Funding is one of the most important aspects of your business. With the right planning, and the right decisions, you can ensure optimal growth, opportunities, and more. However, any wrong decision can bring your business down, potentially halting all progress and resulting in locked doors.

There are, of course, challenges that come with funding, because it isn’t just about how much money you raise and make. Proper funding can shape your finances for years to come. This is why a financial modelling tool like Brixx is so important. With clear modelling and planning – and instant visual feedback – you can see exactly how your funding decisions will play out.

Why do funding decisions matter so much?

Many business owners will think of funding as a simple short-term boost to their cash assets. You do, of course, need cash to keep a business running, so securing it and moving on makes sense. However, every funding choice, big or small, will have effects on your business.

- Loans, for example, will bring in immediate cash but will enact consistent repayments that affect your monthly expenditure.

- Equity investments can strengthen your business, on the other hand, but will reduce your overall share of the business – and thus your overall personal profit over time.

- Internal funding can protect your ownership, but it might result in draining all of the cash reserves that you’ll need later on.

The best choice for funding will depend on what you need right now, but it is essential to consider how it will affect profitability, cash flow, and stability.

Modelling your business funding in Brixx

Brixx isn’t just a financial forecasting tool, it is a way to explore what-if scenarios without the risk. Check out our step-by-step guide below to see how you can envision the full impact of any funding decisions.

1. Build a baseline plan

Start by creating a forecast that reflects your current financial situation. This will require your revenue streams, any expenses, and any other financial commitments. This will tell the story of your business. This ‘baseline’ acts as your control scenario – the version of your business without any new funding.

2. Add all of your funding scenarios

With a baseline in place, you can then begin to experiment.

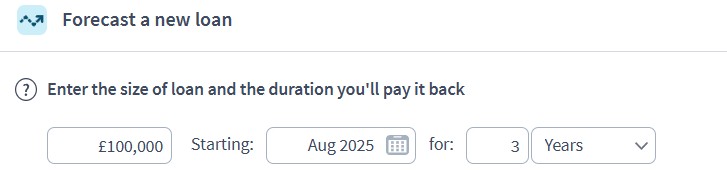

- Test loan fundings by adding different loan amounts, interest rates, repayments schedules, and any other key information.

- Model different equity investments by entering capital, adjusting ownership percentages if you’re modelling any change in shareholders.

- Add differing grants as lump sums into your plan to see how the overall business trajectory will change.

Brixx will handle all of the heavy lifting for you. There is no need to calculate this on your own time. Brix can adjust cash flow, profit and loss, and your balance sheet – with simple visuals to help you see the changes.

3. Enjoy the simple pleasure of seeing those changes – instantly

As previously mentioned, the beauty of Brixx is the clarity of changes in your plan. You can:

- Track how your cash reserves rise and fall over time.

- Watch the effect on monthly profitability.

- See your debt levels and repayment schedules laid out clearly.

And, because you’ve created multiple scenarios, it’s super easy to compare the differences between what a £100,000 loan would look like versus a £100,000 equity investment – without the guessing!

An example of loans vs equity

In order to see the difference between a loan and an equity injection, lets imagine your business needs £100,000 to expand operations.

Scenario 1: A new business loan

Lets say you take a 5-year loan with 5% interest. Your cash reserves will, of course, immediately jump, but monthly repayments will cause a dip in future profit. You will retain ownership of the business but need to carry the burden of all debt.

Scenario 2: A new business equity injection

Lets say you bring in a new investor for the same £100,000. There won’t be any repayments required, so cash flow is much freer, but your ownership is now diluted. Profits in the future are shared between your new partners, and strategy and planning may shift.

In Brixx, you’ll be able to easily see both of these scenarios charted against your ‘baseline’. This will make it much easier to see which option fits your goal better than the other. The main point, of course, is that you’ll know before you make the decision, and not after!

The benefits of seeing your scenarios before you decide

When it comes to funding, no spreadsheet will be able to tell you what Brixx can show you. By modelling your options visually, you can:

- Remove the guesswork, without wondering how repayments will impact next year, and the year after. Your cash flow will be easily identifiable.

- Plan for resilience, being able to spot cash issues before they take place.

- Communicate with ease, showing all stakeholders and investors (if you already have these) exactly what is at stake.

- Make confident choices, without relying on gut feelings!

Start taking control of your funding future

Funding is a tool, not a lifeline. If used with care, it can give your business all of the resources it needs to grow and thrive – and almost all businesses do require funding at some point in their lifecycle.

With Brixx, model every option and compare all of the outcomes, choosing the path that aligns with your vision. There are no surprises – only clarity, confidence, and control!

Ready to see it for yourself? Start your free trial today and explore the impact of your next funding decision in minutes.