In the world of finance for startups and businesses, cash is the lifeblood that keeps operations running. One of the most significant metrics that entrepreneurs, investors, and stakeholders pay attention to is the cash runway. This critical indicator provides insights into how long a company can sustain its operations without fresh external funding. But what exactly is cash runway? And why does it matter? Let’s dive deep.

Get started with our forecasting software so that you can plan your business' futureTrack your finances with Brixx

What is cash runway?

Cash runway is a representation of the time duration during which a business can operate until it runs out of cash, assuming no additional cash inflows. It essentially gauges how long a company has before it potentially runs out of cash under its current operational structure. This metric is particularly vital for startups or companies in their early stages when external funding is the primary source of capital, and consistent profits might not yet have been realized.

Recommended reading: Essential Cash Flow KPIs and Metrics You Need to Know

How to calculate cash runway?

To truly appreciate the importance of cash runway, understanding its calculation is crucial.

Understanding burn rate

Before diving into the formula, it’s essential to know about the burn rate. Burn rate is the rate at which a company is spending (or “burning”) its cash reserves, often expressed on a monthly basis. For startups, this often equates to operational expenses minus any income being generated.

Example:

Suppose a company has monthly operational costs amounting to $50,000 and is currently generating a revenue of $10,000. The burn rate would be: Burn Rate = $50,000 (expenses) – $10,000 (income) = $40,000 per month.

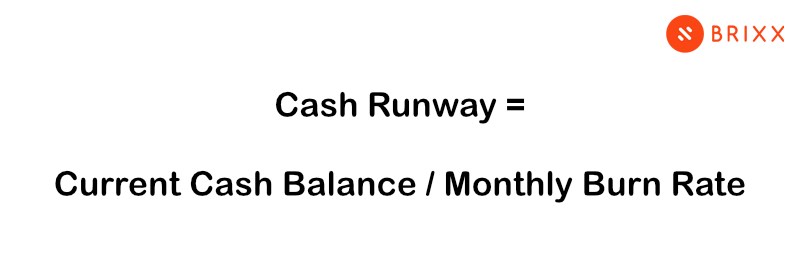

Cash runway formula

Given the importance of the burn rate, calculating cash runway is quite straightforward:

Cash Runway = Current Cash Balance / Monthly Burn Rate

Cash runway calculation example

Let’s say Startup X has a current cash balance of $500,000. Their monthly expenses, including salaries, rent, and other operational costs, amount to $450,000. Meanwhile, they’re generating an income of $100,000 each month.

First, we’ll find the monthly burn rate:

Monthly Burn Rate = Monthly Expenses – Monthly Income = $450,000 – $100,000 = $350,000

Now, using the cash runway formula:

Cash Runway = Current Cash Balance / Monthly Burn Rate = $500,000 / $350,000 ≈ 1.43 months

Thus, with its current cash reserves and burn rate, Startup X has a cash runway of approximately 1.43 months. This means they can sustain for nearly a month and a half without any additional income or funding.

5 reasons why cash runway is important

- Financial health gauge

One of the most straightforward reasons is that the cash runway gives a clear picture of a company’s financial health. A longer runway indicates that a company has more time to become profitable or secure the next round of funding. Conversely, a shorter runway can be a warning sign of looming financial troubles and the need to pivot or secure funding urgently. - Informed decision making

Understanding the length of the cash runway enables businesses to make informed decisions about expansion, investments, hiring, and more. If a company knows it has a year’s worth of cash left, it can decide whether to invest in a new project or save resources for existing ones. - Attracting and retaining investors

For startups and companies reliant on external funding, the cash runway is a key metric that investors look at. A healthy runway can be a sign to investors that the company is managing its funds well, making it a safer bet. On the flip side, a short runway might indicate potential risks, but also an opportunity for investors to step in and fuel growth. It is essential to ensure a positive cash runway to attract new investors. - Effective resource allocation

By keeping an eye on the cash runway, businesses can allocate resources more effectively. For instance, if funds are running low, a company might decide to hold off on a big marketing campaign or delay hiring for a new department. - Risk mitigation and preparedness

A clear understanding of the cash runway equips businesses with the foresight to see potential financial challenges. This allows them to prepare accordingly, whether that means cutting costs, seeking new revenue streams, or approaching investors for additional funding.

In essence, the cash runway acts as both a thermometer and a compass. It helps businesses gauge their current financial temperature while also pointing them in the direction they need to head to ensure longevity and success.

How to track cash runway more efficiently?

In the fast-paced and ever-changing world of startups and businesses, maintaining an accurate and real-time grip on your cash runway is paramount. Traditionally, tracking cash runway was a painstaking endeavor. Many companies resorted to intricate Excel models.

And if you aimed to forecast multiple scenarios? That meant creating multiple models. The challenges were twofold:

- Time-consuming model creation: Designing these models demanded countless hours, and with the fluidity of startups, constant updates were essential, turning it into an ongoing, often overwhelming task.

- Limited accessibility: Such models, due to their complexity, were mostly understood by their creators. This often left other team members or stakeholders at a disadvantage, having to accept projections and insights without fully grasping the underlying dynamics.

But here’s the thing about startups – their runway is an ever-shifting path. With frequent changes in business strategies, market dynamics, or operational costs, the cash runway changes, often daily. Just like navigating a constantly changing landscape, businesses require a compass – one that adjusts in real-time, ensuring they’re always headed in the right direction.

Brixx can help

This is where Brixx comes to the fore, dispelling the challenges of yesteryears and introducing a new era of financial modeling. Brixx is more than just a software; it’s your financial compass. Here’s how it stands out:

- Assist runway calculations: Brixx streamlines the process of calculating cash inflows and outflows, offering an up-to-date look at your cash runway. As your business evolves, Brixx evolves with it, ensuring that you’re never in the dark about your financial position.

- Scenario-based what-if analysis with Brixx: No more toggling through Excel sheets for every forecast. With Brixx’s powerful features, effortlessly craft forward-looking forecasts for your small business. Use What-If Analysis to test assumptions and visualize potential business outcomes. Whether it’s a new product launch or market expansion, Brixx illuminates the financial landscape, enabling decisions based on insight over instinct.

- Inclusivity and user-friendliness: Brixx breaks down the barriers of understanding complex financial models. It’s designed in such a way that not only financial experts but also other team members can interpret and derive insights, promoting a culture of financial transparency and collective decision-making.

The runway for startups isn’t just about numbers; it’s about making informed decisions, preparing for the future, and steering the business in the right direction. As the business landscape undergoes daily transformations, Brixx ensures you have a trusted ally, ensuring that every step taken is informed and strategic. Take a free trial today to find out more.

Cash runway FAQs

Cash Runway vs. Burn Rate, what’s the difference?

Cash Runway:

- Definition: Cash runway refers to the duration a business can continue to operate without needing to secure additional capital, given its current cash reserves.

- Formula: Cash Runway = Current Cash Balance / Monthly Burn Rate

- Purpose: It offers insights into a company’s financial health, indicating how long it can sustain its operations before running out of cash.

Example: If a company has $300,000 in cash reserves and a monthly burn rate of $30,000, its cash runway is 10 months.

Burn Rate:

- Definition: Burn rate measures the rate at which a company consumes its cash reserves, especially in the context of startups or companies not yet profitable.

- Formula: Burn Rate = Monthly Operational Expenses – Monthly Income

- Purpose: It provides a clear snapshot of how quickly a company is spending its available cash. A high burn rate, especially without corresponding growth or revenue, can be a warning sign.

Example: If a company has monthly expenses of $50,000 and generates $20,000 in revenue, its burn rate is $30,000.

In essence, while both terms revolve around a company’s financial health and cash position, the burn rate focuses on cash expenditure, and the cash runway provides a timeline based on that expenditure.

How can I extend my cash runway?

Extending cash runway can involve several strategies: reducing operating costs, optimizing business processes, finding additional revenue streams, or securing additional investments.

How often should I reassess my cash runway?

Startups, given their volatile nature, should assess their cash runway regularly, typically monthly or quarterly. Established businesses might review it less often, but it’s still a crucial metric.

What’s a good cash runway for a startup?

The “ideal” cash runway varies based on the nature of the business and industry. However, many startups aim for a runway of 12-18 months, giving them ample time to adjust business plans or seek additional funding.