T-Accounts are a key tool in double-entry bookkeeping, helping accountants visualise their transactions in different accounts. In this guide, we’ll break down what T-accounts are, how they work, and how they fit into modern accounting.

What is a T-account?

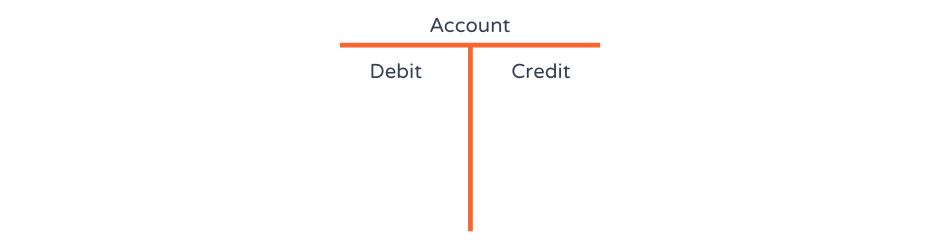

A T-account is a visual representation of an account used in double-entry bookkeeping. It’s called a “T” account because its format resembles the letter T, with debits on the left and credits on the right.

Any transaction a business makes will need to be recorded in the company’s general ledger. The general ledger is divided up into individual accounts which categorise similar transaction types together.

Why do accountants use T-accounts?

T-accounts serve as a simple yet powerful tool for tracking transactions in double-entry accounting. Accountants use them because they offer:

- Clear organisation: T-accounts visually separate debits and credits, making it easier to spot errors.

- A structured audit trail: By recording every transaction in a systematic way, T-accounts help accountants and auditors trace financial movements.

- Better financial insights: When used alongside ledgers and financial statements, T-accounts help businesses track patterns in expenses and revenue.

While modern accounting software automates much of this process, understanding T-accounts is still fundamental for accountants and finance professionals.

T-Account example chart

A T-account has three sections. The top is the name of the account. The left-hand side is where you enter debits whilst the right-hand side is where you enter credits. Understanding the difference between credit and debit is essential for this process.

How do T-accounts work?

T-accounts help to visualise the accounting process, showing a clear picture as to what is occurring with each transaction. They are a useful tool for newcomer and veteran accountants alike to quickly map out the correct way to record a transaction.

Complex entries might have impacts in multiple accounts. By breaking transactions down into a simple, digestible form, you can visualise which accounts are being debited and which are being credited.

In this image, you can see a T-account which shows a café business’ bank account for the first week of March. The cash received from coffee sales is shown in the debit column on the left, while the credits (operating costs) are shown on the right.

Below is a simplified view of the full ledger account. When these transactions are posted to the company’s accounts, they will be displayed with more information:

| Cash Account | ||||

| Date | Description | Debit | Credit | Balance |

| 01/03/2025 | Opening Balance | £1,000.00 | £1,000.00 | |

| 01/03/2025 | Sales | £310.50 | £1,310.50 | |

| 02/03/2025 | Sales | £290.10 | £1,600.60 | |

| 02/03/2025 | Inventory | £30.10 | £1,570.50 | |

| 03/03/2025 | Sales | £314.80 | £1,885.30 | |

| 04/03/2025 | Sales | £306.80 | £2,192.10 | |

| 04/03/2025 | Inventory | £42.70 | £2,149.40 | |

| 05/03/2025 | Sales | £297.40 | £2,446.80 | |

| 05/03/2025 | Operating Cost | £300.00 | £2,146.80 | |

The T-account is a quick way to work out the placement of debits and credits before it’s recorded in full detail to help avoid data entry errors. Although it may lack the detail which the ledger provides, it provides the key pieces of information

Advantages of using T-accounts

T-accounts are more than just a learning tool – they play a key role in helping businesses and accountants maintain accurate financial records. Here’s why they’re valuable:

1. Simplifies transaction tracking

T-accounts break down transactions into clear debit and credit entries, making it easier to follow the movement of money.

2. Acts as a troubleshooting tool

When books don’t balance, T-accounts provide a structured way to identify where errors might have occurred.

3. Enhances financial transparency

By visually separating different accounts, T-accounts help businesses and auditors understand financial flows at a glance.

4. Reinforces double-entry accounting

Every transaction is recorded in at least two places, reducing the likelihood of missing entries.

While many businesses rely on accounting software today, understanding T-accounts remains essential for financial accuracy and decision-making.

Examples of T-Accounts

We will use some examples of a café to highlight the importance of T-Accounts.

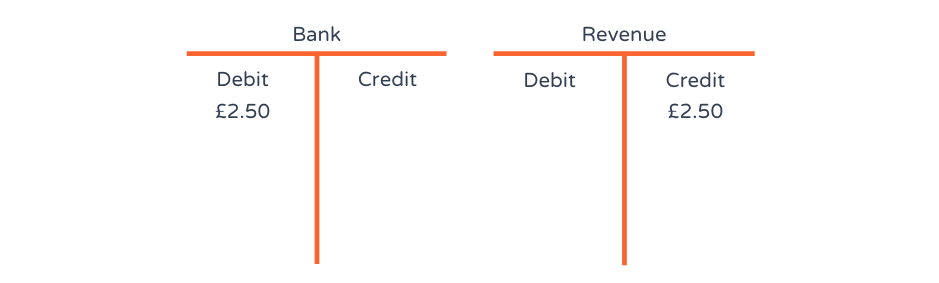

Example 1: Selling a coffee

A cup of coffee is sold for £2.50. What happens in the accounts?

As you can see, the bank account is debited £2.50, increasing its value. The income account (revenue account) is being credited £2.50, increasing its value and making the transaction balanced.

However, the business will use some inventory when making the coffee:

The ingredients for the cup of coffee are recorded as inventory (asset account). They come from the business’ store cupboard. Inventory is reduced each time a cup of coffee is sold, so the business needs to credit the inventory account by 50p, reducing its value. This is a double-entry, and the accounts are balanced.

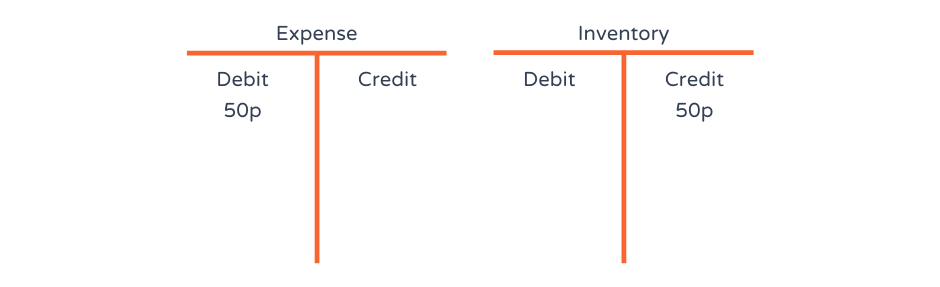

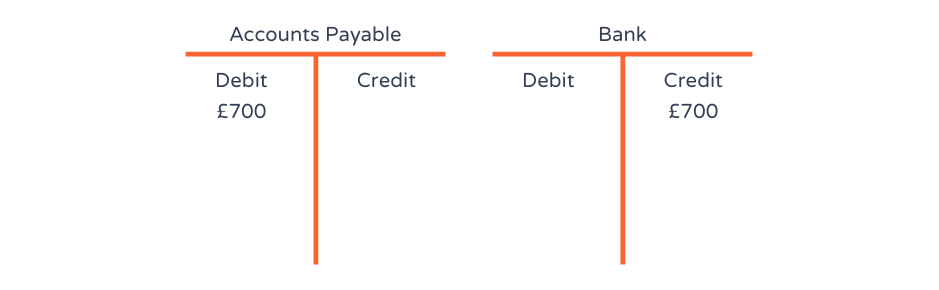

Example 2: Purchasing a coffee machine

The coffee shop has purchased another coffee machine for £700. However, it decides to pay for the machine the following month. So, what happens to the accounts?

As the business has received the coffee machine, it has gained £700 worth of fixed assets (this account has been debited).

As the business will be paying for the coffee machine in the following month, the accounts payable is increased (credited) by £700.

In the next month, the business’ bank account is credited £700 (reducing its value) as the business has now paid for the coffee machine.

With the outstanding bill paid, accounts payable account is debited by £700, reducing its value and showing that there is no more money owed.

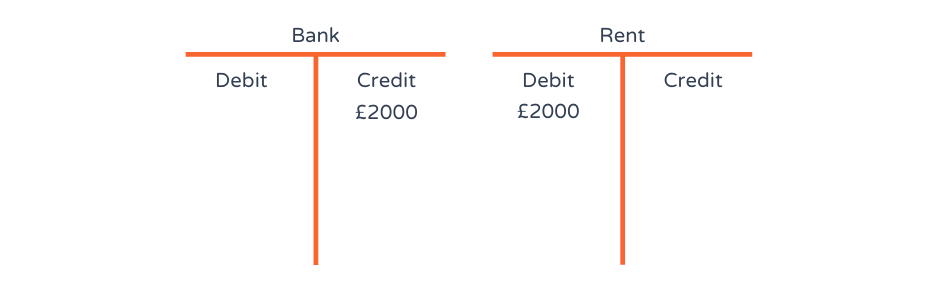

Example 3 – Paying rent

The business needs to pay £2,000 for renting the unit for the coffee shop. So, what happens to the accounts?

Rent is classed as an operating cost as it’s a standard cost required to run the business. Operating costs are a type of expense, so it is debited by £2,000.

To pay the rent, the business has used cash, so the bank account (an asset account) is credited by £2,000.

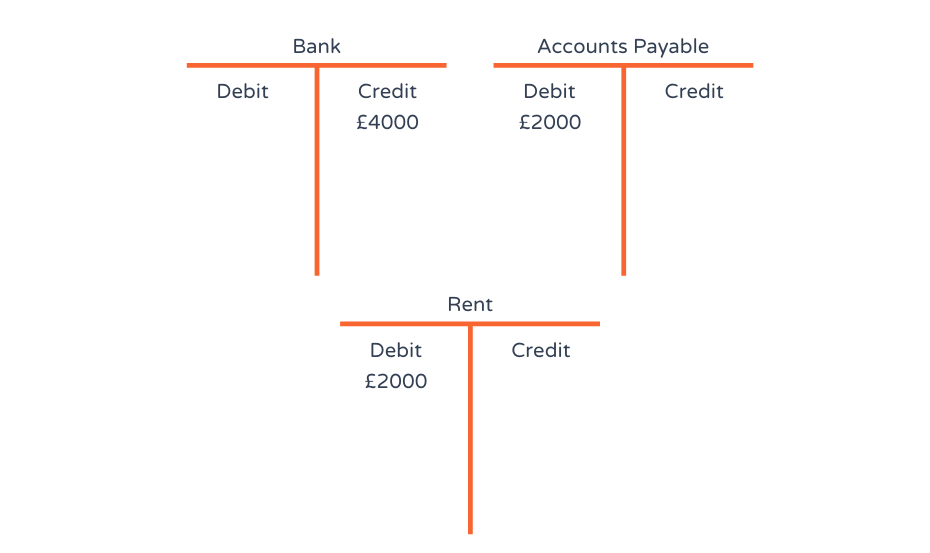

As an example, say the next month comes and the business can’t afford to pay the rent. They agree with the landlord to pay it back the following month, in addition to that month’s rent as well.

As the business has owed both this month and last month’s rent, it has to pay £4,000. The bank account is credited £4,000, whilst the accounts payable account is debited £2,000 and rent is debited £2,000. Therefore, both debits and credits are equal in this transaction.

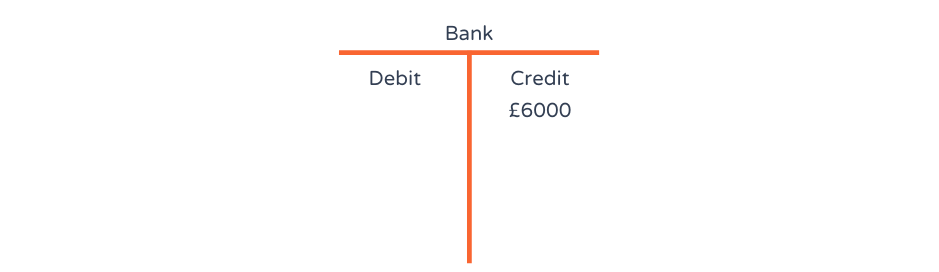

Example 4: Rent prepaid for a quarter

In this example, the business has decided to pay rent for the next quarter.

In January, they pay £6,000 in cash to the landlord, so the bank (asset) account is credited £6,000.

With three months of rent paid for, the prepayments (prepaid rent) account is debited £6,000.

Prepayments is an ‘asset’ account on the balance sheet. This prepaid £6,000 represents an asset because the landlord owes the business 3 months usage of their property rent has been paid in advance.

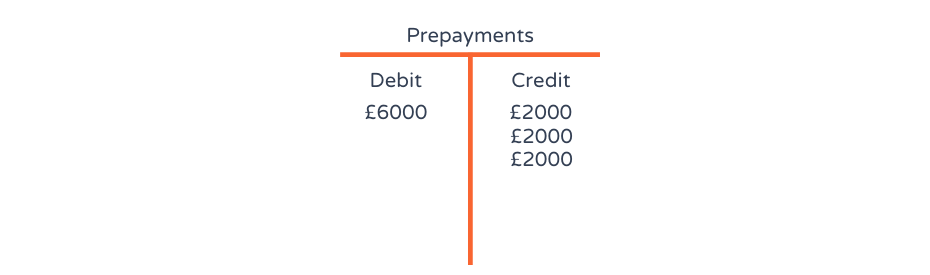

Every month, £2,000 is credited from this account.

The £2,000 credit each month to the prepayment account is balanced by the £2,000 debit to the rent expense account:

Common mistakes when using T-accounts

T-accounts are a great way to visualise accounting transactions, but mistakes can still happen. Here are some common pitfalls:

- Misplacing debits and credits: A simple reversal can throw off the entire balance of an account.

- Forgetting adjusting entries: Without proper adjustments, financial reports may not reflect accurate balances.

- Omitting transactions: If a transaction isn’t recorded in the T-Account, it won’t appear in the ledger or financial statements.

- Not balancing accounts: Each T-Account should eventually balance; if not, an error might exist in the double-entry system.

By double-checking entries and reconciling accounts regularly, businesses can avoid costly accounting errors.

Problems with T-accounts

While T-accounts offer many benefits, they also come with some limitations, especially in modern accounting:

1. Time-consuming for complex businesses

Manually maintaining T-accounts for every transaction can be impractical for large organisations with thousands of entries.

2. Prone to human error

If transactions are recorded incorrectly in a T-account, the mistake carries over to financial reports.

3. Limited real-world use

Businesses don’t typically use T-accounts for daily operations. Instead, ledgers and automated systems handle transaction tracking.

4. Requires double-checking

Because T-accounts rely on manual input, they need careful review to ensure accuracy.

Despite these challenges, T-accounts remain an essential learning tool and a useful way to visualise complex accounting concepts.

Manage your T-accounting in Brixx

When learning the accounting process, from debits and credits to double-entry, it’s easy to get lost in the process and miss the big picture.

Whether you are an accountant or a decision-maker the language of business finance is rooted in accounting. Whatever your role is in the business, it’s worth grasping the basics of this language. Every transaction a company makes, whether it’s selling coffee, taking out a loan or purchasing an asset, has a debit and credit. This ensures a complete record of financial events is tracked and can be accurately represented by financial reports.

The key financial reports (your cash flow, profit and loss and balance sheet) are an organised representation of these fundamental accounting records. They are built from the ground up by these debits and credits. It’s these reports that you’ll be analysing to aid your decision-making process.

Your profit and loss organises your revenue and expense accounts whilst your balance sheet organises your asset, liability and equity accounts. The double entry process connects these reports together. A single transaction will have impacts across all reports due to the way debits and credits work. So grasping these basics helps you delve into these reports and understand the financial story they tell.

Brixx, our financial forecasting software, helps you with this process further. The software handles all the accounting work. When you enter any forecast activity, the double-entry process is completed for you, saving you time and giving you confidence in the numbers. It means you can spend more time analysing the results. Get started today with a free 7-day trial!

Learn more

T-Account vs Balance Sheet

A T-account is used to track specific transactions, while the balance sheet is a summary of a company’s overall financial position. Both statements are important tools in accounting and finance, and they are used to help stakeholders understand a company’s financial health.

A balance sheet is a summary of a company’s financial position at a given point in time. It provides a snapshot of the company’s financial health. The balance sheet summarizes the financial position of the company at the end of a specific period, usually at the end of the fiscal year. It is used by stakeholders to evaluate a company’s financial strength and to make investment decisions.

T-Account vs Ledger

While T-Accounts and ledgers both record financial transactions, they serve different purposes:

| Feature | T-Account | Ledger |

|---|---|---|

| Purpose | Visual representation of transactions | Official record of accounts |

| Structure | Split into debit & credit sides | Typically in a tabular format |

| Usage | Used for learning and quick analysis | Maintains a company’s financial records |

T-accounts help with understanding how transactions flow, but ledgers are the official books used in accounting reports. In practice, accountants use ledgers for final records, while T-accounts are often used for teaching and troubleshooting errors.

T-Account vs Trial Balance

T-accounts are used to track individual account balances and transactions, while trial balance summaries are used to ensure the overall accuracy of a company’s financial records.

A trial balance summary is a report that summarizes the account balances in a company’s general ledger.

It lists all the accounts and their balances, including debit and credit entries. It exists to ensure that the total debits equal the total credits, indicating that all transactions have been recorded accurately.

It is typically prepared at the end of an accounting period before financial statements are generated.

T-Account vs Journal Entry

T-accounts are used to visualise the balances of individual accounts. while a journal entry is a record of a single transaction in chronological order, showing the debits and credits of each account affected.