If you’re new to the balance sheet, understanding each of its components can seem like an overwhelming and complicated ordeal, here we will go over the basics of fixed assets vs current assets.

Ultimately, the difference between fixed (sometimes called non-current) and current assets is the ability of the latter to be transferred into cash in a short period of time. However, there is more to it than that alone.

So, today we’re going to tackle some of the most frequently misunderstood components of the balance sheet, fixed and current assets.

First, we’ll break down fixed and current separately and explain their categories, then we’ll draw the differences between the two.

By the end of this article you’ll understand:

- What are fixed assets

- What current assets are

- The categories make up fixed and current assets

- The differences between them (fixed assets vs current assets)

Ready? Let’s jump in with fixed assets.

What are fixed assets?

Fixed assets are assets that cannot easily be transferred into cash. They can also be referred to as “intangible assets” (applicable to trademarks, patents etc.), “PPE (Property, Plant & Equipment)” or “long term assets”.

How do you determine whether an asset can easily be transferred into cash? Well, a good rule of thumb is if the asset cannot be transferred into cash within one year it would generally be considered fixed. These assets can also be referred to as “non-liquid” simply as they are not fluid enough to be easily sold and turned into cash.

Non-current assets also include investments. These are investments that the business has made into other businesses to grow over time.

How fixed assets are structured within your balance sheet will vary from business to business and industry to industry. There’s no definitive way, but here are a few examples which you will likely see.

Some examples of fixed assets are:

- Vehicles – i.e. vans, cars etc.

- Office furniture

- Machinery

- Buildings

- Land

Get started with our forecasting software so that you can plan your business' futureTrack your assets in Brixx

What are current assets?

Current Assets are reserves or property of the business that are easily exchanged for cash or are already realised as cash.

They are the opposite of fixed assets, meaning these are assets that are easily transferable into cash (within one year).

These assets are referred to as liquid assets, meaning they are fluid (like water) and can easily change into a different form (cash).

The structure for current assets on the balance sheet is a little more universal than fixed assets, but will still change somewhat from industry to industry. Below are some of the categories you might find under current assets. This is by no means a complete list, you may have more or less than the ones listed below.

Inventory

The items that you have in stock that are ready to sell or produce goods.

Accounts Receivable

Any money that you are owed by those you do business with at the end of the month.

Surplus Cash

This is simply the money that’s sitting in your bank account/savings account, tills in your shop, your wallet, or any spare change in your pocket!. It’s readily available cash that the business has immediate access to (the most liquid of liquid assets).

So, now that we’ve understood what fixed and current assets are and what they consist of, we can take a deeper dive into the differences between them.

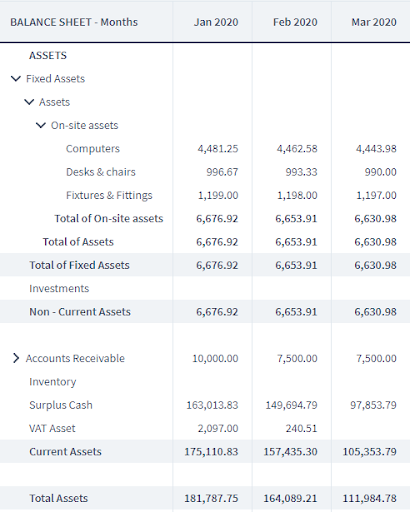

Below you can see an example of how a populated assets section on a balance sheet might look. I have used a software as a service (SaaS) startup as this example.

The difference between fixed and current assets

The eagle-eyed readers amongst you may have already spotted the difference between fixed assets vs current assets.

If you haven’t, don’t worry!

The main difference between fixed and non-current assets is their ability to be changed into cash and the speed at which this can happen.

As we stated earlier, fixed assets are usually intangible or longer-term, such as a building, land or even intellectual properties, making these hard to convert to cash in a short period of time.

Current assets are either already cash or can be made into cash within (usually) one year.

So, that’s the main difference, but what else is there that you should know?

Depreciation.

Fixed assets may be subject to depreciation, whereas current assets will never be subject to depreciation. This is because fixed assets have a much longer life than current assets, for example, cars will naturally depreciate over the course of their useful life. Current assets, on the other hand, are generally more short term (or are already cash) and won’t be affected by depreciation.

How should I balance my assets?

You might be wondering if there’s a balance (no pun intended) you should strike between your fixed and current assets.

Is it bad to have lots of fixed assets and very little current? Or vice versa?

Well, the answer to this is a little complicated and will vary from industry to industry, but I’ll do my best to explain it as simply as I can.

The short answer is no. There are many factors which will affect your ability to control your distribution of fixed and current assets.

Software as a service businesses (like Brixx) may not have many fixed assets but may have a higher amount of current assets in the form of surplus cash. This is because transactions are instant and all products sold are online, meaning the only fixed assets businesses like this may have will be in computers and office fixtures and fittings.

Having said this, having too many fixed assets and not many current assets can be risky.

This is a risk because of how difficult it can be to transfer fixed assets into cash in a short period of time.

If you don’t have enough cash or cash equivalents to pay upcoming bills (like your staff salaries!) you could run into trouble. It’s no good having a building worth £1,000.000 if you can’t use it to pay your upcoming utility bills!

This is seen as a potential problem by investors too.

Picture this:

Your sales are down and need to raise cash quickly to get yourself out of a difficult situation. You turn to your assets, however, most are fixed assets and will take a while to liquidate, you don’t have time.

All types of investors see this as a risk because it more likely a business like this will require calling on other sources for cash to bail them out (like the investors!).

Current Ratio

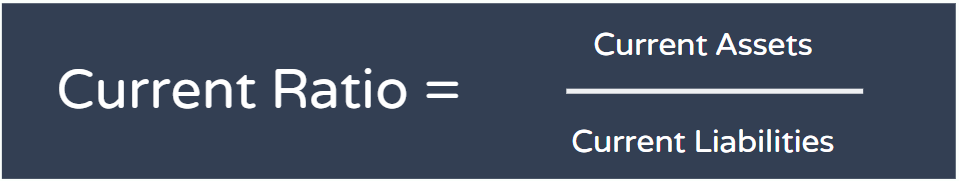

The current ratio is a liquidity ratio which defines a businesses ability to pay short-term debts within a year.

It’s a simple comparison between a businesses current assets and its current liabilities (salaries, accounts payable, taxes etc.)

The formula for it is also simple:

The ratio is looked at by investors and business analysts and compared against industry averages.

A ratio that is lower than the industry average could be viewed as risky by investors.

Comparatively, a ratio that is higher than the industry average generally indicates a smaller risk.

So to conclude this section, sometimes you may find it difficult to have much control over the balance of your fixed and current assets – however, generally speaking, it is riskier to have most of your money in fixed assets due to their non-liquid nature.

Summary

Today we have learnt:

- That fixed assets are longer-term assets which are non-liquid, meaning they aren’t able to be transferred into cash quickly (usually within one year)

- That current assets are shorter-term assets or are already cash. These assets are “liquid” meaning they are easily transferred into cash within one year.

- The difference between fixed and current assets is this ability to be made into cash at a quick pace.

- The ability to balance your assets between fixed and current will depend on many factors such as industry and type of business, therefore sometimes the weighting will be unavoidable.

- The current ratio is a way for investors to weigh up the risk in the businesses asset placement.

- Having more of your money in fixed assets is likely to be riskier from an investor point of view as if the business gets into financial trouble, it becomes harder to raise cash from assets.

Hopefully, we’ve cleared up some of the common questions around fixed assets vs current assets and given some information you might find useful! Remember that this is a very generalised article and many factors will differ from business to business and industry to industry.