What is vertical analysis?

Vertical analysis is a financial statement analysis method in which each line item is listed as a percentage of a base figure within the statement. This technique is used to evaluate the structure of individual financial statements (e.g., balance sheet or income statement) and makes it easier to compare financial data across different companies or time periods, regardless of size or volume.

Importance of vertical analysis

The importance of vertical analysis in financial reporting cannot be overstated. By converting financial statement entries into percentages of a base figure, it allows for a more standardized form of comparison. Investors, managers, and analysts use vertical analysis to identify trends in operational performance, make intra-firm comparisons, and gauge financial health against industry standards.

Get started with our forecasting software so that you can plan your business' futureElevate analysis, drive decisions in Brixx

Vertical analysis formula

The vertical analysis formula, also known as the common-size ratio, is a way to express each line item on a financial statement as a percentage of a base amount. Each line item’s common-size ratio can then be used to conduct comparative analysis across different fiscal periods or companies, allowing for a standardized approach to analyzing financial statements.

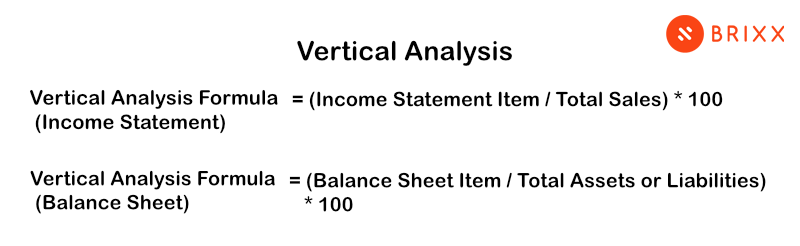

The formulas are straightforward and can be written as:

Vertical Analysis Formula (Income Statement) = (Income Statement Item / Total Sales)* 100

Vertical Analysis Formula (Balance Sheet) = (Balance Sheet Item / Total Assets or Liabilities)* 100

How to do vertical analysis?

Vertical analysis is a financial method that expresses each item in a financial statement as a percentage of a base figure. Here’s how to perform vertical analysis:

- Choose the base amount: For the balance sheet, the base is usually total assets or total liabilities and equity. For the income statement, it’s typically total revenue.

- Calculate the ratios: Apply the vertical analysis formula to each line item. For the balance sheet, divide each asset, liability, or equity item by the total assets or total liabilities and equity. For the income statement, divide each revenue and expense item by the total revenue.

- Convert to percentages: Multiply the result by 100 to get a percentage.

- Repeat for all line items: Perform this calculation for every line item on the financial statement to understand the proportion of each element.

- Analyze and interpret: Use these percentages to analyze the company’s financial structure and performance. Compare them with industry benchmarks, historical data, or competitive data to gauge the company’s standing and trends.

Vertical analysis is useful for understanding the relative significance of each component of the financial statements, making it easier to spot patterns and anomalies.

Vertical analysis example (income statement)

To provide a practical example of vertical analysis, let’s consider a hypothetical company’s income statement for the year ended December 31, 2023:

| Income Statement Item | Amount ($) | As a % of Total Revenue |

|---|---|---|

| Total Revenue | 1,000,000 | 100% |

| Cost of Goods Sold | 400,000 | 40% |

| Gross Profit | 600,000 | 60% |

| Operating Expenses | 250,000 | 25% |

| Operating Income | 350,000 | 35% |

| Interest Expense | 50,000 | 5% |

| Earnings Before Tax | 300,000 | 30% |

| Tax Expense | 90,000 | 9% |

| Net Income | 210,000 | 21% |

Here, the Total Revenue is considered 100%, and all other figures are expressed as a percentage of this total. This vertical analysis shows that the company’s Cost of Goods Sold is 40% of the total revenue, leaving a gross profit margin of 60%. Operating expenses account for 25% of the total revenue, resulting in an operating income of 35%. After accounting for interest and taxes, the net income is 21% of the total revenue, providing a clear picture of the company’s profitability.

Vertical analysis example (balance sheet)

Now let’s consider a hypothetical company’s balance sheet as of December 31, 2023:

| Balance Sheet Item | Amount ($) | As a % of Total Assets |

|---|---|---|

| Total Assets | 500,000 | 100% |

| Cash | 75,000 | 15% |

| Accounts Receivable | 125,000 | 25% |

| Inventory | 100,000 | 20% |

| Equipment | 200,000 | 40% |

| Total Liabilities | 200,000 | 40% |

| Accounts Payable | 50,000 | 10% |

| Long-term Debt | 150,000 | 30% |

| Total Equity | 300,000 | 60% |

| Common Stock | 180,000 | 36% |

| Retained Earnings | 120,000 | 24% |

In this example, total assets are taken as the base figure (100%), and each asset is then calculated as a percentage of total assets. Cash, for instance, makes up 15% of total assets, while equipment represents a significant 40%. Similarly, total liabilities are 40% of total assets, with long-term debt making up 30%. Equity is shown to be 60% of total assets, indicating a strong equity position. This vertical analysis provides insights into the company’s financial structure and the proportion of financing coming from debt versus equity.

Advantages of vertical analysis

The advantages of performing vertical analysis include:

- Comparability: It allows for comparison across companies of different sizes or industries by providing a common ground through percentages rather than absolute figures.

- Trend analysis: It can help in identifying trends over multiple periods by analyzing the changes in proportional costs and revenues.

- Performance measurement: It provides a quick snapshot of cost management and operational efficiency.

- Target setting and benchmarking: Businesses can set targets for individual line items as a percentage of sales and benchmark against industry standards.

Disadvantages of vertical analysis

Despite its usefulness, vertical analysis has certain limitations:

- Snapshot limitation: It only provides a snapshot of the company’s financials at a point in time and doesn’t reflect changes across different periods.

- Seasonality and cyclical factors: Seasonal businesses might find the percentages misleading due to revenue fluctuations.

- Non-operating items impact: One-time events or non-operating items can skew the percentages, leading to an inaccurate representation of ongoing business performance.

- No insight into volume or market factors: Vertical analysis doesn’t provide insight into the company’s size, market share, or the volume of goods sold.

Horizontal analysis vs. vertical analysis

Horizontal and vertical analyses are both valuable tools in financial analysis, but they serve different purposes:

- Horizontal analysis is used to evaluate the trend and growth of financial statements over a period of time. It compares line items in the financial statements from year on year or quarter on quarter, expressing changes in both dollar amounts and percentages.

- Vertical analysis, on the other hand, is used to show the relative sizes of the financial statement items within a single period. It presents each item as a percentage of a base figure such as total assets or total revenue, which can be particularly useful in comparing companies of different sizes.

We can help

Brixx can facilitate both horizontal and vertical analyses, empowering users to gain a comprehensive understanding of their financial statements. The financial forecasting software simplifies the process of comparing financial data over different periods (horizontal) and within a single period (vertical), which can be instrumental in making informed business decisions. With Brixx, businesses have access to powerful tools to help them in analyzing trends, setting benchmarks, and understanding their financial position in the context of their industry standards.

Explore the full potential of your financial analysis with Brixx. Whether you’re conducting vertical or horizontal analyses, Brixx software offers the intuitive tools you need to make data-driven decisions with confidence. Take the first step towards clearer financial insights and sign up for a 7-day free trial at Brixx. No credit card required – start streamlining your financial management today!