Our Financial Jargon Guide

At Brixx, we understand how overwhelming finance can be, especially for those who are new to it. In this article, we will delve into the definitions of key financial terminology whilst keeping it simple and easy to understand.

Accounts receivable

Accounts receivable shows the total money owed to you from your customers.

This might be because you’ve agreed a 30 day payment window, or perhaps they are late to pay. A customer who owes money is called a debtor and you’ll see accounts receivable in the top half of the balance sheet.

For example: If a plumber completes work for a customer, the value of the work is recorded in accounts receivable until the cash has been received.

Accounts payable

Accounts payable shows the total money owed to suppliers for goods or services provided to the business.

This account appears on a company’s balance sheet under current liabilities.

For example: If a business has a website built by a design company, they might pay them upon completion. Until they pay them, the value is shown on accounts payable.

Asset

An asset is anything the business owns that has monetary value. You’ll see these assets represented on the top half of the balance sheet.

There are quite a few different categories and most businesses will have several types.

For example: Inventory, Accounts receivable, Buildings, Vehicles, Cash in bank, Prepayments

Further reading:

Balance sheet

A balance sheet is a financial report displaying a business’ assets, equity and liabilities at a specific point in time.

The top half of the balance sheet represents everything that has value in the business (assets), while the bottom half (liabilities and equities) represents how the assets were acquired.

Further reading:

Bank position

Your bank position is the amount of money in the bank at a certain point in time.

You might see ‘opening’ and ‘closing’ bank position on a financial statement:

- An opening bank position is the amount of money in an account at the start of a time frame.

- The closing bank position is the amount of money in an account at the end of a time frame.

For example: At the end of last month, the closing bank position for a coffee shop was £1,000.

Business plan

This is a plan for the future of a business or startup. Traditionally it takes the form of a multi-page document but there is no set rule for the format it should take.

It often contains the business’ goals and objectives and how the team is going to achieve them. To get this across, the document might cover all areas of the business, from marketing activities to logistics.

Strong business plans will be grounded in research, data and business experience. They’ll have sound financial forecasts to demonstrate how the plan translates into growth.

Further reading:

Breakeven

The break-even point is when total costs and revenue become equal. Any further revenue above this would be considered profit.

Knowing how far out in time this breakeven point is can be really important for both startups and potential investors to measure.

Cash Budgeting

A cash budget is a plan that details a company’s projected cash inflows and outflows over a specific period, focusing only on actual cash transactions. It helps assess if the business has enough cash to operate or needs additional funding, ensuring it can meet short-term obligations and avoid liquidity issues.

Capital

Capital is money used in a business in order to generate income.

People talk about capital in many different ways. Just remember, at its heart, capital means money.

A business would have to raise enough capital to cover its startup and running costs. That capital would go towards equipment, inventory and other expenses associated with starting a business.

Capital budgeting

Capital budgeting is used by businesses to evaluate and choose long-term investments or projects. It helps to determine which opportunities of investment are worth pursuing based on certain factors like risk assessments, cash flows, and more.

Capital repayment

A capital repayment refers to the repayment of borrowed money, often a loan. As repayments are made the original amount owed is reduced.

For example: A company takes out a £12,000 loan. It repays £1,000 a month for 12 months. After 6 months, the company will have repaid £6,000 in capital repayments and still owe £6,000.

Cash collection

Cash collection in accounting is a critical measure that that involves the retrieval of funds from various sources, typically including customers, clients, or debtors.

Cash Conversion Cycle (CCC)

The Cash Conversion Cycle (CCC) is a financial metric that measures how efficiently a business manages its inventory, receivables, and payables by reflecting the time taken to turn inventory investments into cash from sales. A shorter CCC indicates more efficient operations with quicker inventory turnover and faster collection of receivables.

Cash flow

Cash flow is simply the process of cash coming in and out of the business. You can see it is measured on your cash flow report.

Positive cash flow is when you have more cash coming into your business than going out during a period of time. Negative cash flow is when you have more cash going out of your business than coming in. Simple!

Cash flow report

A cash flow report shows the cash coming in and out of your business in a structured format.

Your cash flow report can be as simple as two rows: cash in and cash out. However, cash flow reports can go into more detail by breaking it into categories such as income and cost types.

For example: At the start of the month, I have £10,000 in my bank. In the coming month, I receive £20,000 worth of sales but incur £15,000 worth of costs. Therefore the closing bank position of my cash flow would be £15,000 for the month.

Cash Runway

Cash runway is the time a business can operate before running out of cash, assuming no new cash inflows. It is crucial for startups and early-stage companies reliant on external funding and not yet profitable.

Credit

Credit is money issued by a lender that you’ll need to pay back, sometimes with interest on top. You might also purchase an item ‘on credit’ where you receive the item but agree to pay it at a later date.

Purchasing on credit can help plug holes in your cash flow, where unexpected costs occur, or you don’t have enough cash coming in to pay your bills.

For example: An oven breaks and the bakery cannot afford to pay for a new one with cash this month. They buy an oven on credit so they can carry on producing their products.

Further reading:

Creditor Days

Creditor days, or payable days, is a financial ratio that measures the average time a business takes to pay its suppliers after receiving goods or services. It reflects the company’s payment policies and cash management strategies, affecting supplier relationships and cash flow.

Corporation tax

Corporation tax is a tax based on the profit a business makes in a financial year. The higher the profits, the higher the tax. There are complexities to the system, for example some types of cost are exempt from corporation tax.

For example: If a business made £10,000 of taxable profit in a year, and the corporation tax was 19% then £1,900 would be paid as tax.

Debt

Debt is a term used to describe money owed to a lender. You’re obligated to pay this back under the terms agreed when you borrowed the money or paid for an item on credit.

For example: You pay for £100 worth of goods on your credit card. You are in £100 of debt until you pay off your credit card bill.

Debt Factoring

Debt factoring is a financial transaction in which a business sells its outstanding accounts receivable to a third-party financial company, known as a factor. It is often used by businesses that need immediate cash flow and cannot wait for their customers to pay.

Debtors

A debtor is a person or company who owes you money.

A debtor might be someone who hasn’t yet paid for goods or services you have provided them, see accounts receivable.

Debtor days

The debtor days formula is a useful tool for businesses to understand how long it takes to collect payments or debts. By calculating your debtor days, you can streamline your processes and improve your cash flow.

Debt drawdown

A debt drawdown is when a business withdraws part of a loan rather than the full amount.

This might be so that the lender can ensure the money is spent responsibly, helping to reduce the risk.

Depreciation

Depreciation is the process of an item losing value over a period of time due to wear and tear.

In accounting, purchasing an asset is not registered as a loss to the business immediately on your profit and loss statement. Its value is spread over the course of its useful life, calculated using depreciation.

For example: A business purchases a new van for £10,000. In the first year, it loses £2,000 of value. This is the amount of depreciation for that period.

Direct costs

Direct costs are costs that can be clearly related to a sale, such as production costs or the purchase of materials. They are sometimes also known as ‘cost of goods sold’.

For example: A company that sells computers has to buy the parts for them first. More parts are required as more computers are sold. This means that these costs will increase as a direct result of selling more computers.

In contrast, expenses like rent and utility bills won’t increase with each sale you make. This means they are classed as ‘indirect’ costs.

Dividend

A dividend is a sum of money paid to a shareholder in a business. Dividends are paid out of a company’s profits after tax. If the business is not profitable, it cannot pay dividends.

For example: A business pays each of its shareholders a dividend of 1% of its profits every month. If the business makes £10,000 profit in a month, then the dividend payment would be £100.

Doubtful Debt

Doubtful debt, or bad debt, is the portion of a company’s accounts receivable that is unlikely to be collected due to a customer’s inability or unwillingness to pay.

Economic Profit

Economic profit is a key financial metric that goes beyond traditional accounting profit by factoring in opportunity costs. It includes both explicit costs – such as wages, rent, and materials – and the implicit costs of foregone opportunities, like the potential returns from an alternative investment.

Equity

Equity is a portion of a business which someone owns. Equity is also known as a share of a business.

When someone invests money into a business, it’s usually in exchange for some equity in it.

If an investor owns 10% of a business, then as the business grows, so does the value of their investment. At a later date they could sell their investment to receive a return on it.

FAST Standard

The FAST Standard stands for Flexible, Appropriate, Structured, and Transparent. It’s a set of guidelines for financial modeling and data analysis to create easy-to-understand, reliable, and usable models.

Flexible Budget

A flexible budget is a financial planning tool that adjusts with changes in activity levels or sales volumes, unlike a static budget. This adaptability allows for more accurate performance evaluations and forecasts, aiding better decision-making.

Free Cash Flow

Free cash flow (FCF) measures the cash a business generates after subtracting capital expenditures (CapEx) for long-term assets like buildings and equipment.

Funding

Funding refers to money raised for the purpose of starting or growing a business.

There are multiple ways to fund a business such as bank loans, friends & family, crowd-funding, angel investors and personal savings. They all have different pros and cons and different businesses might use different combinations.

Gearing Ratios

How highly “geared” a business is depends on how much of its funding comes from debt (such as loans) as opposed to shareholders’ equity in the business. Gearing ratios show this differential.

Gross

Gross is the total of a sum of money before any deductions have been made.

For example: Someone’s gross salary would be the total amount of money before tax, pension, national insurance and any other deductions have been made.

Income

Income refers to money received from business sales or other money generating activities.

Further reading:

Incremental budgeting

Incremental budgeting is a financial process that involves creating a new budget by making very slight adjustments to an existing one. The concept is to use the current budget as a starting point and then apply incremental changes, either adding or subtracting assumptions, to calculate the new budget amounts.

Indirect costs

Indirect costs are costs that aren’t directly associated with making or providing products or services.

For example: The rent and utilities for a coffee shop are an indirect cost as they stay the same whether you sell 1 cup of coffee or 100.

Interest

Interest is the cost of borrowing money through a loan agreement.

How interest is calculated varies on the agreement. However, interest is often calculated as an annual percentage of the owed amount (your outstanding balance).

For example: If a business takes out a loan of £20,000 over 2 years, they would need to pay back the £20,000 plus the interest charged on top of that.

Intrapreneurship

Intrapreneurship refers to the process of promoting entrepreneurial thinking and behavior within an established organization. By encouraging employees to think and act like entrepreneurs, companies can unlock new sources of innovation and create a culture of continuous improvement.

Inventory

Inventory is a complete catalogue of day-to-day items owned by the company, usually products, or components used for the creation of products.

Inventory is classed as an asset. The purchase of inventory appears on the cash flow while its value appears on a balance sheet.

KPI

A Key Performance Indicator (KPI) is a value that can be used to measure how effective a company is performing against set objectives.

KPIs can be designed to monitor multiple aspects of a business.

For example: A company selling online software subscriptions monitors their MAU (monthly active users), since user activity is an important metric for driving revenue.

Further reading:

Liability

A liability is a term that covers all types of obligations a business is committed to fulfilling in the future.

Liabilities are listed on the company balance sheet where the categories range from borrowing debt, to accounts payable, to wages owed to staff.

Further reading:

Loans

A loan is an amount of cash lent to a business often by a bank. They are agreements that consist of the loan amount, a time period for repaying and interest charged.

Startups might take out a loan when starting up their business to pay for upfront costs, inventory, rent, and utility bills.

The contractual agreement of a loan varies depending on the type of loan and how much is taken out. Bullet loans, for example, allow you to delay repaying all of the capital until the very end of the loan term.

MIS Reports

A Management Information System (MIS) report is a document that provides information to management and other decision-makers in an organization.

The goal of an MIS report is to provide actionable insights that can be used to improve the efficiency and effectiveness of the organization.

Net

Net is a term which refers to a figure after deductions (eg. tax, overheads) have been made.

For example: The money an employee actually takes home is their ‘net salary’. This is the money they will receive after tax, pension and national insurance deductions have been made.

Net income

Net income is a financial metric that represents the amount of money remaining to a business after deducting all expenses and taxes from their total revenue.

Normal balance of accounts

One of the most fundamental principles in accounting is the concept of the normal balance of accounts. It signifies whether an increase in a particular account is recorded as a debit or a credit. Learn more through our blog post articulating this.

Overheads

Overheads describe the general running costs and ongoing expenditures made from business operating activities.

Overheads are similar to indirect costs, and the terminology is often used interchangeably.

One area of difference is that a company might classify their overheads as a cost specifically related to the provision of a good or service but that can’t be directly tied to any individual sale.

Present Value Table

A Present Value Table is a financial tool that provides pre-calculated present value factors based on various interest rates and time periods. It simplifies the process of determining the present value of future cash flows, allowing you to quickly perform calculations without the need for a financial calculator.

Price Elasticity of Demand

Price elasticity of demand (PED) measures how sensitive the quantity demanded of a good is to changes in its price, calculated by dividing the percentage change in quantity demanded by the percentage change in price. It helps understand how demand for a product varies with price changes.

Price to Earnings Ratio (P/E Ratio)

The price-to-earnings (P/E) ratio is a measure that compares a company’s current share price to its earnings per share. It helps determine if a stock is fairly valued, overvalued, or undervalued, and indicates how much investors are willing to pay for each dollar of the company’s earnings.

Profit

There are three types of profit:

- Gross profit is your total revenue minus total cost of goods sold.

- Operating profit is your total gross profit minus total operating costs.

- Net profit is the total amount of profit after all deductions such as tax and overheads have been made.

Further reading:

Profit & loss report

This is one of primary financial reports businesses rely on for tracking and forecasting performance.

The main areas are revenue, cost of goods sold and operating costs. However, it also tracks every activity that could lead to a profit or a loss to the business resulting with net profit at the bottom.

It differs from your cash flow report because there are many activities that could lead to a profit or loss that don’t have an immediate cash impact. E.g depreciation

Further reading:

Prudence concept

The prudence concept is a rule in accounting that tells accountants to be cautious and not exaggerate how much money a company has or how well it is performing. Accountants follow this rule to make sure that the financial statements they prepare are realistic and not too optimistic. This way, investors and other people who use the financial statements can have a more accurate picture of a company’s financial health.

Retained cash flow

Retained cash flow (RCF) refers to the cash generated by a company which is not distributed to shareholders as dividends; rather, it is kept within the company for reinvestment purposes or reserved for future needs.

Revenue

Revenue is the income that is made from all operations of the business.

Revenue can be confused with profit. Unlike profit, revenue doesn’t take into consideration the costs associated with the business. Profit is your revenue minus these costs.

A company could have a revenue of £80,000 a year. However, most of this revenue might be used to cover costs to the business, whether they are salaries, purchasing inventory or keeping the lights on!

Further reading:

Roll Forwards

Rolling forwards is a financial reporting process that involves updating and extending the current financial data to project future periods, ensuring continuous planning and forecasting.

Further reading:

Rule of 72

The Rule of 72 is a financial concept that estimates how long it takes for an investment to double in value at a fixed annual return rate, illustrating the power of compounding interest.

SaaS Magic Number

The SaaS Magic Number is a metric that measures how efficiently a SaaS company turns sales and marketing investments into revenue growth.

SaaS Rule of 40

Often dubbed the “SaaS Rule of 40”, this metric is more than just a number—it offers a strategic roadmap, balancing growth and profitability. It is a principle that suggests if you add a company’s growth rate and profitability together, the number should be 40% or higher.

Section 179

In the United States, The Section 179 Deduction is a tax benefit enabling businesses to expense the cost of specific qualifying assets, rather than spreading the depreciation over multiple years.

Sortino Ratio

The Sortino ratio serves as a performance metric to assess risk, akin to the Sharpe ratio. But, unlike the Sharpe ratio that factors in the standard deviation of returns to gauge risk, the Sortino ratio solely focuses on the downside risk, specifically the standard deviation of negative returns.

T-Accounts

A T-account is a visual way of displaying the transactions occurring within a single account. These diagrams can be used to map out transactions before they are posted into the company’s ledgers to ensure they are correct.

TAM, SAM, SOM

TAM, SAM, and SOM are acronyms that describe different levels of market size and potential in business and marketing, helping estimate market scope for strategic planning and analysis.

- TAM – Total Addressable Market

- SAM – Serviceable Addressable Market

- SOM – Service Obtainable Market

Total Costs

Total costs refer to all of the expenses that a business incurs throughout the production of goods or services. This financial metric includes every outlay necessary to maintain operational efficiency within your organization.

Total Revenue

Total revenue refers to the complete income earned from selling goods and services over a specific period.

VAT

VAT (Value Added Tax) refers to a government fee (currently 20%) that is added on top of the sale of certain items or services.

This tax is usually paid to the government every quarter and is held separately to income and costs on the business’ financial reports. Businesses that are VAT registered can reclaim the VAT on (some!) bills that they pay.

VAT is applied to a variety of items of items that are available to purchase, from furniture to computer components.

Vertical Analysis

Vertical analysis is a method of financial analysis where each line item is listed as a percentage of a base figure. This helps evaluate the structure of financial statements and facilitates comparison across different companies or time periods.

Working Capital

Working capital is the value left over after all of your short term debts have been met by your available sources of cash or cash equivalents.

This is done by subtracting your current assets from your current liabilities.

Working capital can be positive or negative, as your current liabilities can be greater than your current assets!

Positive working capital is essential for business growth so is an important figure to watch.

Further reading: What are Positive and Negative Working Capital? (and why they’re important)

Year to date

Year to Date (YTD) refers to the period from the start of the current calendar year to the present day. It is used in finance and accounting to measure performance metrics like revenue, expenses, returns, or earnings for that time frame, providing a snapshot of financial performance within the year.

Zero Based Budgeting

Zero-based budgeting (ZBB) is a method of budgeting in which all expenses must be justified for each new period. It is a way to plan your budget. It allocates funding based on how important and useful a program is, not on what was spent in the past.

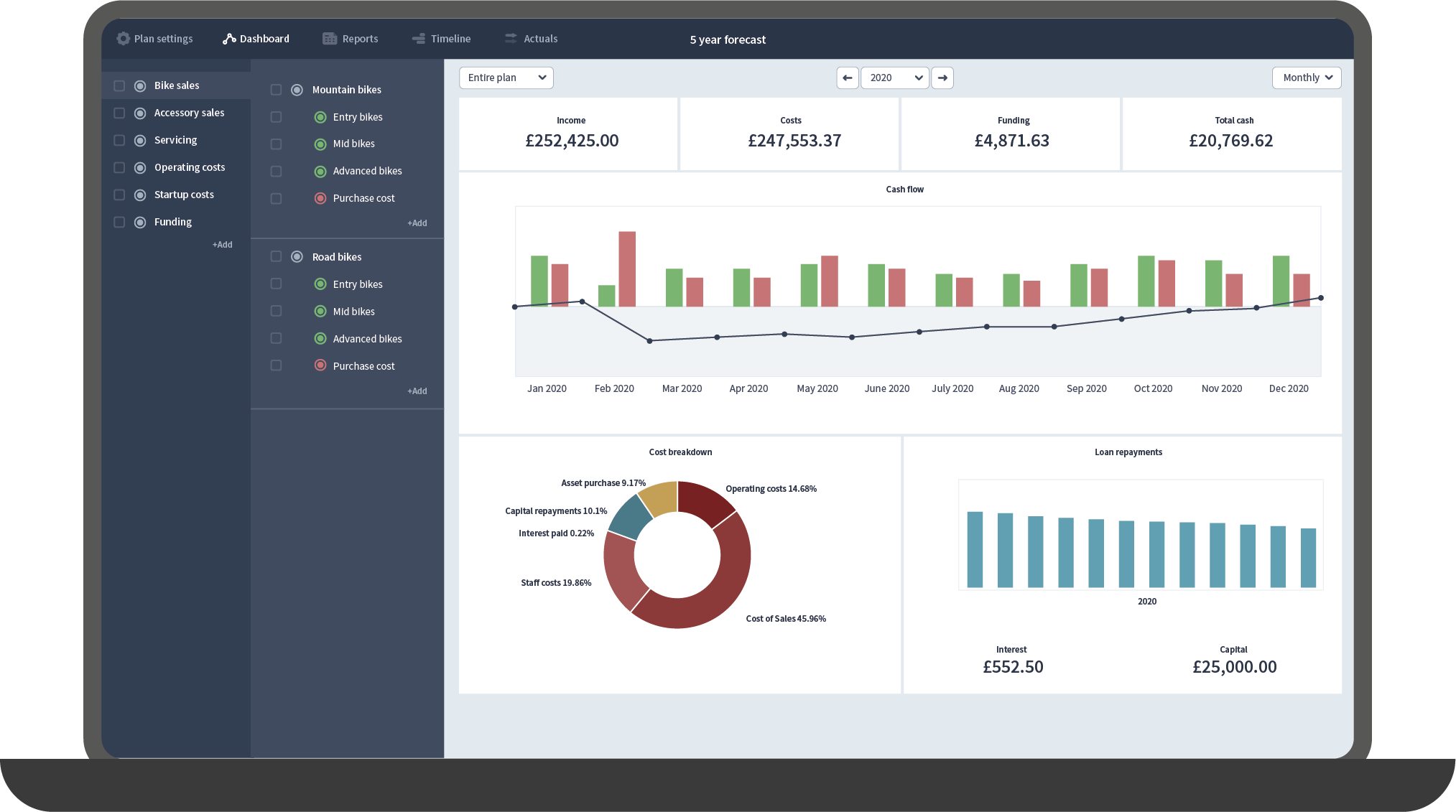

Brixx financial forecasting software

Of course, the final resource we have to offer is our own software!

If you’re planning your business then Brixx makes forecasting super easy and intuitive. Brixx isn’t just a jargon buster, it’s a spreadsheet buster too, handling all accounting and formulas for you.

You’ll be able to model the future of your business and make better decisions today.

Sign up for your free day trial.

Don’t forget to check out our Youtube channel, where we have videos which go through the app in detail.