Financial Modelling Tool for Wholesalers

As a wholesaler, understanding how your cash flow fluctuates throughout the year and knowing when to make strategic decisions is essential. Brixx provides the financial tools you need to gain timely and crucial insights to guide your wholesale operations and growth.

Start free trial

Model your wholesale business in Brixx - see how quickly your finances can make sense!

We are working on creating this template in Brixx. Although it isn’t available just yet, you can follow the guidance below to help get started. If you need any further assistance, don’t hesitate to get in touch – we’re here to help!

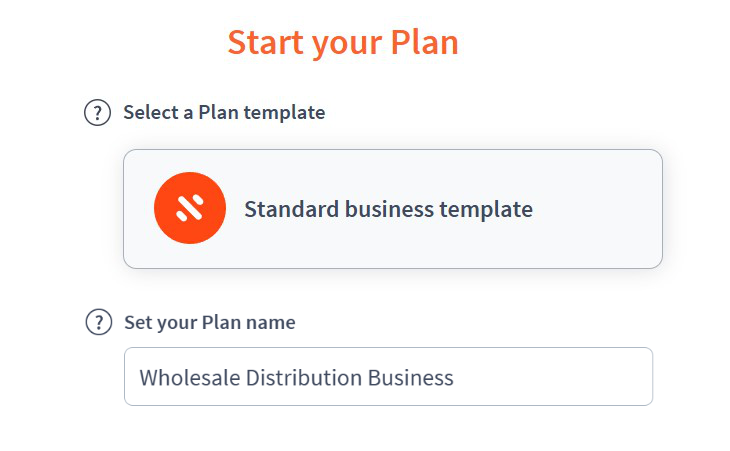

Project Setup

- Project name: Wholesale Distribution Business

- Time period: Monthly (to track cash flow, inventory turnover, and supplier payments)

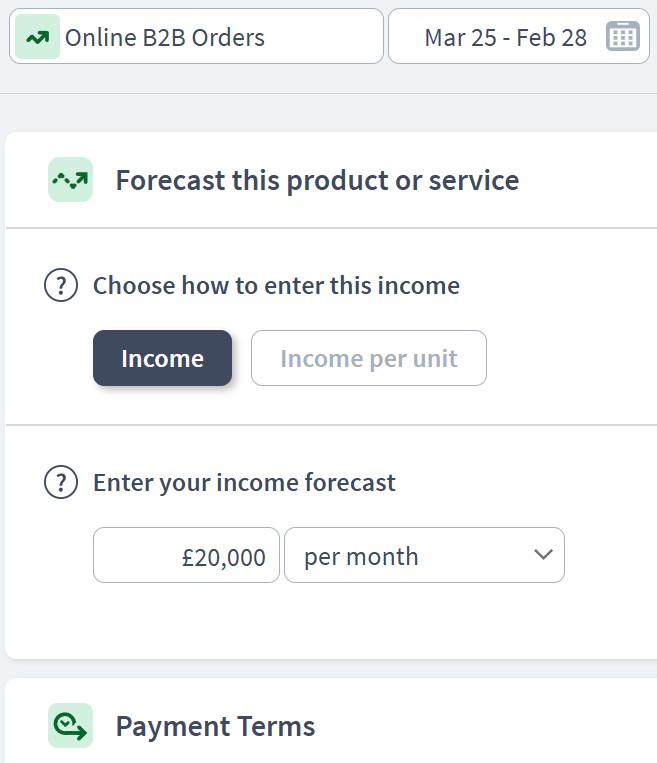

Income Components

- Component: Sales Revenue

- Sub-components:

- Retailer A Orders: £50,000/month

- Retailer B Orders: £30,000/month

- Online B2B Orders: £20,000/month

- Bulk Orders (Large Clients): £40,000/month

- International Sales: £25,000/month (exchange rate fluctuations may apply)

- Sub-components:

- Component: Additional Income

- Sub-components:

- Rebates from Suppliers: £5,000/quarter (volume-based discounts)

- Logistics & Handling Fees: £2,000/month (if charging customers for shipping)

- Damaged Goods Compensation from Suppliers: £1,500/month

- Sub-components:

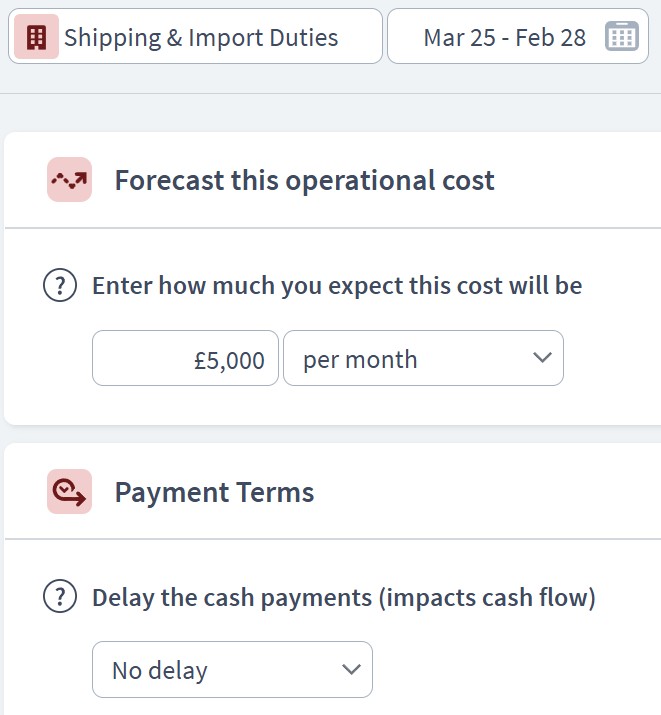

Expenditure Components

- Component: Cost of Goods Sold (COGS)

- Sub-components:

- Supplier Purchases – Product Line A: £35,000/month

- Supplier Purchases – Product Line B: £20,000/month

- Shipping & Import Duties: £5,000/month

- Warehouse Storage Fees: £3,000/month

- Sub-components:

- Component: Operational Costs

- Sub-components:

- Warehouse Rent & Utilities: £8,000/month

- Employee Salaries (Warehouse Staff + Admin): £15,000/month

- Inventory Management Software Subscription: £500/month

- Insurance (Stock & Premises): £3,000/year

- Sub-components:

- Component: Administrative Costs

- Sub-components:

- Accounting & Legal Fees: £1,200/year

- Marketing & Advertising: £5,000/month (including online B2B campaigns)

- Business Development & Travel: £2,000/month (for meeting suppliers/customers)

- Sub-components:

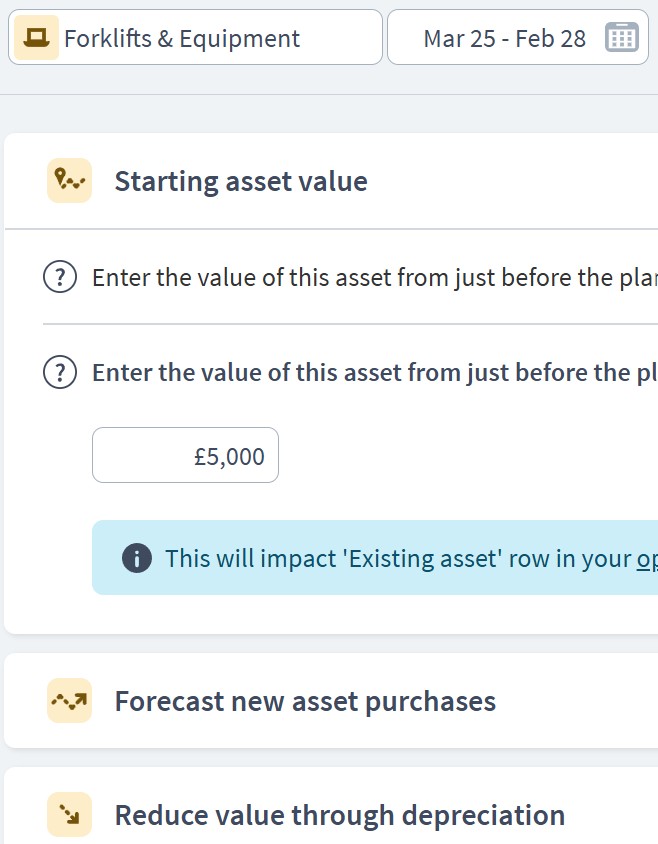

Asset Components

- Component: Fixed Assets

- Sub-components:

- Warehouse Facility (if owned): £500,000 (appreciation: 2% annually)

- Forklifts & Equipment: £50,000 (depreciated over 7 years)

- Delivery Vehicles: £80,000 (depreciated over 5 years)

- Sub-components:

- Component: Current Assets

- Sub-components:

- Inventory (Stock on Hand): £100,000 (fluctuates based on sales cycles)

- Accounts Receivable (Unpaid Customer Invoices): £60,000 (30-day payment terms)

- Cash Reserves: £50,000 (starting balance + surplus profits)

- Sub-components:

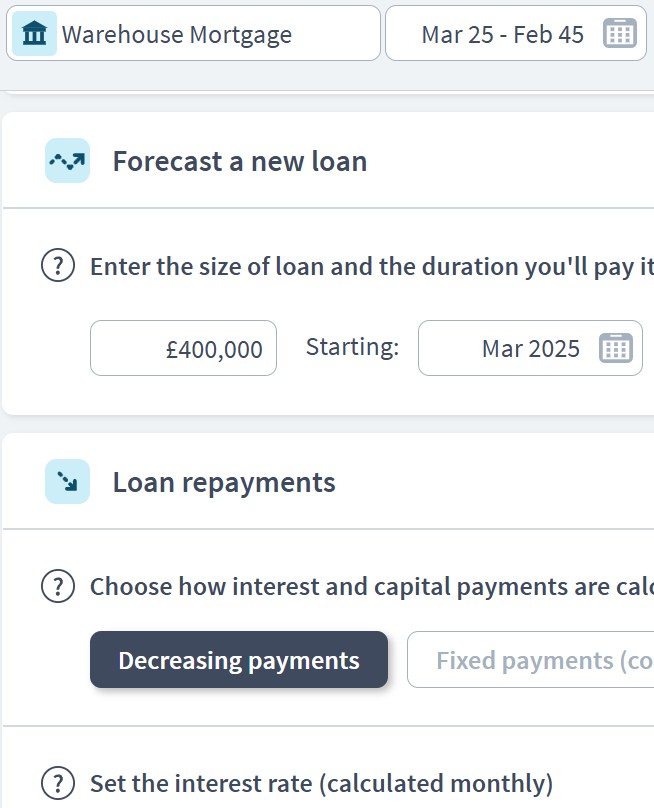

Funding Components

- Component: Business Loans

- Sub-components:

- Warehouse Mortgage (if applicable): £400,000 at 5% interest, 20-year term

- Equipment Financing Loan: £50,000 at 7% interest, 5-year term

- Sub-components:

- Component: Investor Capital

- Sub-components:

- Owner’s Initial Investment: £100,000

- Angel Investment for Expansion: £200,000 (for increasing inventory & logistics)

- Sub-components:

- Component: Trade Credit & Supplier Terms

- Sub-components:

- Supplier Credit Terms: £50,000 (30–60 day payment window)

- Sub-components:

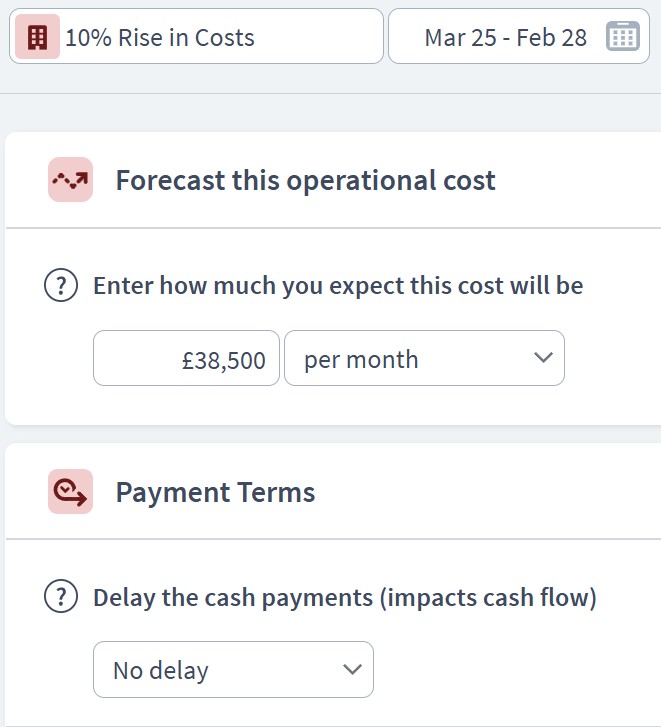

Scenario Planning in Brixx

- Sales Growth Projections

- Model 5%, 10%, and 15% increases in orders to assess profitability.

- Supplier Cost Increases

- Test the impact of a 10% rise in product costs and adjust pricing accordingly.

- Inventory Holding Strategies

- Simulate high vs. low inventory levels and their effects on cash flow.

- Late Payments from Retailers

- Model scenarios where customers delay payments and how it affects working capital.

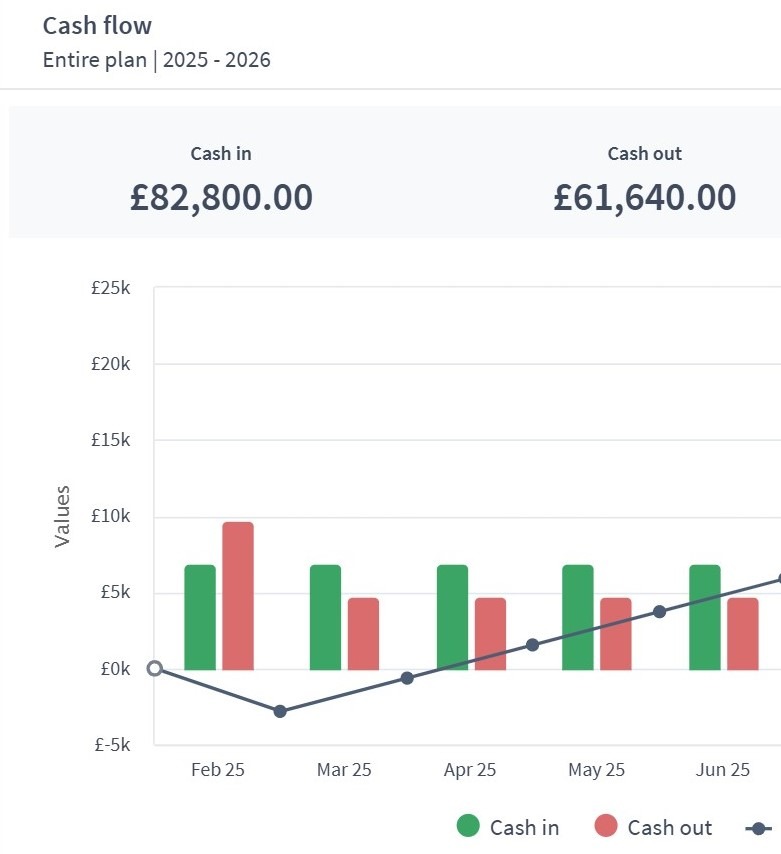

Dashboard & Reporting

- Cash Flow Report

- Track daily inflows and outflows, ensuring enough liquidity to cover supplier payments.

- Balance Sheet

- Monitor stock levels, receivables, and liabilities to optimise financial stability.

- Profit & Loss Statement

- See net margins by comparing revenue, COGS, and expenses for each period.

- Key Financial Metrics

- Gross Margin = (Revenue – COGS) / Revenue

- Inventory Turnover Ratio = COGS / Average Inventory

- Days Sales Outstanding (DSO) = (Accounts Receivable / Revenue) × 365

Who can use this Brixx template?

- Wholesale distributors

- Supply chain managers

- Bulk goods suppliers

Brixx is a great tool for:

- Business owners and managers overseeing financial planning and budgeting

- Accountants tracking revenue, expenses, and cash flow fluctuations

- Wholesalers forecasting sales, supplier costs, and inventory turnover

What are the benefits to wholesalers?

- The template is tailored to the wholesale sector, covering all aspects of supply chain management, revenue, and expenses

- Effortlessly model cash flows, bulk purchase costs, shipping fees, and customer payments

- Easily interpret results and graphs to assess the profitability of different product lines and distribution channels

- Quickly evaluate the impact of new income streams, such as expanding product ranges or offering direct-to-consumer sales

- Receive immediate feedback when modelling different scenarios like price adjustments, supplier negotiations, or changes in demand

Strategic forecasting in Brixx

- Calculating the profitability impact of varying pricing models and order volumes

- Demonstrating projected earnings to support funding applications or supplier negotiations

- Forecasting and budgeting for warehousing, logistics, and operational expenses

- Anticipating financial requirements for seasonal stock fluctuations and bulk purchasing opportunities

- Evaluating the impact of market trends, inflation, and economic shifts on supply chain costs and sales

Explore different industry frameworks you can build in Brixx for your business

Brixx for Retail Businesses

Explore our template for retail businesses. It’s designed to help you manage stock levels, sales channels, and customer demand.

Brixx for Manufacturers

Explore our template for manufacturers. It’s designed to model production costs, inventory, and supply chain workflows.

Brixx for Logistics Companies

Explore our template for logistics companies. It’s designed to help you plan routes, costs, and delivery schedules efficiently.

Brixx for E-Commerce Businesses

Explore our template for E-commerce. It’s designed to support online sales, marketing, and order fulfilment processes.

Get started with Brixx

£30 / month

Prices exclude local taxes

7 Day Free Trial

No credit card required

- Scenario testing

- 10-year financial forecast

- Pre-built templates

- Xero integration

- Automated reports: P&L, balance sheet, cash flow, tax & more

"Brixx is great for analysing at which point I can recruit new staff."

Nikki Bisel, Seafoam MediaGet started with the best financial projection software - today!

Financial forecasting software is essential for wholesalers, offering the insights needed to plan and manage supply chain operations effectively. By forecasting costs and revenue, businesses can gain a clearer picture of their financial landscape. Additionally, forecasting bulk orders, shipping costs, and seasonal demand enables informed decisions on stock management, pricing, and supplier relationships.

The ability to identify industry trends, adjust purchasing strategies, and plan for fluctuations in sales volume further enhances a wholesaler’s ability to succeed long-term. With over 20 years of business modelling experience, Brixx stands out as a trusted solution, offering a robust set of features to help wholesalers confidently navigate financial planning.

Investing in expert financial modelling software like Brixx empowers you to optimise your wholesale business and strategically forecast its future.