Starting an e-commerce business is an exciting venture, but navigating its intricate cash flow intricacies is crucial for long-term success. This guide offers a comprehensive step-by-step journey through cash flow forecasting, delving into crucial “what-if” scenarios to ensure resilience against surprises. Whether you’re just launching your e-commerce platform or seeking to fortify an established venture, let this roadmap guide your cash flow strategies for a prosperous future.

Get started with our forecasting software so that you can plan your business' futureCreate E-commerce cash flows in Brixx

Why is cash flow forecasting important in an E-commerce business?

Cash flow forecasting for e-commerce businesses is crucial for for several key reasons:

- Navigating volatility: Unlike brick-and-mortar stores, e-commerce businesses can experience swift fluctuations in sales, especially during promotional events, product launches, or seasonal trends. Forecasting helps businesses anticipate and prepare for these fluctuations.

- Inventory management: An accurate cash flow forecast helps e-commerce businesses decide when and how much stock to purchase. Overstocking can lead to holding costs and potential wastage, while understocking can result in missed sales opportunities.

- Marketing budgeting: E-commerce heavily relies on digital marketing campaigns to drive traffic and sales. Forecasting assists in allocating a marketing budget effectively, ensuring that funds are available for crucial promotional activities.

- Operational planning: As e-commerce businesses grow, they may need to invest in more sophisticated software, hire more staff, or expand warehousing. A cash flow forecast helps in timely decision-making regarding these operational investments.

- Future growth and expansion: To successfully scale, e-commerce businesses need to reinvest profits. A clear cash flow forecast can pinpoint when and where to reinvest for maximum growth.

- Risk management: By identifying potential shortfalls in advance, businesses can devise strategies to manage or mitigate risks, be it through securing additional funding, cutting costs, or diversifying revenue streams.

The data needed for an e-commerce business cash flow forecast

Incoming Cash:

- Sales: Estimate your daily or monthly sales by analyzing your website’s traffic and the conversion rate of visitors to customers. Consider the average order value and the frequency of purchases.

- Sales growth: Assess your expected growth in sales over a certain period, taking into account seasonal variations, marketing campaigns, and product launches.

Outgoing Cash:

- Cost of goods sold (COGS): Include the direct costs tied to the procurement or production of the items you’re selling. This might include manufacturing costs, packaging, and delivery to your warehouse.

- Operational expenses: Factor in regular, ongoing costs needed to maintain and grow your online presence. This should include web hosting, payment gateway fees, online advertising, website maintenance, and software subscriptions such as customer relationship management (CRM) tools and email marketing platforms.

- Asset expenditure: Include any major assets you’ve invested in to support your e-commerce operations, such as warehouse equipment, advanced server infrastructure, or specialized software.

- Loan payments: If your e-commerce business has taken out loans, ensure you include regular repayments, considering both the principal and interest components.

Steps to create a cash flow forecast for an e-commerce business using Brixx

In this guide, we’re diving deep into how an e-commerce business works, using the example of an online store that sells homemade soaps.

This online business presents a mix of various revenue streams, specific sales categories, diverse operational costs, and digital assets. Initiated with a seed investment, the business has aspirations to diversify its product range and tap into new market segments.

At the core of this venture lies its sales structure. Forecasting the volume and understanding the nuances of the different product categories become essential. Here’s a breakdown of the product offerings:

- Soap bars:

- Lavender

- Coconut

- Grapefruit

- Lemon

- Rose

- Aloe Vera

- Peppermint

- Gift hampers:

- Gift pack 4 bars

- Gift pack 8 bars

- Gift pack 12 bars

Identifying sales trends for each category, like the consistent sellers and the sporadically purchased items, is crucial for an accurate cash flow forecast. Such insights can highlight potential growth areas or indicate segments that might need reevaluation. However, while granularity offers richer insights, overloading the forecast with excessive product-specific details can be counterproductive. Grouping products and leveraging average metrics can give both depth and breadth to your insights, making the forecast more actionable.

Brixx, a powerhouse financial forecasting tool, is instrumental in navigating these layers. It offers tools for comprehensive business planning, allowing projections of profit, cash flow, and balance sheet up to 10 years in the future.

You can start your journey by signing up to Brixx or with a free cash flow forecast template.

All set? Let’s get started!

Step 1: Inputting your starting cash

Kick off your forecasting journey by initializing a new plan tailored for your business. For this guide, we’ll use a 3-year horizon, giving us an in-depth view of the upcoming year while offering a broader perspective on the following two.

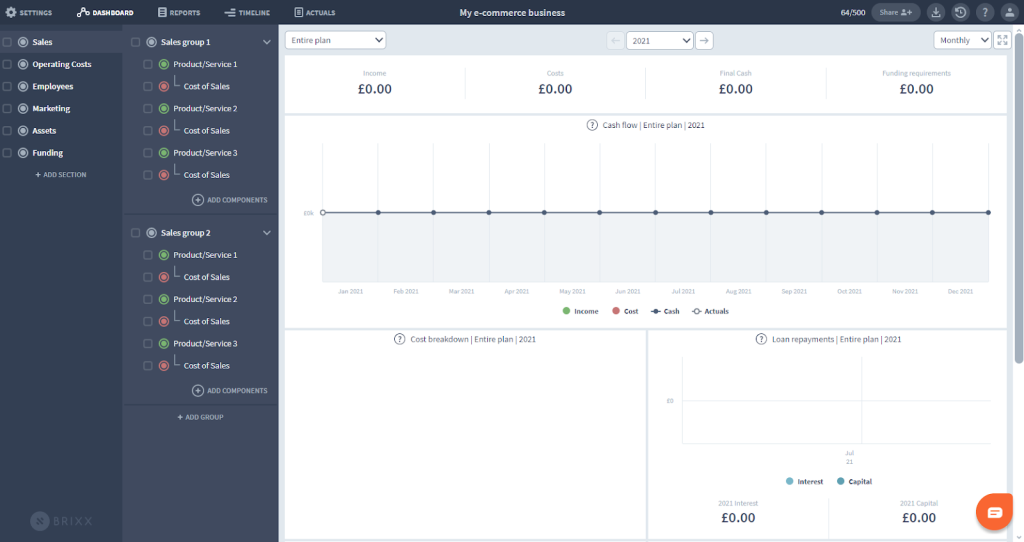

The blank Brixx plan starts like this:

Step 2: Forecasting your income streams

For our online store that sells homemade soaps, we have a variety of products:

- Soap bars:

- Lavender

- Coconut

- Grapefruit

- Lemon

- Rose

- Aloe Vera

- Peppermint

- Gift hampers:

- Gift pack 4 bars

- Gift pack 8 bars

- Gift pack 12 bars

When forecasting, it’s essential to have a detailed understanding of each product’s sales history, growth potential, and cash flow timing.

For instance, our hypothetical soap bars sell at a premium price of £3.99 per bar, while they cost £1 per bar from the supplier. We also offer them as gift boxes at discounted rates. It’s essential to reflect on past sales data, promotional strategies for growth, and account for factors like new product launches, marketing campaigns, market shifts, and competitor activities. Adjusting for these elements helps craft a comprehensive income forecast.

Step 3: Forecasting your costs

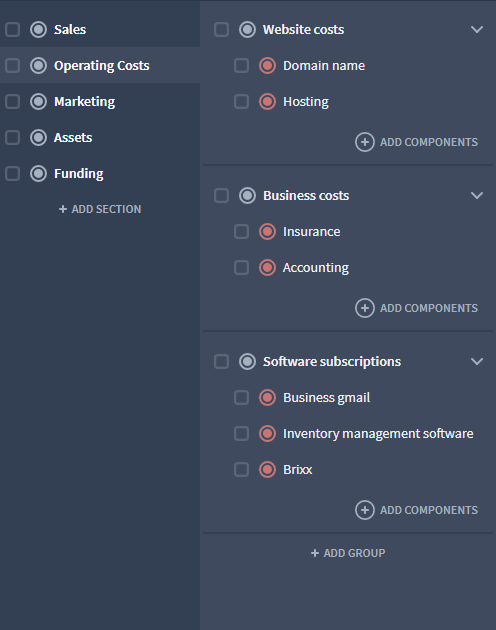

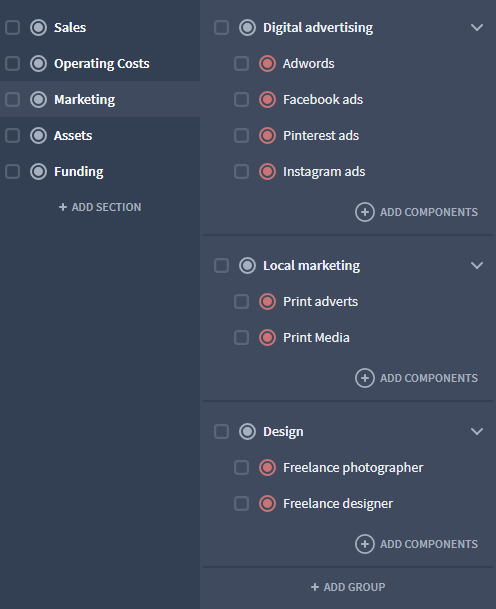

Managing the costs associated with an e-commerce business is as vital as understanding your income. Businesses typically categorize their expenses, with our hypothetical soap store distinguishing between ‘Operating Costs’ and ‘Marketing’.

The operational costs are broken down into further groups:

The marketing costs are similarly broken down:

As previously seen, these costs are mostly predictable and repeatable. This means you don’t have to input a varying amount in a table. You can just enter the figures and the frequency at which it repeats.

For the example below its £30 per month:

However, marketing expenses fluctuate, especially with seasonal campaigns or changing ad spends, making it vital for cash flow planning.

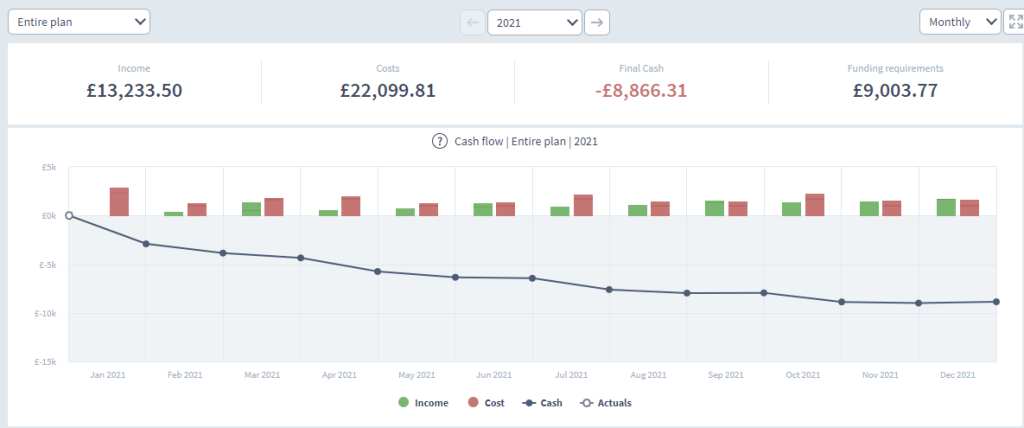

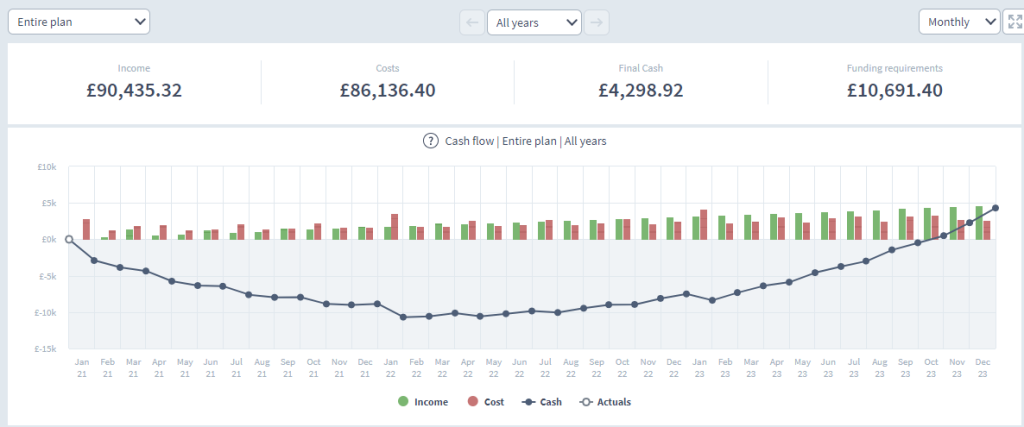

Observing our current cash flow, our startup’s sales don’t yet cover ongoing costs.

But, over a 3-year projection, sales are expected to surpass these costs. This underscores the importance of long-term views and the potential need for initial funding to sustain the business during early growth stages. It also insists that we are going to require funding to cover our first burn period whilst we grow our sales.

Step 4: Including your assets in the forecast

Every e-commerce venture will have significant capital expenses. These are typically large purchases such as office equipment or specialized tools required for production. In our scenario, we might consider the equipment needed for soap production or packaging. An e-commerce venture might also invest in company cars or high-end technology.

While these capital expenses have a direct cash flow impact, their value contributes to the business’s overall worth. For instance, we record a laptop’s value that depreciates by 20% each year. Although this doesn’t impact cash flow directly, if a business holds many assets, it’s an essential financial measure. Adjusting the timing of these asset purchases and assessing their effect on cash flow is crucial for financial planning.

If your particular e-commerce business does need to purchase a large number of assets you can easily explore the best time to spend this money by adjusting their start date on the timeline:

In the timeline view, you can drag the start months of each component.

The initial cash purchase will occur on this start date so you can adjust these around and then check the impact on your cash flow in your dashboard and reports.

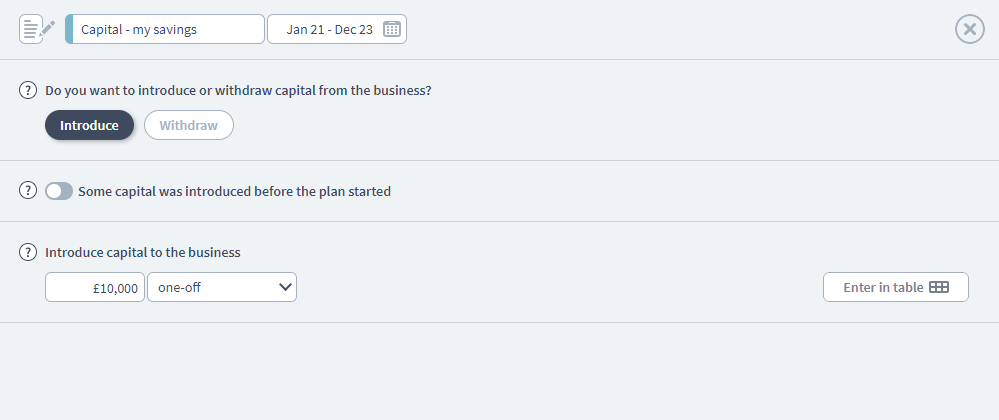

Step 5: Incorporating funding sources into your forecast

Funding is a pivotal component for any business, particularly startups. In platforms like Brixx, you can assess the cash implications of different funding strategies, be it loans, personal capital injection, or equities.

For our current forecast, a £10,000 capital infusion is needed in the initial year.

While this amount is a one-time contribution, Brixx offers flexibility in adding more funds over time. This investment adequately supports my business throughout the first year.

Alternatively, obtaining a bank loan is viable. But remember, loans aren’t just about the principal amount; interest plays a significant role. For instance, a 3-year loan of £20,000 with a 5% interest rate is another option I’ve modeled. Though it sustains the business in year one, it comes at a steeper overall cost.

While personal savings are ideal, not everyone has the luxury. In such cases, loans might be the optimal route. Brixx’s timeline feature enables users to strategize various funding methods throughout the forecast duration.

Like with the assets that were demonstrated earlier, you can use the Brixx timeline to introduce a variety of funding sources over the course of your plan to finance your activities. This covers all the elements that go into any financial plan. The output is your base cash flow scenario.

Once you’ve spent time considering your potential sales and all the other activities that are coming into the future you’ll have a really solid cash flow forecast to base your decisions on!