Uncertainty seems to be the only constant in today’s world! From consistent inflation, to global events that ripple through supply chains and consumer behaviour – navigating the future has never been more complex!

Enter Brixx – a financial modelling tool built for people who are planning ahead – even when the future feels uncertain.

Whether you’re running a growing startup, managing the finances of an established business, or keeping a close eye on your personal financial goals, Brixx helps you model what’s next with confidence.

The certainty of uncertainty

For both businesses and individuals, these financial pressures aren’t just abstract headlines. They show up in real ways – income will fluctuate, costs become unpredictable, and profit margins become tighter. In times like these, planning ahead can feel overwhelming… but it’s never been more important.

That’s where financial modelling comes in.

Instead of relying on guesswork or outdated spreadsheets, financial modelling software gives you a clear picture of what your future could look like – under any scenario. It allows you to model different scenarios, explore risks, and make confident decisions backed by numbers.

At Brixx, we believe that understanding your future starts with seeing it clearly. Whether you’re running a business, launching a new venture, or managing your own finances, Brixx gives you the tools to plan with clarity – even when the road ahead is uncertain.

Get started with our forecasting software so that you can plan your business' future

Navigate financial uncertainty with a financial modelling tool like Brixx

What does it mean to be financially uncertain?

No matter how well you know your business, there are always things you can’t control. Prices rise. Customers pause spending. Supply chains get disrupted. One unexpected change can throw off your whole plan.

This is what we mean by financial uncertainty – the unpredictable ups and downs that affect your income, your costs, and the way your business operates. It could be a dip in sales during a slow quarter, a sudden spike in materials costs, or changes to regulations that shift your budget overnight.

The hard part? These changes often come with little warning. And without a clear way to see the impact ahead of time, it’s easy to end up reacting instead of planning.

At Brixx, we believe the best way to stay in control is to prepare for the unexpected. That’s why we’ve built a tool that helps you explore “what if?” – so that you’re forecasting several futures, not just the one. With Brixx, you can model different paths and feel confident knowing you’re ready for whatever comes next.

Why financial modelling matters

When things feel uncertain, guessing isn’t good enough. You need clarity – something solid to base your decisions on. That’s where financial modelling makes all the difference.

Modelling is about more than just numbers. It’s about exploring possibilities. What if your costs go up next quarter? What if sales slow down for a few months? What if you hire a new team member, or launch a new product line? A good model gives you the space to ask these questions – and actually see the impact before you commit.

Instead of reacting to surprises, you’re planning for them. You’re creating a roadmap with options, not just a single path.

Brixx helps you do this without the spreadsheet stress. You can build different scenarios, compare outcomes side-by-side, and understand how changes affect your future – visually and clearly. It’s not about predicting the future perfectly. It’s about being ready for it.

Businesses and personal finances are more connected than you think

For many business owners, the line between personal and business finances isn’t always clear. When your business does well, you do well. When it’s under pressure, you feel it at home too.

That’s why it’s so valuable to look at the full picture – not just one side of it.

With Brixx, you can model both your business finances and your personal goals in one place. Want to see how a drop in business revenue might affect your salary? Planning to save for a house while investing in your company? These things are connected, and modelling them together helps you make better, more informed decisions.

It’s not about overcomplicating things. It’s about bringing clarity to the money that really matters – so you can plan with less stress, more confidence, and a clear understanding of what’s possible.

So, how do you start modelling through uncertainty?

You don’t need to be a finance expert to build a useful financial model. What matters is getting the basics in place – and knowing how to adjust them as things change.

Start with the essentials:

- Revenue – what’s coming in, and when

- Costs – both fixed and variable, big and small

- Cash flow – the timing of money moving in and out

- Contingency – a buffer for the unexpected

Once you’ve got that, the next step is scenario planning. Try mapping out a few different versions of the future:

- What if things go better than expected?

- What if sales dip or expenses rise?

- What does a steady, “most likely” path look like?

You’ll quickly see how small changes can ripple through your whole plan – and that insight is powerful.

We designed Brixx to make all of this feel intuitive. Instead of wrestling with spreadsheets, you build clear, visual models that are easy to update whenever things shift. Some people review their model monthly. Others tweak it after key decisions or big changes. There’s no perfect schedule – just whatever keeps you feeling informed and in control.

What does success look like?

Picture this: Sarah runs a small creative agency. Things were going well – steady clients, regular income, manageable overheads. But when a key contract ended earlier than expected, the sudden drop in revenue could’ve caused serious issues.

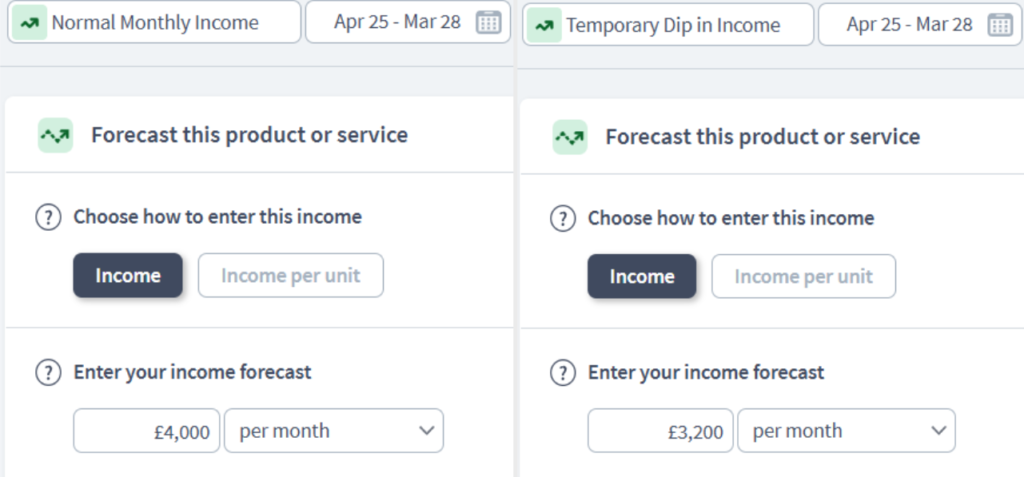

Luckily, Sarah had already modelled a few “what if” scenarios in Brixx. One of them? A temporary dip in income.

Because she’d planned ahead, she already knew what adjustments she could make – how long she could run lean, which costs she could pause, and where to shift her focus to bring in new work fast. Within a few months, she’d replaced the lost income and even uncovered new opportunities she hadn’t considered before.

That’s the power of good forecasting. It’s not about predicting every bump in the road – it’s about staying calm when they happen, and knowing what to do next. With a model behind you, you’re not guessing. You’re making confident, informed choices – even in uncertain times.

Bringing it all together!

Uncertainty isn’t going anywhere – but how you respond to it can change everything.

Financial modelling isn’t just for big corporations or spreadsheet pros. It’s for anyone who wants to feel more in control – whether you’re running a business, launching a new idea, or simply trying to make smarter decisions with your money.

You don’t need all the answers to get started. Build something simple. Ask a few “what ifs.” Adjust as you go. The more you explore, the clearer things become.

At Brixx, we’ve designed our tools to make this process approachable, flexible, and even enjoyable. Because planning for the future shouldn’t feel overwhelming – it should feel empowering.

Start exploring your future with Brixx

If you’re ready to take some of the guesswork out of planning, Brixx is a great place to begin.

You don’t need a finance background. You don’t need to build a perfect plan. Just bring your ideas, your numbers, and your curiosity. Brixx will help you map out different futures, test your thinking, and make smarter decisions – one step at a time.

Try Brixx free and see how easy it is to start modelling your business or personal finances.

Whatever the future holds, you’ll be ready for it.