When looking to assess your business’ performance, one of the most important financial metrics to keep in mind is EBIT (Earnings Before Interest and Taxes).

EBIT represents your business’ profitability from its primary operations, excluding the impact of financing and tax expenses. This makes it a powerful indicator of how efficiently your business is running and whether it is on a sustainable growth path.

Get started with our forecasting software so that you can plan your business' future

Manage your EBIT growth in Brixx

What is EBIT and why does it matter?

EBIT is an essential financial metric that helps to measure how much profit a business will make from its core activities, excluding any interest and tax. It It helps to review and understand the efficiency of all business operations.

How is EBIT calculated?

EBIT can be calculated using two common formulas:

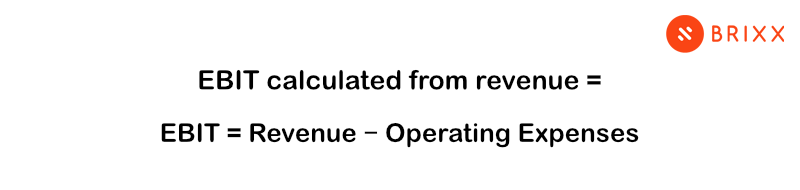

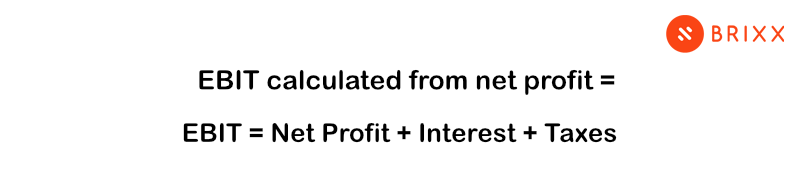

EBIT calculated from revenue:

- EBIT = Revenue − Operating Expenses

EBIT calculated from net profit:

- EBIT= Net Profit + Interest + Taxes

By taking away the financing costs and required tax payments, EBIT can help businesses to focus explicitly on their efficiency and profitability.

EBIT vs. EBITDA vs. Net Profit

While EBIT is a very valuable metric, it is still important to understand why and how it differs from other profitability metrics like EBITDA and Net Profit:

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) goes a step further than EBIT because it excludes non-cash expenses like depreciation and amortization. This means that EBITDA is used to help compare businesses with different capital structures.

- Net Profit (or net income) is the bottom line after all expenses. While net profit reflects overall profitability, EBIT provides a much clearer view of a business’s operational performance.

Why do businesses use EBIT?

EBIT is commonly used because of how it isolates a business’ ability to make profit from its core operations. By ignoring financing and tax structures, it shows a more accurate comparison between businesses of different sizes, industries, and financial strategies.

The importance of EBIT growth

A business’ ability to grow its EBIT is a strong indicator of financial health and long-term success. If your business EBIT increases over time, it will typically mean that your business is generating more revenue, managing costs more effectively, or both.

1. EBIT growth indicates operational efficiency

EBIT growth often signals that a business is improving its operational efficiency. This could be through:

- Better cost control, for example by reducing expenses without sacrificing quality

- Increased revenue, for example by helping to expand sales or improve pricing

- Improved processes, for example by managing to reduce waste, or improving your supply chain

2. EBIT growth increases investor confidence

Investors will also monitor EBIT growth to help understand how financially stable a business is. With a strong EBIT, they can conclude that a business is generating positive profit before any financing even comes into play, making it more attractive to potential investors.

Similarly, for new financers or lenders, EBIT growth shows that a business is in a good position to repay debts. Since EBIT excludes interest expenses, it helps lenders evaluate how much operating profit is available before debt obligations. Businesses with strong EBIT growth are more likely to secure funding with better terms.

3. EBIT growth improves long-term growth

A growing EBIT plays a critical role in business valuation. Many different valuation models, such as discounted cash flow (DCF), will rely on EBIT as a key measure of profitability.

Alongside this, EBIT growth also shows insights into business planning. Businesses with a rising EBIT, for example, have more resources to invest in expansion.

Whether your looking to launch new products, or expand into new regions, EBIT fuels positive, long-term success.

3 Factors that drive EBIT growth

EBIT growth is absolutely important, but it also isn’t just about increasing revenue. It’s about balancing your income and expenses to maximise all profitability. Several key factors contribute to EBIT growth:.

1. Expanding revenue

One of the most direct ways to drive EBIT growth is by increasing revenue. This can be achieved through:

- Expanding customer reach and acquiring new clients

- Enhancing marketing efforts to boost sales

- Upselling or cross-selling additional products or services

However, revenue growth alone doesn’t guarantee higher EBIT – businesses must also control costs to ensure that increased sales translate into stronger profitability.

2. Ensuring costs are efficient

Reducing unnecessary expenses without sacrificing quality is a critical factor in EBIT growth. Businesses can improve cost efficiency by:

- Streamlining operations and automating tasks

- Negotiating better deals with suppliers

- Optimising resource allocation to eliminate waste

By cutting operational inefficiencies, businesses can boost EBIT even if revenue remains stable.

3. Improving pricing

If you adjust your business pricing model, you can also impact your EBIT. With a well-planned pricing strategy, you can ensure that your business maximises revenue while also staying ahead competitively. This might include:

- Value-based pricing

- This means charging based on the perceived value to the customer

- Dynamic pricing

- This means adjusting prices based on demand and market conditions

- Bundling or tiered pricing

- This means encouraging customers to spend more through package deals

A strong pricing strategy helps businesses improve their profit margins without necessarily increasing costs.

- This means encouraging customers to spend more through package deals

3 challenges that can hinder EBIT growth

While a growing EBIT is, of course, a key goal for a business, there are many different challenges that can slow all progress. By understanding these obstacles, you can take positive proactive steps to ensure profitability!

1. Rising operational costs

With increasing costs, such as from wages or materials, your EBIT growth can be hindered if revenue doesn’t also grow. Your business has to regularly evaluate all expenses to ensure continuous growth – without compromising quality!

2. Increased market competition

An increase in general business competition can force your business to reduce prices, leading to lower profits and slower EBIT growth. If you rely too heavily on price reductions to stay competitive, you may end up in a race to the bottom. Instead, make sure your unique values and propositions are strong.

3. Poor financial planning and forecasting

Without a clear financial strategy, your business may end up struggling to manage cash flow and control expenses – or even identify growth opportunities. With poor financial forecasting, you can end up over-investing, under pricing, or even misallocating resources.

How financial forecasting supports EBIT growth

One of the best ways you can protect and grow EBIT is to use effective, accurate financial forecasting. By being able to predict your future trends and analyse any potential risks, you can make better decisions over time.

1. How does financial modelling help to predict EBIT trends?

Proper financial modelling can help your business to analyse different scenarios, forecast revenue and expenses, and also help to identify potential risks – before they end up being a major problem! With a well-structured financial model, your business will have better visibility, helping you to stay ahead of any challenges.

2. How can tools like Brixx help businesses project EBIT growth?

Brixx exists to simplify your financial forecasting. Using our tool can help you to create detailed projections for revenue and profitability. It has easy to use features, all of which can help businesses to:

- Test different financial scenarios to see how EBIT is affected

- Plan for future investments while maintaining profitability

- Identify any potential cash flow gaps before they are able impact operations

3. What real-world examples show how forecasting improves decision-making?

Businesses that use forecasting effectively can make smarter strategic choices. For example:

- A retail business might forecast the impact of rising supplier costs and adjust pricing strategies to maintain EBIT

- A startup could model different funding scenarios to determine the best time to seek investment without sacrificing profitability

- A service-based business may predict seasonal fluctuations in revenue and plan cost adjustments accordingly

By leveraging financial forecasting tools like Brixx, businesses can anticipate challenges, adapt strategies, and ensure steady EBIT growth – regardless of market conditions.

Manage your EBIT growth with Brixx

Monitoring EBIT growth is important for understanding how well a business is performing. It can help to show how your business is being run, and whether or not it’s actually building a stable, profitable base. A consistent increase in EBIT will often indicate effective cost controls and strong financial positions. These are both qualities that are absolutely attractive to investors and partners.

Using forward-looking tools to analyse and project EBIT can support better strategic planning. With the use of good financial forecasting software, your business can prepare for any potential hurdles. Use tools to test difference scenarios, enabling you to make choices to enhance profitability. Reliable forecasts allow for quick adjustments and help identify new opportunities.

Brixx is designed to support this kind of planning. Its user-friendly features make it simple to model future performance, experiment with strategies, and stay focused on sustainable growth. Try Brixx free today and start building a clearer financial path forward.