Financial Modelling Tool for Buy-to-Let Property Developers

As a buy-to-let property developer, understanding how your cash flow may fluctuate throughout the year and knowing when to make strategic decisions is essential. Brixx offers the financial tools you need to gain timely and crucial insights to guide your development projects.

Start using this template in Brixx

Model your buy-to-let business in Brixx - see how quickly your finances can make sense!

This template is available in Brixx. Follow the guidance below to get started. If you need any further assistance, don’t hesitate to get in touch – we’re here to help!

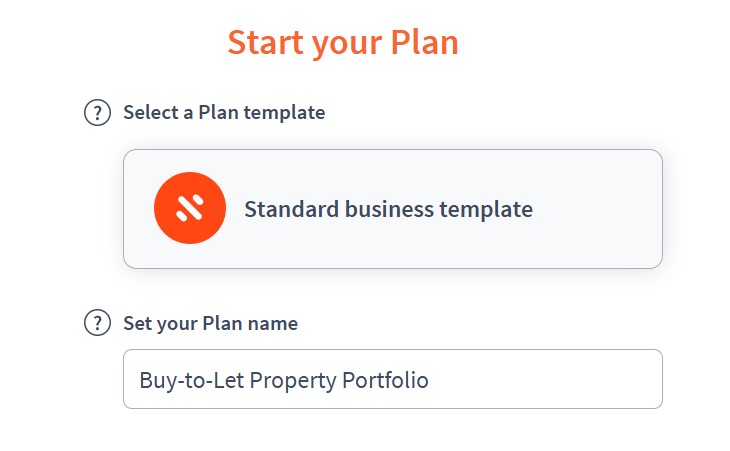

Project Setup

- Project name: Buy-to-Let Property Portfolio

- Time period: Monthly (ideal for tracking rental income and mortgage payments)

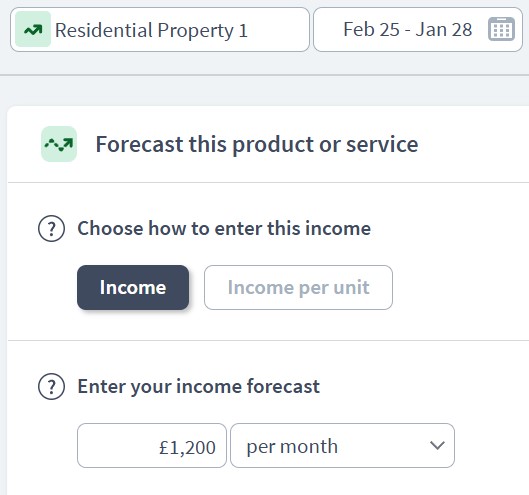

Income Components

- Component: Rental Income

- Sub-components:

- Residential Property 1 – Monthly Rent (£1,200/month)

- Residential Property 2 – Monthly Rent (£1,500/month)

- Short-term Rental Income (Variable, based on occupancy rates)

- Parking Space Rental (£100/month)

- Sub-components:

- Component: Additional Income

- Sub-components:

- Service Charges to Tenants (£50/month per unit)

- Late Payment Fees (Occasional, estimated yearly total)

- Utilities Recharges (if applicable)

- Sub-components:

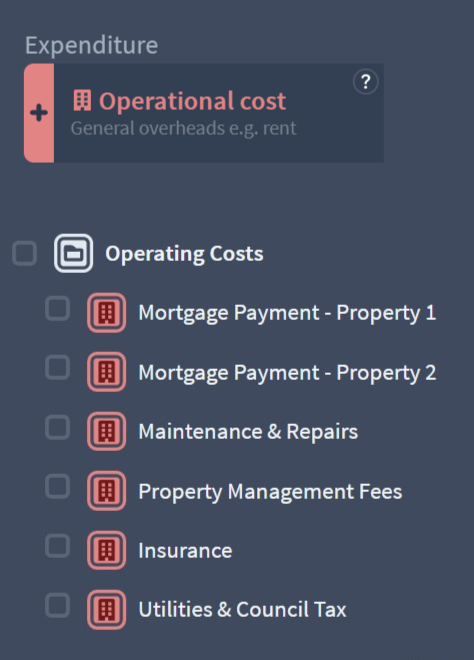

Expenditure Components

- Component: Operational Costs

- Sub-components:

- Mortgage Payment – Property 1 (£800/month interest + principal)

- Mortgage Payment – Property 2 (£1,000/month interest + principal)

- Maintenance & Repairs (£200/month per property, with additional annual refurbishments)

- Property Management Fees (10% of rental income)

- Insurance (£500/year per property)

- Utilities & Council Tax (if covering tenants’ costs)

- Sub-components:

- Component: Administrative Costs

- Sub-components:

- Legal & Accounting Fees (£1,000/year)

- Marketing for Vacant Properties (£300 per vacancy)

- Licensing Fees (£500/year for HMO licenses)

- Software & Tools (Subscription to property management software or Brixx itself!)

- Sub-components:

- Component: Taxes

- Sub-components:

- Income Tax on Rental Profits (Variable, depending on total income)

- Capital Gains Tax (modelled when a property sale is forecasted)

- Stamp Duty (modelled in the acquisition phase)

- Sub-components:

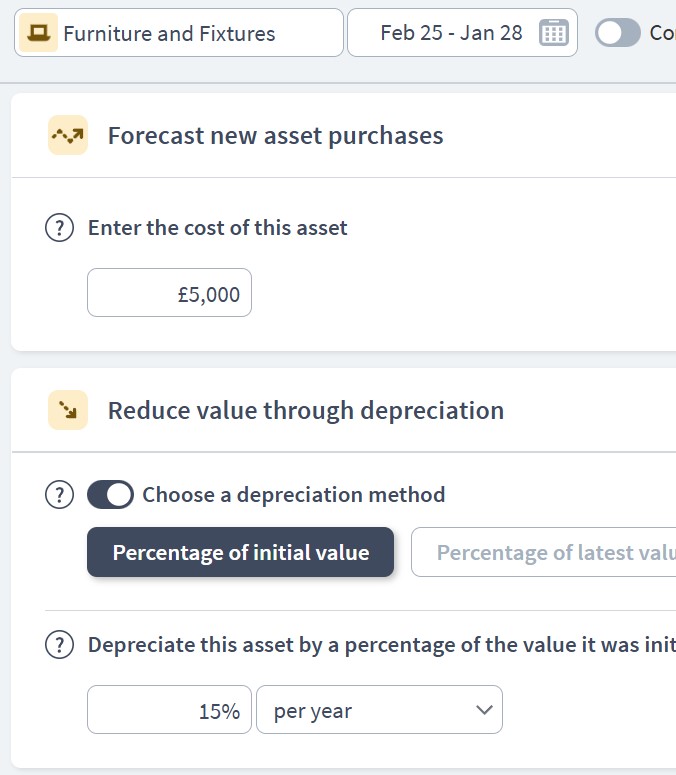

Asset Components

- Component: Fixed Assets

- Sub-components:

- Property 1 (Purchase price: £250,000, appreciation rate: 3% annually)

- Property 2 (Purchase price: £300,000, appreciation rate: 3% annually)

- Furniture & Fixtures (£5,000 per property, depreciated over 5 years)

- Sub-components:

- Component: Current Assets

- Sub-components:

- Cash Reserves (Starting balance + monthly surplus)

- Accounts Receivable (Outstanding rent)

- Tenant Deposits Held (Modelled as a liability if required)

- Sub-components:

Funding Components

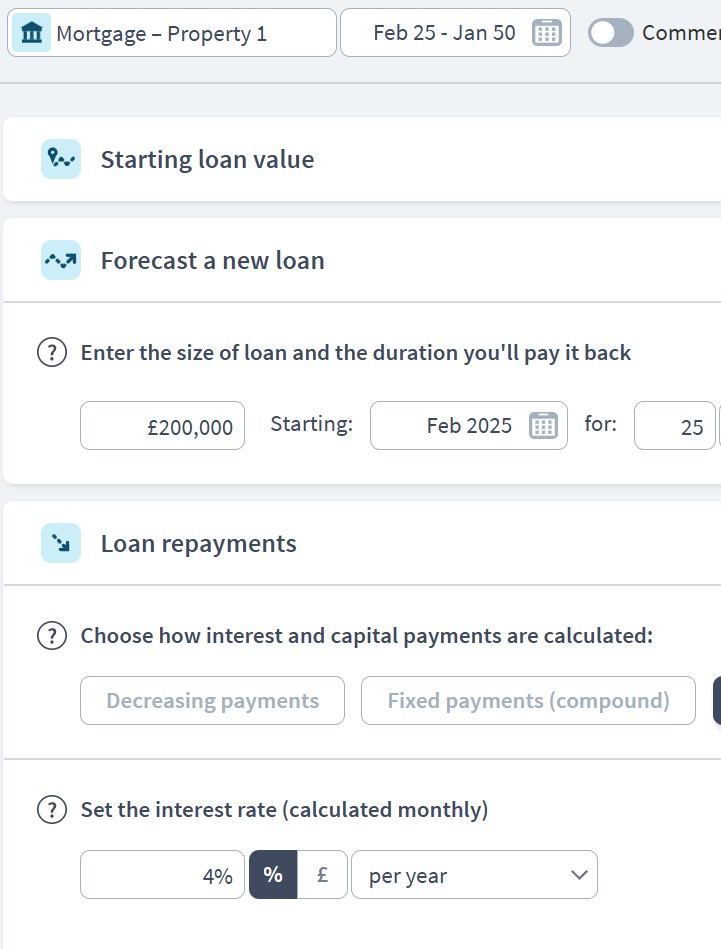

- Component: Mortgages

- Sub-components:

- Buy-to-Let Mortgage – Property 1 (£200,000 at 4% interest, 25-year term)

- Buy-to-Let Mortgage – Property 2 (£240,000 at 3.8% interest, 25-year term)

- Sub-components:

- Component: Personal Investment

- Sub-components:

- Initial Equity Contribution (£50,000 for Property 1, £60,000 for Property 2)

- Sub-components:

- Component: Future Funding (Optional)

- Sub-components:

- Bridging Loan for New Property Acquisition (Short-term, higher interest rate)

- Sub-components:

Scenario Planning in Brixx

- Vacancy Rate Scenarios:

- Model a 5%, 10%, or 20% vacancy rate to see the impact on cash flow.

- Interest Rate Changes:

- Test scenarios with increasing mortgage rates (e.g., 1% rise) to evaluate financial resilience.

- Property Appreciation:

- Forecast how property values grow over time and the effect of capital gains when selling.

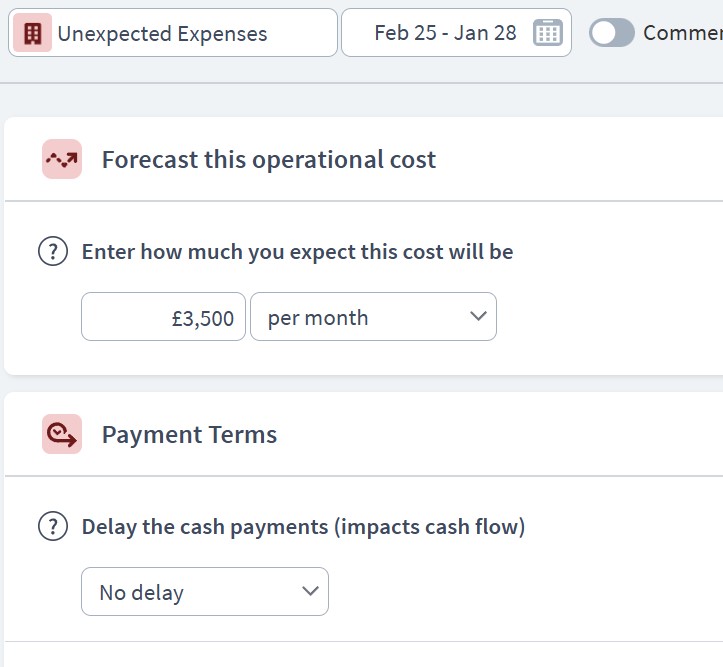

- Unexpected Repairs:

- Create an Unexpected Expenses component to simulate sudden major repairs.

Dashboard & Reporting

- Cash Flow Report:

- Visualise monthly income versus expenses, highlighting net rental income.

- Balance Sheet:

- Track growing property values as assets while seeing mortgage liabilities reduce over time.

- Profit & Loss Statement:

- Display total revenue, operational costs, and net profit for each fiscal year.

- Custom KPIs:

- Set up specific metrics like Rental Yield, Loan-to-Value Ratio, and Return on Investment (ROI).

Who can use this Brixx template?

- Buy-to-let property developers

- Real estate investors

- Property managers

Brixx is a great tool for:

- Anyone managing the financial planning and budgeting for buy-to-let properties

- Property developers, accountants, or business owners overseeing property investments, funding, and expenses

What are the benefits to buy-to-let property developers?

- The template is tailored to the real estate sector, covering all aspects of property development and investment

- Effortlessly model cash flows, rental income, property maintenance, and financing costs

- Easily interpret results and graphs to assess the profitability of various property investments

- Quickly evaluate the impact of new income streams, such as rental yields, property sales, or refinancing options

- Receive immediate feedback when testing different scenarios like rent increases, refurbishments, or changes in occupancy rates.

Strategic forecasting in Brixx

- Calculating the profitability impact of varying rent prices and occupancy rates

- Demonstrating projected earnings and capital appreciation to support loan applications

- Forecasting and budgeting for property maintenance, repairs, and improvements

- Anticipating financial requirements for property acquisitions and refinancing

- Evaluating the impact of market fluctuations on rental income and expenses

Explore different industry frameworks you can build in Brixx for your business

Brixx for Real Estate Developers

Explore our template for real estate developers. It’s designed to help plan acquisitions, development, and rental income.

Brixx for Construction Businesses

Explore our template for construction. It’s designed to manage project timelines, contractor fees, and phased budgets.

Brixx for Insurance Firms

Explore our template for insurance firms. It’s designed to forecast policy income, claims expenses, and financial risk.

Brixx for Consultant Agencies

Explore our template for consultants. It’s designed to support service-based income, advisory work, and client retainers.

Get started with Brixx

£30 / month

Prices exclude local taxes

7 Day Free Trial

No credit card required

- Scenario testing

- 10-year financial forecast

- Pre-built templates

- Xero integration

- Automated reports: P&L, balance sheet, cash flow, tax & more

“We needed a better tool for forecasting and Brixx is lightyears ahead of spreadsheet modelling.”

Berwyn, AccwareGet started with the best financial projection software - today!

Financial modelling software is essential for buy-to-let property developers, offering the insights needed to plan and manage property investments effectively. By forecasting costs, developers can gain a clearer picture of their financial landscape. Additionally, forecasting potential rental income and property sales enables informed decisions on property acquisitions, resource allocation, and risk management.

The ability to identify market trends, adjust rental strategies, and plan for fluctuations in property values further enhances a developer’s ability to succeed in the long term. With over 20 years of business modelling experience, Brixx stands out as a trusted solution, offering a robust set of features to help property developers confidently navigate the complexities of financial planning.

Investing in expert financial modelling software like Brixx empowers you to optimise property portfolios and strategically forecast the future of your buy-to-let business.