When you’re inspecting your business performance and planning the future you really need everyone on the same page and it would help to avoid common cash flow confusions.

Numbers can be open to interpretation, especially if you’re not used to arcane accounting methodologies.

Maybe you usually leave the numbers to the accountant, but if you’re a decision maker, then at some point you’ve got to figure out what it all means.

So, today, I’m going to explain some of the common ways cash flow can cause confusion and how you can avoid it.

1) Profitable businesses never run out of cash

Management accounts are often built on an accrual basis and judge your performance by inspecting a profit & loss statement.

The ‘accrual basis’ aspect means that the value of revenue and expenses are lined up to when they are delivered in the real world, giving you a fairer impression of what the business is really doing.

Once you understand what you’re looking at, this report is really useful for analysing your profitability and for planning the future.

However, let’s get one thing straight though, profit isn’t cash. Nope.

The Profit & Loss statement often the primary report presented by accountants and online accounting software but if you’re using it to manage your cash flow, you might end up in trouble.

Let’s see why.

If you buy an expensive piece of equipment, you might pay out the cash for it immediately. This could be a substantial chunk and have a real impact on your cash flow.

You wouldn’t know this from looking at your profit & loss though. Since you’ve exchanged cash for a piece of equipment, your business is simply trading one asset (cash) for another (a fixed asset).

That trade means it’s not a loss to the business and so won’t show up on the P&L. That’s a big deal!

It’s one way that you might appear profitable but in reality be in dire need of cash.

It’s not the only way the P&L differs from a cash flow statement too. The lag between invoicing a customer and receiving the cash is also a big factor. The P&L shows what has been invoiced but only the cash flow statement picks up when the cash really comes in.

This accrual accounting method can cause huge confusion if you aren’t clear on what it’s telling you. It’s why you need to run both reports to get a true picture of your business performance.

It might seem basic but if you’re making decisions about cash flow, make sure you start with an actual cash flow report. A report that clearly has your closing bank position at the bottom, a figure that can’t lie about your cash situation!

2) A cash flow forecast MUST be accurate

Alright, so we’ve just seen how important it is to be looking at the right numbers. Surely they must be accurate too?

Of course, when it comes to looking at historical performance, you’ll want that 100% correct. In fact, you’ve got to get that right for your tax return anyway! Keeping tidy and accurate historical accounts should be the norm for any business.

It gets a bit muddier when you start forecasting though.

Sure, you’ve got your regular bills to pay, you’ll know how much they are and when they are paid to almost 100% accuracy. You might have regular clients that pay like clockwork too. Nice.

However, most businesses will have a degree of uncertainty over how many customers will walk through their doors next week.

And when you start thinking about how many will walk in next month, in 6 months time, in 2 years time, even more uncertainty creeps in.

So what on earth is the point if it’s just going to be complete guesswork?

Well, to start with, it’s not complete guesswork. You’ve got historical data to go on, your business knowledge and your experience. Even if your historical data is limited there are still ways to forecast a range of realistic scenarios based on careful research.

The point is, you accept that there is some uncertainty and inaccuracy but you identify the spectrum of likely outcomes, positive or negative. Can you cope, no matter what scenario happens? A forecast, even with inaccuracies, will help answer this question.

If you aren’t forecasting, you really are just using guesswork.

This forward thinking gives you time to plan in advance and be prepared for whichever eventuality does become reality.

When it comes to cash flow forecasting, don’t worry about getting every penny right. It’s a tool to help you make sound business decisions. Leave the penny counting to historical accounting.

3) A boost in sales is only ever good for cash flow

So, good news! Your sales trend is up. You think you’re climbing the bottom of a hockey stick curve. Orders are coming in thick and fast. Cash flow must be good, right?

If only.

The trend might be good, but there are a number of ways you might still be cash flow negative. Your cash situation might even be worse! Let me explain that last point…

If you have to buy in inventory or build a product before you can ship it, you may have to spend more money in advance to meet this upcoming demand.

That spending could be before you receive any of the cash from this sales boost, leading to a negative cash position.

This gap will need to be funded or you might not be able to meet your increased demand. In turn, unfulfilled orders could lead to unhappy customers, reputation damage and ultimately worse business performance overall. All because sales were looking up!

Inventory management is one aspect but many types of businesses incur direct costs in advance of receiving their full sale price in cash. This surge of customers might bring additional costs in supporting, implementing and fulfilling your products or services.

You’ve got to look carefully at your cash flow forecasts to understand these ramifications. Positive scenarios can bring just as many issues as negative scenarios sometimes!

Remember, no amount of sales will lead to positive cash flow if your product lines aren’t profitable. Net profit simply can’t be achieved before you’ve reached a healthy gross profit.

This means that if you haven’t found a way to supply your goods or services at a profit, you’ll always be struggling with cash flow as you can’t keep funding the losses forever.

This is another reason it’s great to look at both a cash flow forecast and a profit & loss forecast.

Your profit & loss will show if you can perform profitably and your cash flow forecast shows how you’ll get there without running out of cash.

Your cash flow forecast can hide true business performance due to losses being covered by investment funding and debt sources. The profit & loss keeps this clean and you’ll clearly be able to see which product lines are profitable or not.

If your operational costs are simply too high, then you may also want to reconsider your business model.

Look and see if there is a different way to offer your product that will cost less for you to manufacture. Or perhaps evaluate your pricing structure to see if it makes business sense.

Either way, keeping track of performance and continuously forecasting the future will help you make these decisions.

4) I’ve received a large investment so cash flow isn’t a problem

So we’ve seen the catch that can come with a sales boost. What could possibly go wrong with cash flow when you receive a large chunk of investment? What’s the catch here?

Well, nothing…in the short term. That’s the problem.

Remember we talked about how the cash flow statement can hide business performance by covering up losses with funding? Your closing bank position always looks good after it’s been topped up by an investor.

However, if you’re not careful, this large influx of cash will lead you to spend more than is good for the business. You might spend more inefficiently and wastefully than if you hadn’t received it at all!

If an investor has agreed to invest, it was likely on the back of a financial plan with an agreed set of spending. If it’s your own money or from a source that doesn’t ‘keep you honest’ then you really need to be careful.

The first thing you should think about when you get an investment is; when is my money going to run out? You do this by calculating your burn rate (simply your total costs each month) and your runway (total cash/burn rate = number of months before you run out of cash).

When you factor in your growing sales, you’ll see that the more sales you make, the longer your cash runway is. Of course, the lesson here is that if you can prune unnecessary spending, you can extend your runway, giving you more time to grow your sales.

Clearly your cash flow forecast plays a key role here. A well categorised cash flow report will also separate out investment sources lower down on the report to avoid confusion.

So remember, don’t let investment and funding make you get complacent with your spending or cash flow analysis.

5) There is no such thing as having too much cash

This little mix-up is more forgivable than others. After all, the main goal of most businesses is to make money.

So you’ve gotten over the earlier cash flow hurdle from experiencing a surge in orders and you’ve actually received all the cash! What’s the next hurdle?

Well, believe it or not, it is possible to have too much cash.

If you are sitting on a large pool of cash that you aren’t spending, you are missing out on potential business growth. This is clearly less of a cash flow issue than the previous points but it’s still good to be aware of.

Think about it like this.

You wouldn’t keep all your personal savings stuffed in a pillow somewhere. At the very least you’d put it into a savings account to earn interest and grow. You put your money to work.

It’s the same principle with your business savings too. Of course, you could also put your business savings into a bank account. However, bank savings rates are usually quite low. The idea is that by investing into your business you’ll receive much larger returns through future profits.

Opening new outlets, purchasing new equipment and hiring new staff are all investments into the future of the business. If done correctly, with a plan, they will lead to more profits than if you simply left the money sitting in the bank (or in a pillow).

Your cash flow forecast is the instrument to gauge when it’s safe to spend.

The key is to work out how large your cash surplus should be. If you can achieve a surplus, it’s wise to keep enough readily available cash to pay upcoming bills. You might want to extend this outwards with your forecast to calculate how much you’d need to cover several weeks or months worth of bills. Businesses with highly seasonal sales will need to plan their surplus especially carefully.

You’ll also want to maintain a level of reserves to protect the business from emergencies or disasters outside your control. How much that number is isn’t easy to define and will vary from business to business. You could calculate it based on a certain period of no new business. Or perhaps the cost to replace a key piece of equipment should it fail.

Once you are sure you have a safe level of cash reserves, you can plan out how you’ll spend any surplus above that. The longer it sits there doing nothing, the more you’re missing out on future growth and profits!

6) Creating a cash flow forecast is a job for my accountant

I introduced this article by saying that, as a decision maker, at some point you’ve got to get a firm grip on the numbers. That means getting into the thick of it building your own forecasts too.

Throughout this article we’ve seen how key a cash flow (and a profit & loss!) forecast is. Now, your accountant will happily create a forecast for you but is this going to be effective?

Only you know the direction you’re taking your business in full, as well as all the subtleties and important details that go into its success. It’s your industry, your speciality and your area of expertise.

Not only that, but there are a wide range of possible actions you could take. You need the control and agility to be able to model these different futures for yourself as quickly as you can think of them.

Describing your business plans to your accountant for them to create a forecast for you will introduce a lag and layer of interpretation that can slow the whole decision making process down.

Now, does this mean you should cut your accountant out of the process completely? Absolutely not! A good accountant will provide you with expert advice and direction that’ll help you devise your growth strategy for the future.

But. You should be in the driving seat. If you build your forecast yourself, you’ll be closer to the numbers. You’ll learn more about planning your own business. You’ll be clearer on what realistic goals look like and how long it’ll take to achieve them.

Learning to forecast is a process that many find time consuming and frustrating. However, it’s instrumental for your decision making process. And you’re in the right place, Brixx is here to make it easier.

Getting starting with financial forecasting

If you’re at a loss as to where to start, we are here to help. Our blog is packed full of guides and resources to get you up and running. Our app is perfect for startups and growing businesses.

Make sure you check out our jargon buster if you’re tripping up on any of the financial terminology:

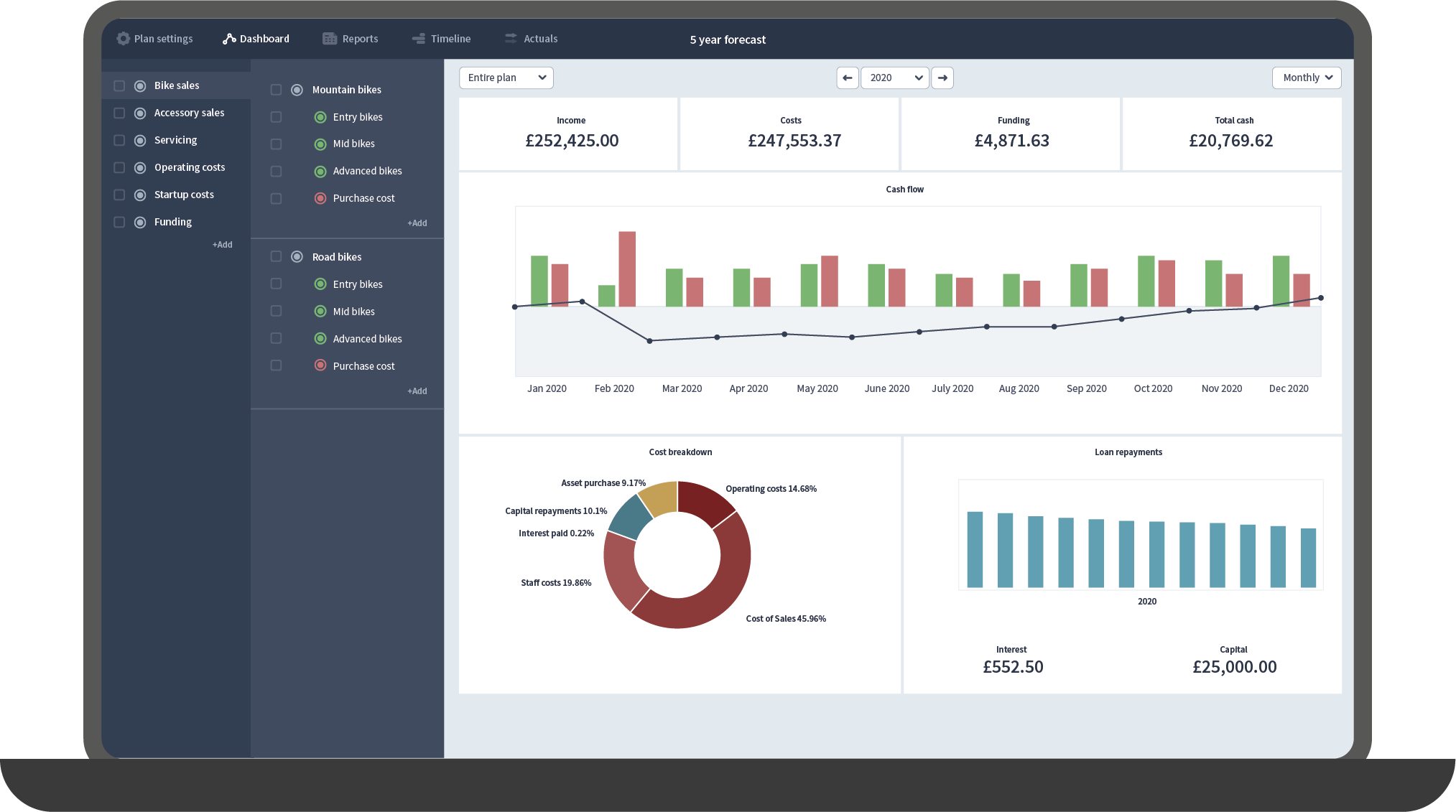

Finally, if spreadsheets aren’t your thing, or you are looking for a tool with a bit more oomph you should try our very own financial forecasting software, Brixx!

It generates a detailed Cash flow, Profit & Loss and Balance Sheet statement for you (through simple inputs). But that is just the start, Brixx is a modelling tool that enables the rapid exploration of future scenarios to super power your decision making process.

Just like our blog articles, we build software that is simple and approachable ready for anyone to jump and get up to speed quickly.