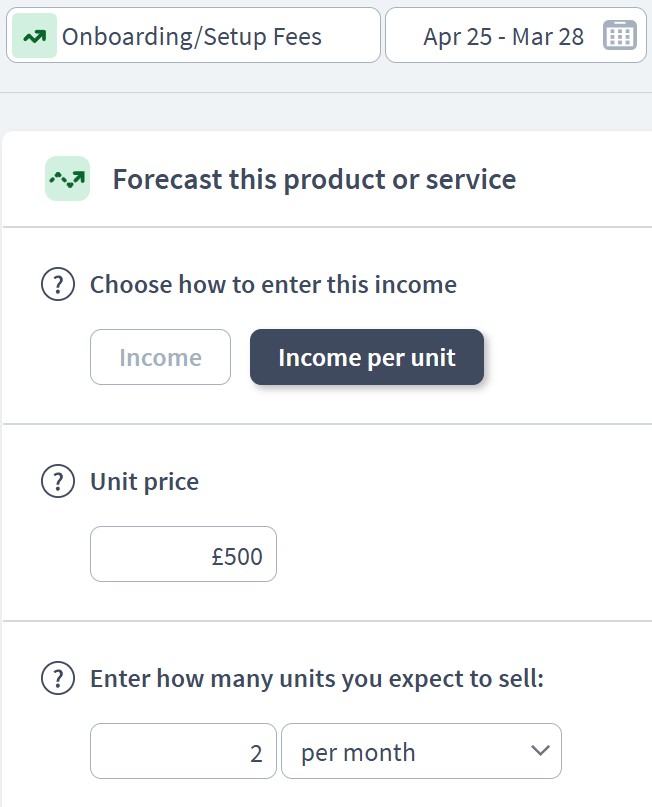

- Component: One-Time Revenue

- Sub-components:

- Onboarding/Setup Fees (£500 per new enterprise client, avg 2/month = £1,000)

- Custom Development Work (£2,000/month, occasional)

- Sub-components:

- Component: Other Income

- Sub-components:

- Affiliate Revenue (£300/month)

- Interest from Cash Reserves (£50/month)

- Sub-components:

Expenditure Components

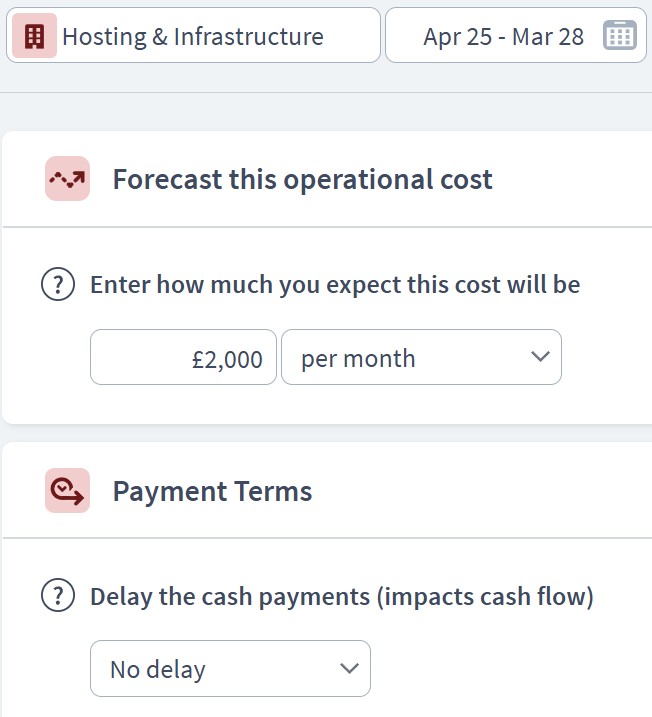

- Component: Operational Costs

- Sub-components:

- Hosting & Infrastructure (AWS, Cloudflare, etc.) – £2,000/month

- Developer Salaries (2 developers @ £4,000/month) – £8,000/month

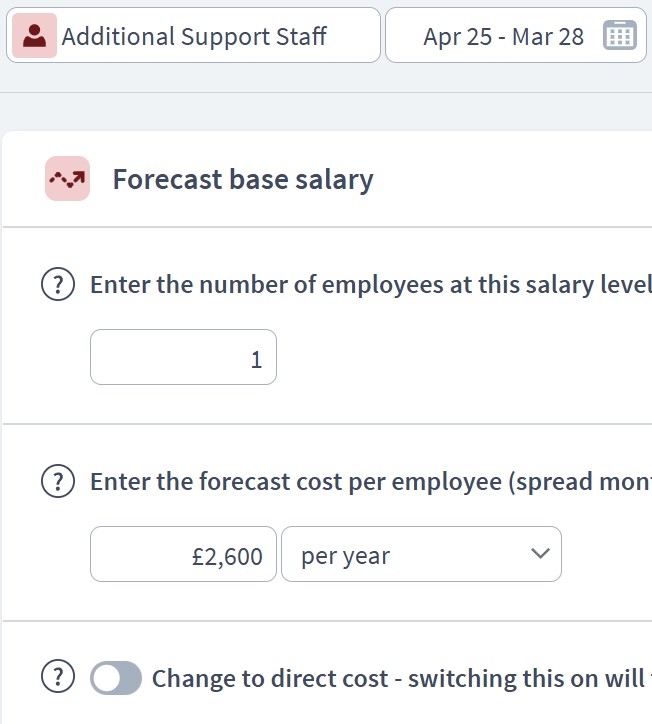

- Customer Support (2 agents @ £2,000/month) – £4,000/month

- SaaS Tools (e.g., GitHub, Slack, monitoring) – £500/month

- Office Rent (co-working or hybrid) – £1,200/month

- Payment Processing Fees (2% of revenue) – ~£500/month

- Sub-components:

- Component: Marketing & Sales

- Sub-components:

- Google Ads & Paid Social – £2,000/month

- SEO Tools, Content Writers – £1,000/month

- Sales Commissions (10% of enterprise revenue) – £450/month

- CRM and Sales Software – £300/month

- Sub-components:

- Component: Administrative & Legal

- Sub-components:

- Accounting & Tax Filing – £250/month

- Legal Retainer – £3,000/year (~£250/month)

- Insurance (Professional indemnity, cyber) – £100/month

- Subscriptions (Brixx, Notion, etc.) – £200/month

- Sub-components:

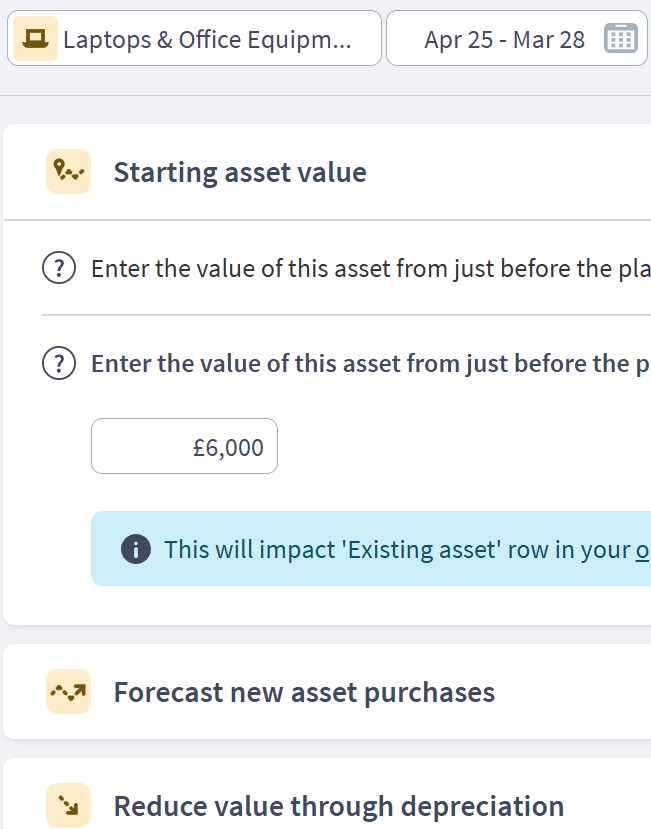

Asset Components

- Component: Fixed Assets

- Sub-components:

- Laptops & Office Equipment (£6,000, depreciated over 3 years)

- Website & App Build (£50,000 initial dev, capitalized and amortized)

- Sub-components:

- Component: Current Assets

- Sub-components:

- Cash Reserves (£100,000 seed funding + monthly net cash)

- Accounts Receivable (B2B clients on 30-day terms)

- Prepaid Expenses (e.g., annual SaaS subscriptions)

- Sub-components:

Funding Components

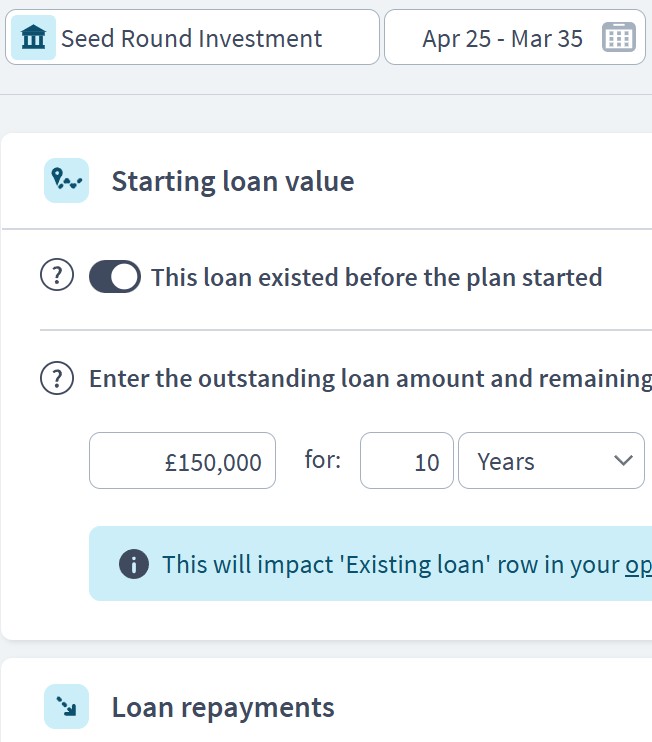

- Component: Equity Investment

- Sub-components:

- Seed Round Investment (£150,000 from angel investors)

- Founder Equity Contribution (£20,000)

- Sub-components:

- Component: Grants

- Sub-components:

- Innovate UK Grant (£30,000 over 6 months – £5,000/month)

- Sub-components:

- Component: Debt/Loans

- Sub-components:

- Startup Loan (£25,000 at 6%, 3-year term)

- Sub-components:

Scenario Planning in Brixx

- User Growth Scenarios

- Base, Optimistic, and Conservative subscriber growth (e.g., 5%, 10%, or 20% monthly growth)

- Burn Rate

- Track how long cash reserves last at different expense levels

- Hiring Plans

- Add developers/support staff in future months and see impact on runway

- Price Changes

- Test impact of raising subscription prices by 10%

- New Funding Rounds

- Forecast a Series A raise in 12-18 months and adjust cash flow

Dashboard & Reporting

- Cash Flow Report

- Visualise runway, cash inflows from subscriptions and grants vs monthly burn

- Balance Sheet

- Show capitalised development costs, decreasing loan balance, and growing cash reserves

- Profit & Loss Statement

- Revenue, gross margin, operating expenses, EBITDA

- Custom KPIs

- Monthly Recurring Revenue (MRR)

- Customer Acquisition Cost (CAC)

- Lifetime Value (LTV)

- Runway (Months of cash left)

- Burn Multiple (Net burn / Net new ARR)

Who can use this Brixx template?

- Tech founders and co-founders

- Startup CFOs and financial controllers

- Product managers and ops leads needing insight into financial performance

Brixx is a great tool for:

- Startups managing fundraising, revenue forecasting, and burn rate

- Entrepreneurs preparing for investor pitches, growth planning, or product launches

- Founders who need clear financial roadmaps for scaling their business

What are the benefits for tech startups?

- A startup-specific template that covers everything from SaaS revenue models to headcount planning

- Model your tech startups income, their churn, any development costs, and all growth targets

- Instantly visualise cash flow, runway, and performance indicators

- Quickly assess the impact of new hires, pricing changes, product launches, or funding rounds

- Run multiple scenarios to test different growth strategies and funding options

Strategic forecasting in Brixx

- Evaluate how changes in pricing, user growth, or churn affect profitability

- Build projections to support investor discussions or funding applications

- Forecast staffing costs, marketing budgets, and infrastructure investments

- Understand when you need to raise funds and how much your business will require

- Prepare for different economic conditions and competitive challenges

Explore different industry frameworks you can build in Brixx for your business

Brixx for SaaS Businesses

Explore our template for SaaS businesses. It’s designed to help you forecast subscriptions, manage churn, and plan for scalable growth.

Brixx for Consultants

Explore our template for consultants. It’s designed to help you plan billable hours, client work, and revenue from projects.

Brixx for Marketing Agencies

Explore our template for digital marketing agencies. It’s designed to model campaigns, retainers, and freelance growth paths.

Brixx for Web Designers

Explore our template for web designers. It’s designed to support solo developers and designers working on client websites.

Get started with Brixx

£30 / month

Prices exclude local taxes

7 Day Free Trial

No credit card required

- Scenario testing

- 10-year financial forecast

- Pre-built templates

- Xero integration

- Automated reports: P&L, balance sheet, cash flow, tax & more

“Feedback from a bank on a new project came back as one of the best new business presentations they’d ever seen. They loved it and said the figures are so well presented from a bank’s point of view.”

Peter Wood, Accounting Services for Business (ASfB)Get started with the best financial projection software - today!

Every successful tech startup needs a clear view of its financial future. With Brixx’s financial forecasting software, you can build robust projections that help you manage growth, secure funding, and scale your operations strategically.

Whether you’re pre-revenue, post-MVP, or entering a high-growth phase, Brixx provides the insight and flexibility you need to make smarter financial decisions. With over two decades of business modelling experience behind it, Brixx is the trusted platform for ambitious startups looking to thrive.

Plan your next funding round, test your growth assumptions, and keep your runway under control – Brixx helps you turn strategy into action.