If you’re thinking of creating a cash flow forecast, it helps to see an exact real-world cash flow statement example. How do other businesses make them effectively? What do they include? How are they formatted?

In this article, I’m going to show you a cash flow statement forecast in a standard format used by thousands (probably millions) of businesses across the world.

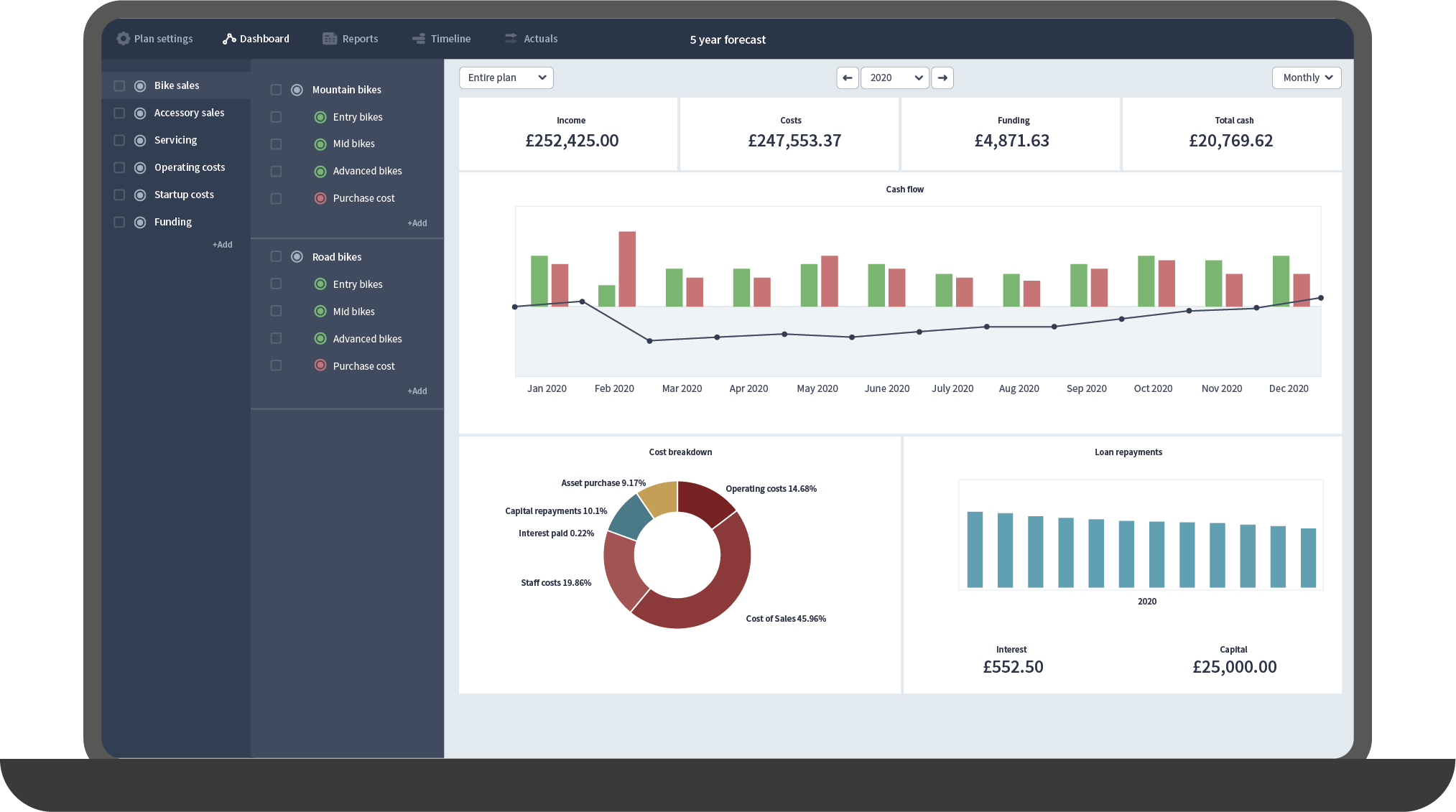

It’s an example coffee shop built in Brixx financial forecasting software but it can also be created using our free template for cash flow forecasting.

We’ll be going through this section by section, line by line, so you can understand how it really works.

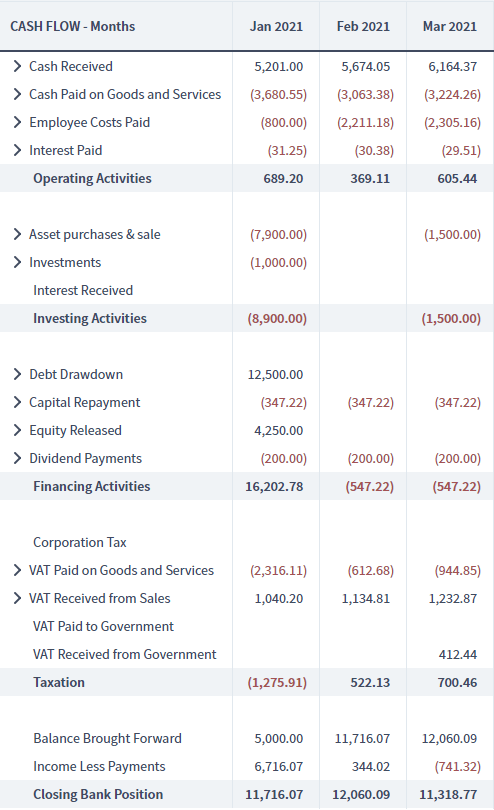

Cash Flow Forecast Example

You are probably used to looking at your bank statement. This is actually a type of cash flow report, showing a chronological breakdown of the cash inflows and outflows for a period.

A full cash flow statement is more useful since it categorises these inflows and outflows.

Different time frames and granularities are useful for different purposes. This example is a multiple year forecast split out by months. Seasonal businesses need to plan ahead in this way to avoid cash flow problems in the future.

This starts with three broad categories:

- Operating activities – your day to day sales and running costs

- Investing activities – less frequent spending aimed at investing into future growth

- Financing activities – receiving or paying back funding sources

Keeping Investing activities and Financing activities distinct from the everyday business activities (Operating activities) is key for good cash flow planning.

If your funding sources get mixed in with cash from sales, it can be difficult to see your true performance and might mean risks in the business remain hidden.

It’s said that cash flow kills businesses and keeping your finances visible is one measure to avoid this.

What goes into operating activities?

The first section of a cash flow forecast shows how the business generates cash through your normal operations.

Looking at the cash flow from your operating activities line by line allows you to identify where the biggest costs from your business comes from.

- Cash received: This is the total cash from your customers. For this coffee shop, that’s all the food and drink being sold.

- Cash Paid on Goods and Services: Money paid out to suppliers. In this example, it includes spending on ingredients like coffee beans as well as running costs like rent.

- Employee Costs Paid: This covers salary costs and other relevant spending on people (including all the taxes and benefits that come with employing people)

- Interest Paid: The regular cost of funding activities like bank loans. The receipt of the loan drawdown and repayment of the principle goes into Financing Activities but the actual on-going cost in interest comes into Operating Activities.

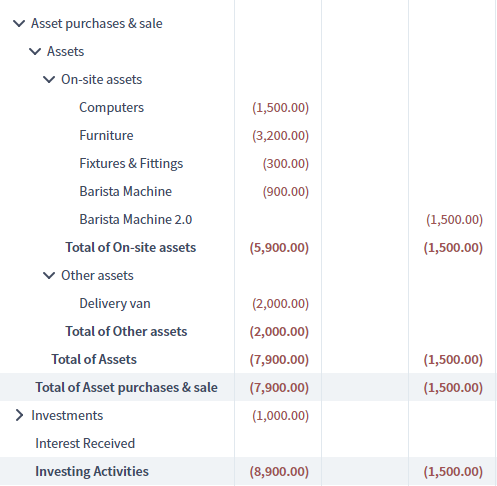

What goes into investing activities?

Investing activities include any money you spent or received from assets, credit agreements, or any other investments you make. Purchasing new equipment, fixtures or even entire buildings often shows that a business is spending on growth and expansion.

- Asset purchases & sale: Assets range from equipment to vehicles to entire buildings and everything in between. For this coffee shop, it’ll be items like barista equipment, kitchen equipment, tables etc. On the cash flow, you see the purchase amount (or the money received from selling an asset later on).

- Investments: Businesses can invest surplus cash into funds, other businesses or any activity that puts their extra cash to work. Money moved in or out in this way appears on this line.

- Interest Received: Surplus cash sitting in savings accounts will generate cash from interest.

What goes into Financing Activities?

This area of your cash flow forecast identifies how your business is being funded and how your cash requirements are being fulfilled.

With operating and Investing activities split out, your forecast will show you if you need any funding to cover them. This can then be planned in the financing activities section of your projections.

You’ll also be able to establish how much debt you’ll actually be able to afford.

You may need to take out a line of credit to bridge gaps in your cash flow, but debt can be crippling for startups if you can’t afford the repayments. This is another reason it’s important to separate lines of credit out from your day to day activities.

- Debt Drawdown: This line shows you how much cash you’ve received from any loans you have.

- Capital Repayment: This shows you how much debt you pay back each month. For instance, the monthly repayments for my loan are £347.22.

- Equity Released: Money injected into the business from investors (including the business owner) appears here.

- Dividend Payments: Dividends payments are often regular payments to investors.

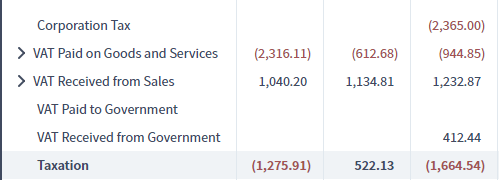

What goes into Taxation?

After the core activities, we’ve got an important area on taxation. In some cash flow reports this is rolled into the core areas – here we’ve split it out so that it’s distinct.

Again, it’s useful to split out from normal activities because the tax bill can catch you off guard if it’s hidden.

The two main forms of tax shown here are VAT (the UK name for sales tax) and Corporation Tax.

Both have their own nuances and payment timings and it’s a key reason to forecast your cash flow to ensure you’ve set aside enough cash to pay these when they are due.

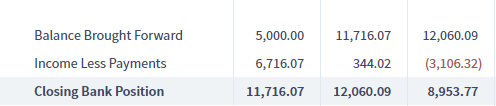

What goes into the Bottom Line(s)?

Lastly, there are three bottom lines, balance brought forward, income less payments, and the closing bank position.

- Balance Brought Forward This shows how much cash you had at the start of the month, carried over from the end of the previous period.

- Income Less Payments This shows the net total of cash flow movements that happened in that month. Looking at this line allows you to quickly identify how the month has performed in comparison to other months.

- Closing Bank Position Last but not least, the closing bank position shows the amount that the business has in the bank at the end of the month. This number will also be used as the balance brought forward for the next month.

So the cash flow report helps our coffee shop owner understand the flow of cash in and out of the business at a glance.

Dividing it into different categories gives you far more transparency compared to a simple bank statement and a total at the end of each month.

You can clearly see actual business performance, day to day activities vs growth activities and potential risks or problems.

Forecasting your cash flow using this structured approach is also hugely beneficial.

Why should you forecast your cash flow?

How can forecasting your cash flow help your business? Is it worth your time?

If you are used to battling spreadsheet problems, you might be turned off from even trying.

Just because you’re profitable, doesn’t mean that you’ll always have the cash you need to fund your business. Forecasting your cash flow will allow you to foresee shortfalls and take actions to stop these periods where you’re struggling for cash before you become a reality.

For managing short term cash flow, you should consider creating a 13 week cash flow forecast at least.

Avoiding bankruptcy is certainly a strong motivator but there are many benefits:

- Manage cash flow in the short term so you can keep paying the bills

- Map out your future sales based on current trends

- Stress test your business

- Plan how you’ll spend money to grow your business

- Create your long term strategy and vision over the coming years

Here at Brixx we believe that modelling the future of your business is essential in this turbulent world.

You need to model the impact of your business decisions and stress test your business to secure it from influences outside of your control.

Our easy to use free financial forecasting tool allows you to model your business activities in detail. It creates detailed financial forecasts that clearly demonstrates the impact of your choices.