Owning a seasonal business can feel like a roller coaster. Busy sometimes, and quiet at others. But did you know the quiet times can be a golden chance to plan better? In this guide, we’ll show you how to use these calm periods to look after your money, plan for the future, and be ready for the busy days ahead. And with a tool like Brixx software, it’s even easier. Let’s explore how you can make the most of every season, busy or not!

1. Forecast at least 12 months ahead

If you’re truly serious about reducing uncertainty and improving your cash flow then the first thing is to create a base forecast. If you’ve never created a cash flow forecast before read our complete beginner’s guide: How to forecast your startup or business’s cash flow.

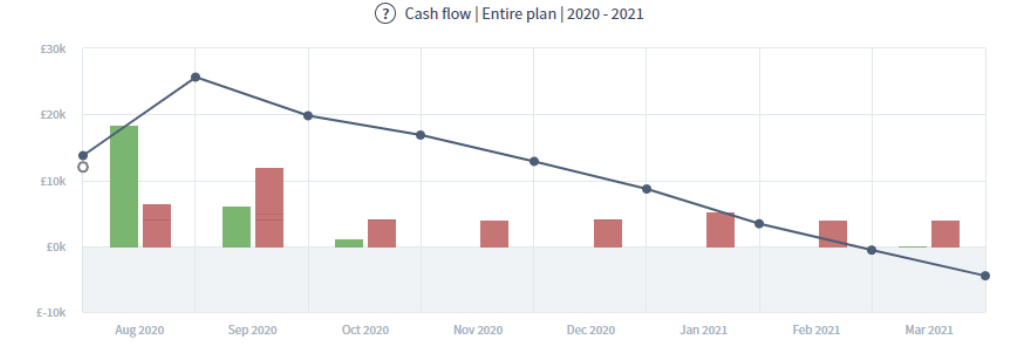

Your cash flow forecast will visualise this disparity for you:

Step 1: Determine monthly costs

Begin by detailing expected monthly expenses. By pinpointing the commencement and culmination of your off-season, you can calculate the cumulative costs during sales-drought periods. This lays the foundation for planning how much cash to set aside after peak season.

Step 2: Incorporate historical data

Use past data to devise a base sales forecast, striking a balance between optimism and realism. For startups or businesses without substantial historical data, employ other forecasting techniques. Discover more in our guide: How to create an effective financial forecast with no historical data.

Step 3: Extend your forecast

While a 12-month forecast is essential, extending it to 2 years or more amplifies its effectiveness. Such a comprehensive forecast provides insights into how one season’s performance influences the subsequent year.

Embark on this journey by utilizing our free cash flow forecast template. Alternatively, you can opt for a free trial of the professional financial planning software to kickstart your exploration.

With your foundational forecast set, you’re now primed to explore and model the implications of other strategic actions detailed in this guide.

2. Build a strong cash reserve

Having a robust cash flow forecast is a significant first step. Next, it’s crucial to determine the size of the cash reserve you should maintain.

Maintaining a cash reserve is paramount for the survival and smooth operation of any business. It safeguards against off-season expenses and unforeseen challenges. But how much should you set aside? Let’s delve into the key steps to determine the right amount and ensure your business thrives irrespective of seasons or unexpected events.

Step 1: Assess off-season costs

The off-season can be challenging with reduced or even no sales. So, first:

- Analyze your cash flow forecast to pinpoint periods with more cash outflow than inflow.

- Sum up all expenses during this off-season period. This total represents the minimum cash reserve you should have by the end of your peak season.

Step 2: Anticipate unplanned events

Let’s visualize: It’s a vibrant autumn, and customers are eagerly waiting to buy your fresh-baked pumpkin pies. Suddenly, your main oven malfunctions! Without it, your peak sales could plummet.

Now, the question arises: Do you have enough in your cash reserve to promptly address this unexpected situation?

If you do, you can swiftly rectify the issue and minimize disruptions. If not, you risk compromising your peak sales period while figuring out financial solutions.

Step 3: Determine your optimal cash reserve

To set a sound cash reserve:

- Start with the total off-season expenses as a base.

- Add a buffer amount for sudden expenses like equipment replacements or emergencies.

- Ensure your annual spending plan allows your cash reserve to remain above this combined amount.

3. Diversify your income streams year-round

Instead of solely relying on boosting sales, mitigating off-season financial dips can be achieved by introducing diverse income sources. While it’s not about entirely negating the low cash flow intervals, the aim is to moderate the sharp downturns.

Step 1: Brainstorm complementary income avenues

Devote time to ideate fresh revenue-generating strategies that can augment your primary business model.

Ideas to explore:

- Merchandising your brand: If you’ve nurtured a brand that resonates with customers, it’s an open door to capitalize on their loyalty.

- Strategy: Introduce branded items such as apparel, accessories, and collectibles. This not only enhances your revenue but also amplifies brand visibility.

- Tap into international markets: Geographical differences mean varied peak seasons. While it might be off-season in one region, it could be prime time elsewhere.

- Strategy: Consider expanding your online store to cater to international markets. It’s crucial, however, to ensure that such expansion doesn’t dilute your focus on your core market.

- Introduce subscription models: The subscription economy is booming, and many products, even unconventional ones, are finding their way into this model.

- Strategy: Package your products into appealing subscription offers. Encouraging subscriptions during your peak times can sustain consistent revenue flow throughout the year.

Step 2: Implementation & evaluation

- Dedicate time to craft and refine your alternative income strategies tailored to your business’s unique needs.

- Be conscious of potential expenses, resource allocations, and time commitments tied to these strategies.

- Incorporate these plans into your cash flow forecast. This will offer a clear picture of the potential positive impact and help determine if the investment justifies the outcome.

Diversifying revenue streams is a proactive approach to ensure financial stability. By embedding these strategies, businesses can enjoy a more consistent cash flow, cushioning them against seasonal fluctuations and unforeseen challenges.

4. Minimize off-season expenditures

Managing spending during off-peak times is vital for maintaining a healthy financial outlook. While core operational costs remain unavoidable, you can strategically reduce expenses by using a well-structured cash flow forecast as a guide.

Step 1: Analyze and identify cost-cutting opportunities

Even during quieter times, some expenses will remain constant. However, a detailed review can reveal areas ripe for financial trimming.

Strategies to consider:

- Optimize physical operations:

- Strategy: Consider temporarily shutting down facilities during the off-season to cut down on utilities.

- Flexibility in staffing:

- Strategy: Employ part-timers or contractors during peak times, allowing you to scale back on wage bills in the off-season. Additionally, offering core staff optional unpaid leaves during slower periods can further reduce costs.

- Review software subscriptions:

- Strategy: Pause any unused software subscriptions, ensuring they can be reactivated when needed.

- Streamline marketing campaigns:

- Strategy: Suspend marketing activities, like AdWords, that may not be as effective during off-peak times.

Step 2: Guard against peak-season overspending

A surge in sales during peak times can be misleading, potentially leading to unwarranted overspending.

- Importance of cash flow forecast: This tool is a beacon, reminding you to stay prudent, especially when revenue seems abundant. With foresight about potential lean periods, you can curb unnecessary expenditures and make judicious decisions.

- Reiterating cash reserve minimums: Recognizing and adhering to your cash reserve minimums is paramount. It offers clarity on financial boundaries, assisting in budgetary planning.

5. Plan your inventory purchases with due care and attention

Inventory management, especially in a seasonal business, is pivotal to cash flow. Properly managing stock orders—neither over-purchasing nor under-purchasing—is crucial to ensure both financial and operational efficiency.

Step 1: Understand the importance of inventory decisions

Stock commitments can exert a considerable strain on cash reserves:

- Over-purchasing risks tying up cash and potentially discarding unsold stock, resulting in a financial hit.

- Under-purchasing can reduce potential peak-season revenue, damage trust, and compromise customer retention.

Remember, seasonal products often have critical time frames. A delay in delivering swimsuits or festive treats, for instance, could mean lost sales.

Step 2: Delve deep into data

Conquering seasonal cash flow hinges on meticulous inventory planning. Foreseeing demand isn’t straightforward, making past data invaluable.

- Analyze previous sales: Consider not just the number, but the timing and product distribution.

- Essential insights include:

- Season duration.

- Best-selling items versus under-performers.

- Peak order volume within specific intervals.

- Stock order lead time.

- Supplier’s minimum order requirement.

- Potential bulk order discounts affecting order decisions.

Step 3: Design a comprehensive purchase plan

Leverage insights to draft a thorough inventory strategy for the year. Your cash flow forecast will spotlight significant cash implications, helping decide optimal purchase volumes.

Remember, always align purchase decisions with the predetermined minimum safe cash reserve amount.

6. Make capital expenditure purchases at the right time

Capital expenditure, the money allocated for new business assets, plays a vital role in your financial health. These purchases can either be to scale the business or to address urgent needs.

Step 1: Understanding capital expenditure categories

- Growth-oriented purchases: These are investments to expand or upgrade the business, ensuring a stronger future.

- Emergency purchases: Sudden and unexpected expenses usually to replace failing critical assets.

Step 2: Assessing key asset replacements

If you anticipate the need to replace crucial assets soon, it’s wise to act before they break down. As illustrated by our earlier example, unexpected breakdowns during peak season can have dire consequences. Equipment pivotal to sales and demand fulfillment is equally vital to maintaining cash flow consistency.

Step 3: Upgrading and expansion

Anticipating peak season, consider updating or enlarging primary machinery and tools. Such proactive steps entail revisiting your cash flow forecast, given the substantial impact of capital expenditures.

7. Make the right decisions by exploring scenarios

Having delved into various topics, you likely have a multitude of strategies to consider for your business. An essential aspect of decision-making is contemplating potential outcomes, both optimistic and pessimistic, of each strategy.

Step 1: Thinking in ‘what-ifs’

You might find yourself pondering, “If I make change X, what would the best-case (Y) and worst-case (Z) impacts on my cash flow be?” Recognizing that each decision can yield a range of outcomes is pivotal in steering your business adeptly.

Step 2: Deciphering the best moves

While an array of potential strategies might appeal, it’s impractical and often impossible to execute them all due to time and monetary constraints. Identifying the most impactful and feasible options is paramount.

Step 3: Exploring scenario analysis

In the realm of financial forecasting, we employ scenario analysis to evaluate potential decisions. Your initial 2+ year cash flow forecast is your base scenario.

This base scenario will already provide an illuminating picture of your finances even before you start exploring other scenarios. You can gain further insights if you make a copy of this base scenario and explore other possibilities.

Use these copies to plan out the financial consequences of your actions, for example:

- Analyse the size and timing of your inventory purchases

- Analyse the money saved through switching to part-time staff

- Analyse if making equipment purchases will cause you to drop below safe cash reserves in the off season

The possibilities are endless!

Mocking up these consequences before they happen is essential for a seasonal business to conquer their cash flow. Try it today with Brixx’s scenario testing tool.

Get started with our forecasting software so that you can plan your business' futurePerform cash flow forecasts in Brixx

Take full advantage of the off-season with Brixx

While the challenges of a seasonal business are distinct, the off-season offers a golden window for strategic introspection and planning. With Brixx, this period becomes a haven for scenario modeling, enabling you to envision multiple financial paths for the upcoming season. The financial forecasting software’s robust capabilities allow you to draft, analyze, and refine potential scenarios, ensuring you make decisions that optimize and safeguard your cash flow. Don’t just passively wait for the high tide of business; proactively prepare with Brixx.

With Brixx’s cash flow forecasting software, you’re not just managing cash flow – you’re mastering it, season by season.