Understanding the basics of cash flow forecasting in Excel

Cash flow forecasting is a vital component of effective financial management for businesses of all sizes. The ability to anticipate and plan for future cash flows is crucial for making informed decisions and ensuring the stability and growth of a business.

One powerful tool that has become synonymous with precise cash flow projections is Microsoft Excel. In this article, we take a look at the common issues that arise when using Excel for forecasting and how you can avoid them. Join us as we unravel these pitfalls help you to better navigate the intricacies of cash flow forecasting.

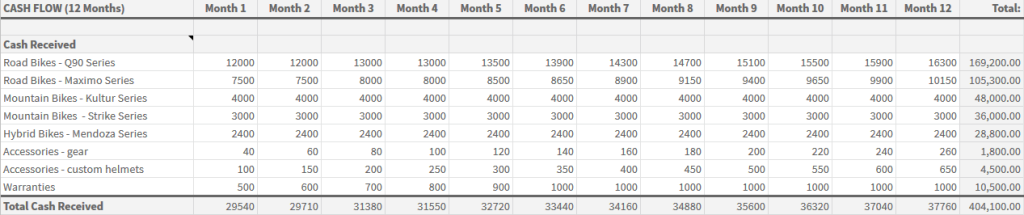

Before we get started, make sure to download our free cash flow forecast template for Excel.

Common Excel mistakes in cash flow forecasting

There are many factors to consider when beginning your forecasting process in Excel. It’s important to take into consideration all possible issues beforehand so that you can proceed without problems. We explore some of the most common mistakes below.

- Formula dragging errors

When trying to calculate totals for different months, you might have a cell for January’s inflows as =SUM(B2:B10). Dragging this formula to the next cell for February’s totals can mistakenly reference B3:B11 instead, misaligning your data.

- Circular references

If you’re attempting to calculate net cash flow by subtracting expenses from revenue in a cell, but you mistakenly include the net cash flow cell itself in that calculation, Excel identifies this as a circular reference.

- Copy-pasting over formulas

For instance, when updating revenue figures, you might manually input a new number for a specific month, but in doing so, you accidentally overwrite a cell’s formula that was summing up individual sales for that month.

- Lack of version control

After making multiple updates to your Excel sheet, you realize you need to revert to an older model due to its accuracy. Without a saved version of that older model, you’re left with a less reliable forecast.

- Inconsistent date formats

You might have cash inflows logged in a DD-MM-YYYY format while your outflows are dated MM-DD-YYYY. When matching these for net calculations, the inconsistency causes calculation errors.

- Not locking critical cells:

Imagine sharing your Excel forecast with a colleague for input. Without locked cells, they might unintentionally modify or overwrite a critical formula, leading to errors in your projections.

- Misusing Excel functions

In evaluating the potential cash flows of an investment, using the PMT function, which is meant for loan payments, instead of the appropriate NPV (Net Present Value) function will result in a misleading analysis.

- Related reading: What is a Present Value Table?

- Related reading: Financial Modelling Software vs Excel & Sheets

How to avoid mistakes in Excel cash flow forecasting?

Cash flow forecasting in Excel is a vital activity that requires precision and attention to detail. When specifically focusing on avoiding mistakes in cash flow forecasting, consider these tailored strategies:

Understand basic cash flow concepts

Before you start, ensure you have a clear understanding of cash flow components like operating activities, investing activities, and financing activities.

Recommended reading: Common Cash Flow Confusions in Business

Use templates or professional software

Consider using a pre-made cash flow forecasting template, which often comes with built-in formulas and structures. Alternatively, professional financial modeling software can provide more advanced features and checks.

Protect critical formulas

Lock cells containing important formulas to prevent accidental overwrites. Clearly label and color-code cells to differentiate between input cells and formula-driven cells.

Scenario analysis

Run different financial scenarios (optimistic, pessimistic, and neutral) to check the robustness of your cash flow model. This helps in understanding potential vulnerabilities in your forecasting.

Automate where possible

Utilize Excel features like pivot tables, data tables, and connections to databases to minimize manual data entry and reduce errors. If you find yourself doing repetitive tasks, look into automating them with macros or other tools.

Update regularly

Regular updates should be prioritized, ensuring that your cash flow forecast remains reflective of the latest financial data and market conditions.

Use historical data and trends

Leverage historical trends to inform the length of your forecasting period, striking a balance between short-term precision and long-term insights.

Manage your finances with ease in Brixx

Get started with our forecasting software so that you can plan your business' future

Forecast with accuracy using a specialized tool

Excel is undoubtedly a versatile tool for various financial tasks, including cash flow forecasting. However, for those seeking a streamlined and more efficient approach, specialized financial planning software like Brixx offers distinct advantages.

Brixx is tailor-made for cash flow forecasting, simplifying the entire process. With its intuitive interface and pre-built templates, Brixx eliminates the complexities often associated with Excel, allowing users to focus on insights rather than formula intricacies. As a scenario planning tool, Brixx carries out automated calculations and empowers users to quickly model different financial scenarios and visualize potential outcomes. Furthermore, Brixx’s real-time data synchronization ensures that your forecasts remain up-to-date, mitigating the risk of data entry errors and outdated projections.

By harnessing the power of specialized tools like Brixx, businesses can achieve accurate and actionable cash flow forecasts with greater ease and confidence.