When it comes to managing the finances of a business, accurate and complete financial records are essential. That’s where double-entry bookkeeping comes in. In this blog post, we’ll explain why this method is important, the difference between single and double-entry bookkeeping, and provide examples of how to do double-entry bookkeeping. Whether you’re a business owner or just curious about accounting, read on to learn more.

What is double-entry bookkeeping?

Double-entry bookkeeping is a system of accounting that requires every financial transaction to be recorded in at least two different accounts – a debit account and a credit account. This means that for every debit entry, there must be a corresponding credit entry, and vice versa.

Understanding double-entry accounting

To understand double entry accounting, you need to bear in mind the accounting equation, the types of accounts, and debits and credits.

The accounting equation

At the heart of double-entry bookkeeping is the accounting equation, which is:

Assets = Liabilities + Equity

This equation must remain in balance at all times, meaning that the total value of assets must always equal the combined value of liabilities and equity. By recording every financial transaction in at least two different accounts, double-entry bookkeeping ensures that the accounting equation remains in balance, providing a clear picture of the financial position of a business at any given time.

Types of accounts

While there are different ways to classify accounts in accounting, the most common classification system used in double-entry bookkeeping involves five main types of accounts:

There are five main types of accounts used in double-entry bookkeeping:

Asset accounts

These accounts represent the resources owned by a business, such as cash, inventory, property, and equipment (Learn more about the different types of assets in accounting).

Liability accounts

These accounts represent the debts owed by a business, such as loans, accounts payable, and taxes payable.

Equity accounts

These accounts represent the ownership interest in a business, such as common stock and retained earnings.

Revenue accounts

These accounts represent the income earned by a business, such as sales revenue and interest revenue.

Expense accounts

These accounts represent the costs incurred by a business in generating revenue, such as salaries, rent, and supplies.

Each transaction is recorded in at least two different accounts, with one account debited and the other credited to ensure that the accounting equation remains in balance.

Gains and losses are usually recorded separately from revenues and expenses in accounting, which are often referred to as “gain accounts” and “loss accounts”. Gains represent increases in the value of assets or decreases in the amount of liabilities, while losses represent decreases in the value of assets or increases in the amount of liabilities.

Debits and credits

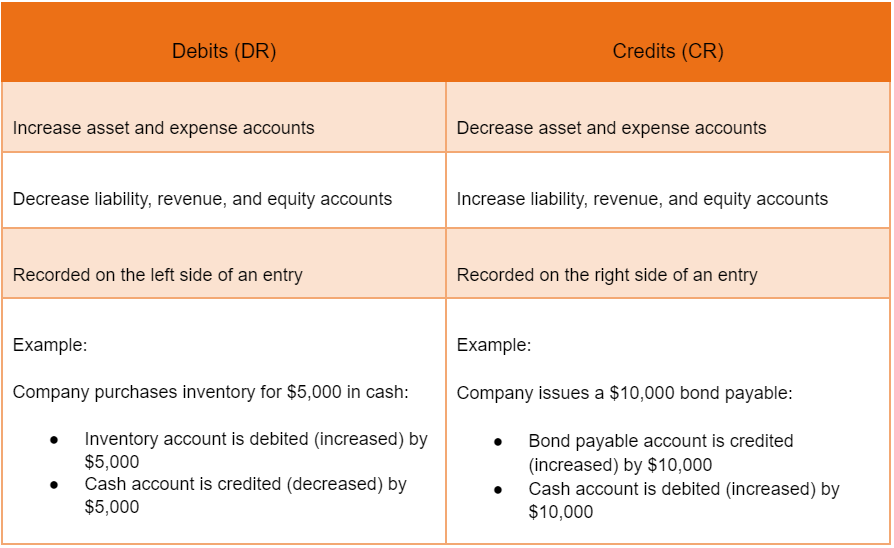

In double-entry bookkeeping, every transaction involves at least two accounts: one account is debited, and another account is credited. Debits and credits are used to record the changes in these accounts.

Debits are used to record increases in assets, expenses, and dividends, as well as decreases in liabilities, equity, and revenue. Credits, on the other hand, are used to record decreases in assets, expenses, and dividends, as well as increases in liabilities, equity, and revenue (learn more about the difference between debit and credit in accounting).

It’s important to note that debits and credits don’t necessarily correspond to an increase or decrease in value. For example, if you purchase office supplies for $500, the debit would be recorded for the office supplies expense account, while the credit would be recorded for the accounts payable liability account.

Why is double-entry bookkeeping important?

Double-entry bookkeeping is essential to maintaining accurate financial records and ensuring that the accounting equation remains in balance. This is why a balance sheet needs to balance, as we explained in our previous blog post. By using double-entry bookkeeping, businesses can accurately record every financial transaction and ensure that the balance sheet reflects the true financial position of the company.

Double-entry bookkeeping examples

In the following examples, we will show how double-entry bookkeeping is applied in various scenarios, including revenue and expenses, assets and liabilities, and equity.

Example 1: Buying inventory

If a company buys inventory worth $1,000 on credit, the following entry would be made:

This entry shows that the inventory account has been increased by $1,000, while the accounts payable account has also been increased by $1,000.

Example 2: Selling goods

If the company then sells the inventory for $1,500 in cash, the following entry would be made:

This entry shows that the cash account has been increased by $1,500, while the sales revenue account has also been increased by $1,500. At the same time, the cost of goods sold account has been increased by $1,000, while the inventory account has been reduced by $1,000.

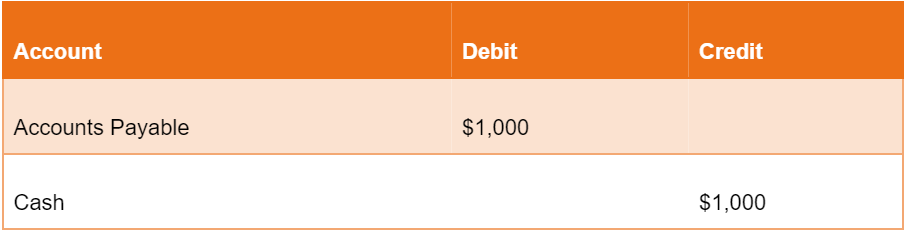

Example 3: Paying bills

If the company then pays the accounts payable balance of $1,000, the following entry would be made:

This entry shows that the accounts payable account has been reduced by $1,000, while the cash account has also been reduced by $1,000.

These are just a few examples of double-entry bookkeeping. By recording every transaction in two separate accounts, this system ensures that the books are always balanced and accurate.

How to do double-entry bookkeeping?

Here are the steps to do double-entry bookkeeping:

1. Identify the transaction

The first step is to identify the transaction that you want to record.

2. Determine the accounts affected

Determine which accounts are affected by the transaction. For example, if you purchase equipment, the asset account for equipment will increase, and the liability account for accounts payable will also increase.

3. Record the transaction

Record the transaction in the journal using debits and credits. Debits are recorded on the left side of the journal, while credits are recorded on the right side of the journal.

4. Post the transaction to the ledger

Once the transaction is recorded in the journal, it needs to be posted to the appropriate accounts in the ledger balance.

5. Balance the accounts

At the end of each accounting period, the accounts need to be balanced to ensure that the total debits equal the total credits.

By following these steps, you can ensure that your financial records are accurate and up-to-date.

We can help

Double-entry bookkeeping may seem daunting at first, but with practice, it becomes second nature. If you need help with your bookkeeping or want to streamline your accounting processes, consider using Brixx software. Our user-friendly platform makes it easy to manage your finances and keep your books balanced. Sign up for a free trial today and experience the benefits of efficient bookkeeping!

Double-entry bookkeeping FAQs

What’s the difference between single-entry and double-entry bookkeeping?

Single-entry bookkeeping is a simple method of recording transactions in a single account, while double-entry bookkeeping is a more complex method of recording transactions in two different accounts. Double-entry bookkeeping provides a more accurate picture of a business’s financial position as each transaction is recorded twice, once as a debit and once as a credit, ensuring that the accounting equation remains balanced. Double-entry bookkeeping is usually used by larger businesses that have more transactions and require more detailed accounting records.

Single-entry vs. double-entry bookkeeping: Which method should you use?

The choice between single-entry and double-entry bookkeeping largely depends on the size and complexity of your business. If you have a small business with a limited number of transactions, single-entry bookkeeping may be sufficient. However, if you have a larger business with more complex financial needs, double-entry bookkeeping is the recommended method. It provides a more accurate and detailed picture of your business’s finances, which is essential for making informed decisions and planning for the future.

What are some common mistakes to avoid in double-entry bookkeeping?

Some common mistakes to avoid in double-entry bookkeeping include: not recording transactions correctly, failing to balance the books, and not reconciling accounts regularly.