Starting and managing a successful gardening business requires careful financial planning, and a cash flow forecast is a valuable tool for achieving financial stability and growth. In this guide, we will provide step-by-step instructions on how to create a comprehensive cash flow forecast specifically tailored for a gardening business. Whether you are just starting out or looking to expand your existing gardening venture, this guide will help you develop an effective cash flow forecast to manage your finances and ensure the success of your gardening business.

If you’re completely new to gardening businesses, you can check out our complete guide to starting a gardening business.

What is cash flow forecasting?

A cash flow forecast is a projected expectation of the total money a company expects to come in and out of the business within a certain time period. This forecast will take into consideration all potential revenue sources and expenses.

Why is cash flow forecasting important in a gardening business?

Cash flow forecasting is essential for gardening businesses as it allows for effective financial management tailored to the unique characteristics of the industry. By accurately predicting the inflow and outflow of cash, gardening businesses can ensure they have sufficient funds to cover expenses such as equipment purchases, seasonal labor costs, plant inventory, marketing efforts, and general operational expenses. This helps in maintaining a healthy cash flow, avoiding cash shortages during low-demand periods, planning for expansion, and making informed financial decisions to ensure the long-term success and sustainability of the gardening business.

The data needed for a gardening business cash flow forecast

Compiling precise data is a key step in creating a robust cash flow forecast for your gardening business. This data can be broadly categorized into cash inflows and cash outflows. Let’s delve into these categories:

Incoming cash:

- Sales: This is your projected income from offering various gardening services or selling products. You will need to estimate the number of hours you plan on working each day and the number of clients you expect to have to calculate your potential revenue.

Outgoing cash:

- Cost of services provided (COSP): These are the costs directly associated with the provision of your gardening services. Typically, this includes expenses for supplies like soil, seeds, and plants, as well as direct labor costs if you employ additional workers.

- Operational expenses: This category encompasses regular, ongoing costs necessary for running your business. Examples in the gardening industry might include insurance, marketing costs, licenses, training, and more.

- Asset expenditure: If your business requires one-off purchases of significant assets such as a van, mowers, strimmers, or other gardening tools, these costs need to be factored in.

- Debt repayments: If your gardening business has accrued any debt, perhaps for initial setup or purchase of essential equipment, it’s important to account for these repayments in your cash flow forecast.

Steps to create a cash flow forecast for a gardening business using Brixx

In this section, we’ll walk through creating our cash flow forecast step by step.

This gardening business offers a range of services, including lawn maintenance, landscaping, and garden design. It operates with a small team and has various income sources, operational costs, and essential assets like tools and equipment. We will navigate through the process of creating a cash flow forecast for this gardening business, taking into account factors such as sales estimates, cost calculations, asset maintenance, and loan repayments.

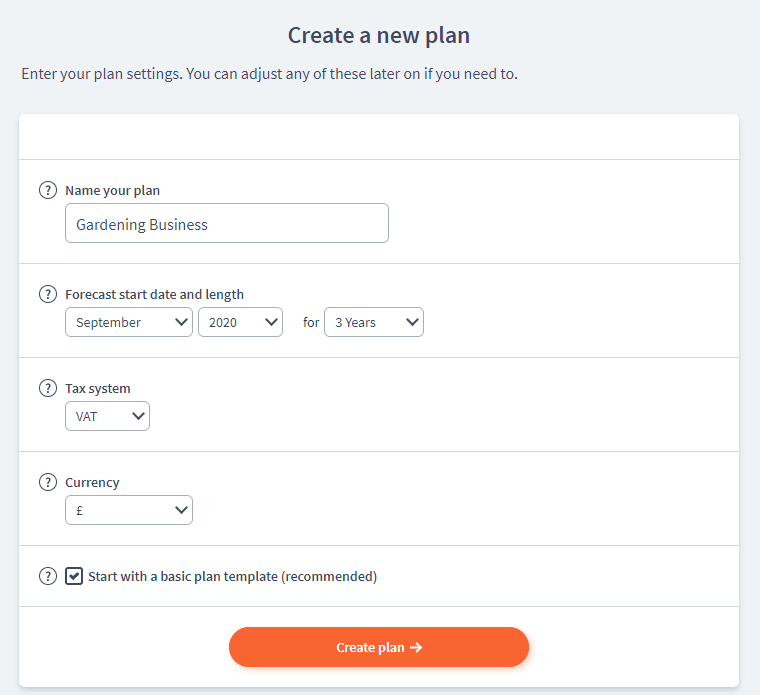

Now, I’ll be building a plan in Brixx – you can follow along by signing up!

With the plan length set for 3 years, VAT activated (applicable for businesses exceeding a turnover of £85k) and GBP as the chosen currency, the next step is to press the “create plan” button.

Following this action, a new screen appears. On its far left, various categories like “Sales,” “Operating costs,” and more can be found. Selecting one of these categories will display a list of components to the right, as depicted in the screenshot with “Sales group 1” and “Sales group 2”.

These components provide slots for specific business data. For instance, “per hour garden maintenance” could be inputted in “Sales group 1”. More on how to add these details will be covered in the next section.

Step 1: Inputting your starting cash

The first step would be to enter your starting cash. This is the initial capital you have on hand to start your gardening business.

Step 2: Forecasting your income streams

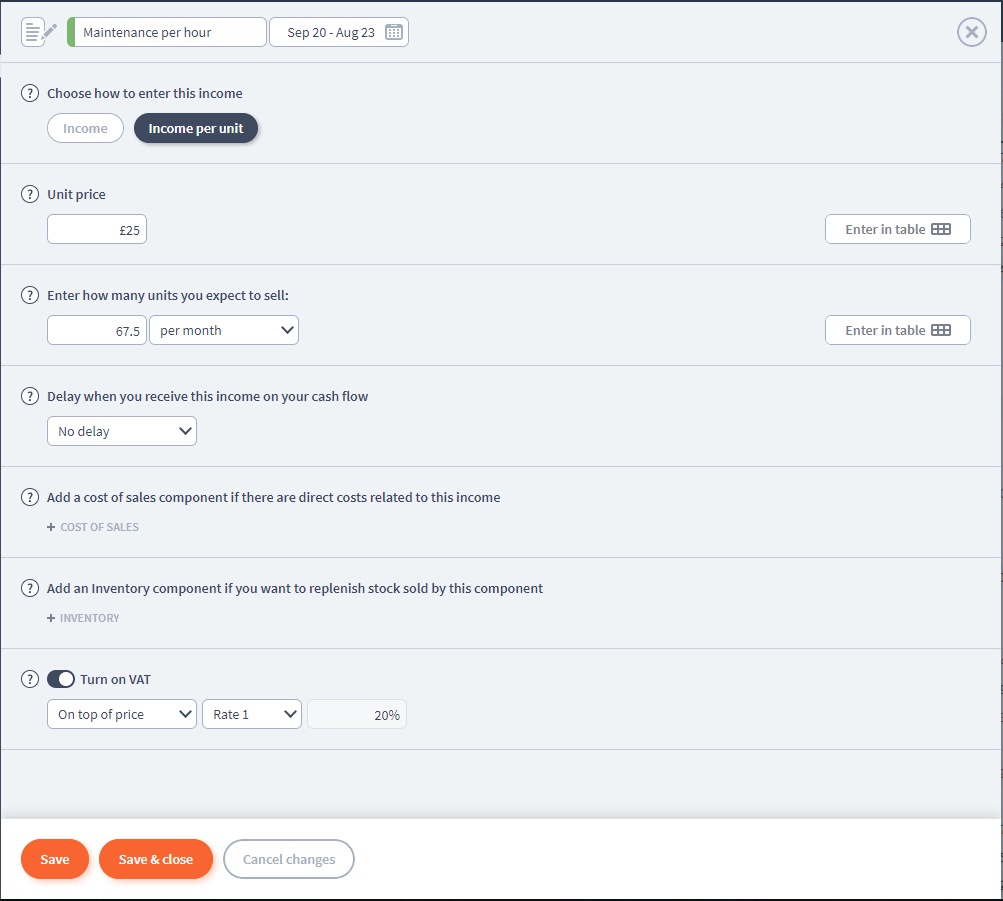

In this step, a clear understanding of average weekly income is key, especially for existing businesses. Calculations can begin with the total work hours per day, such as from 7 am to 4 pm, after subtracting any lunch breaks. Multiplying these daily work hours by the hourly rate and the average number of working days in a month provides a preliminary estimate for the income.

However, for an effective cash flow forecast, it is crucial to think beyond current earnings and consider future revenue growth strategies.

For those just embarking on their gardening business journey, deriving sales estimates without years of past data might seem challenging but it is still doable. Starting with the number of work hours per day, assess the realistic customer base that could be built in the initial months.

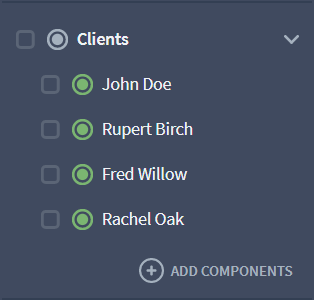

The sales forecast can be inputted into Brixx as shown in the example below:

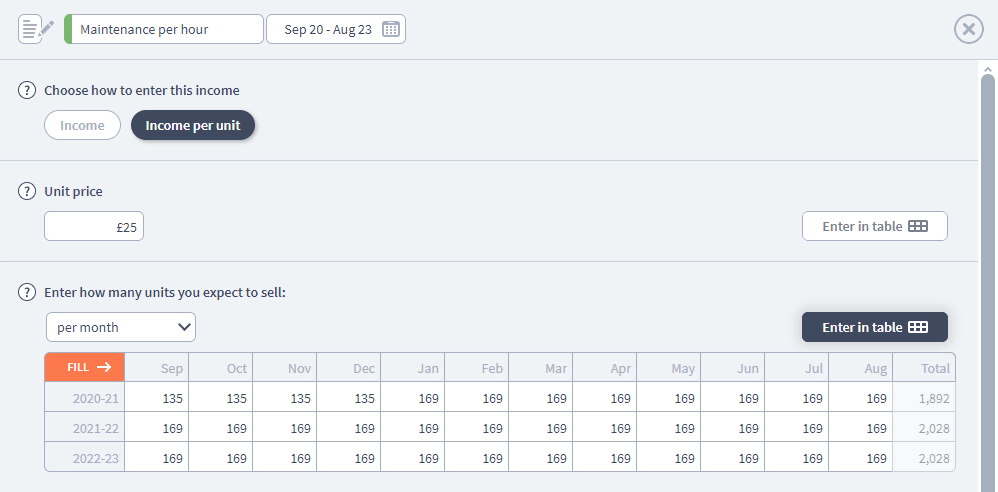

Furthermore, month-by-month variations can be handled by entering units in a table format.

When crafting the forecast, segregate product offerings as much as possible. This helps in identifying the most profitable income streams, a task that becomes arduous when all income is clumped together.

While using a single component or cell can work for quick estimates or uncomplicated businesses, a detailed breakdown provides better insights. This can be achieved by segregating income from recurring weekly clients or by creating separate categories for different services, such as a dedicated planting service.

This detailed product segregation facilitates a comprehensive analysis of product profitability, illuminating what works and what doesn’t in the business. Investing time in this detailed breakdown at the outset can save time in the long run and assist in successful business navigation.

Step 3: Forecasting your costs

1. Detailing cost of services provided (COSP)

Start by noting down every cost directly associated with providing your services. These costs could include expenses like fuel for your vehicle and materials like plants, seeds and fertilizers. You can use past bank statements to help calculate these costs. For example, if you completed 100 hours of work in one month and spent £150 on fuel, you might estimate that your per-hour cost of services provided is £1.50. Keep in mind that if you’re forecasting an increase in services provided, your COSP will likely increase as well.

In the case of a straightforward gardening business, COSP may not be extensive. Consider an example where the costs of services provided are £3 per working hour. If the revenue is £25 per hour, the profit would be £22 per hour. Brixx will automatically calculate the total COSP based on the services forecast. So, any changes to the services forecast will automatically adjust the COSP in sync.

2. Outlining operational costs

Operational costs are generally fixed and relatively easy to predict as they occur either monthly or annually. They encompass regular expenses needed to keep your business running, such as insurance, marketing costs, licenses, and training.

If you anticipate an increase in the services provided, you need to think about how you will achieve that growth. Often, this involves increasing your marketing spend. However, there may come a point when the demand starts to outstrip your capacity to provide services. At this stage, consider the possibility of hiring additional staff. Remember, hiring involves not only the salary but also the cost of additional equipment.

Be sure to review renewal prices for memberships and insurance and cap your marketing spend to avoid unexpected large bills.

As an example, for a start-up, insurance might cost £17.53 per month. For marketing, you might consider local and online advertising. Print adverts might cost around £50 a month, and you could cap social media spend at, say, £25 a month.

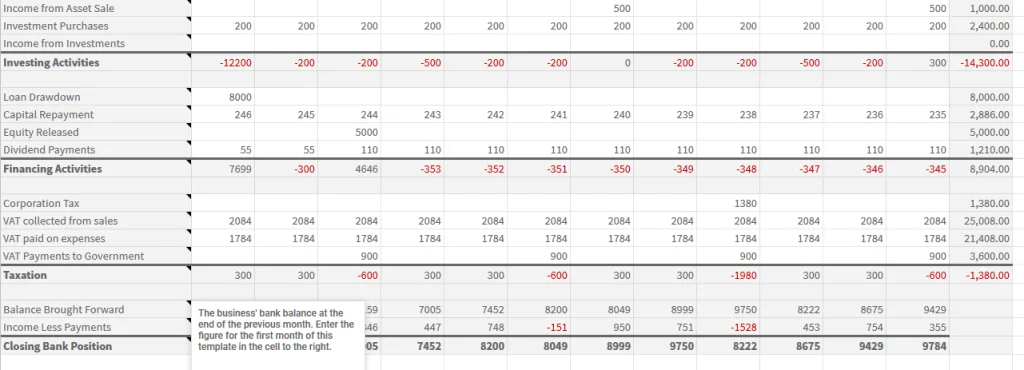

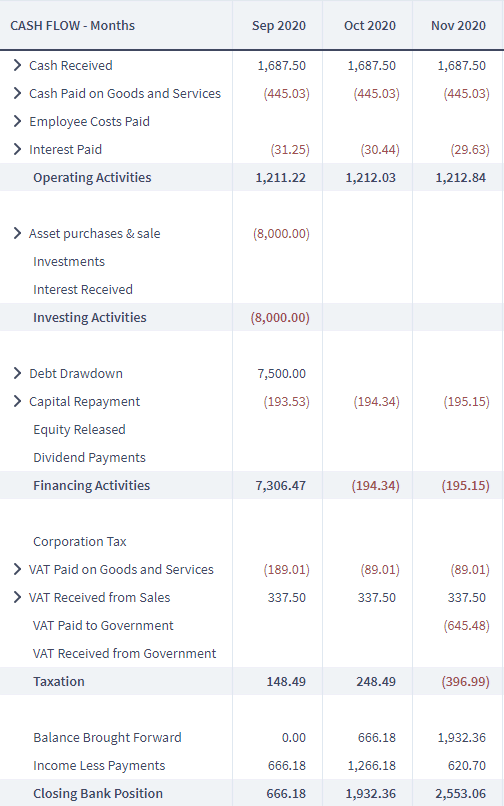

Upon integrating income, COSP, asset purchases, and operational costs, a cash flow forecast may look something like this:

Step 4: Include your assets in the forecast

In expanding your gardening business, you’ll need more tools and staff. These large expenses should be considered in your forecast. Can you afford them upfront, or is a loan required?

It’s also crucial to budget for emergencies like equipment breakdowns. Without prompt repairs or replacements, your business operations and income could stall.

You will likely need to buy all the equipment up-front if you’re starting as a new business. This might end up being relatively expensive, depending on how grand your scope is when starting.

You’ll need to buy things like:

- Strimmers

- Secateurs, trowels, etc.

- Van(s)

- Mowers

Most people won’t be able to afford this upfront, so you’ll likely need to take a small loan out, remember to put the repayments into your cash flow forecast as a monthly cost.

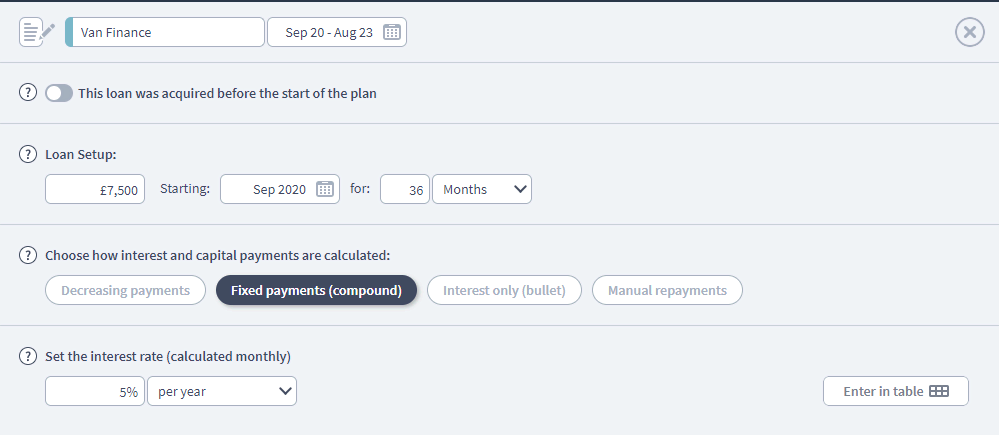

Here’s an example of how this might be entered into Brixx:

- Van = £7500 spread monthly over 36 months

- Lawn Mower = £500 (paid outright)

Remember your assets will decrease in value each year due to depreciation.

Step 5: Incorporating funding sources into your forecast

Getting your gardening business off the ground or growing it might require some form of funding. This could be personal savings, loans, or even investments. With Brixx software, you can simulate various loan scenarios by adjusting loan amounts, interest rates, and repayment terms.

For instance, if you can’t afford to buy the required equipment upfront, you might need to take a small loan. When inputting this into Brixx, make sure to include the repayments in your cash flow forecast as a monthly cost.

If you need a substantial amount of cash, you might need to approach a bank or investors. This inclusion in your forecast will help you understand the financial implications and plan accordingly.

Step 6: Creating your net cash flow

After detailing your income, costs, assets, and funding, you can now create your net cash flow in Brixx. This will involve subtracting your total costs (including cost of sales, operational costs, asset purchases, and loan repayments) from your total income.

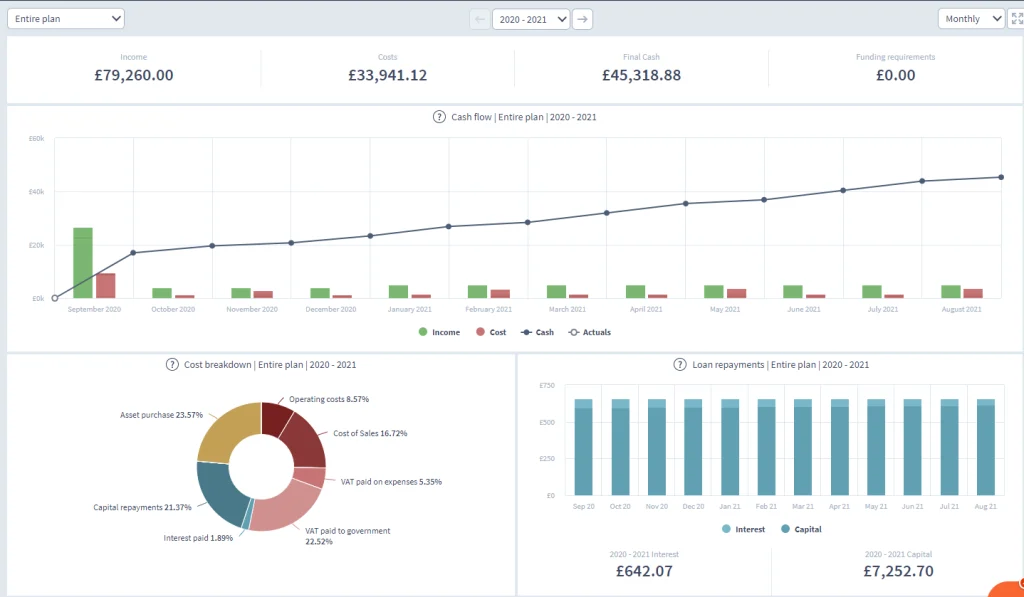

Brixx turns your cash flow data into simple charts and graphs. This makes it easy to see when money is coming in and going out, and to spot any future problems. Here’s a peek at how it looks:

Step 7: Adjust and review your cash flow forecast

Over time, enter your actual performance data to compare it with your forecast. This will help you make necessary adjustments and take action, whether that’s increasing your prices, changing your business model, or planning for growth.

Try testing out different scenarios and see how this will affect your business, some of these questions are great to model:

- What happens if your costs rise?

- When can you hire that extra staff member?

- What happens if your mower breaks down?

- What happens if you a key client?

Taking the next step!

Excellent! You’ve made it through the initial steps of creating a cash flow forecast for your gardening business. However, keep in mind that this process doesn’t stop here.

As your business grows, so will your cash flow, necessitating re-evaluations and consideration of various situations. Whether it’s ensuring enough cash on hand for sudden equipment replacements, budgeting for a new team member, preparing for unexpected maintenance costs, or planning a landscape renovation project, your cash flow forecast serves as a reliable guide.

Perform cash flow forecasts in Brixx

Get started with our forecasting software so that you can plan your business' future

Start your journey towards financial foresight today with a free trial of our forecasting software. Experience the confidence and control that come from a precise and efficient cash flow forecast.