Why focus on a cash flow analysis?

A cash flow forecast (and cash flow analysis) isn’t just for short-term cash management. Creating reliable, forward looking cash flow projections is essential for any business’ success. By closely monitoring cash inflows and outflows, businesses can better manage their liquidity, plan for short-term needs, and make better informed decisions. Investors often require 5 year projections because they want to see a concrete plan for growing the business – a 13 week cash flow forecast just can’t compete!

Your true goal is identifying current assets and performance to work out how you can make more cash and grow your business.

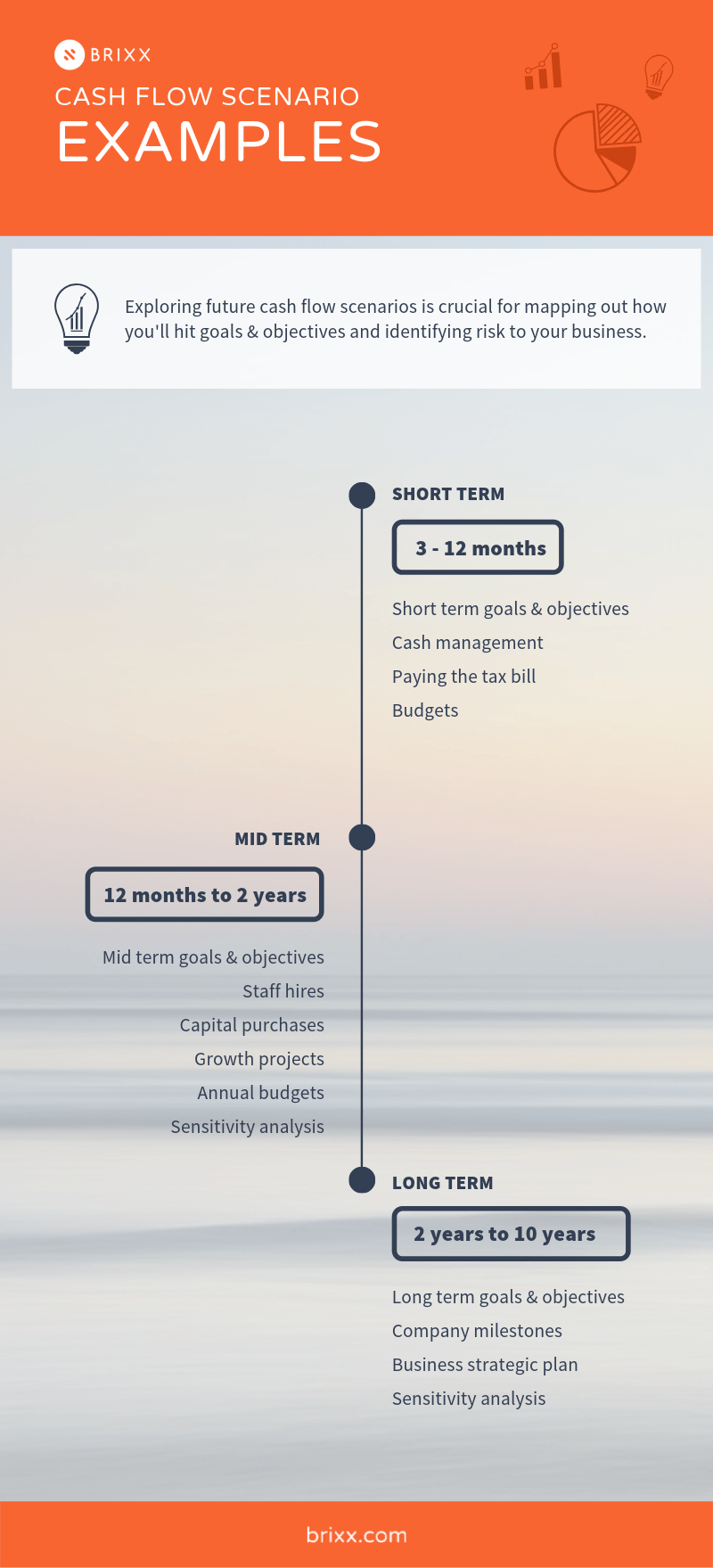

Cash flow scenario examples

The value in the cash flow forecasting process is really unlocked when you start modelling future business scenarios. When it comes to cash flow analysis, building different scenarios that help you understand and mitigate risk, but also help you work out when you can spend money on the activities that will accelerate your growth. Running scenario analysis ultimately helps you figure out the right path to achieve your goals.

Understanding your short term cash situation can help you spot problems and tackle them early. You can work out how much of a cash buffer you need to maintain to survive worst-case scenarios. Or you can take steps like renegotiating the payment terms on your contracts for a bit more flexibility.

Looking at the mid and long-term cash scenarios will inform your goals, budgets and strategic decisions. You can get a bit more ‘aspirational’ and map out the projects, campaigns and expansions needed to hit your next important milestone.

Every business will have their own specific scenarios they need to think about. Lets run through 6 common scenarios relevant to almost any business. Looking at them should help you think of other scenarios you need to consider that are bespoke to your business.

Example 1: What if everyone who owes you money pays you late?

Effective short-term cash management relies on payment timing. While it may seem reassuring to anticipate a flurry of incoming payments, the critical question remains: when will these funds actually reach your account?

Utilising accounting systems that compile outstanding invoices are invaluable in assessing such scenarios. If pending payments are essential for meeting upcoming expenses, it is a requirement to consider the worst-case scenario: what if everyone pays late?

By examining historical data on late payments, businesses can refine their worst-case projections, offering a realistic perspective on potential cash shortfalls. This exercise is crucial for businesses operating on tight margins, showing with ease the risks of cash depletion. Evaluating various scenarios, from best to worst case, empowers businesses to gauge the likelihood of each outcome, drawing upon past experience and industry knowledge to inform their assessments.

Example 2: Do I have enough money in the bank to pay my tax bill?

In the UK, VAT is collected on customer purchases, and businesses are responsible for remitting these funds to the government (often in 3 month batches). However, for small businesses, this can pose some unique challenges, as revenue and expenses are often mixed in the same account. This means that when the VAT bill comes after 3 months, it can be quite substantial!

To avoid accidentally spending the tax-man’s money, it’s crucial to maintain records. This does mean that you’ll need to understand cash inflows and outflows to effectively navigate this ongoing financial responsibility.

This is less of an individual scenario and more a factor you should always consider when running other scenarios. If you are planning on spending money, you have to be aware of what you owe before you commit to it.

Example 3: How sensitive is my business to changes in supplier costs?

Transitioning from short-term concerns to mid-term considerations, the sensitivity of your business to changes in supplier costs takes focus. While not as immediately pressing as short-term cash management, understanding this sensitivity is pivotal for risk mitigation and strategic planning.

Sensitivity analysis, a practice used by financial analysts, is the cornerstone of this evaluation. It involves stress-testing your business against various market and economic shifts. For instance, a nominal increase in your internet bill may not pose a significant threat, but a 25% rise in the cost of T-shirt supplies could dramatically impact your profit margins and cash flow.

Identifying these vulnerabilities in advance is essential. By running sensitivity scenarios in isolation or integrating multiple factors into a comprehensive cash flow forecast, you can prepare for worst-case scenarios and safeguard your financial stability. Moreover, recognizing any areas of high risk allows you to devise contingency plans, such as exploring alternative suppliers, to mitigate potential disruptions.

Example 4: How much do I need to spend on marketing to grow my revenue?

As businesses grow and refine their planning processes, establishing budgets for all expenditure categories, including marketing, becomes standard practice. These budgets exist to maintain control over cash outflows, ensuring they remain within the business’ limits.

However, for small or early-stage businesses, particularly in the realm of marketing, spending tends to be more fluid. This fluidity stems from the ongoing process of discovering and experimenting with various marketing activities to discern their effectiveness.

Flexibility is incredibly important during this phase, allowing businesses to allocate resources to activities that demonstrate a tangible return on investment while phasing out less effective strategies or campaigns.

Whilst you’re experimenting, it’s really useful to have one eye on your cash flow model. You can forecast the potential sales and the marketing costs needed to drive them. Take time to explore the relationship between cash inflows and outflows, aligning your marketing expenditure with other financial priorities.

- Recommended Reading: Understanding Cash Budgets

Example 5: When can I afford to expand my team?

Building the right team is critical to success and if sales are on the rise, you might be itching to expand. However, the timing of this expansion is critical, considering that staffing represents one of the most substantial costs for any business.

The true cost of employing a person can be hidden, extending far beyond their base salary. Recruitment expenses, taxes, benefits, and potential investments in equipment or software must all be factored in. It’s imperative to assess this decision within the broader context of your business’s financial landscape.

If doubling your team is on the horizon, it’s prudent to map out a realistic timeframe. Setting sales milestones as benchmarks can provide a solid foundation for determining when it’s financially viable to onboard new employees.

For businesses committed to strategic growth, outlining a trajectory for team expansion over the coming years is essential. By incorporating this consideration into your scenario planning, you can ensure that your growth strategy is both ambitious and financially sustainable.

Example 6: When can I afford to make large capital purchases?

Are you among those who watch their team battle against 5-year old laptops, clinging to the notion of saving costs? It’s a common notion to make-do with existing equipment to preserve save money. Yet, delaying the upgrade of outdated business infrastructure and equipment can prove to be a costly misstep in the long run. Clinging to poor equipment is of no benefit to your workforce.

Given that salaries represent a significant portion of business expenses, it is key that you optimize employee productivity. Forecasting cash flow and identifying opportune moments to allocate funds towards large purchases can alleviate concerns surrounding such investments.

Strategic planning also involves considering how to stagger these purchases over time to lessen the impact on your finances. By taking a proactive approach to assess future cash flow, you can make informed decisions that balance immediate needs with long-term financial sustainability.

Modelling your business financials with scenarios

There are a lot of ‘what-if’ questions you can ask to explore the future of your business. Running scenarios helps to answer them and give you a better appreciation of what you need to do to achieve your goals. A good cash flow analysis can help you get a better idea of where your company could improve.

Broadly, they help to:

- Ensure you won’t run out of money

- Identify and take steps to reduce risk in the business

- Understand what you need to spend to grow your business

- Understand when you are safe to spend that money

Overall, forecasting cash flow in the short, mid and long term will help you make good strategic decisions. It’ll save you money and help grow your business faster.

If you’re just getting started with cash flow analysis – you might want to keep it simple with our cash flow forecasting template. You may also want to get started with a fantastic financial modelling tool. Try a 7-day free trial now.