For accountants, forecasting isn’t just about numbers. It’s about ensuring that their clients can make informed decisions and grow their business with confidence. However, when you’re juggling multiple clients or business entities, keeping everything accurate and current can be quite a challenge – especially if you’re still relying on spreadsheets!

This is where Brixx comes in. This intuitive financial forecasting software is built to make life easier, giving accountants a clear, efficient way to build and manage forecasts across multiple businesses – all in one place.

Why do accountants struggle with multiple business forecasts?

Handling forecasts across several clients isn’t as simple as plugging numbers into a spreadsheet. It can quickly become a complex, time-consuming process filled with hidden issues. Some of the most common challenges include:

Spreadsheet overload

When each business has its own Excel model, things can spiral fast. Juggling multiple files increases the risk of errors, broken links, and version control issues. One wrong cell can throw off an entire forecast.

Constant updates

Client data is always changing. Whether it’s sales projections, staffing costs, or cash flow, every new number means another update to your model. Doing this manually eats into valuable time and can delay key insights.

Limited visibility

Comparing different financial scenarios or bringing multiple forecasts together into a single, clear view is tricky without the right tools. Spreadsheets make it hard to see the bigger picture or drill down into the details quickly.

High client expectations

Today’s clients expect more than historical reporting. They want timely advice, real-time scenario planning, and forward-looking guidance to help them make confident decisions.

All of this adds up to a significant burden. Without the right systems in place, accountants can find themselves spending more time fixing models and chasing updates than delivering strategic value to their clients. And when that happens, both the accountant and the client lose out.

How does Brixx support accountants?

Brixx is designed with accountants in mind, offering practical features that make managing multiple forecasts simpler, faster, and more accurate. Here’s how it supports your day-to-day work:

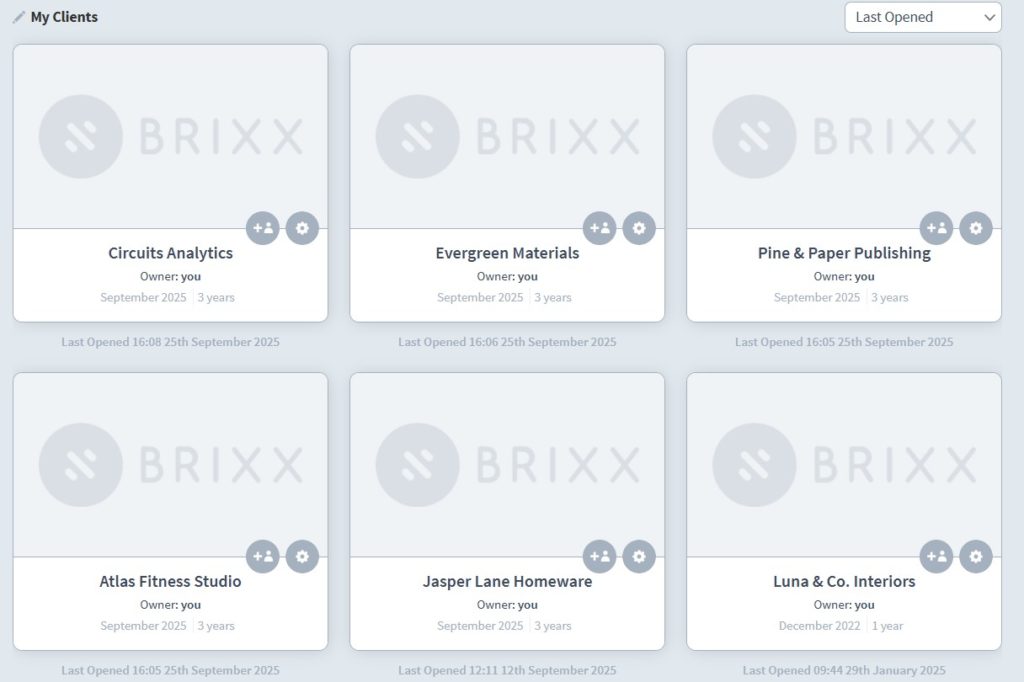

1. Dedicated forecasts for every client or business

Every client is different – and so is their financial outlook. With Brixx, you can create a separate forecast for each client or business, keeping models clean and focused. You can easily clone forecasts to test new assumptions or create alternative versions, all without interfering with your original model. This makes it simple to tailor financial plans to each client’s unique needs, without the risk of overlapping data or tangled spreadsheets.

2. Effortless consolidation & group reporting

For clients who manage multiple companies or departments, pulling everything together can be a headache. Brixx solves this by letting you consolidate multiple forecasts into a single, unified view. Whether it’s cash flow, profitability, or performance metrics across a group of businesses, Brixx gives you a clear, top-level picture – something that would take hours to build manually in Excel.

3. Reliable cash flow forecasting and visual scenario planning

Helping clients plan for the future is at the heart of modern accounting. Brixx includes built-in cash flow forecasting tools that allow you to easily model different ‘what-if’ scenarios – from hiring new staff to weathering a downturn or planning for expansion. These scenarios are visually presented and easy to share, so clients can quickly grasp the impact of their decisions and feel confident about their next steps.

4. Seamless integration with real accounting data

Manual data entry is time-consuming and error-prone. Brixx integrates directly with Xero, pulling in up-to-date financial information automatically. This keeps your forecasts aligned with actuals and saves you hours of admin time. With live data feeding into your models, your forecasts remain relevant and actionable without constant manual updates.

Get started with our forecasting software so that you can plan your business' future

See how Brixx can support accountants

Practical ways accountants use Brixx

Brixx is a practical solution that helps accountants deliver more strategic advice and save time, adding real value to their clients. Here are just a few ways accountants are putting Brixx to work:

For startups & early-stage businesses

Startups often face uncertainty at the beginning of their journey. With Brixx, accountants can quickly build flexible financial models to test various funding scenarios, like bootstrapping, angel investment, or venture capital, showing clients exactly how different decisions could affect their trajectory. It’s a powerful way to guide new businesses through their critical early stages with confidence.

For clients managing multiple businesses

When clients operate more than one business or legal entity, reporting can get complicated. Brixx simplifies this by letting you build separate forecasts for each business, then roll them up into one clear, consolidated view. This gives both you and your clients a full picture of overall cash flow, group performance, and future projections – all without spreadsheet chaos.

For board and stakeholder reporting

Whether it’s monthly board meetings or quarterly investor updates, stakeholders expect clear, insightful reporting. With Brixx, accountants can generate professional, presentation-ready forecasts and reports that are easy to digest, without the confusing rows of spreadsheet data. The visual outputs help boards focus on what matters most: strategy, risk, and future planning.

For cash flow advice and strategic planning

Cash flow is often one of the hardest things for clients to manage. Brixx enables accountants to step into a more proactive advisory role by helping clients navigate both short-term cash constraints and longer-term investment decisions. Brixx equips you to model the outcomes and give your clients a clear financial path forward.

In each of these scenarios, Brixx empowers accountants to move beyond compliance and become trusted financial partners, offering the kind of foresight and clarity that clients truly value.

What are the benefits of using Brixx over spreadsheets?

Spreadsheets have served accountants well for decades, but as client demands grow and businesses become more complex, their limitations start to show. Brixx offers a smarter, more efficient way to handle financial forecasting. Here’s how Brixx compares to spreadsheets:

1. Fewer errors, greater accuracy

Spreadsheets are prone to issues, like accidentally deleting a formula or referencing the wrong cell. With Brixx, these risks are greatly reduced. The platform is purpose-built for forecasting, so the structure is solid and calculations are handled behind the scenes. That means fewer mistakes and more confidence in your numbers.

2. Save time with smarter workflows

Updating models in Excel can be a slow, manual process. Brixx streamlines this by letting you quickly adjust assumptions, duplicate existing forecasts, or build new ones without starting from scratch. Whether you’re reacting to a last-minute client change or building out a new scenario, Brixx helps you move faster.

3. Professional, client-ready outputs

No more fiddling with chart formatting or trying to make Excel graphs look good. Brixx automatically turns your data into clean, easy-to-understand visuals and reports. Whether you’re presenting to a board, advising a startup, or helping a business plan for growth, you can deliver insights in a format that looks polished and makes an impact.

4. Built to scale with your practice

As your client list grows, managing dozens of spreadsheets becomes unmanageable. Brixx gives you a centralised, organised way to build and oversee multiple forecasts across clients or business units. You can switch between models, consolidate reports, and keep everything under control.

Getting started with Brixx as an accountant

Using Brixx is simple, especially with our industry-ready accountant template! However, we’ve listed some quick steps below:

- Begin by setting up a client’s business with revenue, expenses, and cash flow assumptions.

- Build the first forecast and explore your “what-if” scenarios.

- Generate clear, professional reports to share with your clients.

- Easily scale up by adding more businesses or rolling them into a portfolio view.

With Brixx, accountants move beyond the limitations of spreadsheets and into a more strategic, streamlined way of working, saving time, improving accuracy, and delivering insights that truly add value.

Whether you’re advising startups, established companies, or clients with multiple businesses, Brixx makes financial forecasting simple and scalable.

Try Brixx today and see how it can transform the way you manage client forecasts.