Financial Modelling Tool for Car Dealerships

Running a car dealership means juggling seasonal demand, vehicle financing, and operational costs – all of which can shift rapidly. With Brixx, you can take control of your business’s financial future. Our intuitive modelling tools help you forecast cash flow, manage stock turnover, and make smarter decisions year-round.

Start using this template in Brixx

Model your vehicle dealership business in Brixx - see how quickly your finances can make sense!

This template is available in Brixx. Follow the guidance below to get started. If you need any further assistance, don’t hesitate to get in touch – we’re here to help!

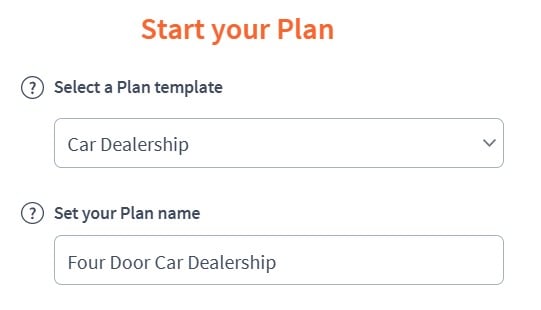

Project Setup

- Project name: Four Door Car Dealership

- Time period: Monthly (to track sales, finance repayments, and operating costs)

Income Components

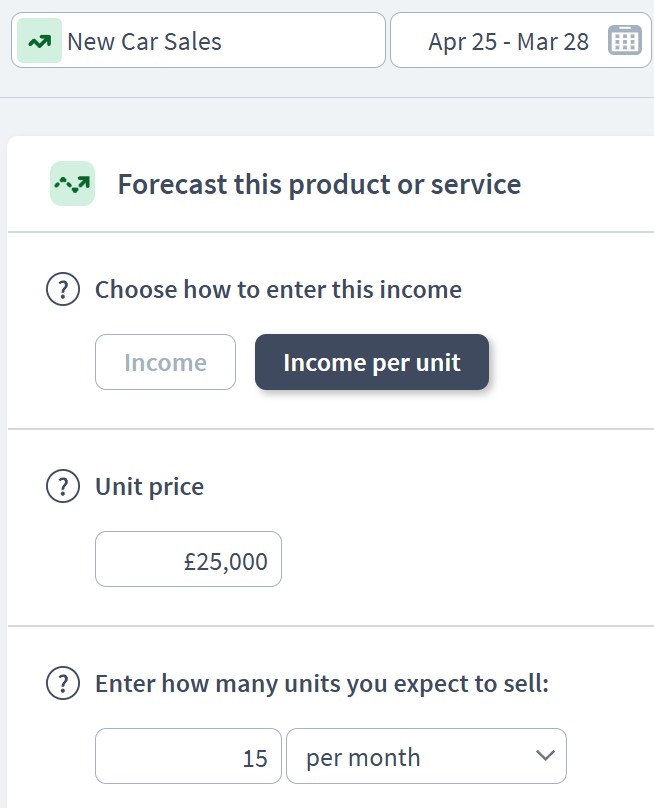

- Component: Vehicle Sales Revenue

- Sub-components:

- New Car Sales (15 cars/month @ £25,000 avg) – £375,000/month

- Used Car Sales (20 cars/month @ £12,000 avg) – £240,000/month

- Sub-components:

- Component: Finance & Insurance (F&I) Income

- Sub-components:

- Loan Arrangement Fees (£500 avg per financed sale, est. 20 deals/month) – £10,000/month

- Extended Warranty Upsells (10/month @ £1,000) – £10,000/month

- GAP Insurance & Add-ons (£200 avg per deal, 25 deals/month) – £5,000/month

- Sub-components:

- Component: Servicing & Repairs

- Sub-components:

- Workshop Labour (200 billable hours @ £60/hour) – £12,000/month

- Parts & Accessories Sales – £8,000/month

- Sub-components:

- Component: Other Income

- Sub-components:

- Car Wash/Valeting Services – £2,500/month

- Vehicle Transport Charges to Customers – £1,000/month

- Sub-components:

Expenditure Components

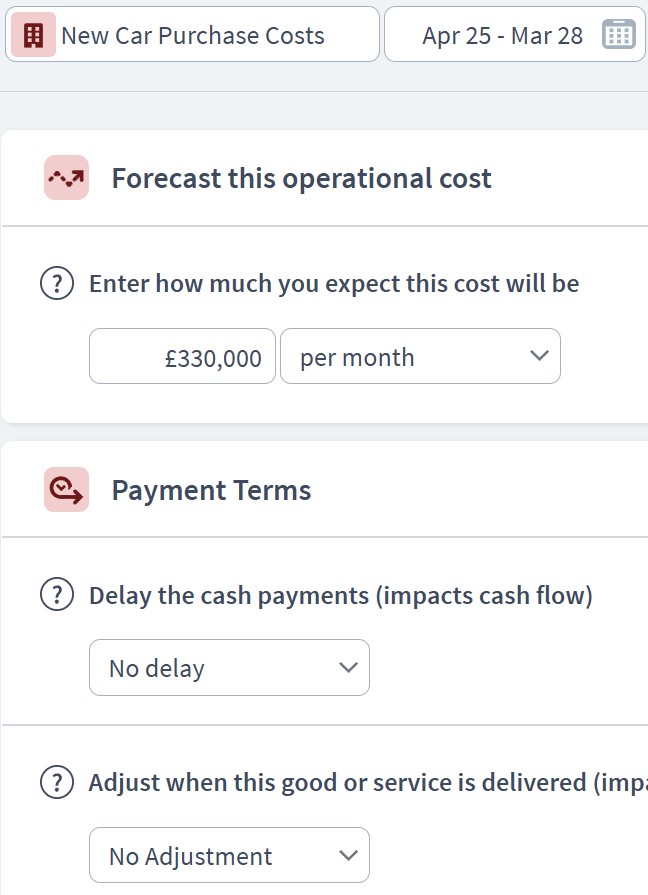

- Component: Cost of Goods Sold (COGS)

- Sub-components:

- New Car Purchase Costs (15 cars @ £22,000) – £330,000/month

- Used Car Purchase Costs (20 cars @ £9,000) – £180,000/month

- Parts & Accessories Purchase – £5,000/month

- Sub-components:

- Component: Operating Costs

- Sub-components:

- Staff Salaries (Sales, Technicians, Admin) – £50,000/month

- Marketing & Advertising – £8,000/month

- Rent & Utilities for Showroom/Workshop – £12,000/month

- Insurance (Business, Premises, Vehicles) – £1,200/month

- Business Rates & Licenses – £1,000/month

- Sub-components:

- Component: Administrative Costs

- Sub-components:

- Accounting & Legal Fees – £1,500/month

- Dealer Management System Subscription (CRM, stock control) – £600/month

- Sub-components:

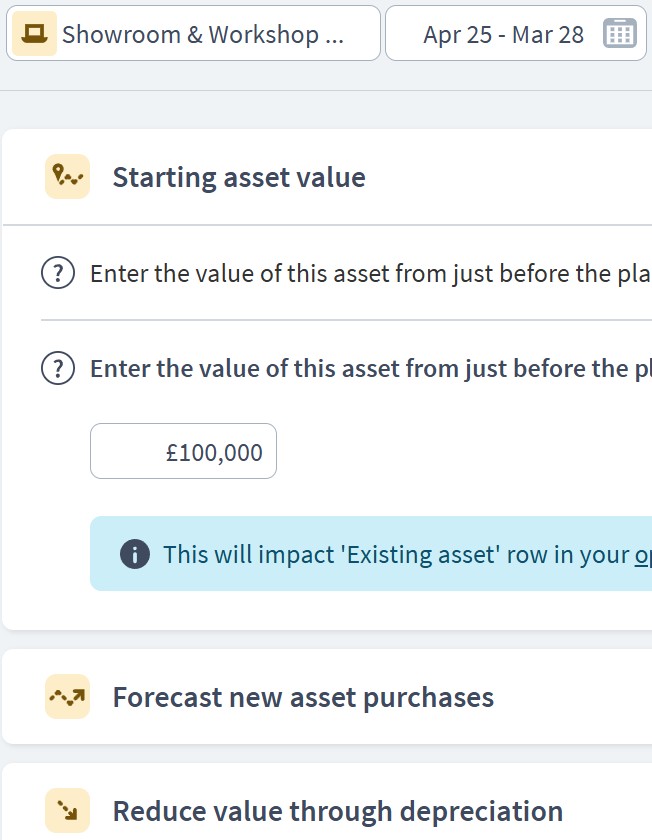

Asset Components

- Component: Fixed Assets

- Sub-components:

- Showroom & Workshop Equipment (£100,000, 10-year depreciation)

- Demo Vehicle Fleet (5 cars @ £25,000) – £125,000, depreciated over 4 years

- Tools & Lifts (Workshop Equipment) – £50,000, 5-year depreciation

- Sub-components:

- Component: Inventory (Current Assets)

- Sub-components:

- New Cars in Stock (avg 20 @ £22,000) – £440,000

- Used Cars in Stock (avg 25 @ £9,000) – £225,000

- Spare Parts Inventory – £15,000

- Sub-components:

- Component: Financial Assets

- Sub-components:

- Cash Reserves – £100,000

- Accounts Receivable (Customer Finance Deposits Due) – £30,000

- Sub-components:

Funding Components

- Component: Floor Plan Financing (Stock Loans)

- Sub-components:

- Stock Loan Facility (£500,000, 5% interest, revolving facility)

- Repayable on sale of each car (modelled per sale)

- Sub-components:

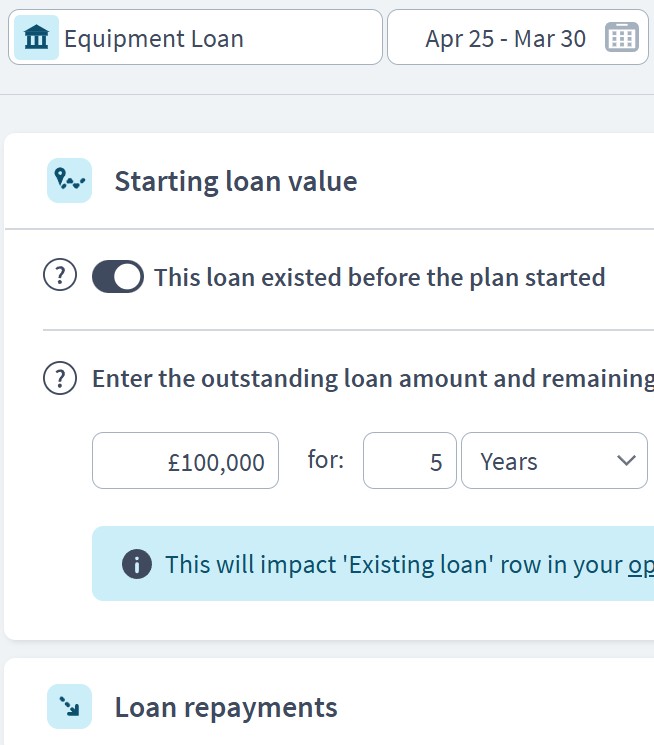

- Component: Business Loan

- Sub-components:

- Equipment Loan (£100,000 @ 6% over 5 years)

- Sub-components:

- Component: Personal Investment

- Sub-components:

- Owner Equity Injection – £150,000

- Sub-components:

Scenario Planning in Brixx

- Sales Volume Scenarios

- Model a dip in new car sales (e.g., drop to 10 cars/month)

- Spike in used car demand during economic downturns

- Interest Rate Sensitivity

- Simulate a rise in floor plan interest rates (e.g., from 5% to 6.5%)

- Stock Turnover Delays

- Model slower sales cycles resulting in longer-held inventory and rising interest costs

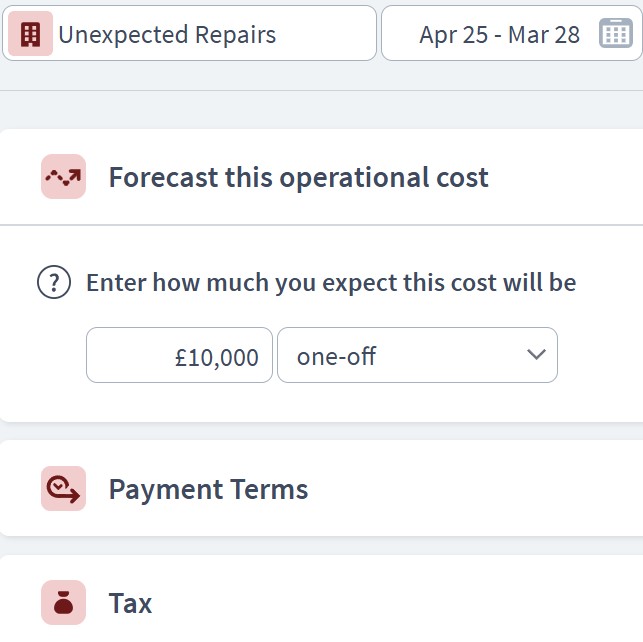

- Unexpected Workshop Costs

- Add an “Unexpected Repairs” component for major lift/machine failure (£10k+)

Dashboard & Reporting

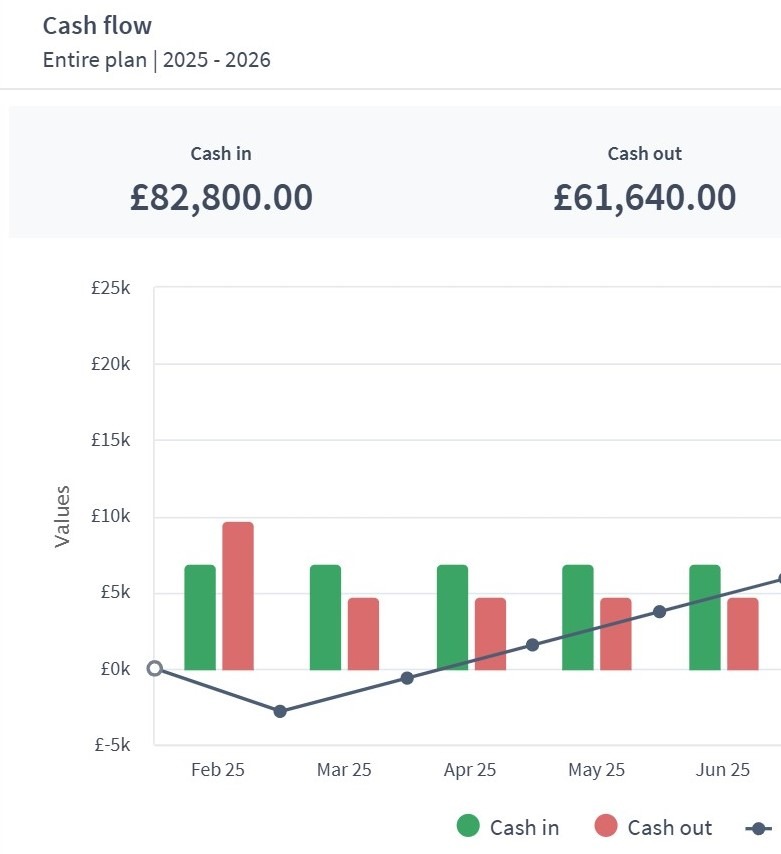

- Cash Flow Report

- Visualise inflows from car sales, F&I, servicing vs. monthly outflows for stock, wages, and loans

- Balance Sheet

- Tracks vehicle inventory as assets and floor plan financing as liabilities

- Reflects depreciation of equipment and demo vehicles

- Profit & Loss Statement

- Monthly/Annual profit breakdown with gross margin on car sales, net profit from F&I and servicing

- Custom KPIs

- Gross Profit per Unit (GPU)

- Inventory Turnover Ratio

- Workshop Utilisation Rate

- Finance Penetration Rate (percentage of sales using dealership financing)

Who can use this Brixx template?

- Independent car dealers

- Franchise dealerships

- Automotive business managers

Brixx is a great tool for:

- Dealership owners planning finances across sales, servicing, and trade-ins

- Accountants overseeing multiple revenue streams and financing options

- Managers forecasting for staffing, stock levels, and marketing spend

How does Brixx benefit car dealerships?

- Designed specifically with the automotive sector in mind – model every element of your dealership’s financials

- Forecast car sales, financing deals, servicing income, and inventory costs

- Use visual reports and dashboards to track profitability and plan for growth

- Instantly see the impact of promotions, seasonal trends, or changes in vehicle pricing

- Simulate different business strategies such as expanding into used car sales or adding new service lines

Strategic forecasting in Brixx

- Predict revenue fluctuations based on demand cycles and sales trends

- Plan financing costs and evaluate profit margins on financed vs. outright sales

- Model inventory acquisition, depreciation, and maintenance schedules

- Estimate hiring needs and payroll costs as your business scales

- Assess how interest rates or market changes could impact your dealership’s bottom line

Explore different industry frameworks you can build in Brixx for your business

Brixx for Garages

Explore our template for garages. It’s designed to forecast service income, parts costs, and labour hours.

Brixx for Wholesalers

Explore our template for wholesalers. It’s designed to support bulk purchasing, supplier costs, and resale margins.

Brixx for Retailers

Explore our template for retail. It’s designed to help you manage product sales, stock levels, and seasonal trends.

Brixx for Logistics Companies

Explore our template for logistics companies. It’s designed to plan fleet movements, delivery schedules, and operational costs.

Get started with Brixx

£30 / month

Prices exclude local taxes

7 Day Free Trial

No credit card required

- Scenario testing

- 10-year financial forecast

- Pre-built templates

- Xero integration

- Automated reports: P&L, balance sheet, cash flow, tax & more

"It’s really clever software and so easy to use. It was so useful to see the cash flow in one, two, and three-year blocks."

Jack Berryman, MintMechGet started with the best financial projection software - today!

Financial forecasting software is a game-changer for car dealerships, offering a clear view of upcoming costs, expected revenues, and strategic opportunities. By modelling sales projections, financing structures, and service revenue, dealership owners can stay ahead of the curve.

From adjusting stock levels to preparing for economic changes, Brixx equips you with the insights to stay agile and profitable. With over two decades of expertise in business modelling, Brixx gives automotive businesses the confidence and clarity to thrive in a fast-moving industry.

Choose Brixx to future-proof your car dealership – and drive your success forward.