Financial Modelling Tool for Pharmaceutical Companies

In the pharmaceutical industry, where R&D timelines, regulatory hurdles, and market launches all affect cash flow, having a clear financial roadmap is vital. Brixx gives pharmaceutical companies the tools to model every financial detail, from early-stage development to commercialisation, helping you plan smarter and grow sustainably.

Start free trial

Model your pharmaceutical business in Brixx - see how quickly your finances can make sense!

We are working on creating this template in Brixx. Although it isn’t available just yet, you can follow the guidance below to help get started. If you need any further assistance, don’t hesitate to get in touch – we’re here to help!

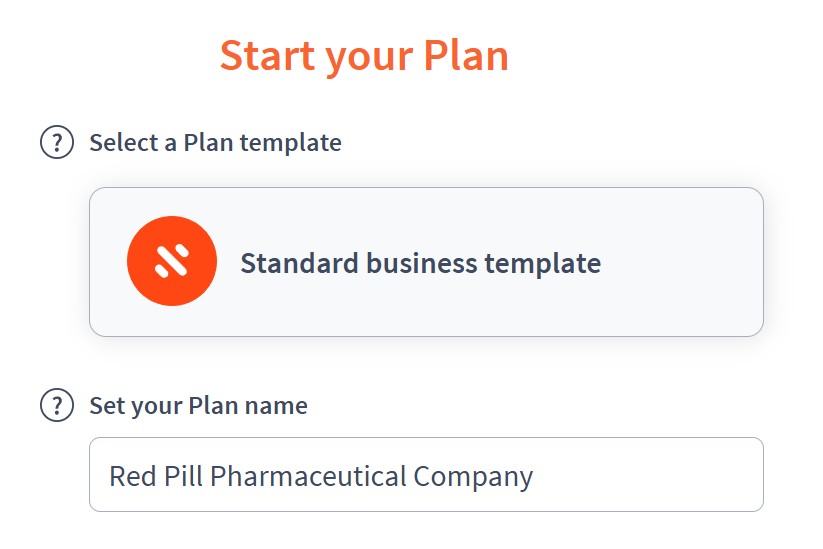

Project Setup

- Project Name: Red Pill Pharmaceutical Company

- Time Period: Monthly (suitable for tracking R&D burn rate, revenue milestones, and funding tranches)

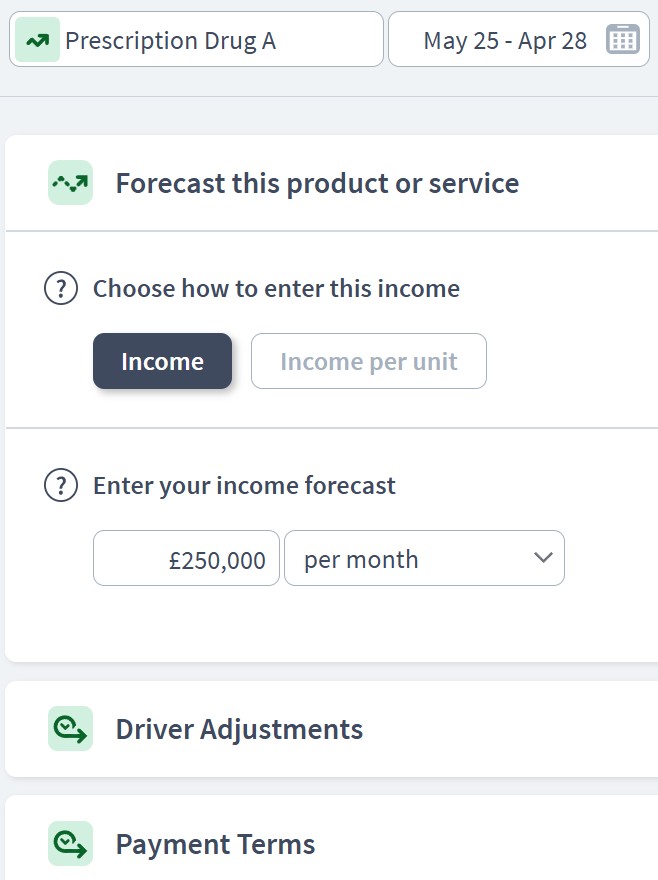

Income Components

- Component: Product Sales

- Sub-components:

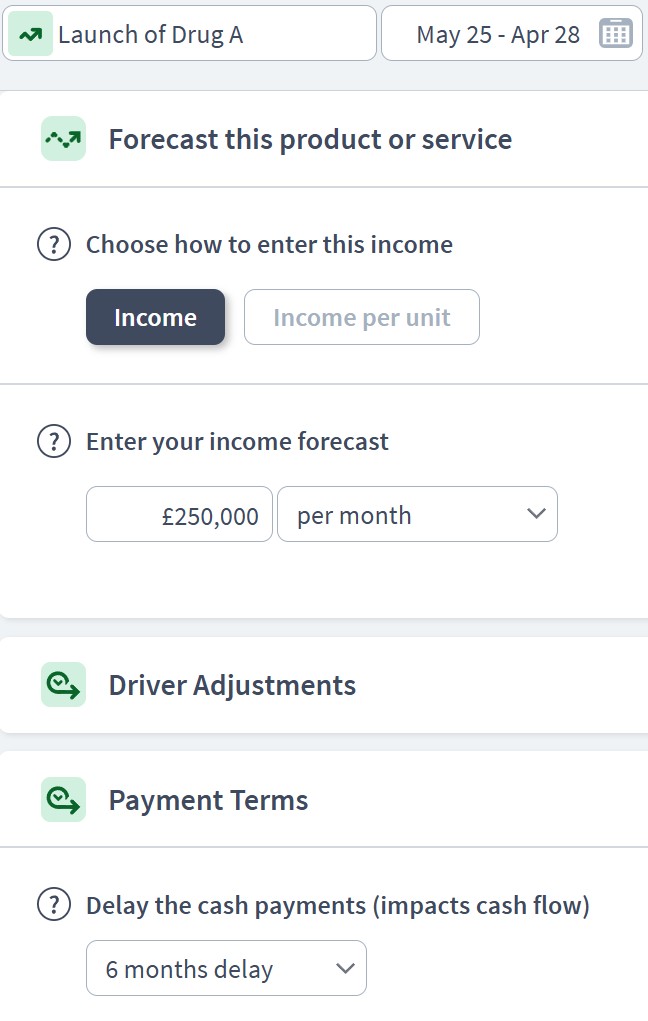

- Prescription Drug A (e.g. antihypertensive) – £250,000/month

- Prescription Drug B (e.g. oncology treatment) – £400,000/month

- Over-the-counter (OTC) Products – £50,000/month

- International Licensing Revenue – £100,000/quarter

- Sub-components:

- Component: Research Grants & Subsidies

- Sub-components:

- Government R&D Tax Credit – £120,000/year

- University/NGO Research Partnerships – £10,000/month

- Sub-components:

- Component: Milestone Payments & Royalties

- Sub-components:

- Licensing Agreement with Big Pharma – £500,000 upon successful trial phase

- Ongoing Royalties from Legacy Product – £15,000/month

- Sub-components:

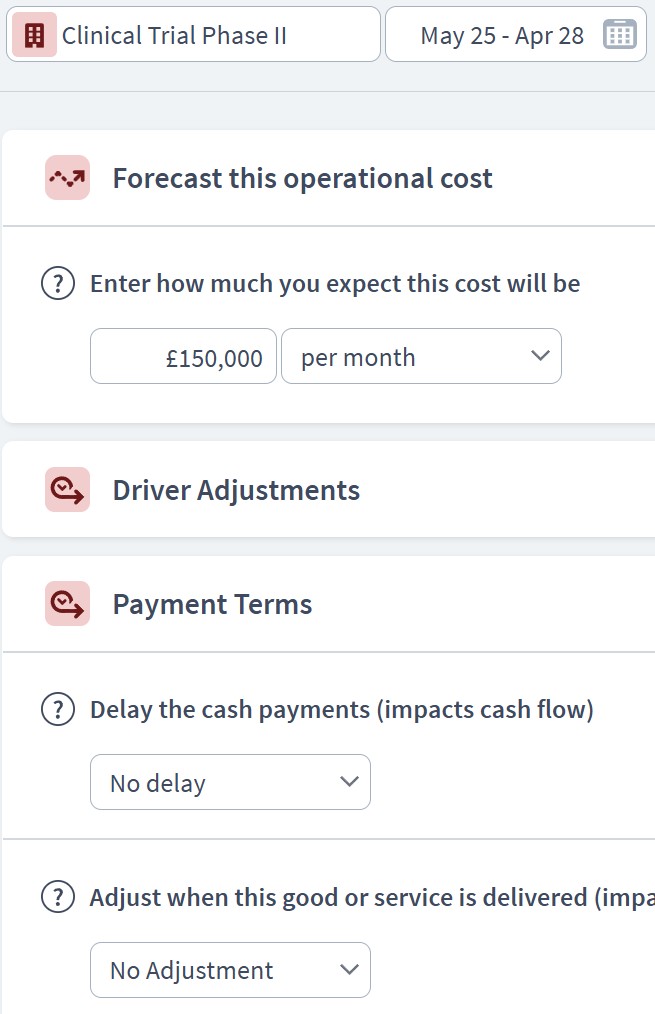

Expenditure Components

- Component: R&D Costs

- Sub-components:

- Clinical Trial Phase II – £150,000/month

- Laboratory Staff Salaries – £100,000/month

- Preclinical Research Supplies – £30,000/month

- Regulatory Filing Costs – £60,000/year

- Sub-components:

- Component: Manufacturing & Distribution

- Sub-components:

- Raw Materials – £75,000/month

- Packaging – £10,000/month

- Third-party Manufacturing – £120,000/month

- Distribution & Logistics – £25,000/month

- Sub-components:

- Component: Sales & Marketing

- Sub-components:

- Pharmaceutical Sales Reps – £80,000/month

- Digital Advertising Campaigns – £20,000/month

- Trade Shows and Conferences – £60,000/year

- Sub-components:

- Component: Administrative & Overheads

- Sub-components:

- Office Rent – £10,000/month

- Insurance & Compliance – £4,000/month

- Accounting & Legal – £3,000/month

- Software Subscriptions – £1,500/month

- Sub-components:

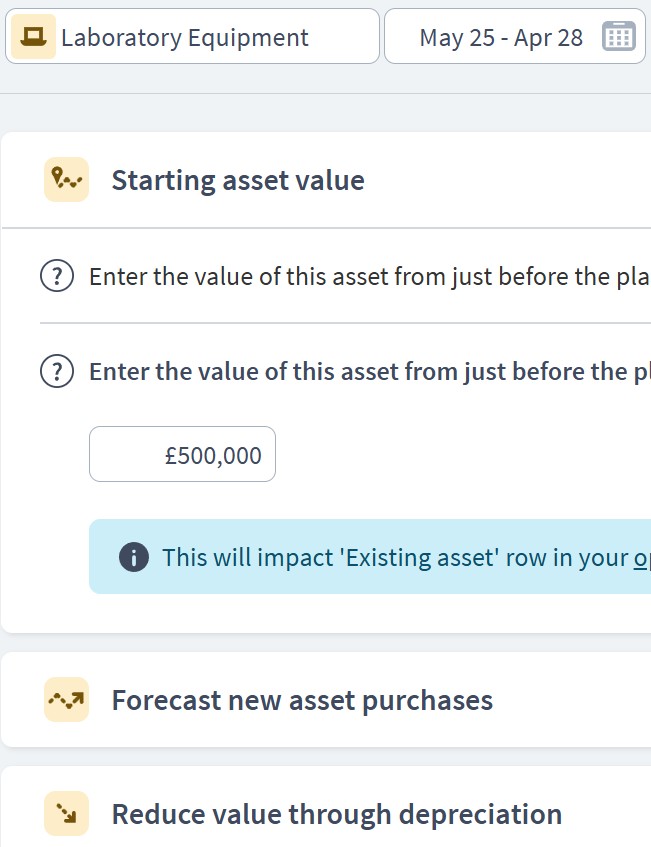

Asset Components

- Component: Fixed Assets

- Sub-components:

- Laboratory Equipment (£500,000, 5-year depreciation)

- Manufacturing Facility (Owned: £2,000,000, appreciating 2% annually)

- Office Equipment (£50,000, 3-year depreciation)

- Sub-components:

- Component: Current Assets

- Sub-components:

- Inventory (Finished Goods) – £400,000 average stock

- Cash Reserves – Starting at £1,000,000

- Accounts Receivable – £300,000 (avg. 60-day terms)

- Sub-components:

Funding Components

- Component: Equity Investment

- Sub-components:

- Series A Investment – £5,000,000 in Year 1

- Series B Investment – £10,000,000 in Year 2

- Sub-components:

- Component: Grants & Subsidies

- Sub-components:

- Innovate UK Grant – £500,000 disbursed over 12 months

- Horizon Europe Grant – £1,000,000 disbursed over 18 months

- Sub-components:

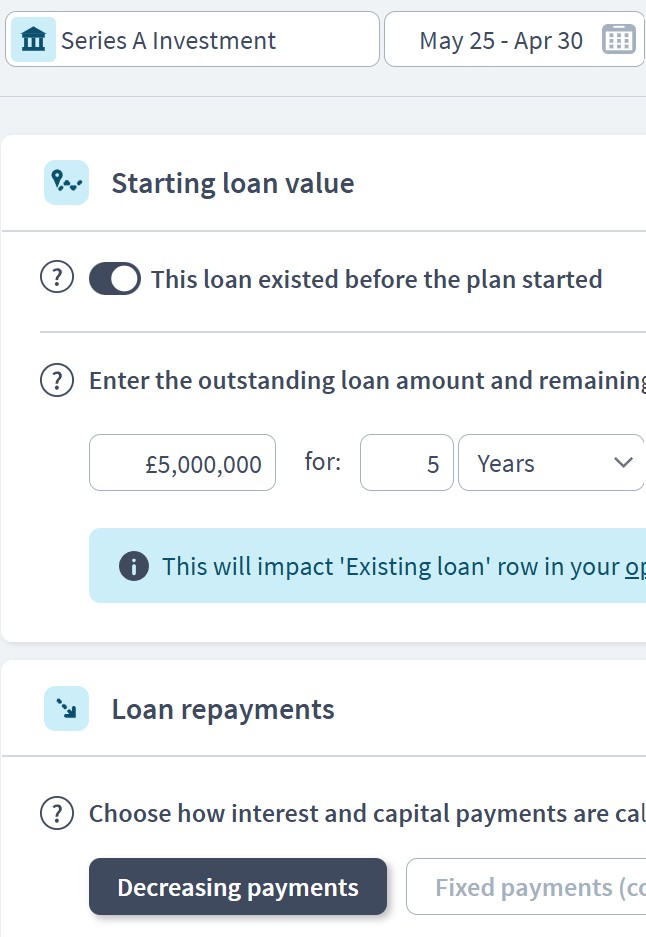

- Component: Loans

- Sub-components:

- R&D Development Loan – £1,500,000 at 6% over 5 years

- Sub-components:

Scenario Planning in Brixx

- R&D Success/Failure

- Model success vs. failure of clinical trials (e.g., success unlocks £500k milestone + future sales, failure halts income + triggers write-off)

- Regulatory Approval Delays

- Push launch of Drug B back 6 months and monitor cash runway impact

- Drug Price Cuts

- Test 10%, 20%, and 30% reductions in average selling price across major markets

- Staff Growth

- Add new R&D and Sales hires over time based on funding rounds

Dashboard & Reporting

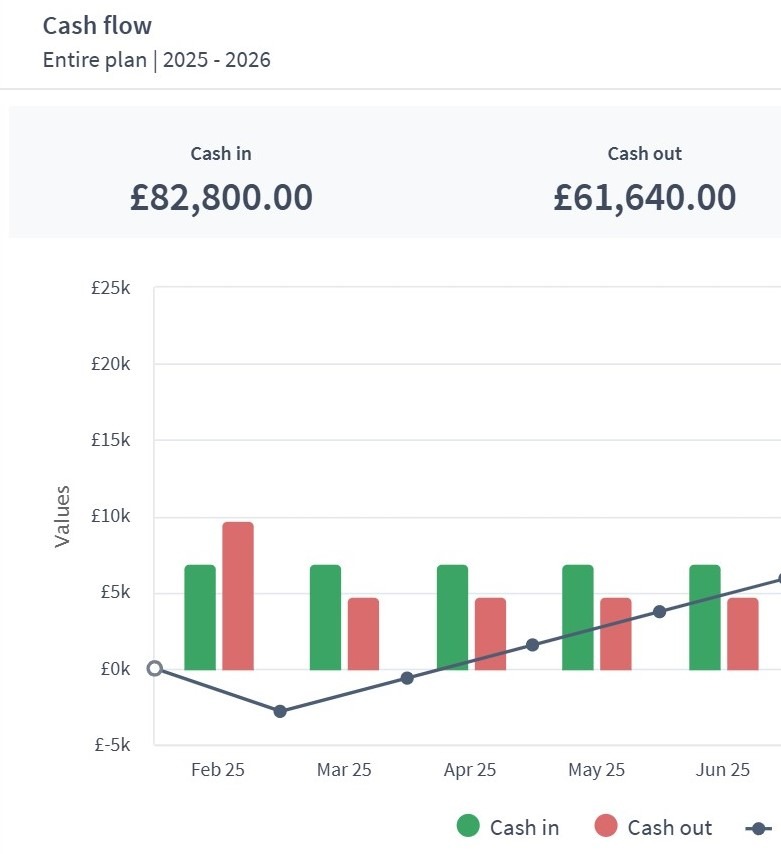

- Cash Flow Report

- Monthly burn rate, funding inflows, and sales growth

- Balance Sheet

- Growing fixed assets, changing inventory, and liability structure from loans

- Profit & Loss Statement

- Revenue breakdown, gross margin, R&D intensity, EBITDA

- Custom KPIs

- R&D Spend as % of Revenue

- Burn Rate vs. Cash Reserves

- Time to Breakeven

- Revenue per Product

Who can use this Brixx template?

- Pharmaceutical startups

- Biotech firms

- Financial planners in life sciences

Brixx is a great tool for:

- Teams managing R&D budgets, clinical trial costs, and product launch forecasts

- Finance professionals, founders, or investors evaluating funding rounds, burn rates, and return on innovation

- Businesses navigating the complex cost structures of drug development and compliance

What are the benefits to pharmaceutical companies?

- Purpose-built for the pharma sector, this template covers development stages, operational expenses, and revenue milestones

- Simulate cash flows for drug trials, production costs, and sales projections with ease

- Use dynamic charts and reports to communicate pipeline performance to stakeholders

- Rapidly assess how changes in trial outcomes, licensing deals, or regulatory timelines affect financial stability

- Instantly see the results of scenario testing for new product launches, manufacturing scale-ups, or funding options

Strategic forecasting in Brixx

- Projecting the financial impact of successful or delayed clinical trials

- Demonstrating future revenue potential for investor pitches or grant applications

- Planning for R&D costs, compliance expenses, and manufacturing scale-up

- Forecasting capital needs for growth or acquisition opportunities

- Evaluating how pricing strategies and global market entry influence revenue streams

Explore different industry frameworks you can build in Brixx for your business

Brixx for Private Clinics

Explore our template for private healthcare clinics. It’s designed to help you plan patient services, manage operational costs, and forecast healthcare revenues.

Brixx for Manufacturers

Explore our template for manufacturers. It’s designed to model production costs, forecast supply chains, and develop large-scale distribution strategies.

Brixx for Energy Companies

Explore our template for energy companies. It’s designed to handle long-term investments, operational expenses, and revenue streams from complex projects.

Brixx for Tech Startups

Explore our template for tech startups. It’s designed to help you plan funding rounds, development costs, and the scaling of innovative products.

Get started with Brixx

£30 / month

Prices exclude local taxes

7 Day Free Trial

No credit card required

- Scenario testing

- 10-year financial forecast

- Pre-built templates

- Xero integration

- Automated reports: P&L, balance sheet, cash flow, tax & more

“Brixx will help us decide when our company has reached its ideal size.”

Martin, CinderconeGet started with the best financial projection software - today!

Robust financial modelling isn’t just useful – it’s essential in pharma, where timelines stretch over years and budgets must adapt to uncertainty. Brixx’s financial forecasting software helps you stay ahead, offering insight into every stage of development and enabling you to react quickly to changing conditions.

By forecasting regulatory costs, revenue from future drug sales, and the impact of strategic decisions, you can plan more effectively and increase your company’s chances of long-term success. With two decades of business modelling expertise, Brixx equips pharmaceutical businesses with the clarity they need to navigate this complex industry.

Plan product launches, manage funding rounds, and optimise your financial strategy with confidence. Brixx is built for your future.