What is CapEx?

Capital Expenditure, or CapEx, is a critical financial concept in business, particularly relevant in strategic planning and accounting. It refers to the funds used by a company to acquire, upgrade, and maintain its physical assets. These assets include properties, industrial buildings, equipment, and technology.

Types of CapEx

CapEx is diverse and can be broadly categorized into:

- Growth CapEx: This is focused on future growth and expansion. When a company invests in new markets or develops new products, it incurs growth CapEx. This type could include investing in building a new factory, expanding into a new geographical location, or launching a research and development center.

- Maintenance CapEx: Contrary to growth CapEx, this type focuses on maintaining current operational levels. It includes expenditures like replacing old machinery, renovating existing facilities, or upgrading necessary technology. Maintenance CapEx is crucial for ensuring the ongoing efficiency and safety of operations.

- Regulatory CapEx: Sometimes, expenditures are driven by regulatory requirements. For instance, upgrading systems to meet new environmental regulations or compliance standards falls under this category.

- Discretionary CapEx: These are expenditures that companies decide to make on projects they believe will be beneficial, like upgrading IT systems or employee training programs, which might not be strictly necessary but are seen as valuable investments.

Get started with our forecasting software so that you can plan your business' futureManage your business finances in Brixx

Examples of capital expenditures

Capital expenditures vary significantly across industries. Some examples include:

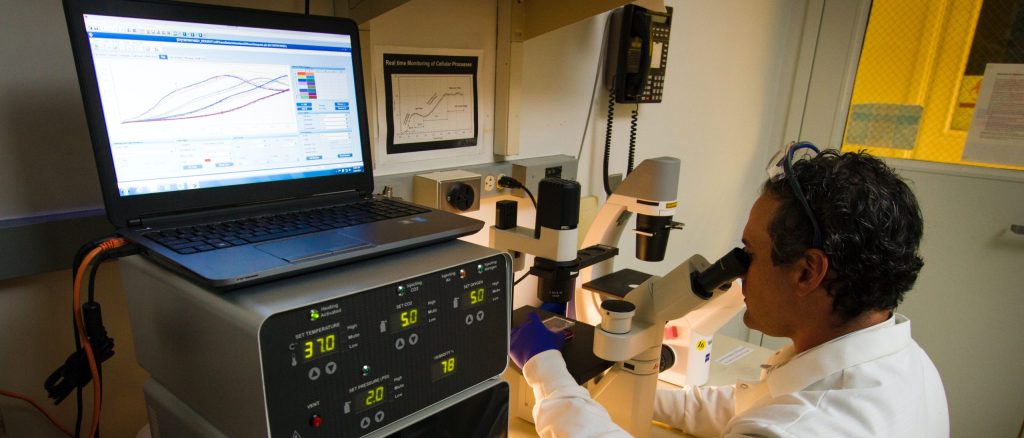

- A tech company investing in state-of-the-art servers or data centers

- An automotive manufacturer purchasing a new assembly line

- A retail chain expanding its network of stores

- A pharmaceutical company investing in advanced research equipment

Capital expenditures: formula and calculation

Capital expenditures (CapEx) are significant investments companies make to acquire, upgrade, or maintain physical assets such as property, buildings, technology, or equipment. Calculating CapEx is crucial for businesses to understand their spending on these long-term assets. The formula for CapEx is straightforward:

CapEx = PP&E (current period) – PP&E (previous period) + Depreciation (current period)

Where PP&E stands for Property, Plant, and Equipment.

This formula helps businesses track their investments in fixed assets over time, which is vital for long-term financial planning and strategy. Understanding CapEx provides a clear picture of a company’s investment in assets that will generate value over several years.

Capital expenditures example calculation:

Let’s say a company’s PP&E at the end of the current year is $500,000, and it was $400,000 at the end of the previous year. During the current year, the company also recorded depreciation expenses of $50,000. Using the CapEx formula:

CapEx = $500,000 (PP&E current year) – $400,000 (PP&E last year) + $50,000 (Depreciation)

CapEx = $150,000

So, the company’s capital expenditures for the current year would be $150,000. This example demonstrates how businesses can utilize this formula to effectively measure their investments in long-term assets.

How does CapEx depreciation work?

Depreciation in the context of CapEx refers to the process of allocating the cost of tangible assets over their useful life. This is important for CapEx because it reflects how assets lose value over time. Depreciation methods can vary, with the straight-line method being the most common. Here, an asset’s cost is evenly spread over its expected lifespan.

In the previous example, the $50,000 depreciation for the current year is added back in the CapEx calculation. This is because when calculating CapEx, you’re trying to measure the company’s investment in fixed assets. Since depreciation is an accounting expense that doesn’t involve actual cash outlay in the current period (it’s an allocation of a past expense), it’s added back to get a clearer picture of the current period’s capital expenditures.

Understanding depreciation is essential for businesses as it affects financial statements and tax calculations. Depreciation reduces the company’s taxable income, thereby impacting its cash flow and profitability.

CapEx vs. Operating Expenses (OpEx)

Understanding the difference between Capital Expenditures (CapEx) and Operating Expenses (OpEx) is critical for any business’s financial management. These two types of expenses play distinct roles in a company’s financials and strategic planning.

Capital Expenditures (CapEx):

- CapEx refers to funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, technology, or equipment.

- These are long-term investments intended to create future benefit.

- Capital expenditures are capitalized on the balance sheet and then depreciated or amortized over the life of the asset.

- Examples include purchasing new machinery, building expansions, or investing in new technology.

Operating Expenses (OpEx):

- OpEx covers the costs necessary for the day-to-day functioning of the business.

- These expenses are short-term costs that are typically used up in the accounting period in which they were incurred.

- Operating expenses are fully expensed on the income statement.

- Examples include rent, utilities, salaries, office supplies, and maintenance costs.

Key differences:

- Nature of costs: CapEx are major investments in goods that will be used for multiple years, while OpEx represents the costs associated with running the business on a day-to-day basis.

- Financial treatment: CapEx is capitalized and then amortized or depreciated over the life of the asset, whereas OpEx is fully expensed in the period they occur.

- Impact on cash flow: CapEx can significantly affect a company’s cash flow due to the large amounts involved, while OpEx represents more regular, predictable expenses.

- Tax implications: The way CapEx and OpEx are treated can have different tax implications. CapEx usually provides a tax benefit over several years, while OpEx can often be deducted in the year they are incurred.

CapEx vs OpEx: How to choose the right model

Choosing between CapEx and OpEx depends on various factors like business goals, cash flow, and tax considerations. CapEx might be more beneficial for long-term growth and asset accumulation, while OpEx can offer more flexibility and less upfront financial commitment.

Businesses should consider their strategic goals, financial health, and the nature of the expenses to decide which model suits their needs. This decision can significantly impact a company’s balance sheet, tax situation, and growth trajectory.

We can help

In conclusion, mastering the intricacies of Capital Expenditures (CapEx) and Operating Expenses (OpEx) is essential for sound financial management and strategic business planning. Whether it’s calculating CapEx, understanding the impact of depreciation, or determining the right expenditure model for your business, having the right tools is crucial.

Brixx offers comprehensive solutions designed to streamline and enhance your financial planning and decision-making processes. Manage your business finances with ease in Brixx.