A cash flow forecast is an essential part of managing and growing your business successfully and learning to create a cash flow forecast in Brixx can make the process easier.

It’s crucial for:

- Highlighting if you are in danger of running out of cash

- Planning how you’ll spend money to grow your business

- Creating 3-5 year financial plans for investors

- Running what-if scenarios to stress test your business

- Exploring the impact of new projects on your future finances

However, creating a cash flow forecast can be daunting! Finance doesn’t come naturally to all of us and not everyone is comfy with spreadsheets.

We set out to change this by making Brixx; a powerful financial forecasting tool that helps to demystify finance. Whether you’re an entrepreneur or an experienced accountant, the app helps people of all financial skill levels generate professional forecasts in a simple way.

In this article, I’m going to demonstrate forecasting a coffee shop but you can use the same principles to model any business in the app. Let’s look at the 7 steps you need to follow using Brixx as your cash flow forecasting tool.

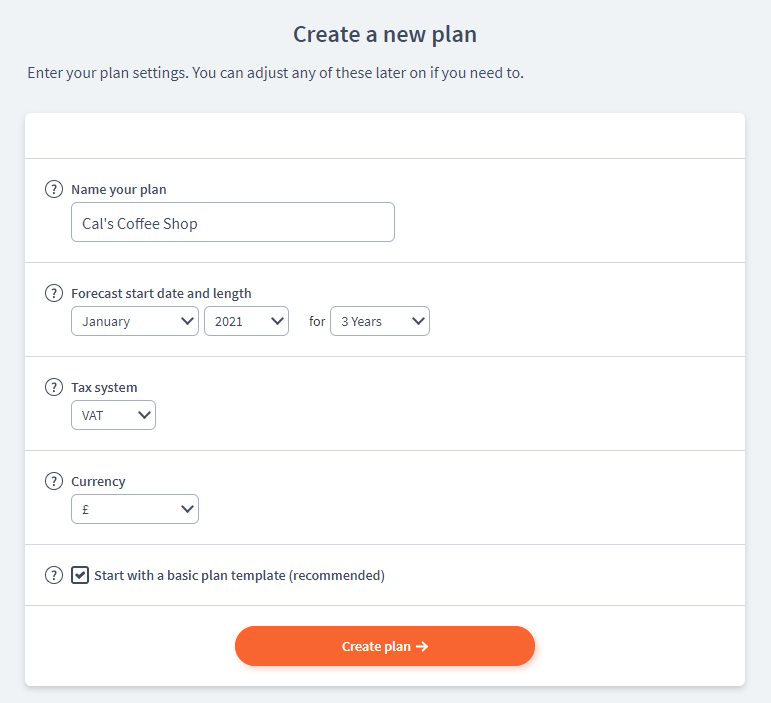

Step 1: Creating your plan

Starting from the beginning: We need to set up a plan and create a cash flow forecast!

This is the plan creation screen. Here, you need to choose the start date and length of time you want to forecast for.

In this plan, I’m going to forecast 3 years into the future.

Longer durations tend to be good for high-level strategic plans where you set out the goals and aspirations for your company. It’s what investors will want to see.

A shorter, one year plan is better for a more detailed set of budgets for the year ahead. Consider your needs and pick the best option for your requirements.

Step 2: Structure your plan

When I explain Brixx to people, I often say “You build a picture of your business in Brixx”.

The “picture” is crucial.

The picture you create is a clear view of every activity in your business. It’s built using components which represent these different activities.

It’s a key difference between typing up a static cash flow statement in a spreadsheet and creating a living model of your business you can manipulate.

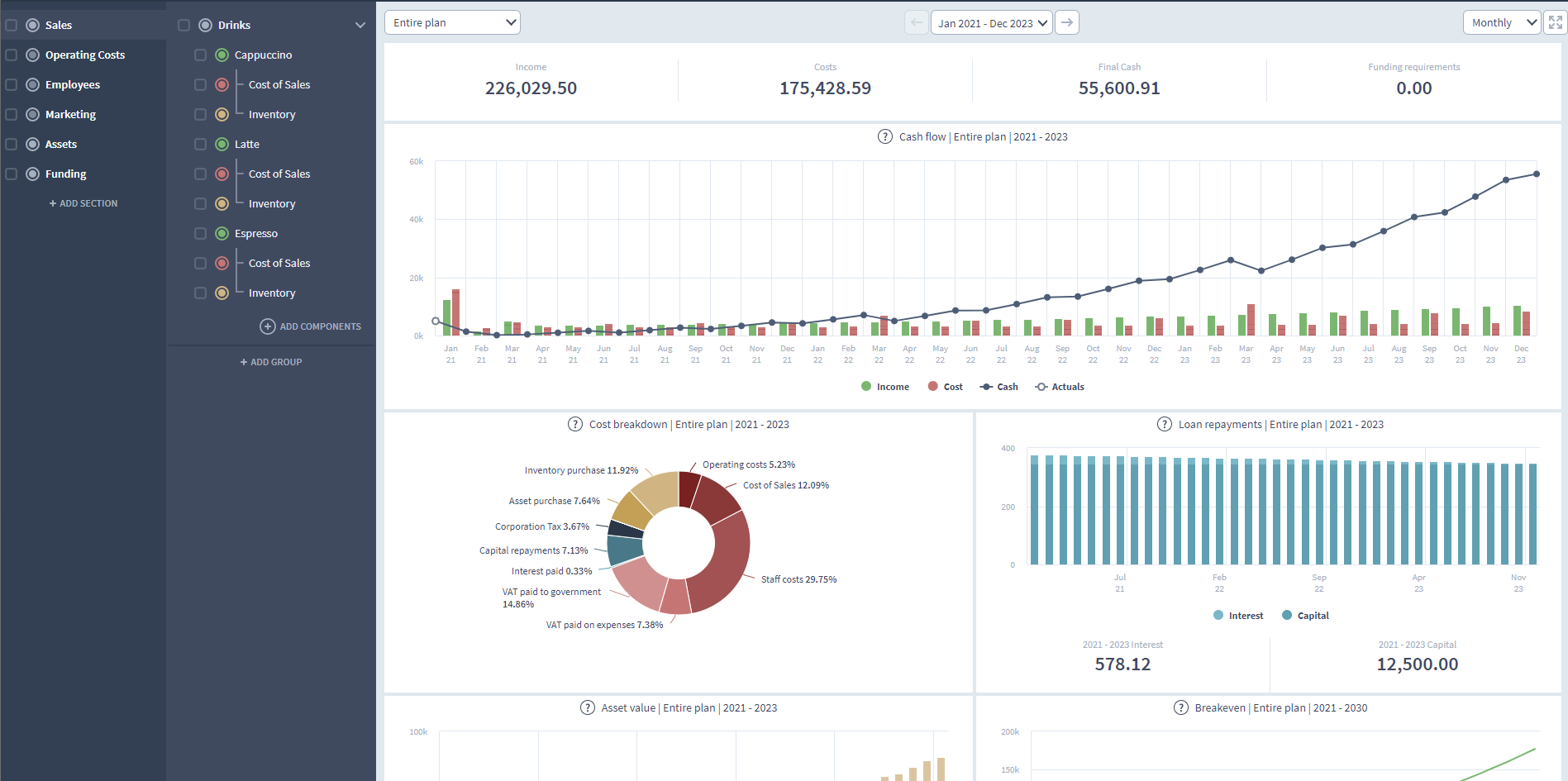

In this image, you can see the dashboard. On the left, you can see the “picture” of my business. Each component represents an activity in my coffee shop and contains a forecast. The combination of these components generates the dashboard and reports on the right hand side.

These components are split into four coloured coded types:

- Income

- Expenditure

- Assets

- Finance

Using combinations of these components, organised into sections and groups you can visualise every activity in your business in a modular and flexible way.

This flexibility makes it incredibly easy to model businesses of any size, complexity and maturity. It is also great for scenarios – more on that later!

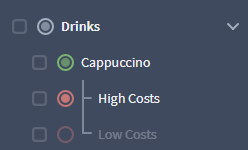

Green represents income, red for expenditure, yellow for assets and blue for funding sources.

When you start your plan, you’ll begin with a standard template so you aren’t staring at a blank page. It’s structured with a set of components typical for many businesses. You can rename, delete, copy or add to this structure to make it fit your particular business.

You can create detailed structures to categorise the activities in your business:

- Income

- Income category 1

- Product or service A

- A Product or service B

- Product or service C

- A Product or service D

- Product or service E

- Income category 2

- A Product or service A

- Product or service B

- A Product or service C

- Income category 1

You can have as many (or as few) components in any group as you want; the more detail you add, the more accurate your forecast can be. However, this comes at the cost of the speed of building and changing your model over time. The more you break down your business, the less agile you can be at quickly testing ideas and scenarios.

You’ve got to strike the right balance and you’ll learn this over time as you forecast more.

I recommend watching “Getting started with Brixx part 2: How to forecast your sales”. In this video, we demonstrate how to use groups and sections to structure your business in Brixx.

Let’s get started with the income forecast for my coffee shop.

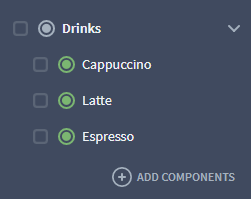

Step 3: Forecast your income

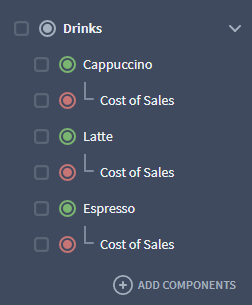

I’m going to use Income components to divide up the products I sell in my coffee shop. Here you can see I’ve used them to represent my cappuccinos, lattes and espressos:

Each drink type is its own component (rather than lumping all my sales together in one) because it allows me to break down my sales forecast in reports. Generally, the more detail you have the more information you have to inform your decisions.

Each component contains the forecast for that particular element of your business. Let’s take look inside one of these components:

You can see I’ve estimated the amount of units I think I’ll be able to sell each month.

Creating a reliable sales forecast for the months ahead can be difficult. The future is hard to predict!

For my coffee shop my starting point will be:

- Looking at the data for the same time last year.

- Looking at my most recent performance.

- Considering current and upcoming market factors.

When it comes to forecasting your cash flow, you need to make some educated decisions about what you think is going to happen using historical data. If you don’t have any historical data yet, you need to rely on your market research.

The Income component will also forecast the associated taxes for your country automatically.

Based on your forecast, the government payments will be generated for you so you can see the upcoming payments.

Step 4: Forecast your costs

They say to make money, you have to spend it first!

In Brixx, we have a number of cost components that handle the forecasts for Operating, Employee and Cost of Sales.

For my coffee shop, I’m going to be:

- Understanding which costs were associated with previous activities.

- If there are any unnecessary costs which can be cut, reduced or prevented.

- Knowing which costs are going to be hitting my cash flow and when.

If you’re looking to start your own business, I recommend checking out our guide on estimating your start-up costs.

Cost of Sales

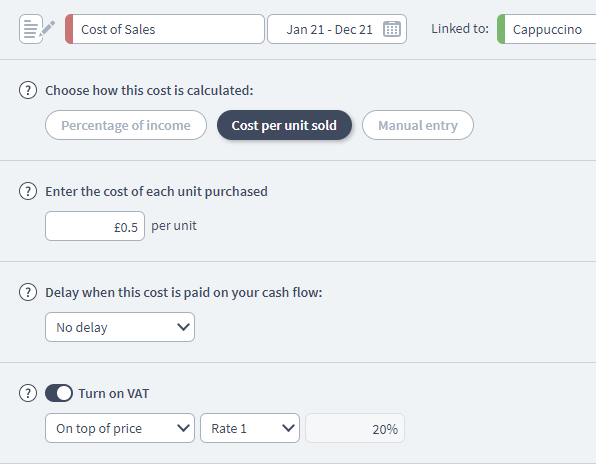

The Cost of Sales components can be linked to Income components to calculate costs based on your sales forecast:

Let’s look inside a Cost of Sales component:

The Cost of Sales component is set to “cost per unit sold”. The number of units I entered in my sales forecast will drive the costs set here.

Operational Costs

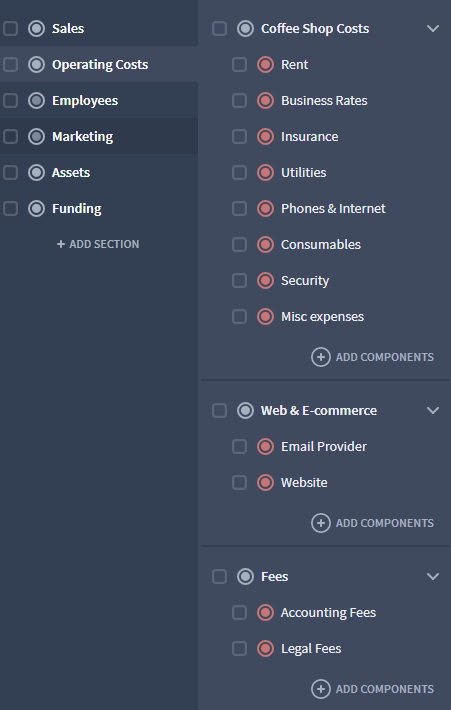

The Operating Costs component can be used to forecast your ‘fixed costs’. These costs don’t vary with the amount of units sold like office rent or phone bills.

If you haven’t started building your forecast yet, I often recommend people to start here.

These costs are often the easiest to predict and so are a good way to get some numbers rolling.

Again, as with your sources of income, make sure you break down your costs into different groups.

The Brixx template starts with 2 sections and numerous groups dedicated to splitting out these operating costs as it’s really key to know where the cash is leaving your business.

Just creating a forecast for the costs in your business is an eye opening exercise. It can make you start to question and probe further into your finances to ensure they are all working efficiently.

Employee costs

The Employee component can be used to forecast staff salaries. Salaries are usually one of the largest costs to any company so it’s really worth focusing on breaking this out into its own area.

Remember, whenever you break an area down in Brixx, it gives you the opportunity to view these components in detail in your reports.

It’s well worth adding one Employee component for every person you employ or plan to employ.

You can use the timeline to manage when they start, allowing you to plan your future hires and play with scenarios around start dates.

Of course, if you employ hundreds of staff – you can make this more manageable by using one Employee component for each salary bracket. You can then set how many employees are in that salary bracket at any one time.

Step 5: Forecast your assets

Assets are different from general costs in the previous step. Whilst they do cost you money to buy, impacting your cash flow – they also add value to your business whilst you own them.

They generally cover large spending towards machinery, equipment, vehicles etc. Items key for running and growing your business.

Assets in Brixx are represented by the Asset, Investment and Inventory components.

There are several areas I am going to look at for my coffee shop forecast:

- Do I need to purchase or replace any equipment?

- Are there any existing assets that I am planning on selling for cash?

- Do I hold any stock for over a month that is worth classing as inventory?

Assets have a simple impact on your cash flow. They are generally simply another source of cash spent.

Assets become more interesting on your Profit & Loss forecast and Balance Sheet forecast!

They add value whilst they are a part of your company but often that value changes over time. This is generally shown as an expense on your Profit & Loss. For example, depreciation through wear and tear.

You don’t need to worry too much about this for your cash flow forecast but if you complete each Asset component then Brixx will also generate the correct entries in your P&L and Balance Sheet forecasts too!

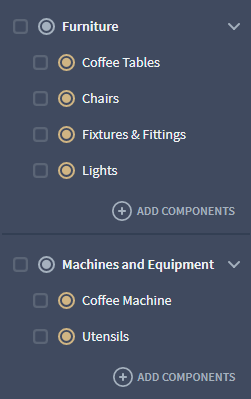

In my coffee shop, I have a surprising amount of assets. From furniture and storage areas to coffee machines and kitchen equipment.

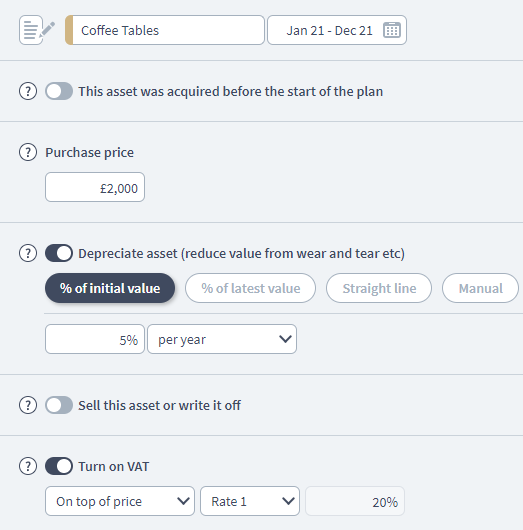

Let’s take a look at a simple but essential asset, the humble coffee table:

Asset component

This component allows for the purchase, depreciation and sale of assets.

This is great for items such as furniture in a coffee shop as it can represent the gradual reduction of value due to wear-and-tear, and eventual replacement.

Investment component

The Investment component is used to forecast external cash investments the business makes including trading on the stock market or purchasing equity for another business.

An Investment component is a great tool for managing how your company handles its cash which has no plans to be utilised in growth or expansion.

Inventory component

Your Inventory components, much like your cost of sales run in parallel with your income components.

Unlike the Cost of Sales component, it has an impact on your balance sheet.

This is because it is used to automatically purchase stock in advance of the sale. The value is then preserved on your Balance Sheet until the sale is made. When the sale is made, the expense is recognised on your Profit & Loss report and the Balance Sheet value reduces.

If you are only interested in looking at cash flow, you can use the Cost of Sales component for all of your direct costs.

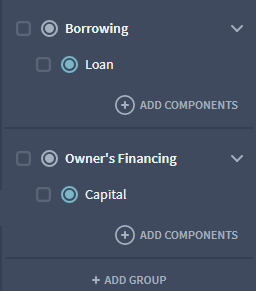

Step 6: Forecast your funding

How you fund your business can have a number of repercussions on your cash flow. You generally need to look at it in two ways:

- Short term funding required to plug any gaps in your cash flow

- Long term funding required to grow my business

There are many ways that a business can acquire funding for starting up, growing or developing a business. The components we use to handle these are Loans, Equity and Capital.

For my coffee shop forecast, I’m going to look at:

- Can I afford the repayments on the loan I’m considering?

- Is it worth giving up ownership in the business for outside investment?

- What would be the benefits and risks of investing my personal capital into the business?

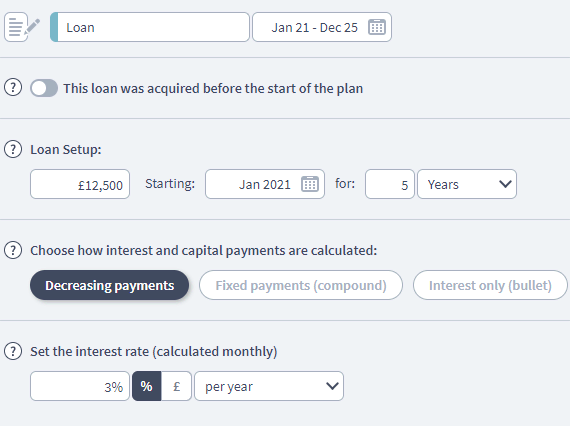

In my coffee shop I have set up a Loan component. I can experiment with different lengths and repayment options to see the impact on my cash flow. I have also set up a Capital component to represent a cash injection from me, the owner.

Loan component

This Loan component allows me to set the length of the loan, the amount borrowed and the interest rate associated with it. It will spread out the repayments of the loan over the period of allocated time either in decreasing payments, compound payments, or interest only.

A longer duration generally means lower repayment costs each month but a higher cost in interest overall.

Equity component

The Equity component allows for shares of the company to be sold in return for cash, as well as modelling dividend payments.

Dividend payments to shareholders can be forecast using an amount per share or a percentage of your profits.

Capital component

The Capital component is used for the introduction or withdrawal of funds from the business.

It can be used to manage funds from the owner or investors that doesn’t calculate based on the number of shares.

Step 7: Run Cash Flow scenarios

Now we’ve gone through all income, expenditure, assets and funding you have a model of all the activities in your business.

Once you’ve worked through the forecast in each component you’ll have a comprehensive cash flow forecast (not to mention Profit & Loss and Balance Sheet forecast!).

With your model ready, it’s time to do some scenario testing.

Scenarios are variations on the same forecast. With your Brixx model you can ask ‘what if’ questions such as:

- What if my sales are lower than expected?

- And if my product launch is delayed?

- What if my marketing costs increase?

- When can I afford to hire new staff?

- How much money should I save to survive the off-season?

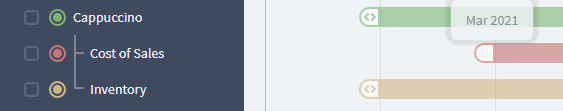

You can set up additional sections, groups or components to map out different scenarios:

Using the icon to the left of the name, you can turn any item on or off in your forecast to switch between different forecasts.

Brixx Timeline

All key events in a business happen at a specific time – and timing is crucial to create a cash flow forecast.

With the timeline, you can drag and drop the start or end date of any activity on the fly:

This adjusts the figures in your cash flow automatically allowing you to judge for example:

- When to launch or discontinue products

- The optimal time to hire new staff

- When to purchase new assets

- When to switch service providers

Taking your first steps forecasting in Brixx

So we’ve been through Brixx: what it is, how it works, and how to best use it. All that’s left now is to try it out if you haven’t already and to create a cash flow forecast!

Make sure you visit our pricing page today, or check out our video series!

To create a cash flow forecast is imperative for any business, at any stage in its life. So whether you decide to use Brixx or not, I highly recommend forecasting your cash flow.