Within the realm of finance, there are hundreds of different types of formulas, concepts, and reports that you may not be familiar with. Actuals might be one of these.

In this article we will provide a clear and simple understanding of actuals in finance, highlighting their significance in assessing true financial performance.

What are Actuals?

In the context of finance, “actuals” refer to the actual financial results of a business over a specific period of time, showing you what happened with your business over the course of your financial period. They are the real, tangible figures that reflect the business’ financial activity, and are often used to compare against budgeted or forecasted expectations.

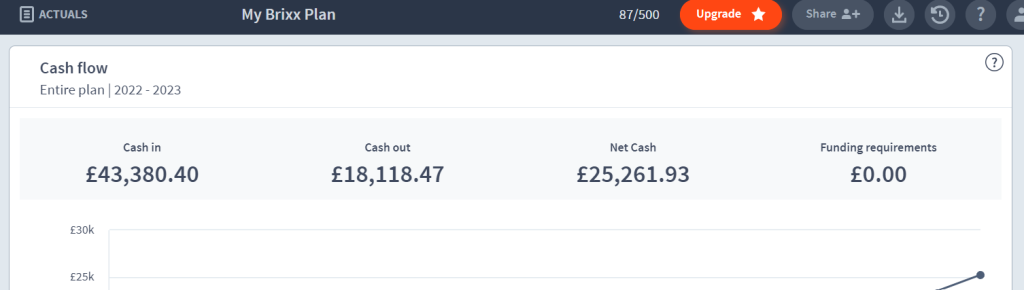

In finer detail, actuals highlight the real amount of cash that enters and exits the business, encompassing all financial factors. This can be measured across either a short-term window, such as a quarter of a year, or a much longer window, which can be over a year or more.

Get started with our forecasting software so that you can plan your business' futureMake the most of your actuals in Brixx

Why are actuals important in finance?

Actuals are absolutely essential in finance. They provide a concrete understanding of what is happening and what has occurred financially. Knowing the actual financial figures, representing the real inflow and outflow of money, serves as a solid foundation for predicting future financial outcomes. This understanding of what “is” and what “was” is crucial for making informed financial forecasts and projections.

In the realm of business and investment, actuals play a pivotal role in planning and assessing the validity of plans, particularly when presenting these plans to investors. By comparing actual results with initially projected figures, businesses can demonstrate the accuracy of their forecasts and showcase their ability to meet financial goals. This transparency and reliability are crucial for gaining and maintaining investor trust.

Consistently knowing and tracking actuals is a fundamental financial practice. Keeping one’s financial records in order ensures that businesses have a clear understanding of their financial performance at any given time. This not only aids in day-to-day decision-making but also allows for more accurate long-term planning.

How to keep track of your actual figures?

Keeping track of actual financial figures can be time consuming and difficult. Here are some options as to how you can do it effectively:

Use accounting professionals

Enlist the help of accountants to manage and track actual figures. While not particularly challenging, this task may be time-consuming, so having dedicated professionals ensures accuracy and efficiency.

Accountants are responsible for organising receipts, invoices, and other financial documents. They maintain clear records, making it easier to track and report actual figures.

Keep accurate records

Maintain a systematic record-keeping system. This can be done manually on paper, through spreadsheet software like Microsoft Excel, or by using dedicated accounting tools.

Ensure that all receipts and invoices are properly stored and categorised. This meticulous record-keeping is vital for accurate financial reporting.

Regularly check your bank transactions

Bank transactions serve as a real-time reflection of actual inflows and outflows of money. Monitoring these transactions provides a clear picture of what has actually happened, so make sure to leverage your bank account as a valuable resource.

Use software like Brixx

Utilise financial software like Brixx, Xero, QuickBooks, or other similar platforms. These tools streamline the process of recording, organising, and analysing financial data. Automation features in accounting tools can help reduce the manual effort required and minimise the risk of errors.

Whether using accounting software or maintaining records manually, having quick access to actual figures facilitates timely decision-making. Accessible actuals empower businesses to respond promptly to financial challenges, identify opportunities, and make informed strategic decisions.

How to make use of your actuals in Brixx

Entering your actuals:

In Brixx, actuals play a crucial role in enhancing the accuracy and utility of financial forecasts. Brixx simplifies the process of using actuals through various methods:

- You can enter actuals manually directly into the Brixx platform

- Copying data from your existing records is an option for quick and accurate entry

- Connect Brixx with your accounting system for real-time automated import of actuals

- Importing CSV files is another convenient way to integrate actuals seamlessly into Brixx.

Once your actuals are within Brixx, you can utilise them in a manner of ways.

Creating projections with actuals

Brixx allows you to incorporate actual figures into your financial models easily. By having a simple and detailed overview of actuals, you gain insights that greatly assist in creating more realistic and accurate projections.

Reforecast based on your actuals

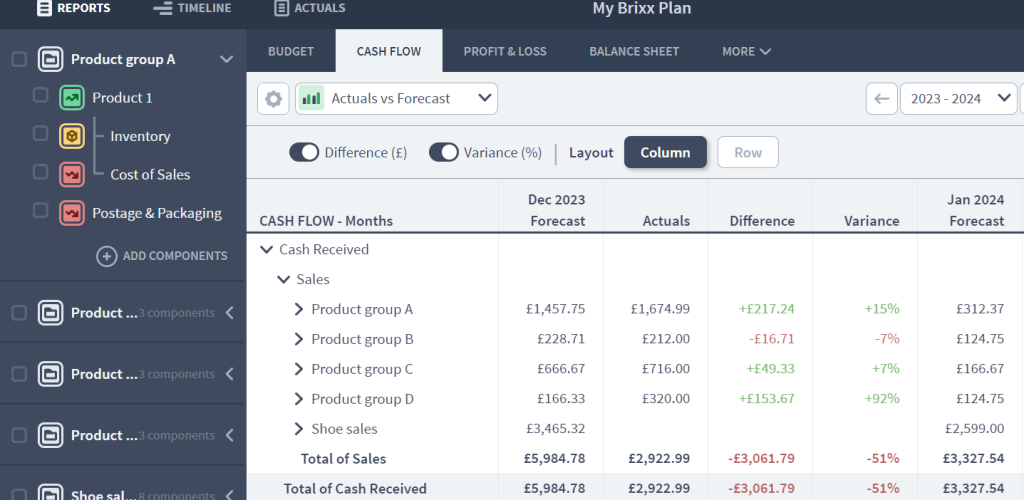

Comparing what actually happened to your initial projections provides valuable insights into the quality of your forecasts.

This process of evaluating variances helps in refining future forecasts, increasing the accuracy of your financial planning.

Improve your decision-making and investor confidence

The greater accuracy achieved through the use of actuals empowers you to make better-informed decisions. When you can demonstrate a track record of aligning projections with actual outcomes, it instils confidence in investors, making your financial proposals more convincing.

Detailed cash flow monitoring

Brixx enables detailed planning, and actuals are instrumental in monitoring your cash flow and spending. Due to the level of granularity, you can see your incoming and outgoing cash in detail, giving you a more nuanced understanding of how the business performs and allowing you to take measures to improve efficiency.

Choose Brixx to help with your actuals

Choosing Brixx for managing your actuals offers several advantages that cater to flexibility, control, and ease of use in financial planning. Here’s why Brixx stands out:

Plan without an accounting tool

Brixx allows you to plan and manage your finances even if you don’t have a separate accounting tool. You can start your financial forecasting without the need for complex accounting software.

You can control your actuals

With Brixx, you are in complete control of your actuals. You can continue to edit your actual figures after bringing them in, providing the flexibility to adjust and modify them to accurately reflect the real financial picture. This hands-on approach ensures that your actuals align with the true financial events.

Easy comparison and adjustment

Brixx makes it extremely easy to compare your actual financial progress against your forecasted plan. The dashboard and reports provide clear visualisations that highlight differences between planned and actual figures. This comparison allows you to make informed adjustments to your financial forecasts based on real-world data.

No restrictions to chart of accounts

The chart of accounts is a list of all the accounts used by a business to record financial transactions. In some financial tools, there can be limitations or predefined categories that restrict users from tailoring the chart of accounts to their specific needs.

In the case of Brixx, the absence of restrictions means users can model their business in a way that best suits their requirements, because you are not tied to a chart of accounts. This independence allows you to design and customise your financial models freely.

Independence and accessibility

Your financial modelling is independent and free from unnecessary constraints. This flexibility empowers you to tailor your financial plans according to your unique business needs. Brixx ensures that you can easily access detailed information when needed. The platform strikes a balance between independence and accessibility, allowing for a customised yet comprehensive financial planning experience.

Hopefully, this has given you an understanding as to what actuals are and how they are utilised. We invite you to see how easy it is to work with them within Brixx. Take a 7-day trial to see for yourself.