Cash flow is the backbone of your business’s financial health. By tracking the right cash flow KPIs and metrics, you can make smarter financial decisions. In this guide, we’ll explore 8 essential cash flow KPIs every small business should track in 2025 to stay profitable and resilient.

Get started with our forecasting software so that you can plan your business' futureTrack your cash flow KPIs in Brixx

Cash flow metrics vs. cash flow KPIs

Before delving into cash flow metrics and KPIs, let’s distinguish these terms.

What are cash flow metrics?

Cash flow metrics provide basic figures about your business’s money movement. They are straightforward measurements found on financial statements, giving an initial look at cash inflows and outflows.

What are cash flow KPIs?

On the other hand, Key Performance Indicators (KPIs) add depth to these metrics. A net income metric is informative, but when you consider factors like past performance or how assets and liabilities balance, it becomes more insightful.

In short, Cash flow KPIs are the next level up. They are specific financial metrics that guide decision-making by showing a full picture of your company’s cash flow performance against financial goals. While all KPIs are metrics, not all metrics make the cut as KPIs.

Stay with us as we explore the 8 key cash flow metrics and KPIs in the following sections.

8 key cash flow metrics and KPIs

Understanding your cash flow is essential to maintaining a healthy business. It’s not just about tracking money coming in and out, it’s about analysing the data, spotting trends, and making data-driven decisions. Here are the top eight cash flow metrics and KPIs that every business should keep an eye on:

1. Operating cash flow

Operating Cash Flow (OCF) provides an insight into the cash generated from a company’s regular business operations. It indicates if a business can generate enough positive cash flow to sustain and expand its operations or if it needs to seek external financing.

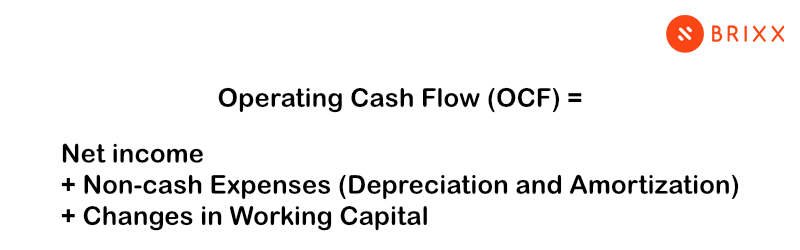

The formula for calculating OCF

For example, if a business has a net income of $50,000, non-cash expenses of $20,000, and its working capital changes by -$10,000, the OCF would be $60,000. If the OCF is positive, it shows the company is efficiently generating more cash than it uses.

2. Free cash flow

Free Cash Flow (FCF) gauges a company’s financial flexibility and is a crucial profitability measure. It represents the cash a company generates after deducting the cash outflows required to maintain its operations and capital assets.

The formula for calculating FCF

For instance, if a company has an operating cash flow of $80,000 and capital expenditures of $20,000, its FCF would be $60,000. A positive FCF indicates the company can generate enough cash to support activities such as debt repayment, dividends, stock buybacks, or new investments.

3. Days sales outstanding (DSO)

Days Sales Outstanding (DSO) measures the average time a company takes to collect payment after a sale. It’s vital for understanding how effectively a company manages its accounts receivable and cash flow.

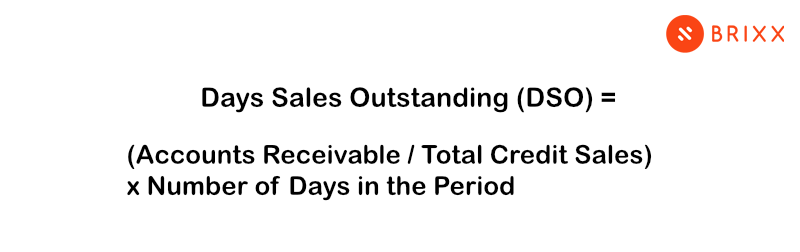

The formula for calculating DSO

For instance, if a company has accounts of $5,000, total credit sales of $20,000, and the period is 30 days, the DSO would be 7.5 days. A lower DSO is favorable as it indicates the company can efficiently collect its receivables, which is beneficial for cash flow.

4. Days payable outstanding (DPO)

DPO is a ratio that shows the average time a company takes to pay its bills to its trade creditors. It reflects how a company manages its payables.

The formula for calculating DPO

Let’s say a company has accounts payable of $10,000, its cost of goods sold (COGS) is $50,000, and the period is 30 days. The DPO would then be 6 days. A higher DPO signifies the company is taking longer to pay its suppliers, which can allow it to use the cash for other operations longer, thereby improving cash flow. However, an excessively high DPO might suggest payment struggles, which could strain supplier relationships.

5. Cash conversion cycle (CCC)

The Cash Conversion Cycle (CCC) measures how long it takes for a company to convert its investments in inventory and other resources into cash flows from sales. This metric provides insights into the efficiency of a company’s operations and its short-term financial health.

The formula for calculating CCC

For example, if a company’s DIO is 30 days, DSO is 45 days, and DPO is 25 days, then the CCC would be 50 days. A lower CCC is better, as it means the company spends fewer days converting its inventory into cash.

6. Liquidity ratios (current ratio, quick ratio)

Liquidity ratios take a look at a company’s ability to meet short-term obligations. Two important liquidity ratios are the current ratio and the quick ratio.

- The formula for calculating current ratio

For instance, if a company has current assets of $200,000 and current liabilities of $100,000, its current ratio would be 2.0. A current ratio greater than 1 indicates that the company has enough resources to cover its short-term obligations.

- The quick ratio (or Acid-Test Ratio) is a more stringent measure, as it excludes inventory from current assets:

For example, if a company has current assets of $200,000 (with $50,000 in inventory) and current liabilities of $100,000, the quick ratio would be 1.5. A higher quick ratio indicates a better short-term liquidity position.

7. Debt to equity ratio

Debt to Equity Ratio reviews a company’s financial positioning by comparing its liabilities to its shareholder’s equity. It indicates the proportion of a company’s funding that comes from debt versus equity.

The formula for calculating this ratio

For instance, a business can have total liabilities of $500,000 and shareholder’s equity of $250,000. This will make its debt to equity ratio be 2.0. A higher ratio implies a greater degree of financial risk as it means the company has been aggressive in financing its growth with debt.

8. Return on equity

Return on Equity (ROE) measures financial performance by dividing net income by shareholders’ equity. It shows how effectively a company is generating profits from the money shareholders have invested.

The formula for calculating ROE

For instance, if a company’s net income is $200,000 and shareholder’s equity is $1,000,000, the ROE would be 20%. A higher ROE indicates the company is using its investments to generate income effectively.

In summary, understanding these cash flow KPIs and metrics can make a significant difference in how well you manage your business finances. These metrics can help identify potential issues before they become significant problems and can guide your decision-making process.

For further insights into related metrics, particularly around profitability, we recommend reading our detailed guide on 7-profitability-ratios-and-kpis-you-need-to-know.

How to choose the ideal cash flow metrics and KPIs for your business?

Selecting the most relevant cash flow metrics and KPIs is integral to your business’s financial health. These metrics can vary based on the nature and size of your business, the industry you operate in, and your specific strategic objectives. Let’s take a look at the cash flow metrics and KPIs that are significant for various types of businesses:

Retail business

For retail businesses, the Cash Conversion Cycle (CCC) is of prime importance. Retailers typically manage large inventories, so tracking how quickly they can convert this inventory into cash can provide valuable insights. Metrics like Days Sales Outstanding (DSO) and Days Payable Outstanding (DPO) also hold significance as they reflect how effectively a retail business is managing its receivables and payables.

Service-based business

In contrast, a service-based business with limited tangible assets and lower inventory might place more emphasis on liquidity ratios such as the Quick Ratio. This can provide a clear picture of whether the business can meet its short-term liabilities. They might also focus on the Operating Cash Flow to ensure they are generating sufficient cash from their regular operations.

Manufacturing business

Manufacturing businesses often find Free Cash Flow (FCF) to be a crucial metric as it helps them gauge how much cash is left after accounting for the costs of maintaining and upgrading equipment and machinery. The Debt to Equity Ratio can be another vital indicator for manufacturing businesses, especially those that rely on debt financing for capital expenses.

Startups

Startups, particularly those in the growth stage, should prioritise metrics like Free Cash Flow and Operating Cash Flow. Many startups operate at a loss in the initial years, making the understanding of their cash burn rate critical for survival and growth.

Non-profit businesses

Although they do not operate for profit, non-profit businesses still need effective cash flow management. They might find Operating Cash Flow and liquidity ratios essential to ensure they have enough resources for their ongoing activities.

In essence, selecting the right cash flow metrics and KPIs depends on your unique business needs and goals. And with Brixx Software, you can tailor your dashboard to focus on the metrics that matter most to your specific business type, ensuring you get the most meaningful insights into your financial performance.

Leverage visual dashboards for cash flow management optimisation in Brixx

Visualisation dashboards offer a powerful tool in the arsenal of cash flow management. They simplify complex data into easily digestible graphs, charts, and infographics, improving understanding. In addition, they enable tracking of trends and patterns over time, leading to precise forecasting and informed decision-making.

Brixx provides you with an intuitive, customisable visualisation dashboard that can significantly enhance your approach to cash flow management. By integrating these prudent practices with the robust visualisation capabilities provided by Brixx, businesses can obtain a superior understanding of their financial standing.