Financial Modelling Tool for Education Providers

Running an educational facility means that you need to juggle so many different things – including income cycles, staff, grants, and more! Plus, you need to do this while also maintaining positive growth! Brixx can help you as an education facility to plan better – and more precisely!

Start free trial

Model your education programmes in Brixx - see how quickly your finances can support your institution’s growth!

We are working on creating this template in Brixx. Although it isn’t available just yet, you can follow the guidance below to help get started. If you need any further assistance, don’t hesitate to get in touch – we’re here to help!

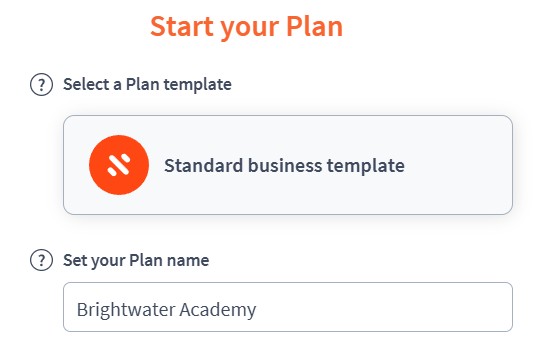

Project Setup

- Project name: Brightwater Academy

- Time period: Monthly (ideal for tracking tuition income, salaries, and term-based changes)

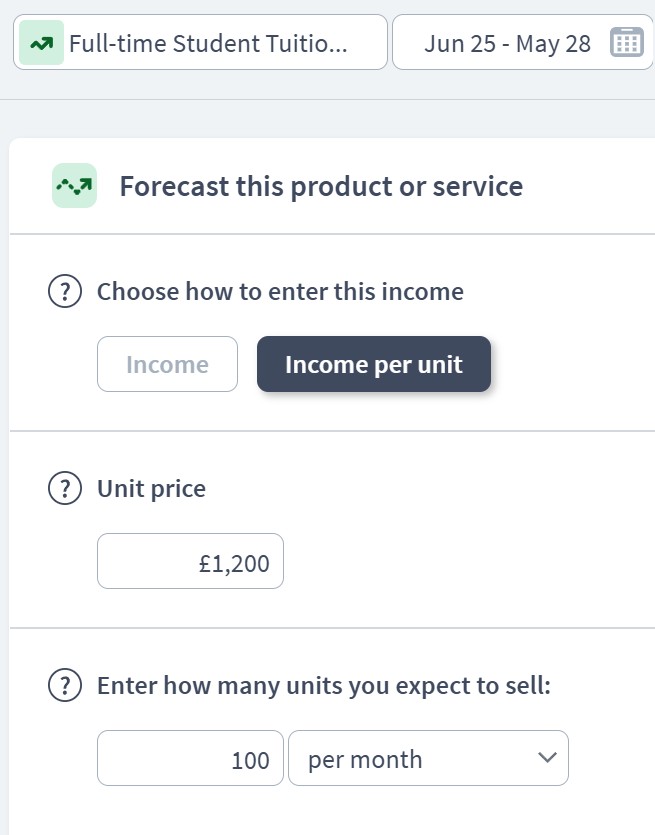

Income Components

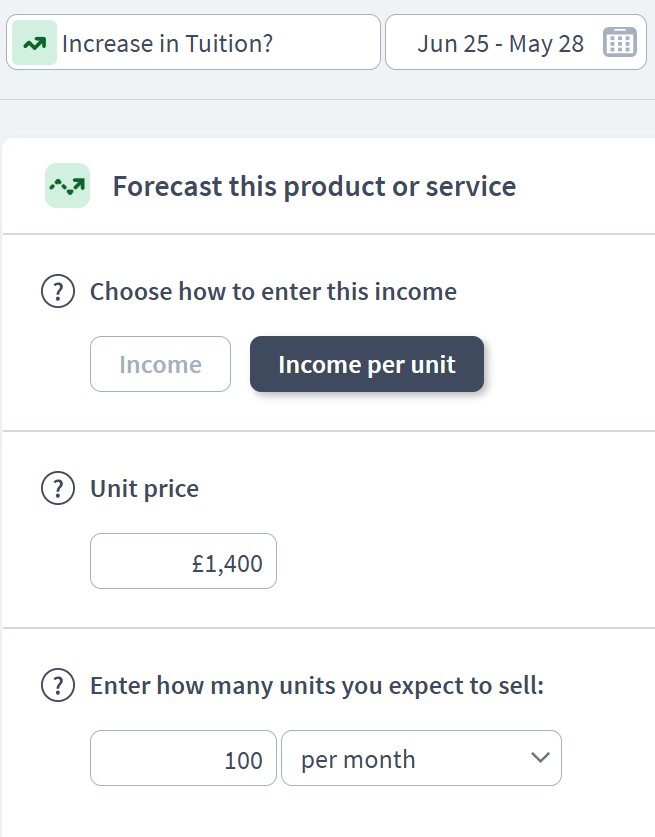

- Component: Tuition & Course Fees

- Sub-components:

- Full-time Student Tuition Fees – 100 students @ £1,200/month = £120,000/month

- Part-time Student Fees – 50 students @ £500/month = £25,000/month

- Corporate Training Contracts – 3 contracts averaging £4,000/month = £12,000/month

- Sub-components:

- Component: Additional Income

- Sub-components:

- Exam Fees – £50/student/term, 150 students = £7,500/term (~£2,500/month)

- Cafeteria Revenue – £3,000/month (self-operated)

- Facility Rental – Evening/weekend room hire = £2,000/month

- Grants or Subsidies – e.g., £30,000/year = £2,500/month

- Sub-components:

Expenditure Components

- Component: Staffing Costs

- Sub-components:

- Salaries – 8 Teaching Staff @ £3,000/month = £24,000/month

- Salaries – 4 Admin Staff @ £2,000/month = £8,000/month

- Payroll Taxes & Pension Contributions = ~20% of salary = £6,400/month

- Freelance Tutors for Specialist Courses = £2,000/month

- Sub-components:

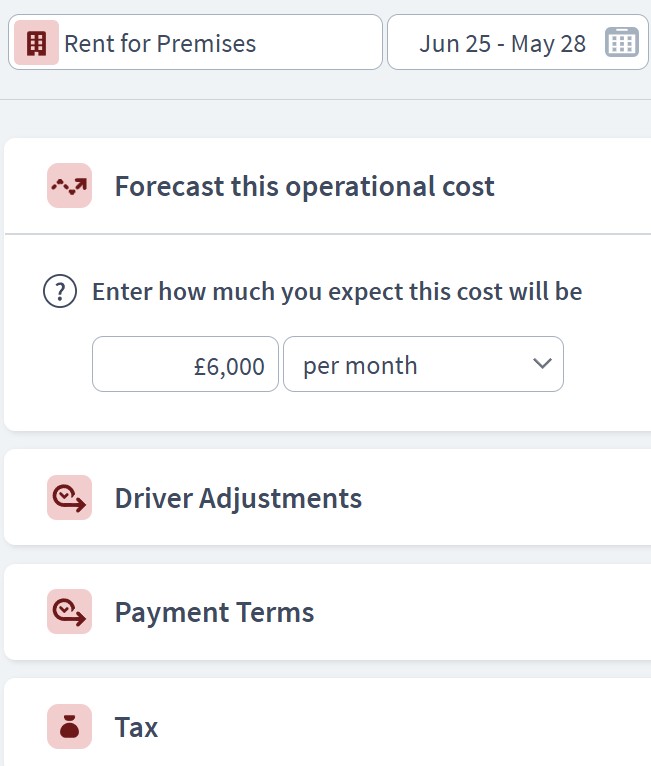

- Component: Operational Costs

- Sub-components:

- Rent for Premises = £6,000/month

- Utilities (Electricity, Internet, Water, etc.) = £1,500/month

- Teaching Materials & Course Content = £2,000/month

- Software Subscriptions (LMS, Office Suite, etc.) = £800/month

- Marketing & Advertising = £3,000/month

- Sub-components:

- Component: Administrative & Compliance Costs

- Sub-components:

- Insurance (Public liability, buildings, etc.) = £2,000/year = £167/month

- Accounting & Legal Services = £500/month

- Regulatory Fees / Accreditation Renewals = £2,000/year = £167/month

- Sub-components:

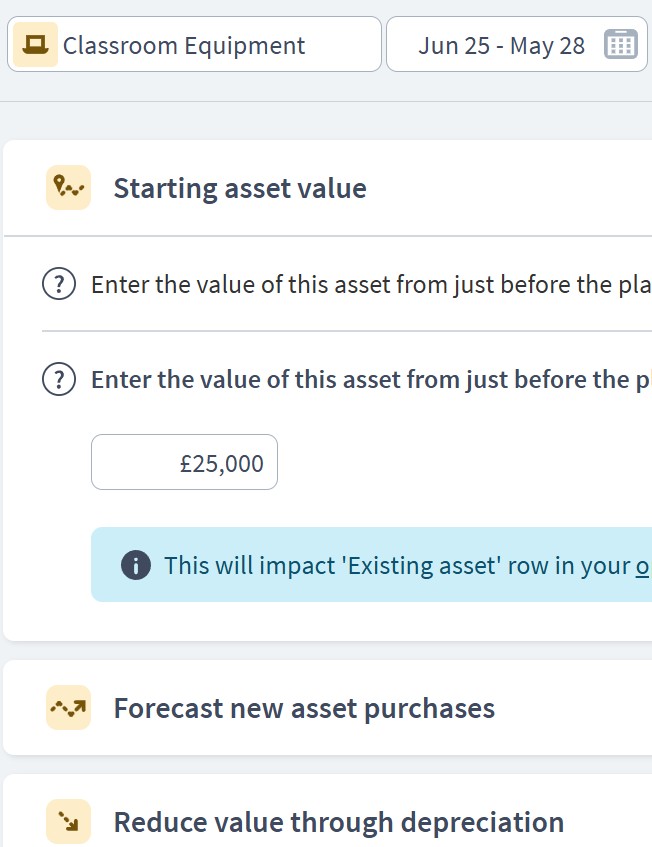

Asset Components

- Component: Fixed Assets

- Sub-components:

- Classroom Equipment (Smartboards, projectors, etc.) = £25,000 (Depreciated over 5 years)

- IT Equipment (Computers, tablets) = £20,000 (Depreciated over 3 years)

- Furniture & Fixtures = £10,000

- Leasehold Improvements = £15,000

- Sub-components:

- Component: Current Assets

- Sub-components:

- Cash at Bank – Starting balance £50,000

- Accounts Receivable – Outstanding fees from students = £10,000

- Inventory – Books, stationery, uniforms = £2,000

- Sub-components:

Funding Components

- Component: Initial Investment

- Sub-components:

- Personal Investment from Founders = £100,000

- Government Start-up Grant = £30,000

- Sub-components:

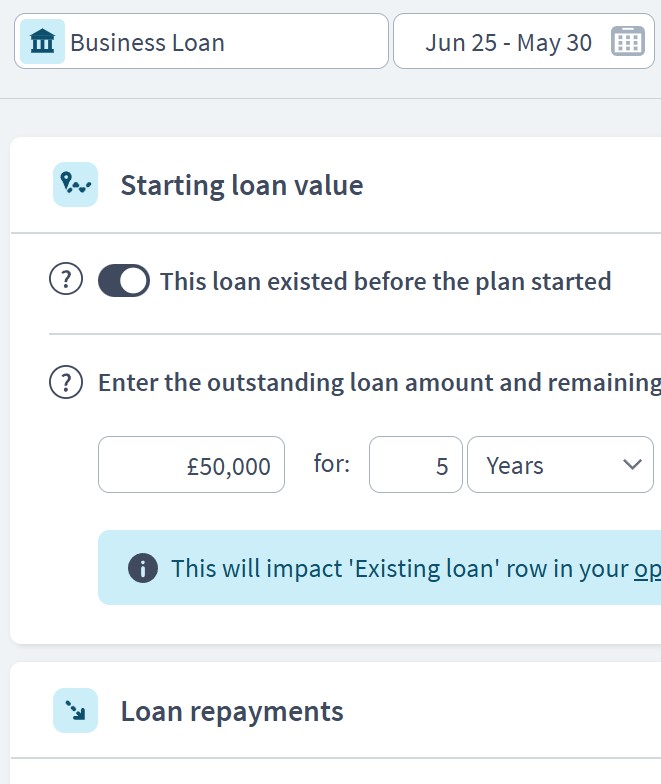

- Component: Loans

- Sub-components:

- Business Loan – £50,000 @ 6% interest, 5-year term = ~£966/month repayment

- Sub-components:

- Component: Future Funding (Optional)

- Sub-components:

- Education Innovation Grant – £20,000 expected in Year 2

- Crowdfunding/Alumni Support for scholarships = £5,000 target

- Sub-components:

Scenario Planning in Brixx

- Enrolment Variation

- Model high/low enrolment scenarios (e.g., -10%, +15% student numbers) and their impact on income.

- Grant Delays or Rejections

- Test what happens if expected grants don’t come through in time.

- Staff Cost Increases

- Add scenario for 5% staff salary rise next academic year.

- Facility Expansion

- Simulate increased rent, capex, and tuition income from a second location in year 3.

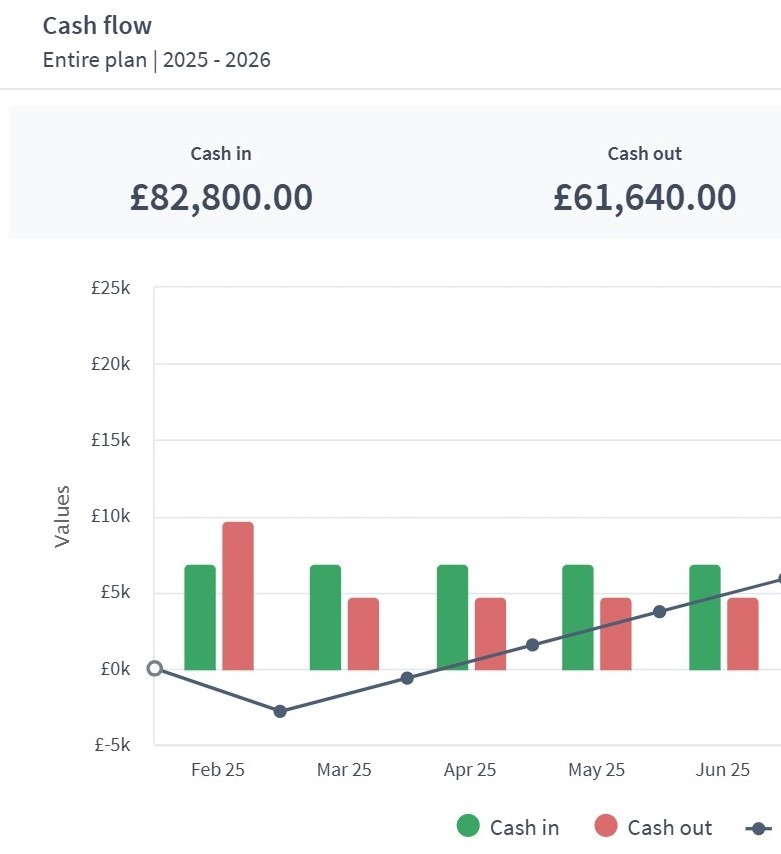

Dashboard & Reporting

- Cash Flow Report

- Shows tuition inflows vs. salary, rent, and running costs.

- Predicts cash pinch points before term starts when income is lower.

- Balance Sheet

- Fixed assets depreciate over time

- Accounts receivable (student debts) monitored

- Loans gradually reduced

- Profit & Loss Statement

- Gross profit from tuition

- Operating margin after salaries and overheads

- Net profit post-tax

- Custom KPIs

- Average revenue per student

- Staff cost ratio (% of income)

- Net surplus margin

- Student acquisition cost (from marketing spend)

Who can use this Brixx template?

- Independent schools and colleges

- Private training centres

- Tuition providers and academies

Brixx is a great tool for:

- Finance managers handling budgeting and forecasting for education businesses

- School administrators, business officers, or owners planning for staffing, facilities, and growth

- Anyone managing funding from tuition, grants, and donations

What are the benefits to educational providers?

- This template is tailored to the unique financial cycles and demands of education organisations

- Easily map income from multiple streams, including tuition fees, funding grants, and ancillary services

- Plan for expenses like staffing, learning materials, and facility maintenance with clarity

- Simulate the impact of enrolment changes, funding shifts, or program expansions in real time

- Assess the long-term sustainability of new initiatives or campus developments through scenario testing

Strategic forecasting in Brixx

- Model how changes in student numbers affect revenue and staffing needs

- Demonstrate financial projections to stakeholders and funding bodies

- Build multi-year budgets aligned to academic planning cycles

- Evaluate capital investment opportunities and ongoing maintenance obligations

- Prepare for seasonal fluctuations in income and expenditure with confidence

Explore different industry frameworks you can build in Brixx for your business

Brixx for Tutors

Explore our template for tutors. It’s designed to manage hourly sessions, student numbers, and income per lesson.

Brixx for Course Creators

Explore our template for course creators. It’s designed to track course sales, platform fees, and content development.

Brixx for Private Healthcare

Explore our template for private healthcare. It’s designed to plan appointment scheduling, staffing costs, and service-based income.

Brixx for Consultants

Explore our template for consultants. It’s designed to help forecast income from projects, contracts, and client engagements.

Get started with Brixx

£30 / month

Prices exclude local taxes

7 Day Free Trial

No credit card required

- Scenario testing

- 10-year financial forecast

- Pre-built templates

- Xero integration

- Automated reports: P&L, balance sheet, cash flow, tax & more

“We needed a better tool for forecasting and Brixx is lightyears ahead of spreadsheet modelling.”

Berwyn, AccwareStart planning smarter with financial modelling software made for education providers

With financial forecasting software, educational providers can gain the foresight the need to manage term-time cash flow, alongside allocating resources and planning for potential expansions. Whether you run a private school, a training centre, or even a tuition business, Brixx helps you stay in control by forecasting income and expenses with clarity.

From grant applications to enrolment planning, Brixx equips you to make strategic decisions based on accurate projections. With decades of experience in business modelling, Brixx delivers the tools educators need to support long-term growth and financial resilience.

Empower your education business today with Brixx – your partner in forward-thinking financial planning.