A balance sheet is an essential tool used to show the value of a business at a specific point in time and we have explained a balance sheet layout below with a simple example.

It shows a snapshot of a business’ assets, liabilities and equity, which is pretty useful when you know what it all means.

The only issue is…it can be difficult to get your head around. For instance, why does a balance sheet need to balance anyway?

In this article, I’m going to go through the balance sheet layout of an example coffee shop. We’ll go through each account from top to bottom to help you get to grips with this tricky report.

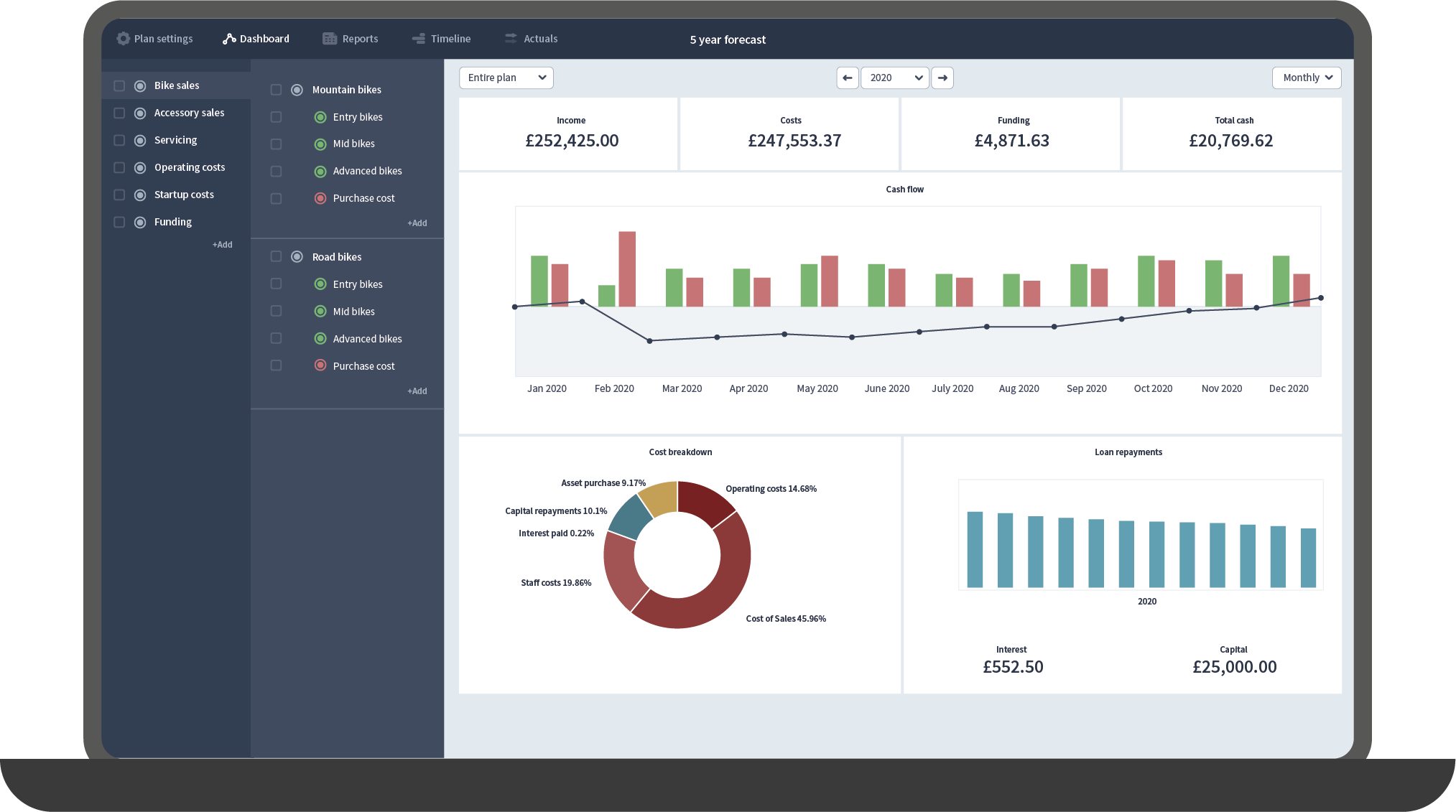

This example was built in Brixx which you can sign up for free. You could also build it in our balance sheet template.

Before we dive in, remember we have a similar coffee shop example for the other key reports.

What goes into assets?

Imagine walking into a coffee shop, it’s not just the money behind the till that’s worth something.

You’ve got everything from kitchen equipment, to tables and chairs, to the stored ingredients in the back. They are all worth something and that value is represented here under assets.

On a balance sheet layout, there are two categories of assets: Current and non-current.

What are non-current assets?

Non-current assets can’t be turned into cold hard cash easily or quickly. They generally cover large purchases that are investments into the long-term health of the business.

Here are some common types:

- Plant or machinery: This covers any equipment or machinery used to carry out the businesses operations. For example, I have an expensive barista machine key to delivering high quality coffee.

- Fixtures & fittings: the coffee shop has a huge range of furniture, kitchen fittings, lighting that contribute to its overall value

- Land & buildings: The business might outright own land or buildings used for their operations. This coffee shop doesn’t since it simply rents the premise.

- Investments: Investments are portions of money your company invests into other businesses. These count as assets on the business’ balance sheet – they are parts (shares) of other businesses that your company owns. Investing in other companies, either directly or through funds, offers the business a way to use excess cash and hopefully generate a return on this investment. They could also be used to gain a stake in other companies. The cash generated by a chain of coffee shops might be used to invest in related businesses, for example.

What are current assets?

Current assets can be turned into cash easily and include categories like accounts receivable, inventory, surplus cash.

It’s important for a company to have a safe amount of current assets so that it can readily pay salaries and upcoming bills or liabilities.

- Accounts receivable: Accounts receivable is money owed to you by your customers. As a coffee shop, I don’t really have to worry about accounts receivable since cash transactions happen on the spot. However, if my coffee shop was hired as a venue and only paid after the event then this amount would sit in accounts receivable until it’s been paid.

- Inventory: Inventory can describe raw materials used to create a product, items used to deliver a product, or even goods to be sold. The inventory in my coffee shop includes coffee beans, takeaway cups and milk.

- Surplus cash: Surplus cash is simply total cash which you have on a particular date, for example in the bank, till or wallet.

- VAT assets: VAT assets are owed to a business when it purchases goods that have VAT applied. This money can then be claimed back. When I purchased my coffee machine, I was charged VAT. However, I can claim that money back through my business as my company is VAT registered.

Your “Total Assets” at the bottom give you the total of both your current and non-current assets, showing the full value of everything in your business.

It’s a pretty interesting figure for most businesses to know!

What goes into liabilities and equity?

Your liabilities and equity make up the bottom half of the balance sheet layout and explain how your business gained its assets. Where did the money come from that I used to purchase my barista machine? Am I paying for my inventory on credit?

Everything about this coffee shop had to be funded at some point, by something, either through debt, or by money invested into the business, or by profits the business itself made.

What are current liabilities?

Current liabilities are amounts a business owes to creditors and lenders which are due within 12 months. Think of these as short term liabilities.

- Accounts payable: Has your company received goods or services that it hasn’t paid for yet? The money that you owe will be shown here. For example, if I contacted a company to decorate my coffee shop, the amount I owe to them for the work will sit here until I have paid them.

- Short term borrowing: Short term borrowing represents lines of credit a company takes out, often to help manage short term cash flow.

- Prepayment liabilities: A prepayment liability is the money a business receives in advance of providing a product or service. Since the product or service hasn’t yet been delivered, this cash hasn’t been earnt yet, making it a liability. It’s a really useful part of the balance sheet to see how much product or service the business is obligated to deliver but hasn’t yet done so. This coffee shop caters for local businesses who pay in advance of the events.

- VAT liabilities: VAT Liabilities is the tax that you owe to the government after someone purchases your goods or services. All the products I sell, from coffee to cake, have VAT applied. I pay the government quarterly and until I have paid it, the amount I owe appears here.

- Corporation tax: Corporation tax is a percentage of a company’s net profit owed to the government (around 20% in the UK). It is paid 8 months after the end of the company’s financial year. Like with the VAT liability line, until I had paid it, the owed amount stays here on my balance sheet.

What are non-current liabilities?

Your non-current liabilities are liabilities which are not short term and usually surpass 12 months.

- Loan Balance: Loan balance refers to a long term borrowing of cash which expands further than a 12 month period. However, the loan balance does not include interest charged. When starting out my business, I took out a loan with my bank. I repay it monthly, reducing this outstanding balance over time.

- Deferred revenue: Similar to prepayment liabilities. You may have received cash in advance payment that you haven’t yet earnt through the provision of goods or services. If this is occurring over a long period (12 months or more) then it will appear here.

What is equity?

Equity is the value invested into the business by shareholders as well as any profits made by the company.

- Share/shareholders capital: Share capital (also known as shareholders capital) are funds invested into a business, by the owner or another shareholder. In this coffee shop the owner invested cash in the business to pay for the initial assets and costs.

- Retained Profit: Profit carried over from previous period(s). It is possible for a negative figure to appear here if my business has been making a loss so far.

Having gone through both liabilities and equity, you’ll see that the total here is equal to the total of your assets.

The assets section of the balance sheet is a breakdown of everything of value in the coffee shop business. The liabilities and equity explain how all of it was funded hence why they must be the same and ‘balanced’. Check out our guide on why the balance sheet must balance for a more detailed run through.

We’re at the end of this infamous report. It’s been a coffee flavoured, jargon infused journey but you’ve made it!

Of all the 3 financial statements the balance sheet is often the most neglected. The cash flow report, quite rightly, has its royal status (cash is king don’t you know).

The profit & loss gives you your all important profitability KPIs.

So what does the balance sheet offer? What do I get from battling through this technical terminology other than a caffeine induced headache?

Why is it important to forecast the balance sheet?

The balance sheet is great for interrogating the financial health of a business.

If you’re looking to secure investment from a bank or investor they’ll likely want to see your current balance sheet position as well as a forecast – often in the form of a complete 5 year financial plan.

The reasons investors want this detail are the same reasons any business should pay attention to the composition of their balance sheet:

- Identifying risk in the business and addressing how you’ll fix them in your forecast, for example:

- Owing too much money to lenders

- A large amount of invoices in accounts receivable that haven’t translated into actual cash

- Not enough current assets to pay short term obligations (like salaries)

- Demonstrating how you’ll fund future growth through debt or equity

- Demonstrating what needs to be purchased in the future to fuel this growth

For further reading, check out our introduction to gearing ratios. This article really helps you start to unpack the value from what your balance sheet is telling you.

Learning to read the lines of a balance sheet layout might seem daunting at first, but if you can get past the terminology it’s a logical structure.

If you are looking for an easy way to start forecasting, try signing up to the Brixx trial. It’s an easy to use financial modelling tool. You’ll be able to get stuck in whether you are a financial wizard or you’re just finding your feet.

Instead of building a balance sheet from scratch, you simply have to model your business activities. Brixx will generate a detailed balance sheet statement for you. Magic. We hope you’ve found this balance sheet layout example useful.