What is Customer Attrition (Churn) in SaaS: Complete Understanding and Strategies

In the fast-paced world of business, keeping loyal customers can often be as challenging as attracting new ones. Understanding customer attrition, commonly known as churn, is pivotal for businesses striving to maintain steady growth. This article will shed light on what churn is, its significance, and its common causes—providing you a comprehensive overview to grasp this essential business metric.

What is customer churn or customer attrition?

Customer churn or attrition refers to the phenomenon where customers or subscribers stop doing business with a company or service. It can be visualized as the opposite of customer acquisition; while companies strive to gain new clients, they also face the challenge of customers leaving.

To put it simply, if you started a month with 100 customers and lost 5 by the end, your churn rate for that month would be 5%. It is crucial to understand that churn doesn’t only refer to customers who cancel their subscription or service. It can also represent clients who downgrade their package, reduce order frequency, or buy less than before.

Customer retention vs customer attrition (churn)

Customer retention

This is the company’s ability to keep its customers. Why it matters? It’s matters because its much cheaper to keep existing customers than find new ones. It’s measured through loyalty programs, NPS, satisfaction surveys, and retention rate, with benefits like steady revenue, referrals, and opportunities for up-selling or cross-selling.

Customer attrition (Churn)

This refers to the loss of customers over time. High churn can suggest issues with the product/service or strong competition. It’s typically measured by the churn rate and exit surveys. The downsides of high churn include revenue loss, a bad reputation, and the costs associated with acquiring new customers.

In short, retention is about keeping customers, while attrition is about understanding why they leave. Both are vital for business growth and health.

Why is customer churn important?

The importance of monitoring and understanding churn lies in its direct impact on a business’s bottom line. Here’s why:

- Revenue impact: High churn rates directly reduce the steady revenue stream, especially in subscription models.

- Increased costs: Acquiring new customers is typically more costly than retaining existing ones. High churn amplifies these costs.

- Feedback indicator: A high churn rate can signal product, service, or experience issues that need addressing.

- Company valuation: Investors view high churn rates unfavorably, potentially impacting a company’s valuation and its ability to secure funding.

- Lost growth opportunities: Satisfied customers are sources of referrals. Conversely, dissatisfied customers can deter potential new ones.

- Market reputation: Persistent churn can tarnish a company’s public image, making new customer acquisition challenging.

Addressing churn is crucial for financial health, reputation, and sustainable growth.

Common causes of customer attrition

Customer churn can be attributed to a myriad of reasons, some of which are:

- Subpar customer service: A single negative experience can push a customer to leave. Prompt responses and resolutions are key.

- Better competitor offers: In today’s competitive market, competitors are always on the lookout for your clients, luring them with better offers or features.

- Economic factors: Economic downturns or recessions can lead to customers cutting costs, which might mean saying goodbye to your service.

- Mismatched expectations: If the product or service doesn’t meet the expectations set by marketing campaigns, customers might feel misled and leave.

By understanding these common causes, businesses can proactively work towards enhancing customer experiences, adjusting their strategies, and thereby reducing attrition.

How to calculate customer churn rate: Key metrics to understand

Metrics drive strategic decision-making in businesses. To grasp the impact of customer churn, you must be equipped with the right measurement tools. Tracking churn rate sheds light on customer behavior, providing pivotal insights for optimizing retention strategies.

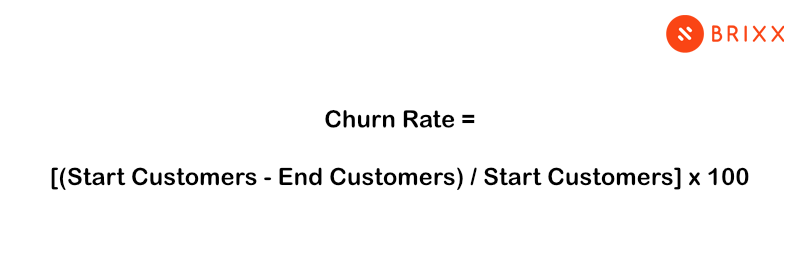

The customer attrition formula

A handy formula for calculating customer churn rate is below:

Churn Rate = [(Start Customers – End Customers) / Start Customers] x 100

Here’s a simple walkthrough:

- Find out the number of customers at the onset of your chosen timeframe (e.g., beginning of a month, quarter, or year).

- Find out the number of customers at the close of that period.

- Subtract the latter number from the former.

- Divide this difference by the initial customer count.

- Multiply by 100 to yield the percentage.

This percentage represents your customer churn rate for the designated period.

Practical examples to illustrate churn rate calculation

Example 1: Monthly churn

Let’s say you run a subscription-based software service. You began January with 1,000 subscribers. By the end of January, 950 subscribers remained. To calculate the churn rate for the month:

Churn Rate = [(1000 – 950) / 1000] x 100 = 5%

Your churn rate for January was 5%.

Example 2: Quarterly churn

Suppose you begin Q1 with 1,500 clients. By the end of Q1, you have 1,350 clients left. The churn rate for Q1 would be:

Churn Rate = [(1500 – 1350) / 1500] x 100 = 10%

The quarterly churn rate for Q1 stands at 10%.

While the churn rate is an invaluable metric, it’s also crucial to consider other indicators such as customer lifetime value, customer acquisition cost, and customer satisfaction scores for a comprehensive understanding of your business’s vitality.

While the churn rate is an invaluable metric, it’s also crucial to consider other indicators such as customer lifetime value, customer acquisition cost, and customer satisfaction scores for a comprehensive understanding of your business’s vitality. Another essential metric for SaaS businesses to understand is the SaaS Magic Number, which gives insights into the efficiency of sales and marketing expenses.

Strategies on how to reduce customer churn

In a competitive business landscape, it’s not just about attracting new customers; it’s equally crucial to keep the existing ones engaged and satisfied. Reducing customer churn can significantly boost profitability, and the key lies in understanding the reasons behind attrition and implementing effective strategies to counteract them. Below, we’ll explore four tried-and-true techniques to retain your customer base.

Four proven techniques to retain customers

- Personalized customer experience:

- Why: Customers today expect personalized experiences. They want to feel valued and understood.

- How: Use data analytics to understand customer preferences, purchase histories, and behaviors. Segment your customer base and tailor your offerings, communications, and promotions to fit individual needs.

- Responsive customer support:

- Why: Quick and effective resolution of issues can greatly enhance customer loyalty.

- How: Invest in training your support staff, utilize modern CRM systems, and consider implementing chatbots for immediate responses. Always ensure the availability of a human touch when needed.

- Loyalty programs and incentives:

- Why: Rewarding long-term customers can increase their lifetime value and discourage them from switching to competitors.

- How: Develop loyalty programs that offer exclusive deals, discounts, or rewards based on purchase history. Regularly update and promote these programs to keep the engagement high.

- Regular feedback and engagement:

- Why: By keeping a finger on the pulse of your customer’s needs and sentiments, you can preemptively address potential issues.

- How: Use surveys, feedback forms, and direct communications to gather insights. Regularly engage with your customers through newsletters, product updates, and community events to keep your brand top-of-mind.

Combat customer attrition with Brixx

Navigating the SaaS landscape means grappling with the persistent challenge of customer attrition. To stem the tide of churn, it’s not enough just to understand why customers leave – businesses must also anticipate these shifts in their financial forecasts. Brixx stands out as your essential partner against churn.

With over 20 years of financial forecasting software expertise, Brixx provides a specialized toolset tailored for SaaS entrepreneurs, focusing on customer retention and financial stability. Using its comprehensive forecasting features, businesses can model potential churn scenarios and craft strategies to maintain strong customer relationships. Brixx’s user-friendly interface is accessible to everyone, from startup founders to financial experts, and the accuracy and efficiency of Brixx in report generation is a game-changer.

In a SaaS environment where every customer counts, Brixx offers the insights you need to effectively combat customer churn. By understanding your customer’s needs and behaviors, Brixx helps you craft strategies to keep them engaged. Ready to make a change? Take a free trial now.