Starting a food van business can be fun and rewarding. But to make sure your business runs smoothly, you need to understand your cash flow – the money coming in and going out. This guide will show you how to make a cash flow forecast. It’s a helpful tool that can keep your business on track and help you plan for the future. It’s not as hard as it sounds and by the end, you’ll be more comfortable handling your business money. Let’s jump in!

What is cash flow forecasting?

Cash flow forecasting refers to the process of estimating the amount of money that will flow in and out of your business within a specified period. It involves predicting the cash your business will generate (income) and the money it will spend (expenses) over a certain period, typically on a monthly basis. This process allows you to anticipate the future financial position of your business, giving you a clearer understanding of your venture’s financial health and sustainability. It serves as a roadmap, guiding your financial decisions to ensure the long-term viability of your business.

Learn more with our beginners guide to cash flow forecasting.

Get started with our forecasting software so that you can plan your business' futureCreate cash flows for your food van business in Brixx

Why is cash flow forecasting important in a food van business?

Cash flow forecasting is crucial in a food van business due to the industry’s inherent challenges like fluctuating demand, seasonality, and unpredictable operational costs. It allows you to anticipate potential financial pitfalls, make informed investment decisions, and plan for substantial upfront expenses such as the van, equipment, and licensing. Importantly, an accurate forecast enhances your capability to respond effectively to unforeseen business circumstances, ensuring resilience amidst volatility.

The data needed for a food van business cash flow forecast

Creating a cash flow forecast for your food van business requires a detailed and accurate understanding of the money coming in and going out. Here’s a simplified breakdown of the data you need:

Incoming Cash:

- Sales: Estimate your daily or monthly sales by considering the volume and pricing of your food items.

- Sales growth: Project your expected growth in sales over a certain period.

Outgoing Cash:

- Cost of goods sold (COGS): Account for the direct costs tied to the production and sale of your food items.

- Operational expenses: Consider regular, ongoing costs needed to run your business. This can include things like insurance, licenses, advertising, and utilities.

- Asset expenditure: If you’ve invested in significant assets for your business like a van or equipment, include these in your outgoing cash.

- Loan payments: If you have a business loan, don’t forget to factor in your regular repayments.

Steps to create a cash flow forecast for a food van business using Brixx

In our guide, we’ll be using a real-world example of a coffee van business to demonstrate the steps.

This food van, selling coffee, cakes, and cold drinks, is a growing venture with multiple income components, varying operational costs, and significant assets. The business also holds a loan for initial setup and plans to expand by adding a second van. We will navigate the complexities of forecasting these elements, including sales growth, cost calculations, asset depreciation, loan repayments, and expansion costs. This case study serves to show how you can effectively manage your cash flow forecast for your food van business using Brixx.

Brixx is a financial forecasting tool used for business planning and more – allowing you to forecast your profit and loss, your cash flow, and Balance Sheet up to 10 years in the future.

You can start your journey by signing up or with a free cash flow forecast template.

With that out of the way, let’s get cracking.

Step 1: Inputting your starting cash

The starting point for any business forecast is your beginning cash balance. This can be funds from savings, early investments, or loans. In our coffee van example, the startup acquired a business loan of £22,500 which would be input as the starting cash.

Step 2: Forecasting your income streams

Next, you’ll want to forecast your income streams, often divided into product categories. In the coffee van case study, the income was broken down into “coffee sales”, “cake sales”, and “cold drink sales”. The forecast was based on selling 30 units of coffee, 10 units of cake, and 5 units of cold drinks per day, with a projected increase of 5% a month until the end of the year, then 3% growth a month thereafter.

- Recommended Reading: How to Start a Cake Business

The next graph represents a standard percentage growth over three years, but real life isn’t quite so straightforward. There are likely to be fluctuations due to seasonality and shifts in the market. For example, in February 2021, there were more people out walking as we were in the middle of a lockdown. But what happens when people have more options for spending their leisure time, such as during the summer? It might be prudent to forecast a downturn or uptick in sales to account for these potential changes.

We also have a more detailed guide on planning a sales forecast.

Step 3: Forecasting your costs

Forecasting costs requires careful analysis and can be broken down into two categories:

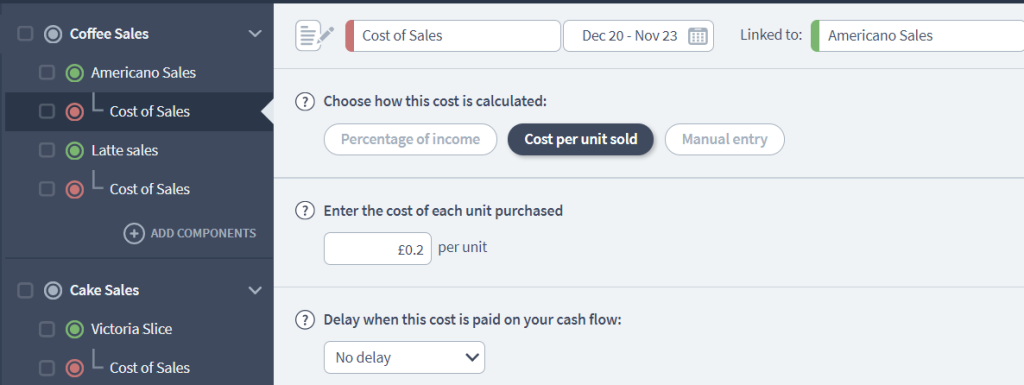

1. Detailing cost of goods sold (COGS)

The COGS directly corresponds to each income stream. In the case of the coffee van, the costs for producing coffee, cakes, and cold drinks were linked to each income component using Brixx’s “cost per unit sold” feature, which automatically calculates total costs based on the sales forecast.

2. Outlining operational costs

Operational costs include all the ongoing expenses needed to run the business. For the coffee van, this included insurance, marketing costs, licenses, and training. More specifically:

- Public Liability Insurance: £324.30 annually

- Car insurance: £950 annually

- Road tax: £150 annually

- Street food license: £200 annually

- Social media ads: £50 monthly

- Print adverts: £25 monthly

- Utilities: £100 monthly

These operational costs were carefully projected and incorporated into the overall cash flow forecast.

Step 4: Including your assets in the forecast

The assets for a food van business typically include the van and any equipment necessary to prepare and serve your food. Brixx can be used to calculate depreciation of these assets, an important factor for long-term financial planning.

Step 5: Incorporating funding sources into your forecast

To kick start the coffee van business, a business loan of £22,500 was acquired. This loan, set up for 3 years at 5% interest, covered the cost of the van and conversion. Such sources of funding should be factored into your cash flow forecast.

There are several different types of investor that you can approach for funding, or you can get a business loan – it’s up to you.

Step 6: Growing your food van business

Let’s say our coffee van startup plans to add a second van in the city centre. We’d duplicate our income and cost of sales components since the new van will sell the same products, and adjust sales based on the expected higher city centre footfall.

We’d also duplicate costs for insurance, utilities, etc. and account for new staff.

Planning to start the second van’s activities in mid-2022, we need an additional loan for the van and branding.

Using Brixx’s Timeline feature, we can test various scenarios and see when expansion is feasible based on our steady income and the ability to afford extra monthly payments.

However, it’s crucial that your cash flow is built on sound assumptions. Creating best, worst, and base case scenarios can help with this. Brixx also lets you adapt to unexpected circumstances and track your progress against forecasts, ensuring your growth is on track.

Step 7: Creating your net cash flow

The net cash flow is the difference between your cash inflow (income) and outflow (expenses) in a given period. Brixx allows you to visualize your net cash flow in the form of charts and graphs, enabling you to see your cash flow trends and patterns.

Step 8: Adjusting and reviewing your cash flow forecast

It’s crucial to regularly revisit and adjust your cash flow forecast to reflect changes in your business or market conditions. In our coffee van example, a plan for expansion was modeled, including the costs and income of adding a second van and staff. Adjustments were made using Brixx’s Timeline feature, testing different start times and potential scenarios.

Taking the next step!

In conclusion, keeping an eye on your cash flow forecast is key for your food van business. It helps you see when you can grow, plan for changes, and stay on track. By comparing your real figures with your forecasts, you’ll get better at predicting future cash flow.

Plus, you can run ‘what-if’ scenarios, like hiring more staff or dealing with price increases, to help you be ready for whatever comes next. By using a financial modelling tool for food vans like Brixx, managing your cash flow becomes easier and your business planning more effective.