What is goodwill?

Goodwill in accounting refers to an intangible asset that represents the reputation, customer loyalty, and brand value of a company. It is an important concept in financial reporting, particularly in situations involving business acquisitions.

When a company acquires another business, the purchase price often exceeds the fair value of the identifiable net assets. The excess amount is referred to as goodwill. Goodwill arises from intangible factors such as the target company’s customer relationships, brand recognition, and employees to name a few.

Goodwill is classified as an intangible asset because it lacks physical substance and cannot be separately measured or sold independently from the company as a whole. Unlike tangible assets such as buildings or equipment, goodwill represents the intangible value that a company possesses and contributes to its overall worth.

How is goodwill different from other assets?

Goodwill is an intangible asset, but unlike patents or trademarks, it cannot be separately sold or valued independently. While tangible assets like equipment or buildings have a clear physical presence, goodwill represents intangible factors like reputation and customer loyalty, which increase the value of an acquired business. It’s essential for distinguishing between assets that can be physically owned versus those that contribute to a company’s long-term success but aren’t easily quantified.

Types of goodwill

In accounting, there are two main types of goodwill: internally generated goodwill and acquired goodwill. Let’s explore each type in more detail:

Internally generated goodwill

Internally generated goodwill refers to the value that a company creates through its own efforts and operations. It is not acquired from external sources but is developed over time as a result of the company’s successful business practices, brand building, customer relationships, and market positioning. This type of goodwill is typically not recognised on the balance sheet because it is difficult to measure objectively and reliably.

Acquired goodwill

Acquired goodwill, also known as purchased goodwill, is the goodwill that arises when a company acquires another business through a merger or acquisition. It represents the excess of the purchase price paid over the fair value of the identifiable net assets acquired. Acquired goodwill is recognised as an intangible asset on the balance sheet and is subject to annual impairment tests.

Acquired goodwill can further be categorised into the following subtypes:

a) Business goodwill:

Business goodwill is the most common form of acquired goodwill. It arises when a company acquires another company as a going concern. This type of goodwill represents the overall value of the acquired business, including the previously mentioned intangible assets that contribute to its success.

b) Customer-related goodwill:

Customer-related goodwill specifically refers to the value derived from the relationships with the acquired company’s customers. It includes factors such as customer loyalty, customer contracts, and the potential for future business from existing customers.

c) Technology-based goodwill:

Technology-based goodwill arises when a company acquires another company for its technological capabilities, intellectual property, patents, or proprietary technology. It represents the value associated with the acquired company’s innovative products, research and development capabilities, and technological expertise.

d) Contract-based goodwill:

Contract-based goodwill is linked to the value derived from contracts and agreements held by the acquired company. It includes contracts with suppliers, distributors, customers, or other parties that provide the company with a competitive advantage and revenue-generating opportunities.

e) Location-based goodwill:

Location-based goodwill arises when the location of the acquired business contributes to its value. This could include factors such as prime real estate, advantageous geographic positioning, or access to key markets or resources.

It’s important to note that the classification and valuation of acquired goodwill may vary depending on the accounting standards followed, such as International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP).

Understanding the different types of goodwill helps businesses and investors assess the specific components and value drivers of acquired goodwill, enabling better evaluation of the overall intangible value associated with a company’s acquisitions.

How do you measure goodwill in accounting?

In accounting, goodwill is initially measured at the time of acquisition. We’ll see how to measure Goodwill below.

- Determine the purchase price: The purchase price is the total consideration paid by the acquiring company to acquire the business. It includes any cash, stock, debt assumption, contingent payments, or other assets given in exchange for the acquired business.

- Identify thefair value of identifiable net assets: The identifiable net assets include the tangible and intangible assets, liabilities, and contingent liabilities acquired in the business combination. Tangible assets may include buildings, equipment, and inventory, while intangible assets may include patents, trademarks, and customer contracts. Valuation techniques, such as market comparisons, income-based approaches, or cost-based methods, are used to determine the fair value of these assets and liabilities.

- Calculate the excess purchase price: The excess purchase price is the difference between the purchase price and the fair value of the identifiable net assets. This excess represents the value of goodwill.

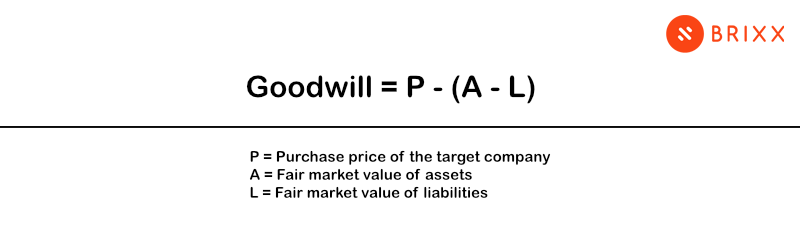

Mathematically, the formula to calculate goodwill is as follows:

Goodwill = Purchase Price – Fair Value of Identifiable Net Assets

- Record goodwill as an intangible asset: Goodwill is recognised as an intangible asset on the acquiring company’s balance sheet. It is typically presented separately from other intangible assets and is subject to annual impairment tests.

- Impairment testing: Goodwill is subject to annual impairment tests to assess whether its carrying value exceeds its recoverable amount. If the carrying value of goodwill is determined to be higher than its recoverable amount, an impairment loss is recognised, reducing the value of goodwill on the balance sheet.

As previously mentioned, the IFRS or GAAP may measure the treatment of goodwill differently depending on the accounting standards followed.

What is goodwill impairment?

Goodwill impairment refers to a decrease in the value of goodwill recognised on a company’s balance sheet. It occurs when the carrying amount of goodwill exceeds its recoverable amount. In other words, when the value assigned to goodwill on the books is higher than its actual worth or the future economic benefits it can generate.

How to test goodwill impairment?

Goodwill impairment tests are conducted to assess whether the carrying amount of goodwill exceeds its recoverable amount. There are two commonly used methods for performing goodwill impairment tests:

Two-step impairment test:

This method is commonly followed under both International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP).

Step 1: Identify potential impairment:

The first step involves comparing the carrying amount of the reporting unit (including goodwill) with its fair value. If the fair value is higher than the carrying amount, no impairment is indicated, and no further testing is required. However, if the fair value is lower than the carrying amount, it indicates a potential impairment, and the test proceeds to the second step.

Step 2: Calculate impairment loss:

In the second step, the impairment loss is determined by comparing the implied fair value of goodwill to its carrying amount. The implied fair value of goodwill is calculated by deducting the fair value of all identifiable net assets of the reporting unit from the fair value determined in Step 1. If the calculated fair value of goodwill is lower than its carrying amount, it indicates a potential impairment. In such cases, the company recognises an impairment loss for the difference between the carrying amount and the calculated fair value.

One-step impairment test:

This method is allowed under certain circumstances in IFRS but is not permitted under GAAP.

Under the one-step impairment test, the carrying amount of the reporting unit (including goodwill) is compared directly to its recoverable amount, which is determined based on the higher of its fair value less costs to sell or its value in use. If the carrying amount exceeds the recoverable amount, an impairment loss is recognised for the difference.

As previously mentioned, ensure each business has followed the guidelines relevant to their jurisdiction and industry, and consult with accounting professionals to ensure compliance and accuracy in performing impairment tests.

Why goodwill matters for investors

For investors, goodwill plays a crucial role in understanding a company’s overall valuation. It can indicate the premium paid over the fair market value of a company’s tangible assets during an acquisition. Changes in goodwill due to impairment or overvaluation can affect stock prices and investor sentiment, making it essential to track goodwill for accurate financial forecasting. Additionally, goodwill impacts mergers and acquisitions, as a large amount of goodwill may signal strategic value beyond physical assets.

Goodwill in financial statements

Goodwill has a specific impact on a company’s financial statements. Here’s how goodwill is presented in the financial statements:

Balance sheet: Goodwill is reported as an intangible asset on the balance sheet. It is typically presented separately from other intangible assets and is recorded at its initial recognition and subsequent carrying amount. Goodwill is disclosed as a separate line item under the assets section of the balance sheet.

Income statement: Goodwill does not directly affect the income statement unless it is impaired. Impairment losses on goodwill, if any, are recognised as an expense in the income statement. The impairment loss reduces the carrying amount of goodwill and is reported as a separate line item, typically referred to as “Goodwill Impairment Loss” or “Impairment of Goodwill.”

Cash flow statement: Goodwill is not directly reported in the cash flow statement. However, cash flows associated with the acquisition of a business that includes goodwill are disclosed in the investing activities section of the cash flow statement.

Disclosures: Financial statements typically include additional disclosures related to goodwill. These disclosures provide information about the nature, valuation, and any impairment of goodwill. They may include details about the methods used to determine the fair value of reporting units, the carrying amount and changes in goodwill, and the assumptions made in the impairment testing process.

Properly reporting and disclosing goodwill in the financial statements is crucial for providing transparent and meaningful information to stakeholders. It allows all stakeholders and other users of financial statements to understand the value of a company’s intangible assets and evaluate its financial position and performance accurately.

Goodwill in accounting example

Company A wants to buy Company B. Company B has:

Assets equating to £2.5m

Liabilities equating to £1m

This means that the company has approximately £1.5m of net value.

Company A agrees to purchase Company B for £2m. This means that the goodwill for Company B was agreed to be £500,000.

It is £500,000 because that is the difference between the purchase price and the total of assets minus liabilities.

This goodwill would be recognised on the balance sheet as £500,000.

Note that the numbers used in this example are for illustrative purposes, and the actual values and treatment of goodwill may vary based on the specific circumstances, accounting standards, and regulations applicable in a given situation.

Get started with our forecasting software so that you can plan your business' futureTrack your finances in Brixx

Goodwill limitations

While goodwill has its importance in accounting, there are several limitations associated with its measurement and usefulness. Here are some key limitations of goodwill:

- Subjectivity in measurement: Goodwill is an intangible asset, and its measurement relies on estimates and assumptions. Determining the fair value of goodwill and assessing its recoverable amount involves judgement and subjectivity, which can introduce uncertainty into the financial reporting process.

- Non-transferability: Goodwill is typically specific to the acquiring company and the acquired business. It cannot be separated or sold independently, making it challenging to determine its true market value.

- Potential for impairment: Goodwill is subject to annual impairment tests to assess its carrying value compared to its recoverable amount. However, impairment tests are based on future cash flow projections and other assumptions, which may not accurately predict the actual performance and economic value of goodwill.

- Incomplete representation of intangible assets: Goodwill represents only a portion of a company’s intangible assets. Other valuable intangibles may not be reflected in goodwill but are relevant to a company’s overall value.

- Difficulty in valuation: Valuing goodwill accurately can be complex, especially in situations involving business combinations or acquisitions. Determining the fair value of identifiable net assets and allocating the excess consideration to goodwill requires careful assessment of various factors. The inherent subjectivity in valuation can lead to different opinions and potential challenges in reaching a consensus on the value of goodwill.

- Limited usefulness in financial analysis: Goodwill does not directly contribute to a company’s cash flows or profitability. It represents the premium paid for the intangible benefits associated with an acquisition. As a result, analysts and investors may exclude goodwill from certain financial ratios and metrics to assess a company’s operating performance or financial health accurately.

It’s important for stakeholders to be aware of these limitations and consider them when interpreting financial statements and assessing the value of goodwill.

Can you incorporate goodwill into a forecasting tool

In a financial forecasting tool, you can incorporate the testing of goodwill by conducting sensitivity analysis and scenario modelling. While it is not possible to directly test goodwill itself in a forecasting tool, you can assess its impact on financial projections and evaluate the potential outcomes under different scenarios.

Sensitivity analysis can understand how changes in the value of goodwill or its underlying drivers can affect your financial forecasts. This involves adjusting the assumptions related to goodwill and observing the resulting impact on key financial metrics.

Scenario modelling, on the other hand, allows you to create different financial scenarios that reflect potential changes in goodwill and its components. Develop scenarios that capture both optimistic and pessimistic outcomes. Analyse the financial implications of each scenario to evaluate the potential range of outcomes.

Assessing impairment evaluates whether the carrying amount of goodwill exceeds its recoverable amount. Set up calculations and formulas to compare the carrying amount of goodwill with its recoverable amount based on relevant assumptions and inputs. By analysing the results of impairment testing, you can assess the potential impairment losses and their impact on financial statements.

Remember, while a financial forecasting tool can help simulate and assess the impact of goodwill on financial projections, the actual value of goodwill depends on numerous factors and can be subject to significant uncertainty. Regularly review and update your assumptions and models based on actual performance and market conditions to improve the accuracy of your forecasts.

Get started today for free with Brixx and see how our features can help you and your business.

Goodwill in Accounting FAQ

Can goodwill be negative?

Yes, goodwill can be negative, but it’s rare. Negative goodwill occurs when a company acquires another for less than its fair value, usually because of financial distress or a forced sale. This situation is recorded as a gain on the buyer’s financial statements and may indicate a bargain purchase.