Financial Forecasting

What is Ledger Balance? Available Balance vs Ledger Balance

As a new business owner, there will be a variety of financial reports and terms that you may not be...

What is the Prudence Concept in Accounting?

The prudence concept is a core accounting principle that means choosing conservative methods to understate assets and overstate liabilities, anticipating...

What is EBIT Growth and why is it Important for Businesses?

When looking to assess your business’ financial performance, one of the most important metrics to keep in mind is EBIT...

The Importance of Multilingual Financial Forecasting for Global Businesses

Financial forecasting is the backbone of any successful business, and having access to forecasting tools in your native language can...

Modelling the Future Through Financial Uncertainty: Why It Matters More Than Ever

In today’s world, uncertainty seems to be the only constant. From consistent inflation, to global events that ripple through supply...

What is Property Management Accounting?

Property management accounting is simply the financial process involved in managing rental properties. Without it, it can be difficult to...

The Sortino Ratio Explained: Formula, Calculation & Examples

The Sortino ratio is a risk-adjusted performance measure that is similar to the Sharpe ratio. Learn why it is important...

Year Over Year (YOY) in Finance: What Does it Mean and How is it Used?

Year-over-year (YOY) is a financial term used to compare data for a specific period of time with the corresponding period...

How to Create Financial Pitch Deck Slides That Attract Investors

Any investor with a genuine interest in the business will want to see detailed financial pitch deck slides to gain...

What is Economic Profit and Why is it Important for Businesses?

In the world of business, there’s a critical distinction between different types of profit that can impact decisions at every...

Why Does a Balance Sheet Need to Balance? Understanding the Key Formula

For a lot of people, the balance sheet is one of the hardest financial statements to get to grips with. Even...

What is a 13 Week Cash Flow Forecast in Accounting?

The 13 week cash flow forecast is a tool for improving cash management in your business. Dedicating just a small...

Healthcare financial modelling: How to manage costs and revenue streams

There are dozens of reasons that a healthcare provider would want to plan their finances - as would any business....

How to Start a Photography Business

Like all businesses, starting a photography business isn’t as simple as registering and getting hired as a freelancer in photojournalism....

What is the FAST Standard in Finance?

If you're reviewing the intricacies of financial reporting or wish to streamline your business’ financial statements, this blog post is...

What is Total Cost: A Definitive Guide

Total costs refer to the overall business costs and expenses incurred when creating goods or services. Everything that your business...

What are Direct Costs in Finance?

In the landscape of financial management, direct costs stand out as one of the key players. However, if you are...

Forecasting vs Budgeting: Which is best for you?

This week, we're looking at budgets and forecasts. Have you ever wondered what the difference is between a budget and...

The Importance of Revision History in Financial Forecasting

Revision history, a feature often seen in document editing and software development, is vital in financial forecasting tools. In this...

Can Spreadsheets Still Help with FP&A?

The spreadsheet still remains a staple across many finance departments. This raises an important question: Can they still help with...

How to Start Your Business Planning Cycle

Having a business planning cycle helps your vision to keep on track, but what exactly is the process? Read more...

The Importance Of Forecasting In Business: What You Need To Know

In this post, we'll briefly cover the types of commonly found business forecasts and why forecasting is so crucial for...

What are Rolling Budgets in Finance?

A rolling budget is a financial planning approach where the budget or forecast is regularly updated by adding a new...

What is Deferred Revenue in Finance?

Deferred revenue is a critical aspect of financial management. However, it often poses significant challenges in accurate forecasting and tracking....

How to Build a Financial Model: Steps, Tips, and Tricks

Creating a robust financial model is a critical skill for businesses. Whether you're a seasoned financial analyst or a new...

Learn how you can set up an established business in Brixx

Do you have an established business? If you do, it's important to have a financial plan. The good news is...

The Importance of a 3-Way Forecast for your Business

Effective financial planning is absolutely essential for a business’ sustained success. One such tool that can help to empower your...

Are Financial Forecasts Accurate?

Financial forecasting is critical for all businesses. However, the accuracy of these forecasts is a topic of ongoing debate. This...

What is the month-end close process? A complete guide of month-end

In this comprehensive guide, we'll delve into the intricacies of the month-end close process. From understanding its importance to identifying...

How to Calculate Net Income – with Formula and Examples

Managing your business’ finances requires a firm grasp of financial concepts. One of these to be aware of is ‘net...

How to raise capital for your business

Starting your own business venture can be very exciting, but it often requires a critical ingredient for success: capital. Whether...

What is data visualization and why is it important?

In a world where data is at the forefront of all businesses, the ability to understand and communicate data effectively...

Return on Assets (ROA): Formula, Calculation & Industry Examples

Return on assets (ROA) is a financial ratio that calculates the profitability of a business in relation to its total...

The Top 4 Advantages of Financial Forecasting

Financial forecasts are key to helping your business make the unknown a little more known! Let's take a look at...

6 Ways Financial Forecasting Isn’t What You Think It Is

Financial forecasting is a discipline shrouded in mysticism. How do people make predictions and why do people use it if...

What is Financial Planning & Analysis (FP&A)?

In this blog, we will focus on Financial Planning & Analysis (FP&A), a critical element in business management that intersects...

What is the Rule of 72 in Finance?

The Rule of 72 is a fundamental financial concept that provides a quick and easy way to estimate the time...

What is a Pricing Strategy? How to Identify a Strategy for Your Business

So far this week we’ve looked at how to choose the right business model for your startup. Now, we’ll be...

How Long Should a Financial Forecast Be?

In this article in our series on the basics of Financial Forecasting, we take a look at how long your...

How to Avoid Making a Mess of Cash Flow Forecasts in Excel

Spreadsheets are ubiquitous for a reason - you can use them for anything! But with increasing complexity comes the danger...

What is Incremental Budgeting in Finance?

Capital budgeting enables informed decision-making regarding the allocation of financial resources for projects that contribute to the company's growth and...

8 Ways to Improve Financial Forecasting in Business

We have created many informative articles exploring financial forecasting and business planning, and this time we would like to explore...

What is Capital Budgeting in Financial Management?

Capital budgeting enables informed decision-making regarding the allocation of financial resources for projects that contribute to the company's growth and...

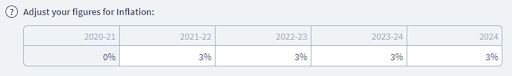

How to manage inflation with Brixx

Inflation, an ever-present economic phenomenon, can significantly impact our financial well-being, both as individuals and businesses. As we navigate the...

What is Break-Even Analysis: Calculating Break-Even for your Business

A break-even analysis is a critical metric for businesses as it provides valuable information about the minimum level of activity...

How to Create a Cash Flow Forecast for a Clothing Business

Whether you’re starting or you already have a clothing business, one thing which is often overlooked is the financial forecasting...

Brixx vs Poindexter – A Comparison Between Financial Forecasting Software

It is crucial to have effective financial planning for the success and growth of any organisation. To achieve accurate and...

Brixx vs LivePlan – Forecasting and Business Planning Comparison

In this blog post, we will compare two popular business planning software options: Brixx and LivePlan. By examining their features,...

Brixx vs Futrli – A Financial Forecasting Tool Comparison

In today's competitive business environment, having robust financial planning software is essential for effective decision-making and long-term success. Two popular...

What are Journal Entries? A Beginner’s Guide to Journal Entries in Accounting

Journal entries are the recorded transactions that your business carries out. Every business activity that involves money - sales, purchases,...

Scenario Analysis: How it Works, Examples and FAQs

Scenario analysis is a technique used in various fields, such as business, finance, and risk management, to evaluate the potential...

What are Liquid Assets?

In the realm of finance, liquid assets are the lifeblood of financial flexibility. In this comprehensive guide, we delve into...

A Comprehensive Guide to Sales Forecasting

Sales forecasting provides valuable insights and predictions about a company's future sales performance. This guide will help you understand the...

Improve Your Business Finances with Generative AI Like ChatGPT

As we step further into the digital age, there's a seismic shift reshaping how businesses handle their financial operations. One...

AI-Driven Scenario Forecasting and Planning

This blog post delves into how ChatGPT can improve scenario forecasting in Brixx, offering a more robust, dynamic, and predictive...

Measuring Return on Investment in Business

There are a huge variety of metrics that you will need to have understanding of when starting your own business....

Retained Cash Flow: What is RCF?

Understanding all elements of cash flow - including retained cash flow - can be quite a tricky task. We are...

How to Use ChatGPT for Financial Forecasting and Planning

Financial forecasting and planning are essential for any business, big or small. However, traditional financial analysis methods can be time-consuming...

Discounted Cash Flow: A Comprehensive Guide

Debt factoring is a financial transaction in which a business sells its accounts receivable, or outstanding invoices, to a third-party...

Debt Factoring: Understanding Factoring Debt

Debt factoring is a financial transaction in which a business sells its accounts receivable, or outstanding invoices, to a third-party...

Debtor Days Formula & Calculation

The debtor days formula is a useful tool for businesses to understand how long it takes to collect payments or...

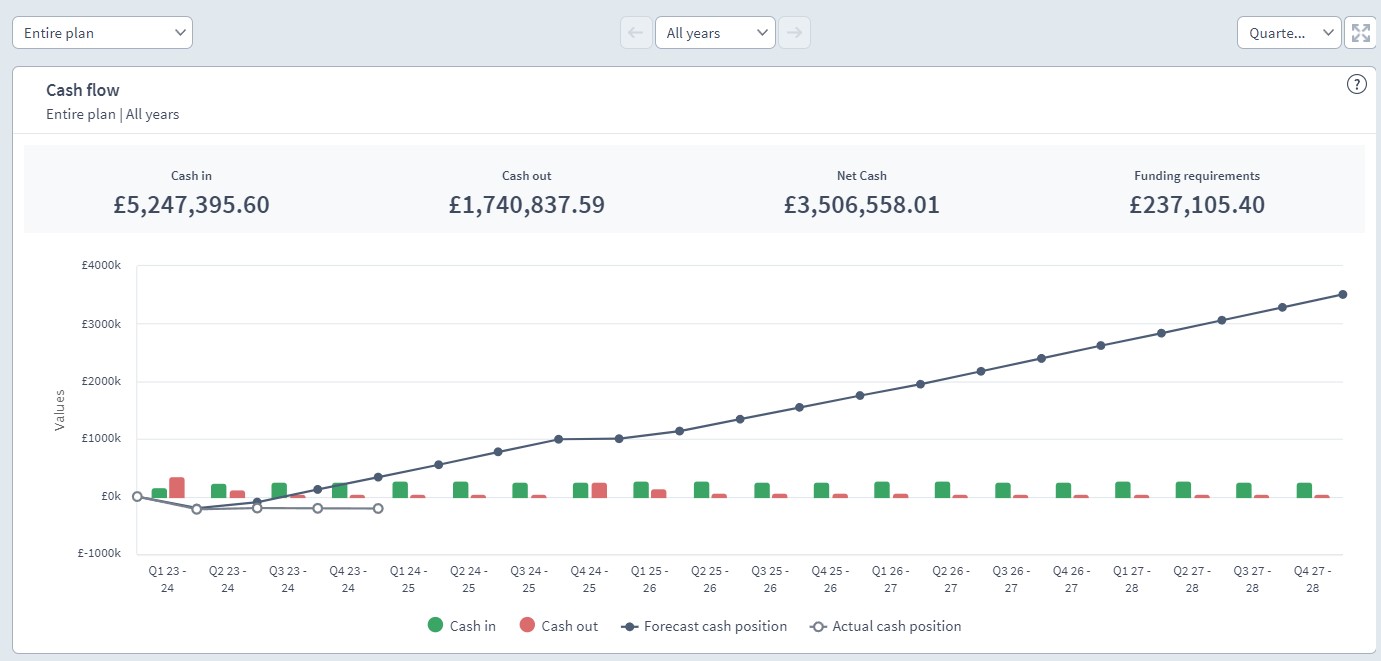

Cash Inflow vs Outflow: What’s the Difference?

Understanding cash flow and the differences between cash inflow and cash outflow is critical for managing your business finances with...

How to Choose A New Accountant for Your Business

Choosing a new accountant for your business is an important decision that can greatly impact your financial success, and it...

What is an Aged Debtors Report?

An aged debtors report is a financial report that shows the amounts owed to a business by its customers, classified...

Should You Use Predictive Analytics For Finance?

Predictive analytics is the prediction of future trends and events using historical data, whereas forecasting is the process of making...

Brixx And Crunch: A Financial Forecasting Masterclass

The integration between Brixx and Crunch means that you are able to visualise your company's financial future and see the...

How To Use A 3-Statement Financial Model To Grow Your Business

A 3-Statement Financial Model is, in essence, a reflection of the three key financial statements. Forecasting those statements allows for...

What is a 3-Statement Model?

A well-built 3-Statement Financial Model helps insiders and outsiders see how various activities of a firm work together to see...

Using Brixx to present Financial Projections for Business Plans

When presenting your projections, having a structure is key as it will guide you and allow you to present your...

Choosing a Financial Forecasting Template

A financial projection template is a structured format used to forecast your business's future financial performance. This template typically includes...

Brixx vs Float – Cash Flow Forecasting And Scenario Planning

Here at Brixx, we enjoy a bit of healthy competition and have done some of the heavy lifting for you...

Budgeting And Financial Scenario Modelling For Restaurants

When looking at budgeting and financial scenario modelling for restaurants, identifying and understanding the effects that events and decisions will...

E-Commerce: An Introduction to Business Forecasting and Budgeting

All business owners should be using forecasting for one reason or another. Especially for e-commerce, business forecasting provides a tentative...

Excel And Google Sheets vs Software For Financial Forecasting

Financial modelling helps businesses predict future outcomes. Using the right tools for this will aid in achieving success.

Financial Forecasting Methods: Top-Down vs. Bottom-Up Forecasting

Deciding on the best financial forecasting method can be a challenge as there are two primary approaches to consider: top-down...

Building up a Brixx plan – a 24 minute demo [Video]

This week we bring you a video demo of Brixx - a "back to basics" tour of the app that...

Free Profit and Loss Statement Template

Get a free profit and loss template on us! Claim your template in this article, which features: equations to calculate...

Financial Forecasting Template for Startups

To produce effective and accurate financial projections for startups, you will need three key reports: a Balance Sheet, a Cash...

How to Create an Effective Financial Forecast With No Historical Data

Extrapolating historical data is one way of creating a financial forecast. If you're a new business or a you are...

6 Cash Flow Analysis Examples for Exploring Key Business Scenarios

Once you've created a cash flow forecast, you're in a great position to start examining future scenarios for your business....

What is Financial Modelling for Small Businesses?

Financial modelling is seen as a niche activity. But, it's actually the best and most natural way to make the...